|

Subsidize

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect (tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidy - Visualization 2

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect ( tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rail Subsidies

Many countries offer subsidies to their railways because of the social and economic benefits that it brings. The economic benefits can greatly assist in funding the rail network. Those countries usually also fund or subsidize road construction, and therefore effectively also subsidize road transport. Rail subsidies vary in both size and how they are distributed, with some countries funding the infrastructure and others funding trains and their operators, while others have a mixture of both. Subsidies can be used for either investment in upgrades and new lines, or to keep lines running that create economic growth. Rail subsidies are largest in China ($130 billion), Europe (€73 billion) and India ($35.8 billion), while the United States has relatively small subsidies for passenger rail with freight not subsidized. Social and economic benefits of rail Railways channel growth toward dense city agglomerations and along their arteries. These arrangements help to regenerate cities, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Break

Tax break also known as tax preferences, tax concession, and tax relief, are a method of reduction to the tax liability of taxpayers. Government usually applies them to stimulate the economy and increase the solvency of the population. By this fiscal policy act, government favourable behaving of population sample or general behaving. By announcing a new tax break state budget possibly deprecate some of their revenues from collecting taxes. On the other hand, a new tax break stimulates the economy of subjects in the state, which could possibly strengthen the increase of outcomes that will be taxed. Every tax break must go through the Legislative system to be accepted by authorized institutions to become valid. Most of the countries pledge this position to the Ministry of finance, which approves new tax breaks as tax law. Whether for validation is needed an agreement with other constitutional officials depends on state legislative. However, in the same manner, could the tax break b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renewable Energy Subsidies

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access. The International Renewable Energy Agency tracked some $634 billion in energy-sector subsidies in 2020, and found that around 70% were fossil fuel subsidies. About 20% went to renewable power generation, 6% to biofuels and just over 3% to nuclear. Overview of all sources of energy If governments choose to subsidize one particular source of energy more than another, that choice can impact the environment. That distinguishing factor informs the below discussion on all energy subsidies of all sources of energy in general. Main arguments for energy subsidies are: * Security of su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Expenditures

Tax expenditures are government revenue losses from tax exclusions, exemptions, deductions, credits, deferrals, and preferential tax rates. They are a counterpart to direct expenditures, in that they both are forms of government spending. Tax expenditures function as subsidies for certain activities and alter the horizontal and vertical equity of the basic tax system by giving preferential treatment to those activities. For instance, two people who have the same income can have different effective tax rates if one of the tax payers qualifies for certain tax expenditures by owning a home, having children, or receiving employer-provided health care and pension insurance. Definition The Congressional Budget and Impoundment Control Act of 1974 (CBA) defines tax expenditures as "those revenue losses attributable to provisions of the Federal tax laws which allow a special credit, a preferential rate of tax, or a deferral of tax liability". The term was coined in 1967 by S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perverse Incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionally rewards people for making the issue worse. The term is used to illustrate how incorrect stimulation in economics and politics can cause unintended consequences. Examples of perverse incentives The original cobra effect The term ''cobra effect'' was coined by economist Horst Siebert based on an anecdote of an occurrence in India during British rule. The British government, concerned about the number of venomous cobras in Delhi, offered a bounty for every dead cobra. Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income. When the government became aware of this, the reward program was scrapped. When cobra breede ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anti-corruption

Anti-corruption (or anticorruption) comprises activities that oppose or inhibit corruption. Just as corruption takes many forms, anti-corruption efforts vary in scope and in strategy. A general distinction between preventive and reactive measures is sometimes drawn. In such framework, investigative authorities and their attempts to unveil corrupt practices would be considered reactive, while education on the negative impact of corruption, or firm-internal compliance programs are classified as the former. History Early history The code of Hammurabi (), the Great Edict of Horemheb (), and the Arthasastra (2nd century BC) are among the earliest written proofs of anti-corruption efforts. All of those early texts are condemning bribes in order to influence the decision by civil servants, especially in the judicial sector. During the time of the Roman empire corruption was also inhibited, e.g. by a decree issued by emperor Constantine in 331. In ancient times, moral p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Audit Management

Audit management is responsible for ensuring that board-approved audit directives are implemented. Audit management helps simplify and well-organise the workflow and collaboration process of compiling audits. Most audit teams heavily rely on email and shared drive for sharing information with each other. Typically task such as submitting client request, sender reminder and following up on findings are all done from using broad tools. Investing in the right software could help save time, reduce errors and save on resources. Audit management oversees the internal/external audit staff, establishes audit programs, and hires and trains the appropriate audit personnel. The staff should have the necessary skills and expertise to identify inherent risks In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 194 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

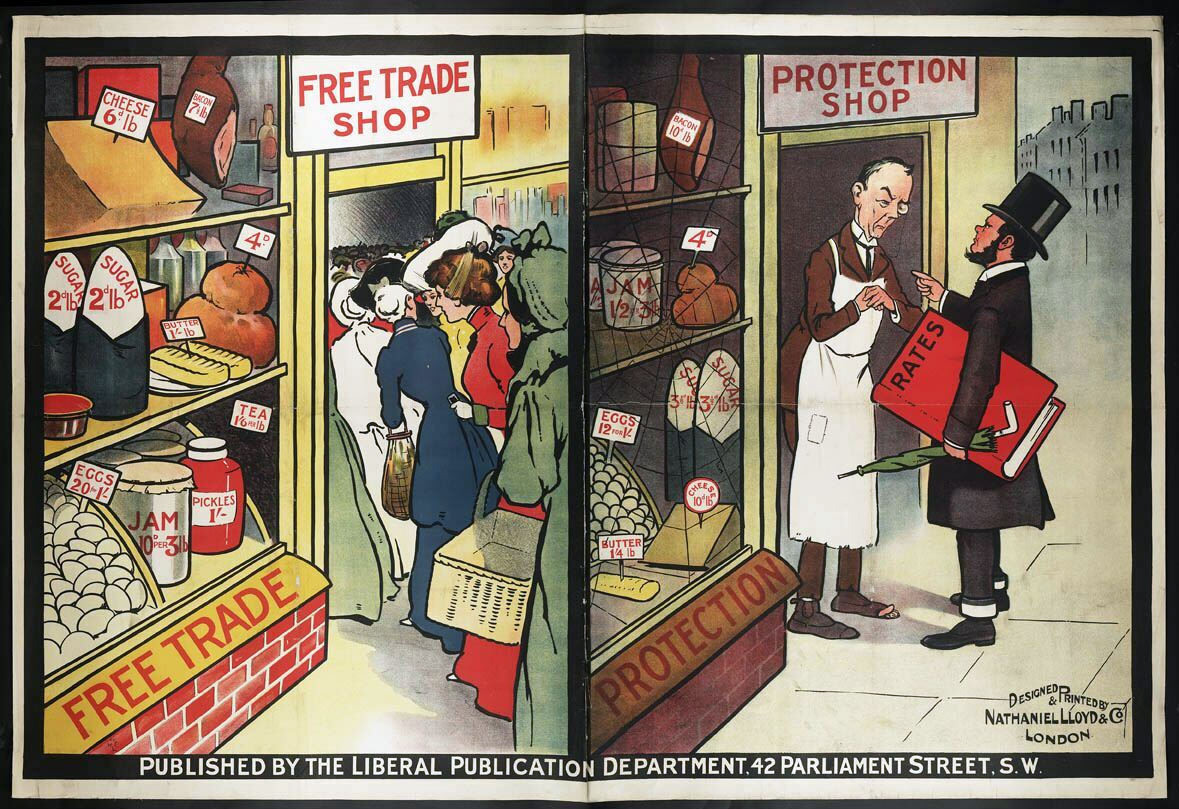

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectionism has a negative effect on economic growth and econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ExxonMobil

ExxonMobil Corporation (commonly shortened to Exxon) is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil, and was formed on November 30, 1999, by the merger of Exxon and Mobil, both of which are used as retail brands, alongside Esso, for fueling stations and downstream products today. The company is vertically integrated across the entire oil and gas industry, and within it is also a chemicals division which produces plastic, synthetic rubber, and other chemical products. ExxonMobil is incorporated in New Jersey. ExxonMobil's earliest corporate ancestor was Vacuum Oil Company, though Standard Oil is its largest ancestor prior to its breakup. The entity today known as ExxonMobil grew out of the Standard Oil Company of New Jersey (or Jersey Standard for short), the corporate entity which effectively controlled all of Standard Oil prior to its breakup. Jersey Standard gr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |