Transactional account on:

[Wikipedia]

[Google]

[Amazon]

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at

In

In

credit union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (che ...

s) is a deposit account or bank account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, ...

held at a bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either ...

s, cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing ...

s and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting

Accounting, also known as accountancy, is the process of recording and processing information about economic entity, economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activit ...

terms, they are considered as cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

.

Transaction accounts are known by a variety of descriptions, including a current account (British English), chequing account or checking account when held by a bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

, share draft account when held by a credit union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (che ...

in North America

North America is a continent in the Northern Hemisphere, Northern and Western Hemisphere, Western hemispheres. North America is bordered to the north by the Arctic Ocean, to the east by the Atlantic Ocean, to the southeast by South Ameri ...

. In the Commonwealth of Nations

The Commonwealth of Nations, often referred to as the British Commonwealth or simply the Commonwealth, is an International organization, international association of member states of the Commonwealth of Nations, 56 member states, the vast majo ...

, United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

, Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

, India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

, Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelan ...

, Australia

Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ...

, New Zealand

New Zealand () is an island country in the southwestern Pacific Ocean. It consists of two main landmasses—the North Island () and the South Island ()—and List of islands of New Zealand, over 600 smaller islands. It is the List of isla ...

, Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

, Malaysia

Malaysia is a country in Southeast Asia. Featuring the Tanjung Piai, southernmost point of continental Eurasia, it is a federation, federal constitutional monarchy consisting of States and federal territories of Malaysia, 13 states and thre ...

, South Africa

South Africa, officially the Republic of South Africa (RSA), is the Southern Africa, southernmost country in Africa. Its Provinces of South Africa, nine provinces are bounded to the south by of coastline that stretches along the Atlantic O ...

and a number of other countries they are commonly called current or, before the demise of cheques, cheque accounts. Because money is available on demand they are also sometimes known as demand accounts or demand deposit accounts. In the United States, NOW accounts operate as transaction accounts.

Transaction accounts are operated by both businesses and personal users. Depending on the country and local demand economics earning from interest rates varies. Again depending on the country the financial institution that maintains the account may charge the account holder maintenance or transaction fees or offer the service free to the holder and charge only if the holder uses an add-on service such as an overdraft.

History

Holland

Holland is a geographical regionG. Geerts & H. Heestermans, 1981, ''Groot Woordenboek der Nederlandse Taal. Deel I'', Van Dale Lexicografie, Utrecht, p 1105 and former provinces of the Netherlands, province on the western coast of the Netherland ...

in the early 1500s, Amsterdam

Amsterdam ( , ; ; ) is the capital of the Netherlands, capital and Municipalities of the Netherlands, largest city of the Kingdom of the Netherlands. It has a population of 933,680 in June 2024 within the city proper, 1,457,018 in the City Re ...

was a major trading and shipping city. People who had acquired large accumulations of cash began to deposit their money with ''cashiers'' to protect their wealth. These cashiers held the money for a fee. Competition drove cashiers to offer additional services, including paying out money to any person bearing a written order from a depositor to do so. They kept the note as proof of payment.

This concept spread to other countries including England

England is a Countries of the United Kingdom, country that is part of the United Kingdom. It is located on the island of Great Britain, of which it covers about 62%, and List of islands of England, more than 100 smaller adjacent islands. It ...

and its colonies in North America, where land owners in Boston

Boston is the capital and most populous city in the Commonwealth (U.S. state), Commonwealth of Massachusetts in the United States. The city serves as the cultural and Financial centre, financial center of New England, a region of the Northeas ...

in 1681 mortgaged their land to cashiers who provided an account against which they could write checks.

In the 18th century in England, preprinted checks, serial numbers, and the word "cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing ...

" appeared. By the late 18th century, the difficulty of clearing checks (sending them from one bank to another for collection) gave rise to the development of clearing houses.

Features and access

All transaction accounts offer itemised lists of all financial transactions, either through a bank statement or apassbook

A passbook or bankbook is a paper book used to record bank or building society transactions on a deposit account.

Traditionally, a passbook was used for accounts with a low transaction volume, such as savings accounts. A bank teller or postm ...

. A transaction account allows the account holder to make or receive payments by:

* ATM cards (withdraw cash at any Automated Teller Machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account ...

)

* Debit card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either ...

(cashless direct payment at a store or merchant)

* Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

(deposit and withdrawal of coin

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by ...

s and banknote

A banknote or bank notealso called a bill (North American English) or simply a noteis a type of paper money that is made and distributed ("issued") by a bank of issue, payable to the bearer on demand. Banknotes were originally issued by commerc ...

s at a branch)

* Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing ...

and money order

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque.

History

Systems similar to modern money orders can be traced back centuries. Paper documents known ...

(paper instruction to pay)

* Direct debit (pre-authorized debit)

* Standing order (automatic regular funds transfers)

* Electronic funds transfer

Electronic funds transfer (EFT) is the transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems.

The funds transfer process generally consists ...

s (transfer funds electronically to another account)

* Online banking

Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institut ...

(transfer funds directly to another person via internet banking facility)

Banks offering transactional accounts may allow an account to go into overdraft if that has been previously arranged. If an account has a negative balance, money is being borrowed from the bank and interest and overdraft fees as normally charged.

Country specific differences

In theUnited Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

and other countries with a UK banking heritage, transaction accounts are known as current accounts. These offer various flexible payment methods to allow customers to distribute money directly. One of the main differences between a UK current account and an American checking account is that they earn considerable interest, sometimes comparable to a savings account, and there is generally no charge for withdrawals at cashpoints (ATMs), other than charges by third party owners of such machines.

Transfer systems

Certain modes of payment are country-specific: * Giro (funds transfer, direct deposit in European countries) *In theUnited Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

, Faster Payments Service offers near immediate transfer, BACS offers giros that clear in a matter of days while CHAPS

Chaparreras or chaps () are a type of sturdy over-pants (overalls) or leggings of Mexican origin, made of leather, without a seat, made up of two separate legs that are fastened to the waist with straps or belt. They are worn over trousers and ...

is done on the same day.

*Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

has an Interac e-Transfer service

*In India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

, NEFT and RTGS services are available to clear funds in a day.

In the European Union

The Regulation (EU) n. 655/2014 has introduced the European Account Preservation Order, a new procedure of asset freezing in order "to facilitate cross-border debt recovery in civil and commercial matters."Access

Branch access

Customers may need to attend a bank branch for a wide range of banking transactions including cash withdrawals andfinancial advice

A financial adviser or financial advisor is a professional who provides financial services to clients based on their financial situation. In many countries, financial advisors must complete specific training and be registered with a regulatory ...

. There may be restrictions on cash withdrawals, even at a branch. For example, withdrawals of cash above a threshold figure may require notice.

Many transactions that previously could only be performed at a branch can now be done in others ways, such as use of ATMs, online, mobile and telephone banking.

Cheques

Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing ...

s were the traditional method of making withdrawals from a transaction account.

Automated teller machines

Automated teller machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account ...

s (ATMs) enable customers of a financial institution

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial ins ...

to perform financial transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, Service (economics), services, or assets for payment. Any transaction involves a change in the status of the finances of two or mo ...

s without attending a branch. This enables, for example, cash to be withdrawn from an account outside normal branch trading hours. However, ATMs usually have quite low limits for cash withdrawals, and there may be daily limits to cash withdrawals other than at a branch.

Mobile banking

With the introduction of mobile banking; a customer may perform banking transactions and payments, view balances and statements, and use various other services using theirmobile phone

A mobile phone or cell phone is a portable telephone that allows users to make and receive calls over a radio frequency link while moving within a designated telephone service area, unlike fixed-location phones ( landline phones). This rad ...

. In the UK this has become the leading way people manage their finances, as mobile banking has overtaken internet banking as the most popular way to bank.

Internet banking

Internet or online banking enables a customer to perform banking transactions and payments, to view balances and statements, and various other facilities. This can be convenient especially when a bank is not open and enables banking transactions to be effected from anywhere Internet access is available. Online banking avoids the time spent travelling to a branch and standing in queues there. However, there are usually limits on the value of funds that can be transferred electronically on any day, making it necessary to use a cheque to effect such transfers when those limits are being reached.Telephone banking

Telephone banking provides access to banking transactions over thetelephone

A telephone, colloquially referred to as a phone, is a telecommunications device that enables two or more users to conduct a conversation when they are too far apart to be easily heard directly. A telephone converts sound, typically and most ...

. In many cases telephone banking opening times are considerably longer than branch times.

Mail banking

A financial institution may allow its customers to depositcheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing ...

s into their account by mail

The mail or post is a system for physically transporting postcards, letter (message), letters, and parcel (package), parcels. A postal service can be private or public, though many governments place restrictions on private systems. Since the mid ...

. Mail banking can be used by customers of virtual banks (as they may not offer branches or ATMs that accept deposits) and by customers who live too far from a branch.

Stores and merchants providing debit card access

Most stores and merchants now have to accept debit card access for purchasing goods if they want to continue operating, especially now that some people only use electronic means of purchase.Cost

Any cost or fees charged by the financial institution that maintains the account, whether as a single monthly maintenance charge or for eachfinancial transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, Service (economics), services, or assets for payment. Any transaction involves a change in the status of the finances of two or mo ...

, will depend on a variety of factors, including the country's regulations and overall interest rates for lending and saving, as well as the financial institution's size and number of channels of access offered. This is why a direct bank

A direct bank (sometimes called a branch-less bank or virtual bank) is a bank that offers its services only via the Internet, mobile app, email, and other electronic means, often including telephone, online chat, and mobile check deposit. A direct ...

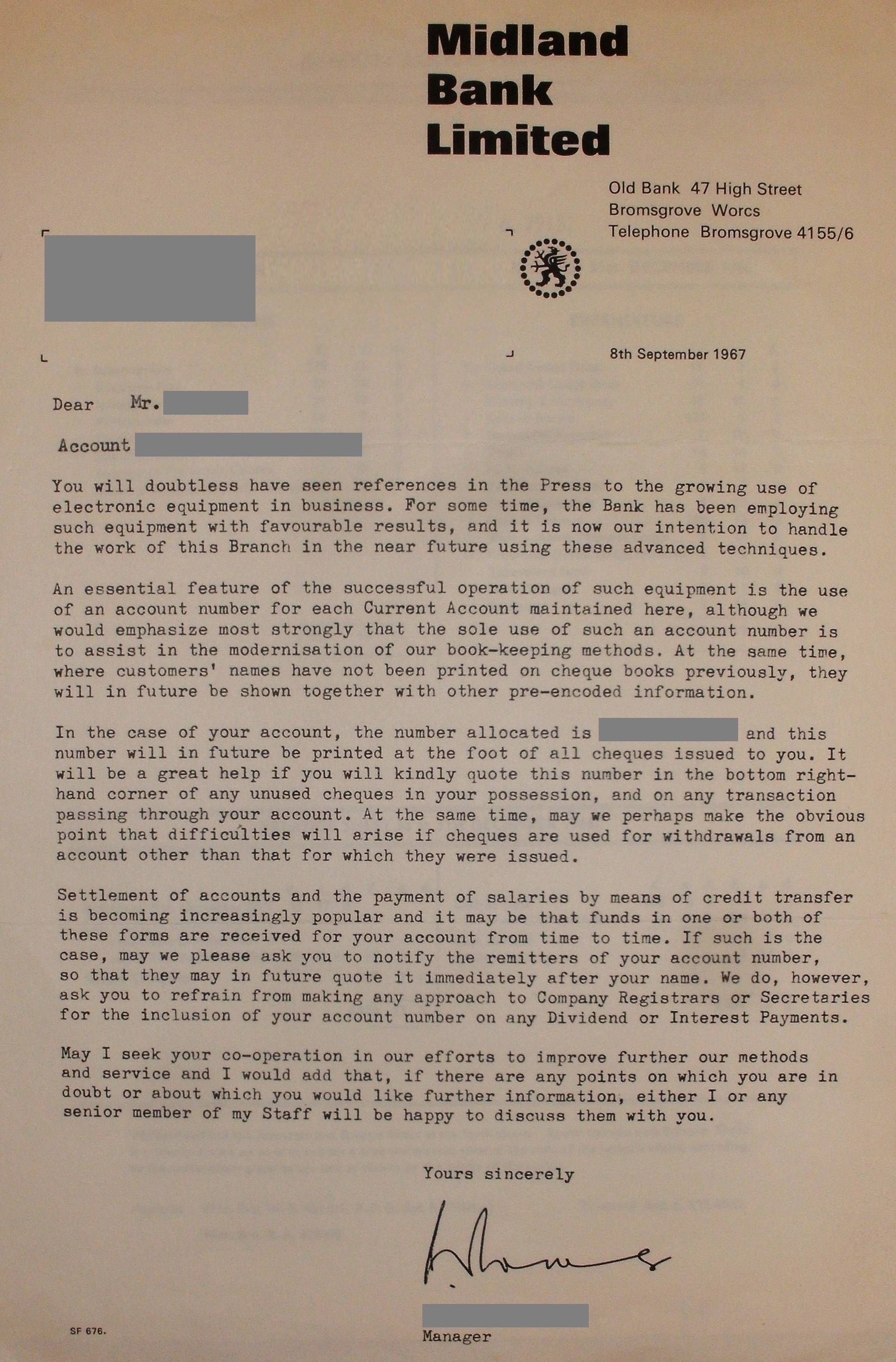

can afford to offer low-cost or free banking, as well as why in some countries, transaction fees do not exist but extremely high lending rates are the norm. This is the case in the United Kingdom, where they have had free banking since 1984 when the then Midland Bank, in a bid to grab market share, scrapped current account charges. It was so successful that all other banks had no choice but offer the same or continue losing customers. Free banking account holders are now charged only if they use an add-on service such as an overdraft.

Financial transaction fees may be charged either per item or for a flat rate covering a certain number of transactions. Often, youth

Youth is the time of life when one is young. The word, youth, can also mean the time between childhood and adulthood (Maturity (psychological), maturity), but it can also refer to one's peak, in terms of health or the period of life known as bei ...

s, student

A student is a person enrolled in a school or other educational institution, or more generally, a person who takes a special interest in a subject.

In the United Kingdom and most The Commonwealth, commonwealth countries, a "student" attends ...

s, senior citizen

Old age is the range of ages for people nearing and surpassing life expectancy. People who are of old age are also referred to as: old people, elderly, elders, senior citizens, seniors or older adults. Old age is not a definite biological sta ...

s or high-valued customers do not pay fees for basic financial transactions. Some offer free transactions for maintaining a very high average balance in their account. Other service charges are applicable for overdraft, non-sufficient funds

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the mos ...

, the use of an external interbank network

An interbank network, also known as an ATM consortium or ATM network, is a computer network that enables ATM cards issued by a financial institution that is a member of the network to be used to perform ATM transactions through ATMs that belo ...

, etc. In countries where there are no service charges for transaction fees, there are, on the other hand, other recurring service charges such as a debit card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either ...

annual fee. In the United States, there are checking account options that do not require monthly maintenance fees and this can keep costs down. While a majority of U.S. checking accounts do charge monthly maintenance fees, about one-third of accounts do not charge those fees. A survey of monthly checking account maintenance fees shows the average cost to be $13.47 per month or $161.64 per year.

Interest

Unlike savings accounts, for which the primary reason for depositing money is to generate interest, the main function of a transactional account is transactional. Therefore, most providers pay little or no interest on credit balances. Formerly, in theUnited States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, Regulation Q (12 CFR 217) and the Banking Acts of 1933 and 1935 (12 USC 371a) prohibited a member of the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

system from paying interest on demand deposit accounts. Historically, this restriction was frequently circumvented by either creating an account type such as a Negotiable Order of Withdrawal account (NOW account), which is legally not a demand deposit account or by offering interest-paying chequing through a bank that is not a member of the Federal Reserve system.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, however, passed by Congress and signed into law by President Obama on July 21, 2010, repealed the statutes that prohibit interest-bearing demand deposit accounts, effectively repealing Regulation Q (Pub. L. 111-203, Section 627). The repeal took effect on July 21, 2011. Since that date, financial institutions have been permitted, but not required, to offer interest-bearing demand deposit accounts.

In the United Kingdom, some online banks offer rates higher as many savings accounts, along with free banking (no charges for transactions) as institutions that offer centralised services (telephone, internet or postal based) tend to pay higher levels of interest. The same holds true for banks within the EURO currency zone.

High-yield accounts

High-yield accounts pay a higher interest rate than typical NOW accounts and frequently function as loss-leaders to drive relationship banking.Lending

Accounts can lend money in two ways: overdraft and offset mortgage.Overdraft

An overdraft occurs when withdrawals from a bank account exceed the available balance. This gives the account a negative balance and in effect means the account provider is providing credit. If there is a prior agreement with the account provider for an overdraft facility, and the amount overdrawn is within this authorised overdraft, then interest is normally charged at the agreed rate. If the balance exceeds the agreed facility then fees may be charged and a higher interest rate might apply. In North America, overdraft protection is an optional feature of a chequing account. An account holder may either apply for a permanent one, or the financial institution may, at its discretion, provide a temporary overdraft on an ad hoc basis. In the UK, virtually all current accounts offer a pre-agreed overdraft facility the size of which is based upon affordability and credit history. This overdraft facility can be used at any time without consulting the bank and can be maintained indefinitely (subject toad hoc

''Ad hoc'' is a List of Latin phrases, Latin phrase meaning literally for this. In English language, English, it typically signifies a solution designed for a specific purpose, problem, or task rather than a Generalization, generalized solution ...

reviews). Although an overdraft facility may be authorised, technically the money is repayable on demand by the bank. In reality this is a rare occurrence as the overdrafts are profitable for the bank and expensive for the customer.

Consumer reporting

In the United States, some consumer reporting agencies such as ChexSystems, Early Warning Services, and TeleCheck track how people manage their checking accounts. Banks use the agencies to screen checking account applicants. Those with low debit scores are denied checking accounts because a bank cannot afford an account to be overdrawn.Offset mortgage

An offset mortgage was a type of mortgage common in the United Kingdom used for the purchase of domestic property. The key principle is the reduction of interest charged by "offsetting" a credit balance against the mortgage debt. This can be achieved via one of two methods: either lenders provide a single account for all transactions (often referred to as a current account mortgage) or they make multiple accounts available, which let the borrower notionally split money according to purpose, whilst all accounts are offset each day against the mortgage debt.See also

Transaction related * Collection item * Demand draft * Error account a necessity for auditing transaction accounts * Transaction deposit Account type related * Current account mortgage * Negotiable Order of Withdrawal account *Personal account

A personal account is a bank account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction

A financial transaction is an Contract, agreement, or communication, betwee ...

* Savings account

A savings account is a bank account at a retail banking, retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditi ...

Notes

{{Authority control Bank account Banking terms