|

Tax Competition

Tax competition, a form of regulatory competition, exists when governments use reductions in fiscal burdens to encourage the inflow of productive resources or to discourage the exodus of those resources. Often, this means a governmental strategy of attracting foreign direct investment, foreign indirect investment (financial investment), and high value human resources by minimizing the overall taxation level and/or special tax preferences, creating a comparative advantage. Scholars generally consider economic development incentives to be inefficient, economically costly, and distortionary. History From the mid-1900s governments had more freedom in setting their taxes, as the barriers to free movement of capital and people were high. The gradual process of globalization is lowering these barriers and results in rising capital flows and greater manpower mobility. Impact According to a 2020 study, tax competition "primarily reduces taxes for mobile firms and is unlikely to substanti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulatory Competition

Regulatory competition, also called competitive governance or policy competition, is a phenomenon in law, economics and politics concerning the desire of lawmakers to compete with one another in the kinds of law offered in order to attract businesses or other actors to operate in their jurisdiction. Regulatory competition depends upon the ability of actors such as companies, workers or other kinds of people to move between two or more separate legal systems. Once this is possible, then the temptation arises for the people running those different legal systems to compete to offer better terms than their "competitors" to attract investment. Historically, regulatory competition has operated within countries having federal systems of regulation - particularly the United States, but since the mid-20th century and the intensification of economic globalisation, regulatory competition became an important issue internationally. One opinion is that regulatory competition in fact creates a "r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Redistribution Of Wealth

Redistribution of income and wealth is the transfer of income and wealth (including physical property) from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals. Understanding of the phrase varies, depending on personal perspectives, political ideologies and the selective use of statistics. It is frequently used in politics, to refer to perceived redistribution from those who have more to those who have less. Rarely, the term is used to describe laws or policies that cause redistribution in the opposite direction, from the poor to the rich. The phrase is sometimes related to the term ''class warfare'', where the redistribution is alleged to counteract harm caused by high-income earners and the wealthy through means such as unfairness and discrimination. R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Residence

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in double taxation treaties may be different from those of d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emigration

Emigration is the act of leaving a resident country or place of residence with the intent to settle elsewhere (to permanently leave a country). Conversely, immigration describes the movement of people into one country from another (to permanently move to a country). A migrant ''emigrates'' from their old country, and ''immigrates'' to their new country. Thus, both emigration and immigration describe International migration, migration, but from different countries' perspectives. Demographers examine push and pull factors for people to be pushed out of one place and attracted to another. There can be a desire to escape negative circumstances such as shortages of land or jobs, or unfair treatment. People can be pulled to the opportunities available elsewhere. Fleeing from oppressive conditions, being a refugee and Asylum seeker, seeking asylum to get Refugee#Refugee status, refugee status in a foreign country, may lead to permanent emigration. Forced displacement refers to group ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renunciation Of Citizenship

Renunciation of citizenship is the voluntary loss of citizenship. It is the opposite of naturalization, whereby a person voluntarily obtains citizenship. It is distinct from denaturalization, where citizenship is revoked by the state. Historic practices The common law doctrine of perpetual allegiance denied an individual the right to renounce obligations to his sovereign. The bonds of subjecthood were conceived in principle to be both singular and immutable. These practices held on in varying ways until the late 19th century. The refusal of many states to recognize expatriation became problematic for the United States, which had a large immigrant population. The War of 1812 was caused partly by Britain's impressment of US citizens born in the UK into the Royal Navy. Immigrants to the US were sometimes held to the obligations of their foreign citizenship when they visited their home countries. In response, the US government passed the Expatriation Act of 1868 and concluded va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Base

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce negative Externality, externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat tax, flat percentage rate of taxation on personal annual income, but most progressive tax, scale taxes are progressive based on brackets of yearly income amounts. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of the longest-running newspapers in the United States, the ''Times'' serves as one of the country's Newspaper of record, newspapers of record. , ''The New York Times'' had 9.13 million total and 8.83 million online subscribers, both by significant margins the List of newspapers in the United States, highest numbers for any newspaper in the United States; the total also included 296,330 print subscribers, making the ''Times'' the second-largest newspaper by print circulation in the United States, following ''The Wall Street Journal'', also based in New York City. ''The New York Times'' is published by the New York Times Company; since 1896, the company has been chaired by the Ochs-Sulzberger family, whose current chairman and the paper's publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

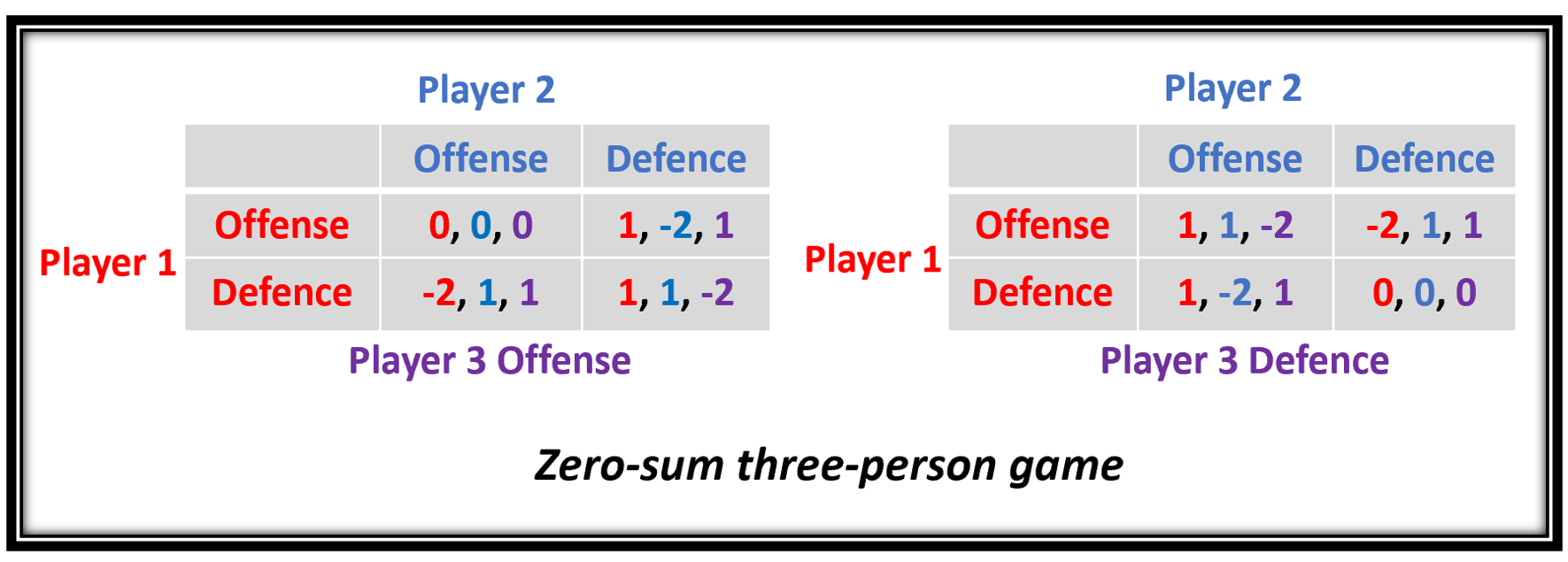

Zero-sum Game

Zero-sum game is a Mathematical model, mathematical representation in game theory and economic theory of a situation that involves two competition, competing entities, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, with the result that the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, Fair cake-cutting, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if marginal utility, all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, sport and Contract bridge, bridge where one person gains and another person loses, which results in a zero-net benefit for every ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Responsibility

Social responsibility is an ethical concept in which a person works and cooperates with other people and organizations for the benefit of the community. An organization can demonstrate social responsibility in several ways, for instance, by donating, encouraging volunteerism, using ethical hiring procedures, and making changes that benefit the environment. Social responsibility is an individual responsibility that involves a balance between the economy and the ecosystem one lives within, and possible trade-offs between economic development, and the welfare of society and the environment. Social responsibility pertains not only to business organizations but also to everyone whose actions impact the environment. History Writers in the classical Western philosophical tradition acknowledged the importance of social responsibility for human thriving. Aristotle Aristotle determined that "Man is by nature a political animal." He saw ethics and politics as mutually-reinforcing: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State

A welfare state is a form of government in which the State (polity), state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life. There is substantial variability in the form and trajectory of the welfare state across countries and regions. All welfare states entail some degree of Public–private partnership, private–public partnerships wherein the administration and delivery of at least some welfare programs occur through private entities. Welfare state services are also provided at varying territorial levels of government. The contemporary capitalist welfare state has been described as a type of mixed economy in the sense of state interventionism, as opposed to a mixture of planning and markets, since economic p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resources and/or foreign aid. An inefficient collection of taxes is greater in countries characterized by poverty, a large agricultural sector and large amounts of foreign aid. Just as there are different types of tax, the form in which tax revenue is collected also differs; furthermore, the agency that collects the tax may not be part of central government, but may be a third party licensed to collect tax which they themselves will use. For example, in the UK, the Driver and Vehicle Licensing Agency (DVLA) collects vehicle excise duty, which is then passed on to HM Treasury. Tax revenues on purchases come in two forms: "tax" itself is a percentage of the price added to the purchase (such as sales tax in U.S. states, or VAT in the UK), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and " offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among financial centers regardin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |