|

Bootstrapping (finance)

In finance, bootstrapping is a method for constructing a ( zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps. A ''bootstrapped curve'', correspondingly, is one where the prices of the instruments used as an ''input'' to the curve, will be an exact ''output'', when these same instruments are valued using this curve. Here, the term structure of spot returns is recovered from the bond yields by solving for them recursively, by forward substitution: this iterative process is called the ''bootstrap method''. The usefulness of bootstrapping is that using only a few carefully selected zero-coupon products, it becomes possible to derive par swap rates (forward and spot) for ''all'' maturities given the solved curve. Methodology As stated above, the selection of the input securities is important, given that there is a general lack of data points in a yield curve (there are only a fixed number of products in the market). Mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Rates

The forward price (or sometimes forward rate) is the agreed upon price of an asset in a forward contract. Using the rational pricing assumption, for a forward contract on an underlying asset that is tradeable, the forward price can be expressed in terms of the spot price and any dividends. For forwards on non-tradeables, pricing the forward may be a complex task. Forward price formula If the underlying asset is tradable and a dividend exists, the forward price is given by: : F = S_0 e^ - \sum_^N D_i e^ \, where :F is the forward price to be paid at time T :e^x is the exponential function (used for calculating continuous compounding interests) :r is the risk-free interest rate :q is the convenience yield :S_0 is the spot price of the asset (i.e. what it would sell for at time 0) :D_i is a dividend that is guaranteed to be paid at time t_i where 0< t_i < T. Proof of the forward price formula The two questions here are what price the short position ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Support Annex

A Credit Support Annex (CSA) is a legal document that regulates credit support ( collateral) for derivative transactions. Effectively, a CSA defines the terms under which collateral is posted or transferred between swap counterparties to mitigate the credit risk arising from in the money derivative positions. It is one of the four parts that make up an ISDA Master Agreement but is not mandatory; it is possible to have an ISDA agreement without a CSA but normally not a CSA without an ISDA. If on any Valuation Date, the Delivery Amount equals or exceeds the Pledgor's Minimum Transfer Amount, the Pledgor must transfer Eligible Collateral with a Value at least equal to the Delivery Amount. The Delivery Amount is the amount the Credit Support Amount exceeds the Value of all posted Collateral held by the Secured Party. The Credit Support Amount is the Secured Party's Exposure plus Pledgor's Independent Amounts minus Secured Party's Independent Amounts minus the Pledgor's Threshold. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central bank to influence monetary policy. In most countries, the central bank is also a participant on the overnight lending market, and will lend or borrow money to some group of banks. There may be a published overnight rate that represents an average of the rates at which banks lend to each other; certain types of overnight operations may be limited to qualified banks. The precise name of the overnight rate will vary from country to country. Background Throughout the course of a day, banks will transfer money to each other, to foreign banks, to large clients, and other counterparties on behalf of clients or on their own account. At the end of each working day, a bank may have a surplus or shortage of funds (or a shortage or excess reserves in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Libor

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading Bank, banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, with market participants encouraged to transition to risk-free interest rates such as SOFR and SARON. LIBOR was discontinued in the summer of 2023. The last rates were published on 30 June 2023 before 12:00 pm UK time. The 1 month, 3 month, 6 month, and 12 month Secured Overnight Financing Rate (SOFR) is its replacement. In July 2023, the International Organization of Securities Commissions (IOSCO) said four unnamed United States dollar, dollar-denominated alternatives to LIBOR, known as "credit-sensitive rates", had "varying degrees of vulnerability" that might appear during times of market stress. Libor rates w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Indexed Swap

An overnight indexed swap (OIS) is an interest rate swap (''IRS'') over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period. Note that the OIS term is not overnight; it is the underlying reference rate that is an overnight rate. The exact compounding formula depends on the type of such overnight rate. The index rate is typically the rate for overnight lending between banks, either non-secured or secured, for example the Federal funds rate or SOFR for US dollar, €STR (formerly EONIA) for Euro or SONIA for sterling. The fixed rate of OIS is typically an interest rate considered less risky than the corresponding interbank rate ( LIBOR) because there is limited counterparty risk. LIBOR–OIS spread The LIBOR–OIS spread is the difference between IRS rates, based on the LIBOR, and OIS r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

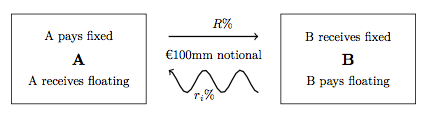

Multi-curve Framework

In finance, an interest rate swap (finance), swap (IRS) is an interest rate derivative, interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a Interest rate derivative#Linear and non-linear, "linear" IRD and one of the most Market liquidity, liquid, benchmark products. It has associations with forward rate agreement, forward rate agreements (FRAs), and with zero coupon swap, zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global Over-the-counter (finance), OTC Derivative (finance), derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Day Count Fraction

A day is the time period of a full rotation of the Earth with respect to the Sun. On average, this is 24 hours (86,400 seconds). As a day passes at a given location it experiences morning, afternoon, evening, and night. This daily cycle drives circadian rhythms in many organisms, which are vital to many life processes. A collection of sequential days is organized into calendars as dates, almost always into weeks, months and years. A solar calendar organizes dates based on the Sun's annual cycle, giving consistent start dates for the four seasons from year to year. A lunar calendar organizes dates based on the Moon's lunar phase. In common usage, a day starts at midnight, written as 00:00 or 12:00 am in 24- or 12-hour clocks, respectively. Because the time of midnight varies between locations, time zones are set up to facilitate the use of a uniform standard time. Other conventions are sometimes used, for example the Jewish religious calendar counts days from sunset to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The IRR of an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value (NPV) of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the future cash fl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero-coupon Bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably. In contrast, an investor who has a regular bond receives income from coupon payments, which are made semi-annually or annually. The investor also receives the principal or face value of the investment when the bond matures. Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilmott (magazine)

''Wilmott Magazine'' is a mathematical finance and risk management magazine, combining technical articles with humor pieces. Each copy of ''Wilmott'' is 11 inches square, runs about 100 pages, and is printed on glossy paper. The magazine has the highest subscription price of any magazine. ''Esquire''. 16 July 2007. Retrieved 4 March 2017. Content and contributors ''Wilmott'' has a section with technical articles on , but includes quantitative financial comic strips, and lighter articles. ''Wilmott'' magazine's regular contributors include[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |