|

Eldridge (company)

Eldridge Industries, LLC is an American holding company headquartered in Miami, with offices in New York City, Greenwich, Connecticut, London, and Beverly Hills. Eldridge Industries makes investments in various industries including insurance, asset management, technology, sports, media, real estate, and the consumer sector. History Eldridge Industries was formed in 2015 by CEO and Chairman Todd Boehly, President Anthony D. Minella, and General counsel Duncan Bagshaw, after Boehly purchased Dick Clark Productions, ''Billboard'' and ''The Hollywood Reporter'', and Mediabistro from Guggenheim Partners. In 2019, Eldridge Industries increased its investment in investment manager Maranon Capital, after which it held a majority ownership stake in the company. In December 2020, Eldridge Industries provided financing to Ark Invest, allowing ARK founder Cathie Wood to remain majority shareholder of the company. In January 2021, the College of William & Mary announced that it had partne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cathie Wood

Catherine Duddy Wood (born 1955) is an American investor and founder, chief executive officer (CEO), and chief investment officer (CIO) of Ark Invest, an investment management firm. Her flagship ARK Innovation exchange-traded fund (ETF) has received accolades for its performance in 2017, 2020 and 2023, but is also considered by Morningstar to be the third highest "wealth destroyer" investment fund from 2014–2023, losing US$7.1 billion of shareholder value in ten years. Early life and education Wood was born in Los Angeles, the eldest child of Gerald and Mary Duddy, immigrants from Ireland. Wood's father served in the Irish Army and the United States Air Force as a radar systems engineer. In 1974, Wood graduated from Notre Dame Academy in Los Angeles, an all-girls Catholic high school. In 1981, Wood graduated ''summa cum laude'' from the University of Southern California, with a Bachelor of Science degree in finance and economics. One of Wood's professors was economist Arth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq

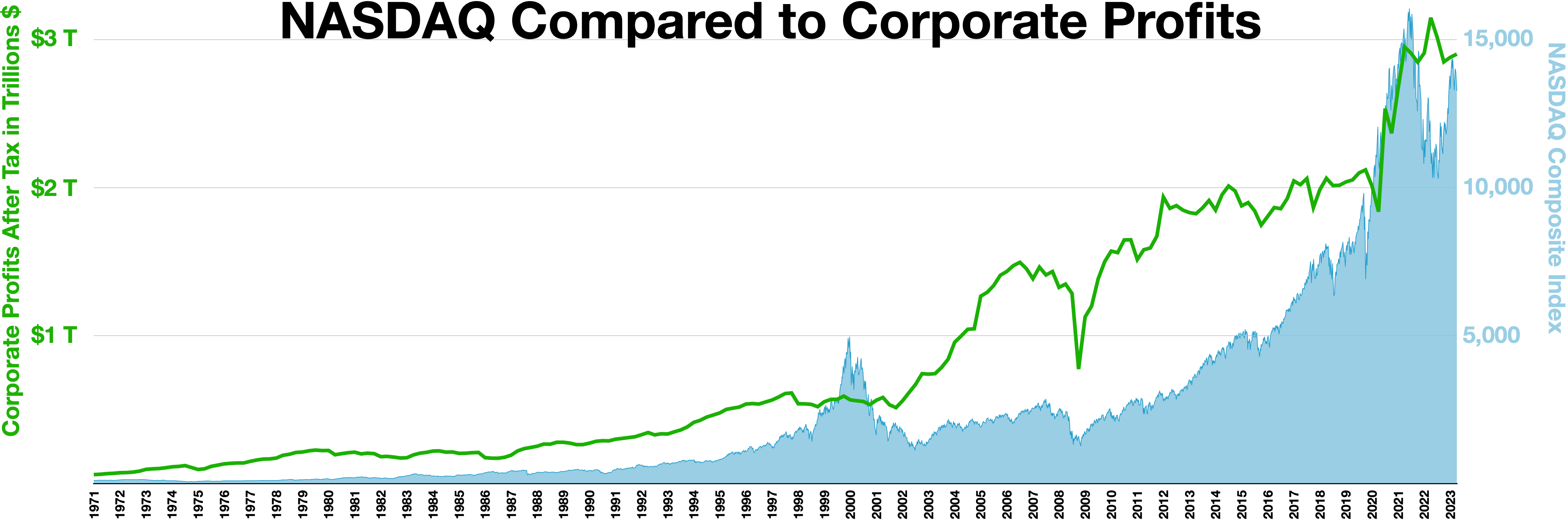

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vivid Seats

Vivid Seats Inc. is an online ticket market place and resale company that uses its technology platform to connect fans of live sports and entertainment events with ticket sellers. It is the official ticketing partner of numerous sports teams and media outlets including ESPN, United Airlines, the San Francisco 49ers and the Los Angeles Chargers. Its rewards program allows fans to earn points on purchases. Vivid Seats is a member of the Internet Association, which advocates for net neutrality. History Vivid Seats was founded in Chicago, Illinois, in 2001 by Jerry Bednyak and Eric Vassilatos. Its major investors include Vista Equity Partners (2016) and GTCR (2017). GTCR bought a majority stake for a rumored $575 million. The company went public on October 19, 2021 after a merger earlier in 2021 with Horizon Acquisition Corporation, a SPAC. It trades on Nasdaq as SEAT. Todd Boehly is chairman of Horizon Acquisitions Corporation, which announced that “Eldridge Industries, LLC, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special-purpose Acquisition Company

A special-purpose acquisition company (SPAC; ), also known as a blank check company or a blind-pool stock offering, is a shell corporation listed on a stock exchange with the purpose of acquiring (or merging with) a private company, thus taking the private company public through a procedure which requires less regulatory filings and has less safeguards for investors than the initial public offering (IPO) process. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds. In the U.S., SPACs are registered with the SEC and considered publicly traded companies. The general public may buy their shares on stock exchanges before any merger or acquisition takes place. For this reason they have at times been referred to as the "poor man's private equity funds." The majority of companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets Under Management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institution—or a decentralized network protocol manages and invests, typically on behalf of its clients. Funds may be managed for clients, platform users, or solely for themselves, such as in the case of a financial institution which has mutual funds or holds its own venture capital. The definition and formula for calculating AUM may differ from one entity to another. Overview Assets under management is a popular metric used within the traditional investment industry as well as for , such as cryptocurrency, to measure the size and success of an investment management entity. AUM represents the market value of all of the securities that a financial entity owns and manages, or simply manages. The AUM of an entity is often compared with historical d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blue Owl Capital

Blue Owl Capital Inc. is an American alternative investment asset management company. It is listed on the New York Stock Exchange under the ticker symbol: "OWL". The company is headquartered in New York City with additional offices around the world, including London, Dubai, and Hong Kong, among other major cities. In June 2024, Blue Owl Capital ranked 26th in Private Equity International's PEI 300 ranking among the world's largest private equity firms. History In December 2020, it was announced there would be a merger between Owl Rock Capital Group and Dyal Capital Partners. The two firms would combine with a special-purpose acquisition company, Altimar Acquisition Corp to form Blue Owl. The deal was valued at $12.2 billion which included a $1.5 billion commitment from investors such as ICONIQ Capital, Federated Hermes and Liberty Mutual. On May 19, 2021, the transaction was completed and Blue Owl was listed on the New York Stock Exchange. On October 18, 2021, Bl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reuters

Reuters ( ) is a news agency owned by Thomson Reuters. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide writing in 16 languages. Reuters is one of the largest news agencies in the world. The agency was established in London in 1851 by Paul Reuter. The Thomson Corporation of Canada acquired the agency in a 2008 corporate merger, resulting in the formation of the Thomson Reuters Corporation. In December 2024, Reuters was ranked as the 27th most visited news site in the world, with over 105 million monthly readers. History 19th century Paul Julius Reuter worked at a book-publishing firm in Berlin and was involved in distributing radical pamphlets at the beginning of the Revolutions of 1848. These publications brought much attention to Reuter, who in 1850 developed a prototype news service in Aachen using homing pigeons and electric telegraphy from 1851 on, in order to transmit messages between Brussels and Aachen, in what today is Aa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raymond James Financial

Raymond James Financial, Inc. is an American multinational independent investment bank and financial services company providing financial services to individuals, corporations, and municipalities through its subsidiary companies that engage primarily in investment and financial planning, in addition to investment banking and asset management. The company is headquartered in St. Petersburg, Florida. History Raymond James was founded in 1962 when St. Petersburg broker, Robert James, formed Robert A. James Investments. In 1964, it merged with Raymond & Associates, founded by Edward Raymond in 1963, to form Raymond James & Associates. Robert James' son, Tom James, joined in 1966 and assumed leadership of the firm in 1970. The firm planned to go public in 1969, but market conditions delayed its plan until 1983. Tom turned over the CEO's post to Paul Reilly in 2010, and his title as Chairman of the Board to Paul Reilly in 2016. He remains on the leadership team as Chairman Em ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Carlyle Group

The Carlyle Group Inc. is an American multinational company with operations in private equity, alternative asset management and financial services. As of 2023, the company had $426 billion of assets under management. Carlyle specializes in private equity, real assets, and private credit. One of the world's largest investment firms, it ranked first among private equity firms by capital raised from 2010-2015, according to the PEI 300 index. In June 2024, it ranked sixth in Private Equity International's PEI 300 ranking among the world's largest private equity firms. Founded in 1987 in Washington, D.C., the company has nearly 2,200 employees in 28 offices on four continents . On May 3, 2012, Carlyle completed a million initial public offering and began trading on the NASDAQ stock exchange. History Founding and early history Carlyle was founded in 1987 as a boutique investment bank by five partners with backgrounds in finance and government: William E. Conway Jr., ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateralized Loan Obligations

Collateralized loan obligations (CLOs) are a form of securitization where payments from multiple middle sized and large business loans are pooled together and passed on to different classes of owners in various tranches. A CLO is a type of collateralized debt obligation, or CDO. Leveraging Each class of owner may receive larger yields in exchange for being the first in line to risk losing money if the businesses fail to repay the loans that a CLO has purchased. The actual loans used are multimillion-dollar loans to either privately or publicly owned enterprises. Known as syndicated loans and originated by a lead bank with the intention of the majority of the loans being immediately "syndicated", or sold, to the collateralized loan obligation owners. The lead bank retains a minority amount of highest quality tranche of the loan while usually maintaining "agent" responsibilities representing the interests of the syndicate of CLOs as well as servicing the loan payments to the syn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |