|

Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy, Chaired Professor at the Paris School of Economics, and Director of the EU Tax Observatory. Zucman is a major proponent of the idea behind the current push for a global wealth tax on centimillionaires and richer still high-net-worth individuals . The author of '' The Hidden Wealth of Nations: The Scourge of Tax Havens'' (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax havens are all OECD–compliant, and that tax disputes between high–tax locations and havens are very rare. His papers are some of the most cited papers on research into tax havens. Zucman is also known for his work on the quantification of the financial scale of base erosion and profit shifting (BEPS) tax avo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paris School Of Economics

The Paris School of Economics (PSE; French: ''École d'économie de Paris'') is a French research institute in the field of economics. It offers MPhil, MSc, and PhD level programmes in various fields of theoretical and applied economics, including macroeconomics, econometrics, political economy and international economics International economics is concerned with the effects upon economic activity from international differences in productive resources and consumer preferences and the international institutions that affect them. It seeks to explain the patterns an .... PSE is a brainchild of the École des Hautes Études en Sciences Sociales (EHESS, where the students are enrolled primarily), the École Normale Supérieure, the École des ponts ParisTech, École des Ponts and University of Paris 1 Pantheon-Sorbonne, and it is physically located on the ENS campus of ''Jourdan'' in the 14th ''arrondissement'' of Paris. It was founded in 2006 as a coalition of universities and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bloomberg News

Bloomberg News (originally Bloomberg Business News) is an international news agency headquartered in New York City and a division of Bloomberg L.P. Content produced by Bloomberg News is disseminated through Bloomberg Terminals, Bloomberg Television, Bloomberg Radio, '' Bloomberg Businessweek'', '' Bloomberg Markets'', Bloomberg.com, and Bloomberg's mobile platforms. Since 2015, John Micklethwait has been editor-in-chief. History Bloomberg News was founded by Michael Bloomberg and Matthew Winkler in 1990 to deliver financial news reporting to Bloomberg Terminal subscribers. The agency was established in 1990 with a team of six people. Winkler was first editor-in-chief. In 2010, Bloomberg News included more than 2,300 editors and reporters in 72 countries and 146 news bureaus worldwide. Beginnings (1990–1995) Bloomberg Business News was created to expand the services offered through the terminals. According to Matthew Winkler, then a writer for ''The Wall Street Jo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelanda sovereign state covering five-sixths of the island) and Northern Ireland (part of the United Kingdomcovering the remaining sixth). It is separated from Great Britain to its east by the North Channel (Great Britain and Ireland), North Channel, the Irish Sea, and St George's Channel. Ireland is the List of islands of the British Isles, second-largest island of the British Isles, the List of European islands by area, third-largest in Europe, and the List of islands by area, twentieth-largest in the world. As of 2022, the Irish population analysis, population of the entire island is just over 7 million, with 5.1 million in the Republic of Ireland and 1.9 million in Northern Ireland, ranking it the List of European islands by population, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad solely to diversify financial risks. Most of the current largest and most influential companies are Public company, publicly traded multinational corporations, including Forbes Global 2000, ''Forbes'' Global 2000 companies. History Colonialism The history of multinational corporations began with the history of colonialism. The first multinational corporations were founded to set up colonial "factories" or port cities. The two main examples were the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantification (science)

In mathematics and empirical science, quantification (or quantitation) is the act of counting and measuring that maps human sense observations and experiences into quantity, quantities. Quantification in this sense is fundamental to the scientific method. Natural science Some measure of the undisputed general importance of quantification in the natural sciences can be gleaned from the following comments: * "these are mere facts, but they are quantitative facts and the basis of science." * It seems to be held as universally true that "the foundation of quantification is measurement." * There is little doubt that "quantification provided a basis for the objectivity of science." * In ancient times, "musicians and artists ... rejected quantification, but merchants, by definition, quantified their affairs, in order to survive, made them visible on parchment and paper." * Any reasonable "comparison between Aristotle and Galileo shows clearly that there can be no unique lawfulness discov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, world trade. It is a forum (legal), forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are generally regarded as developed country, developed countries, with High-income economy, high-income economies, and a very high Human Development Index. their collective population is 1.38 billion people with an average life expectancy of 80 years and a median age of 40, against a global average of 30. , OECD Member countries collectively comprised 62.2% of list of countries by GDP (nominal), global nom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

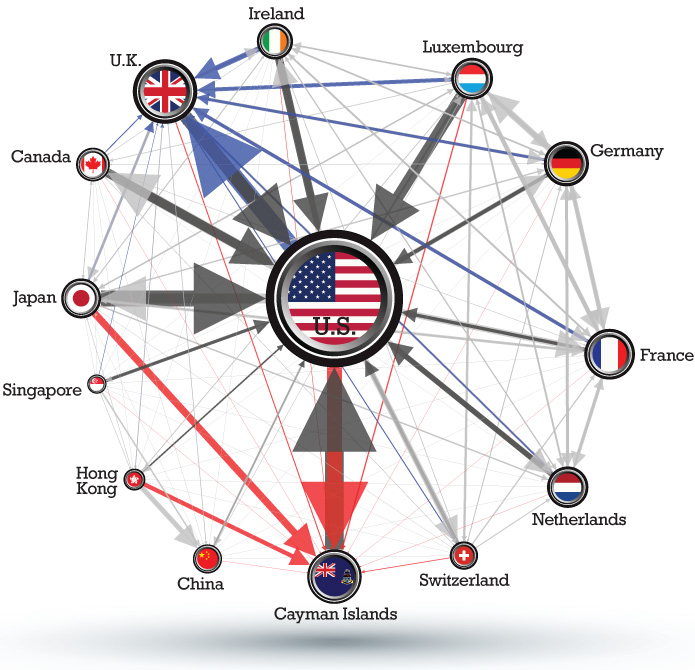

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the Dutch sandwich, and single malt). Corporate tax hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Scourge Of Tax Havens

''The'' is a grammatical article in English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic pronoun ''thee' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |