finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid

Liquid is a state of matter with a definite volume but no fixed shape. Liquids adapt to the shape of their container and are nearly incompressible, maintaining their volume even under pressure. The density of a liquid is usually close to th ...

, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs).

In its December 2014 statistics release, the Bank for International Settlements

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central bank ...

reported that interest rate swaps were the largest component of the global OTC derivative

In mathematics, the derivative is a fundamental tool that quantifies the sensitivity to change of a function's output with respect to its input. The derivative of a function of a single variable at a chosen input value, when it exists, is t ...

market, representing 60%, with the notional amount

The notional amount (or notional principal amount or notional value) on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument. This amount generally does not change and is thus referred to a ...

outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion.

Interest rate swaps can be traded as an index through the FTSE MTIRS Index.

Interest rate swaps

General description

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

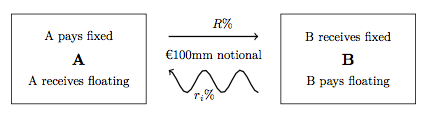

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example LIBOR

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading Bank, banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the prim ...

in GBP, EURIBOR

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks borrow unsecured funds from counterparties in the euro wholes ...

in EUR, or STIBOR in SEK.

To completely determine any IRS a number of parameters must be specified for each leg:Pricing and Trading Interest Rate Derivatives: A Practical Guide to SwapsJ H M Darbyshire, 2017, *the

notional principal amount

The notional amount (or notional principal amount or notional value) on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument. This amount generally does not change and is thus referred to a ...

(or varying notional schedule);

*the start and end dates, value-, trade- and settlement date Settlement date is a securities industry term describing the date on which a trade (bonds, equities, foreign exchange, commodities, etc.) settles. That is, the actual day on which transfer of cash or assets is completed and is usually a few days a ...

s, and date scheduling (date rolling

In finance, date rolling occurs when a payment day or date used to calculate accrued interest falls on a holiday, according to a given business calendar. In this case, the date is moved forward or backward in time such that it falls in a busines ...

);

*the fixed rate (i.e. "swap rate

Swap or SWAP may refer to:

Finance

* Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another

* Barter

Science and technology

* Swap (computer programming), exchanging two variables in ...

", sometimes quoted as a "swap spread

Swap spreads are the difference between the yield on a government bond or sovereign debt security and the fixed component of a swap, both of which have a similar time until maturity. Given that most sovereign debt securities such as government bon ...

" over a benchmark);

*the chosen floating interest rate index tenor

A tenor is a type of male singing voice whose vocal range lies between the countertenor and baritone voice types. It is the highest male chest voice type. Composers typically write music for this voice in the range from the second B below m ...

;

*the day count convention

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days ...

s for interest calculations.

Each currency has its own standard market conventions regarding the frequency of payments, the day count conventions and the end-of-month rule.

Extended description

As OTC instruments, interest rate swaps (IRSs) can be customised in a number of ways and can be structured to meet the specific needs of the counterparties. For example: payment dates could be irregular, the notional of the swap could beamortized

In computer science, amortized analysis is a method for analyzing a given algorithm's complexity, or how much of a resource, especially time or memory, it takes to execute. The motivation for amortized analysis is that looking at the worst-case ...

over time, reset dates (or fixing dates) of the floating rate could be irregular, mandatory break clauses may be inserted into the contract, etc.

A common form of customisation is often present in new issue swaps where the fixed leg cashflows are designed to replicate those cashflows received as the coupons on a purchased bond.

The interbank market

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Reut ...

, however, only has a few standardised types.

There is no consensus on the scope of naming convention for different types of IRS.

Even a wide description of IRS contracts only includes those whose legs are denominated in the same currency.

It is generally accepted that swaps of similar nature whose legs are denominated in different currencies are called cross currency basis swaps.

Swaps which are determined on a floating rate index in one currency but whose payments are denominated in another currency are called Quanto

A quanto is a type of derivative in which the underlying is denominated in one currency,

but the instrument itself is settled in another currency at some rate. Such products are attractive for speculators and investors who wish to have exposure to ...

s.

In traditional interest rate derivative terminology an IRS is a fixed leg versus floating leg derivative contract referencing an IBOR as the floating leg.

If the floating leg is redefined to be an overnight index, such as EONIA, SONIA, FFOIS, etc. then this type of swap is generally referred to as an overnight indexed swap (OIS).

Some financial literature may classify OISs as a subset of IRSs and other literature may recognise a distinct separation.

Fixed leg versus fixed leg swaps are rare, and generally constitute a form of specialised loan agreement.

Float leg versus float leg swaps are much more common. These are typically termed (single currency) basis swap A basis swap is an interest rate swap which involves the exchange of two floating rate financial instruments. A basis swap functions as a floating-floating interest rate swap under which the floating rate payments are referenced to different bases ...

s (SBSs). The legs on SBSs will necessarily be different interest indexes, such as 1M LIBOR, 3M LIBOR, 6M LIBOR, SONIA, etc. The pricing of these swaps requires a spread often quoted in basis points to be added to one of the floating legs in order to satisfy value equivalence.

Uses

Interest rate swaps are used to hedge against or speculate on changes in interest rates. They are also used to manage cashflows by converting floating to fixed interest payments, or vice versa. Interest rate swaps are also used speculatively by hedge funds or other investors who expect a change in interest rates or the relationships between them. Traditionally, fixed income investors who expected rates to fall would purchase cash bonds, whose value increased as rates fell. Today, investors with a similar view could enter a floating-for-fixed interest rate swap; as rates fall, investors would pay a lower floating rate in exchange for the same fixed rate. Interest rate swaps are also popular for thearbitrage

Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which th ...

opportunities they provide. Varying levels of creditworthiness

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal sum, principal payment, leading to disrupted Cash flow, cash flows and increased Colle ...

means that there is often a positive quality spread differential

Quality spread differential (QSD) arises during an interest rate swap in which two parties of different levels of creditworthiness experience different levels of interest rates of debt obligations. A positive QSD means that a swap is in the inter ...

that allows both parties to benefit from an interest rate swap.

The interest rate swap market in USD is closely linked to the Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States. The term was originally applied to U.S. dollar accounts held in banks situated in Europe, but it expanded over the years to cover US dollar accounts ...

futures market which trades among others at the Chicago Mercantile Exchange

The Chicago Mercantile Exchange (CME) (often called "the Chicago Merc", or "the Merc") is an American derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board ...

.

Valuation and pricing

IRSs are bespoke financial products whose customisation can include changes to payment dates, notional changes (such as those in amortised IRSs), accrual period adjustment and calculation convention changes (such as aday count convention

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days ...

of 30/360E to ACT/360 or ACT/365).

A vanilla IRS is the term used for standardised IRSs. Typically these will have none of the above customisations, and instead exhibit constant notional throughout, implied payment and accrual dates and benchmark calculation conventions by currency. A vanilla IRS is also characterised by one leg being "fixed" and the second leg "floating" referencing an index. The net present value

In economics and finance, present value (PV), also known as present discounted value (PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money ha ...

(PV) of a vanilla IRS can be computed by determining the PV of each fixed leg and floating leg separately and summing. For pricing a mid-market IRS the underlying principle is that the two legs must have the same value initially; see further under Rational pricing.

Calculating the fixed leg requires discounting all of the known cashflows by an appropriate discount factor:

:

where is the notional, is the fixed rate, is the number of payments, is the decimalised day count fraction of the accrual in the i'th period, and is the discount factor associated with the payment date of the i'th period.

Calculating the floating leg is a similar process replacing the fixed rate with forecast index rates:

:

where is the number of payments of the floating leg and are the forecast index rates of the appropriate currency.

The PV of the IRS from the perspective of receiving the fixed leg is then:

:

Historically IRSs were valued using discount factors derived from the same curve used to forecast the rates (i.e. the erstwhile reference rate A reference rate is a rate that determines pay-offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of LIBOR rate, but it can take many forms, such as a consumer price index, a house pric ...

s). This has been called "self-discounted". Some early literature described some incoherence introduced by that approach and multiple banks were using different techniques to reduce them. It became more apparent with the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

that the approach was not appropriate, and alignment towards discount factors associated with physical collateral of the IRSs was needed.

Post crisis, to accommodate credit risk, the now-standard pricing approach is the multi-curve framework, applied where forecast discount factors and (see below re MRRs) exhibit disparity.

Note that the economic pricing principle is unchanged: leg values are still identical at initiation. See Financial economics § Derivative pricing for further context.

Here, overnight index swap

An overnight indexed swap (OIS) is an interest rate swap (''IRS'') over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from ...

(OIS) rates are typically used to derive discount factors, since that index is the standard inclusion on Credit Support Annex A Credit Support Annex (CSA) is a legal document that regulates credit support ( collateral) for derivative transactions. Effectively, a CSA defines the terms under which collateral is posted or transferred between swap counterparties to mitigate ...

es (CSAs) to determine the rate of interest payable on collateral for IRS contracts. As regards the rates forecast, since the basis spread between LIBOR

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading Bank, banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the prim ...

rates of different maturities widened during the crisis, forecast curves are generally constructed for each LIBOR tenor used in floating rate derivative legs.

Regarding the curve build, see:

Under the old framework a single self-discounted curve was "bootstrapped" for each tenor;

i.e.: solved such that it exactly returned the observed prices of selected instruments—IRSs, with FRAs in the short end—with the build proceeding sequentially, date-wise, through these instruments.

Under the new framework, the various curves are best fit

Curve fitting is the process of constructing a curve, or mathematical function, that has the best fit to a series of data points, possibly subject to constraints. Curve fitting can involve either interpolation, where an exact fit to the data is ...

ted to observed market prices as a "curve set": one curve for discounting, and one for each IBOR-tenor "forecast curve";

the build is then based on quotes for IRSs ''and'' OISs, with FRAs included as before.

Here, since the observed average overnight rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central ba ...

plus a spread is swapped for CQF Institute"Multi-curve and collateral framework"

/ref> the rate over the same period (the most liquid tenor in that market), and the IRSs are in turn discounted on the OIS curve, the problem entails a

nonlinear system

In mathematics and science, a nonlinear system (or a non-linear system) is a system in which the change of the output is not proportional to the change of the input. Nonlinear problems are of interest to engineers, biologists, physicists, mathem ...

, where all curve points are solved at once, and specialized iterative methods

In computational mathematics, an iterative method is a Algorithm, mathematical procedure that uses an initial value to generate a sequence of improving approximate solutions for a class of problems, in which the ''i''-th approximation (called an " ...

are usually employed — very often a modification of Newton's method.

The forecast-curves for other tenors can be solved in a "second stage", bootstrap-style, with discounting on the now-solved OIS curve.

Various approaches to solving curves are possible.

Modern methods

tend to employ global optimizers with complete flexibility in the parameters that are solved relative to the calibrating instruments used to tune them. (Maturities corresponding to input instruments are referred to as "pillar points".) These optimizers will seek to minimize some objective function

In mathematical optimization and decision theory, a loss function or cost function (sometimes also called an error function) is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost ...

- here matching the observed instrument values - and this assumes that some interpolation

In the mathematics, mathematical field of numerical analysis, interpolation is a type of estimation, a method of constructing (finding) new data points based on the range of a discrete set of known data points.

In engineering and science, one ...

mode has been configured for the curves.

A CSA could allow for collateral, and hence interest payments on that collateral, in any currency.

To accommodate this, banks include in their curve-set a USD discount-curve to be used for discounting trades which have USD collateral; this curve is sometimes called the (Dollar) "basis-curve".

It is built by solving for observed (mark-to-market) cross-currency swap rates, where the local is swapped for USD LIBOR with USD collateral as underpin.

The latest, pre-solved USD-LIBOR-curve is therefore an (external) element of the curve-set, and the basis-curve is then solved in the "third stage".

Each currency's curve-set will thus include a local-currency discount-curve and its USD discounting basis-curve.

As required, a third-currency discount curve — i.e. for local trades collateralized in a currency other than local or USD (or any other combination) — can then be constructed from the local-currency basis-curve and third-currency basis-curve, combined via an arbitrage relationship known here as "FX Forward Invariance".

Starting in 2021, LIBOR is being phased out, with replacements including other "market reference rates" (MRRs) such as SOFR

Secured Overnight Financing Rate (SOFR) is a secured overnight rate, overnight interest rate. SOFR is a reference rate (that is, a rate used by parties in commercial contracts that is outside their direct control) established as an alternative to L ...

and TONAR. (These MRRs are based on secured overnight funding transactions).

With the coexistence of "old" and "new" rates in the market, multi-curve and OIS curve "management" is necessary, with changes required to incorporate new discounting and compounding conventions, while the underlying logic is unaffected; see.

The complexities of modern curvesets mean that there may not be discount factors available for a specific index curve. These curves are known as 'forecast only' curves and only contain the information of a forecast index rate for any future date. Some designs constructed with a discount based methodology mean forecast -IBOR index rates are implied by the discount factors inherent to that curve:

: where and are the start and end ''discount factors'' associated with the relevant forward curve of a particular index in a given currency.

To price the mid-market or par rate, of an IRS (defined by the value of fixed rate that gives a net PV of zero), the above formula is re-arranged to:

:

In the event old methodologies are applied the discount factors can be replaced with the self discounted values and the above reduces to:

:

In both cases, the PV of a general swap can be expressed exactly with the following intuitive formula:

where is the so-called Annuity

In investment, an annuity is a series of payments made at equal intervals based on a contract with a lump sum of money. Insurance companies are common annuity providers and are used by clients for things like retirement or death benefits. Examples ...

factor (or for self-discounting). This shows that the PV of an IRS is roughly linear in the swap par rate (though small non-linearities arise from the co-dependency of the swap rate with the discount factors in the Annuity sum).

Risks

Interest rate swaps expose traders and institutions to various categories offinancial risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financi ...

: predominantly market risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility.

There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the m ...

- specifically interest rate risk

Interest rate risk is the risk that arises for bond owners from fluctuating interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The ...

- and credit risk

Credit risk is the chance that a borrower does not repay a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay ...

. Reputation risks also exist. The mis-selling of swaps, over-exposure of municipalities to derivative contracts, and IBOR manipulation are examples of high-profile cases where trading interest rate swaps has led to a loss of reputation and fines by regulators.

As regards market risk, during the swap's life, both the discounting factors and the forward rates change, and thus, per the above valuation techniques, the PV of a swap will deviate from its initial value. The swap will therefore at times be an asset to one party and a liability to the other. (The way these changes in value are reported is the subject of IAS 39

IAS 39: Financial Instruments: Recognition and Measurement was an international accounting standard which outlined the requirements for the recognition and measurement of financial assets, financial liabilities, and some contracts to buy or sell n ...

for jurisdictions following IFRS

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's fina ...

, and FAS 133

Launched prior to the millennium, (and subsequently amended) FAS 133 ''Accounting for Derivative Instruments and Hedging Activities'' provided an "integrated accounting framework for derivative instruments and hedging activities."

FAS 133 Overvi ...

for U.S. GAAP.) In market terminology, the first-order link of swap value to interest rates is referred to as delta risk; their gamma risk reflects how delta risk changes as market interest rates fluctuate (see Greeks (finance)

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying p ...

). Other specific types of market risk that interest rate swaps have exposure to are basis risk

Basis risk in finance is the risk associated with imperfect hedging due to the variables or characteristics that affect the difference between the futures contract and the underlying "cash" position. It arises because of the difference between the ...

s, where various IBOR tenor indexes can deviate from one another, and reset risks, where the publication of specific tenor IBOR indexes are subject to daily fluctuation.

Uncollateralised interest rate swaps — those executed bilaterally without a CSA in place — expose the trading counterparties to funding risks and counterparty

A counterparty (sometimes contraparty) is a Juristic person, legal entity, unincorporated entity, or collection of entities to which an exposure of financial risk may exist. The word became widely used in the 1980s, particularly at the time of the ...

credit risk

Credit risk is the chance that a borrower does not repay a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay ...

s.Cory Mitchell (2024)"Introduction To Counterparty Risk"

Investopedia

Investopedia is a global financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products, such as securities accounts. It ...

Funding risks because the value of the swap might deviate to become so negative that it is unaffordable and cannot be funded. Credit risks because the respective counterparty, for whom the value of the swap is positive, will be concerned about the opposing counterparty defaulting on its obligations. Collateralised interest rate swaps, on the other hand, expose the users to collateral risks: here, depending upon the terms of the CSA, the type of posted collateral that is permitted might become more or less expensive due to other extraneous market movements. Credit and funding risks still exist for collateralised trades but to a much lesser extent. Regardless, due to regulations set out in the Basel III

Basel III is the third of three Basel Accords, a framework that sets international standards and minimums for bank capital requirements, Stress test (financial), stress tests, liquidity regulations, and Leverage (finance), leverage, with the goa ...

Regulatory Frameworks, trading interest rate derivatives commands a capital usage. The consequence of this is that, dependent upon their specific nature, interest rate swaps may be capital intensive; with the latter, also, sensitive to market movements. Capital risks are thus another concern for users, and Banks typically calculate a credit valuation adjustment

A Credit valuation adjustment (CVA),

in financial mathematics, is an "adjustment" to a derivative's price, as charged by a bank to a counterparty to compensate it for taking on the credit risk of that counterparty during the life of the tran ...

, CVA - as well as XVA

X-Value Adjustment (XVA, xVA) is an hyponymy and hypernymy, umbrella term referring to a number of different "valuation adjustments" that banks must make when assessing the value of derivative (finance), derivative contracts that they have entered ...

for other risks - which then incorporate these risks into the instrument value.

Debt security traders, daily mark to market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" ...

their swap positions so as to "visualize their inventory" (see valuation control).

As required, they will attempt to hedge

A hedge or hedgerow is a line of closely spaced (3 feet or closer) shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate ...

, both to protect value and to reduce volatility. Since the cash flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.

*Cash flow, in its narrow sense, is a payment (in a currency), es ...

s of component swaps offset each other, traders will implement this hedging on a net basis for entire books. Here, the trader would typically hedge her interest rate risk through offsetting Treasuries (either spot or futures).

For credit risks – which will not typically offset – traders estimate:

for each counterparty the probability of default

Probability of default (PD) is a financial term describing the likelihood of a default over a particular time horizon. It provides an estimate of the likelihood that a borrower will be unable to meet its debt obligations.

PD is used in a varie ...

using models such as Jarrow–Turnbull and KMV, or by stripping these from CDS

CDS, CDs, Cds, etc. may refer to:

Finance

* Canadian Depository for Securities, Canadian post-trade financial services company

* Certificate of deposit (CDs)

* Counterfeit Deterrence System, developed by the Central Bank Counterfeit Deterrence ...

prices;

and then for each trade, the potential future exposure and expected exposure to the counterparty.

Credit derivative

In finance, a credit derivative refers to any one of "various instruments and techniques designed to separate and then transfer the ''credit risk''"The Economist ''Passing on the risks'' 2 November 1996 or the risk of an event of default of a corp ...

s will then be purchased as appropriate.

Often, a specialized XVA-desk centrally monitors and manages overall CVA and XVA exposure and capital, and will then implement this hedge.

The other risks must be managed systematically, sometimes involving group treasury.

These processes will all rely on well-designed numerical risk models: both to measure and forecast the (overall) change in value, and to suggest reliable offsetting benchmark trades which may be used to mitigate risks. Note, however, (and re P&L Attribution) that the multi-curve framework adds complexity in that (individual) positions are (potentially) affected by numerous instruments not obviously related.

Quotation and market-making

ICE Swap rate

ICE Swap rate replaced the rate formerly known as ISDAFIX in 2015. Swap Rate benchmark rates are calculated using eligible prices and volumes for specified interest rate derivative products. The prices are provided by trading venues in accordance with a “Waterfall” Methodology. The first level of the Waterfall (“Level 1”) uses eligible, executable prices and volumes provided by regulated, electronic, trading venues. Multiple, randomised snapshots of market data are taken during a short window before calculation. This enhances the benchmark's robustness and reliability by protecting against attempted manipulation and temporary aberrations in the underlying market.Market-making

The market-making of IRSs is an involved process involving multiple tasks; curve construction with reference to interbank markets, individual derivative contract pricing, risk management of credit, cash and capital. The cross disciplines required include quantitative analysis and mathematical expertise, disciplined and organized approach towards profits and losses, and coherent psychological and subjective assessment of financial market information and price-taker analysis. The time sensitive nature of markets also creates a pressurized environment. Many tools and techniques have been designed to improve efficiency of market-making in a drive to efficiency and consistency.See also

*Constant maturity swap A constant maturity swap (CMS) is a swap that allows the purchaser to fix the duration of received flows on a swap.

The floating leg of an interest rate swap typically resets against a published index. The floating leg of a constant maturity swap ...

* Equity swap

An equity swap is a financial derivative contract (a swap) where a set of future cash flows are agreed to be exchanged between two counterparties at set dates in the future. The two cash flows are usually referred to as "legs" of the swap; one o ...

* Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States. The term was originally applied to U.S. dollar accounts held in banks situated in Europe, but it expanded over the years to cover US dollar accounts ...

* FTSE MTIRS Index

* Inflation derivative

In finance, inflation derivative (or inflation-indexed derivatives) refers to an over-the-counter (finance), over-the-counter and exchange-traded derivative (finance), derivative that is used to transfer inflation risk from one counterparty to anot ...

* Interest rate cap and floor

In finance, an interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to recei ...

* Swap rate

Swap or SWAP may refer to:

Finance

* Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another

* Barter

Science and technology

* Swap (computer programming), exchanging two variables in ...

* Total return swap

In finance, a total return swap (TRS), total rate of return swap (TRORS), or cash-settled equity swap is a financial contract that transfers both the credit risk and market risk of an underlying asset.

Contract definition

A swap agreement in ...

References

Further reading

General: * * * Richard Flavell (2010)''Swaps and other derivatives''

(2nd ed.) Wiley. * Miron P. & Swannell P. (1991). ''Pricing and Hedging Swaps'', Euromoney books. Early literature on the incoherence of the one curve pricing approach: * Boenkost W. and Schmidt W. (2004). ''Cross Currency Swap Valuation'', Working Paper 2, HfB - Business School of Finance & Managemen

SSRN preprint.

* Tuckman B. and Porfirio P. (2003). ''Interest Rate Parity, Money Market Basis Swaps and Cross-Currency Basis Swaps'', Fixed income liquid markets research,

Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merril ...

Multi-curves framework:

* Henrard M. (2007). ''The Irony in the Derivatives Discounting'', Wilmott Magazine, pp. 92–98, July 2007SSRN preprint.

* Kijima M., Tanaka K., and Wong T. (2009). ''A Multi-Quality Model of Interest Rates'', Quantitative Finance, pages 133-145, 2009. * Henrard M. (2010). ''The Irony in the Derivatives Discounting Part II: The Crisis'', Wilmott Journal, Vol. 2, pp. 301–316, 2010

SSRN preprint.

* Bianchetti M. (2010). ''Two Curves, One Price: Pricing & Hedging Interest Rate Derivatives Decoupling Forwarding and Discounting Yield Curves'', Risk Magazine, August 2010

SSRN preprint.

* Henrard M. (2014

''Interest Rate Modelling in the Multi-curve Framework: Foundations, Evolution, and Implementation.''

Palgrave Macmillan. Applied Quantitative Finance series. June 2014. .

External links

Pricing and Trading Interest Rate Derivatives

by J H M Darbyshire

Understanding Derivatives: Markets and Infrastructure

Federal Reserve Bank of Chicago, Financial Markets Group

- Semiannual OTC derivatives statistics

- Interest rate swap glossary

Investopedia - Spreadlock

- An interest rate swap future (not an option)

Basic Fixed Income Derivative Hedging

- Article on Financial-edu.com.

''WorldwideInterestRates.com''

Interest Rate Swap Calculators and Portfolio Management Tool

{{Derivatives market and are regarded as an Derivatives (finance) Swap Swaps (finance)