Tax Form on:

[Wikipedia]

[Google]

[Amazon]

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for

In the United States, a tax schedule is a form that the Internal Revenue Service (IRS) requires taxpayers to fill out in addition to the tax return. It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.

Tax schedules are used by both taxpayers and taxation authorities such as the IRS. Simple tax returns can be filed using the

In the United States, a tax schedule is a form that the Internal Revenue Service (IRS) requires taxpayers to fill out in addition to the tax return. It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.

Tax schedules are used by both taxpayers and taxation authorities such as the IRS. Simple tax returns can be filed using the

tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

.

Tax returns are usually processed by each country's tax authority, known as a revenue service

A revenue service, revenue agency or taxation authority is a government agency responsible for the intake of government revenue, including taxes and sometimes non-tax revenue. Depending on the jurisdiction, revenue services may be charged wit ...

, such as the Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

in the United States, the State Taxation Administration in China, and HM Revenue and Customs

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a department of the UK government responsible for the collection of taxes, the payment of some forms of stat ...

in the United Kingdom.

Preparing the tax return

A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of income, age, and filing status also play a role. Occasionally, there may be situations where the tax return need not be filed, but is filed anyway to receive a tax refund. The tax return is not necessarily the final calculation; it may be accepted or not accepted as correct by the government authority. The time and effort involved in filing a tax return varies from country to country, but governments try to help citizens in different ways. Many governments utilize electronic filling and payment systems that keep a record of a person's history of tax returns and refunds. Another notable change in recent years is that government bodies share the data with each other. Within several European nations such as Denmark and Sweden, governments already provide citizens with prefilled return forms, which a citizen would sign if accurate, and if not, can fix the error on their own or prepare returns themselves. In Denmark and Sweden, 97 percent and 74 percent of taxpayers had their forms prefilled by tax authorities respectively in 1999. The length of the completion of a tax return depends on the country, but the world average is almost 232 hours.Components of a tax return

A tax return usually includes the following components. Income consists of the sources of a citizen'srevenue

In accounting, revenue is the total amount of income generated by the sale of product (business), goods and services related to the primary operations of a business.

Commercial revenue may also be referred to as sales or as turnover. Some compan ...

, excluding items which are exempt from tax by law. Wages, salaries, income from retirement plans, dividends, interest and capital gains or losses should be considered as a source of revenue.

Taxable income includes wages, salaries, rental income, dividends, and business profits, after deducting any allowable deductions. In Australia

Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ...

, the concept of taxable income is central to determining the amount of income tax you are liable to pay.

Deductions are items that are subtracted from taxable income, thereby reducing the tax liability. For organizations, most expenses specifically identified with business tasks are deductible

In an insurance policy, the deductible (in British English, the excess) is the amount paid

Out-of-pocket expenses, out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term ''deductible'' m ...

. Examples of tax deductions include mortgage interests, student loan interest, contributions to saving plans for retirement etc. In general, taxes paid will be less when the taxpayer chooses the larger of itemized deductions

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

...

or the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

. The standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

varies according to filing status. In the United States, the standard deduction is higher for older taxpayers (65 and above). If the taxpayer chooses to itemize, such deductions are recorded on Schedule A. Itemized deductions should be supported by documentation which the taxpayer retains after filing the tax return.

Tax credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "disc ...

reduce the amount of paid to government entities. Tax credits are more impactful than deductions because they directly reduce the amount of tax owed. If a person has $500 in tax credits, and the tax owed is $500, the tax credits will reduce a person's liability to zero. Tax credits arise from multiple areas. For example, a person may receive a Child Tax Credit if they care for a child under the age of 13. Education expenses might be treated as a tax credit in some countries, such as the American Opportunity Tax Credit in the United States.

Payments and refunds include estimated tax payments and amounts withheld from your paycheck. If you've overpaid your taxes, you'll receive a refund.

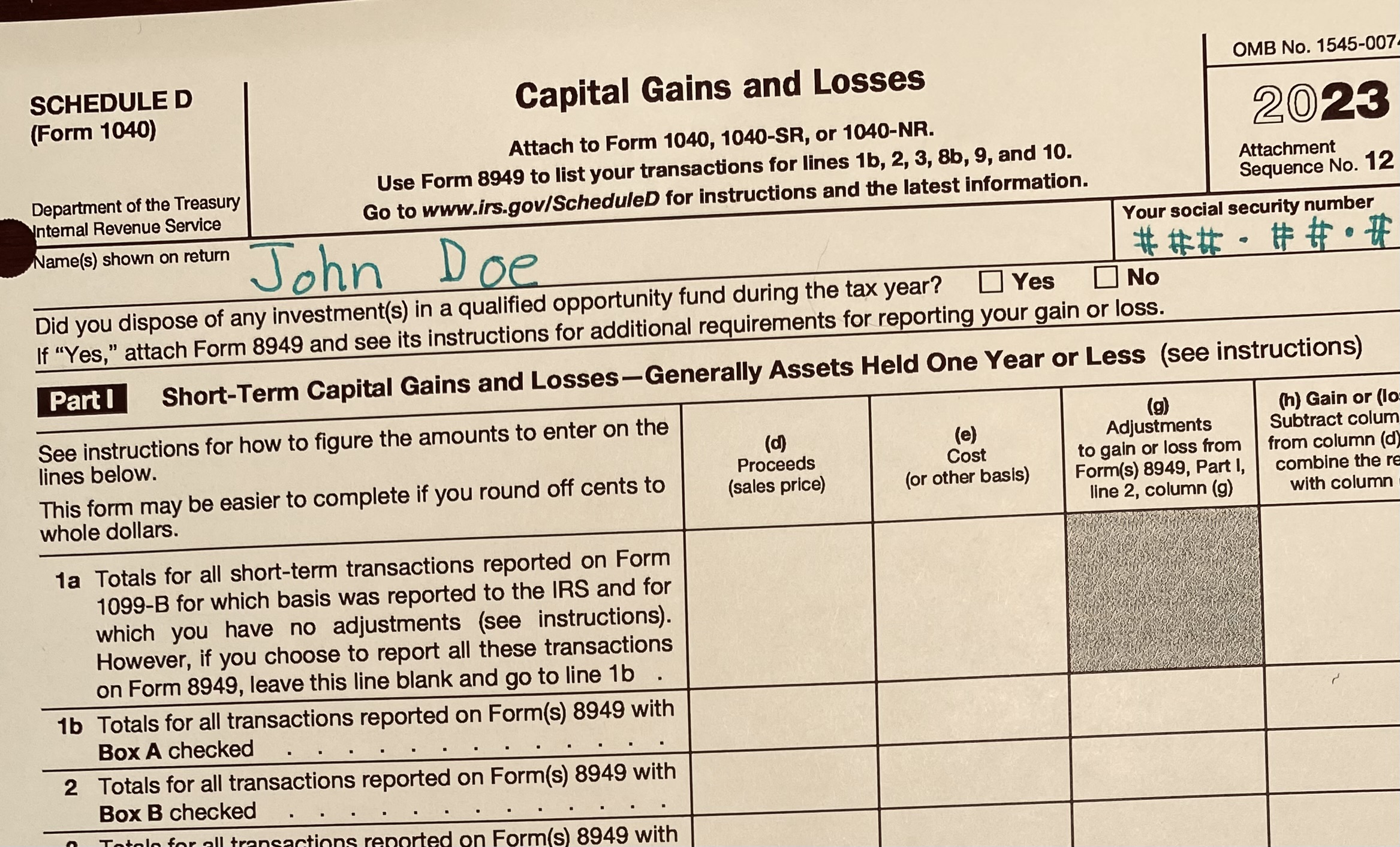

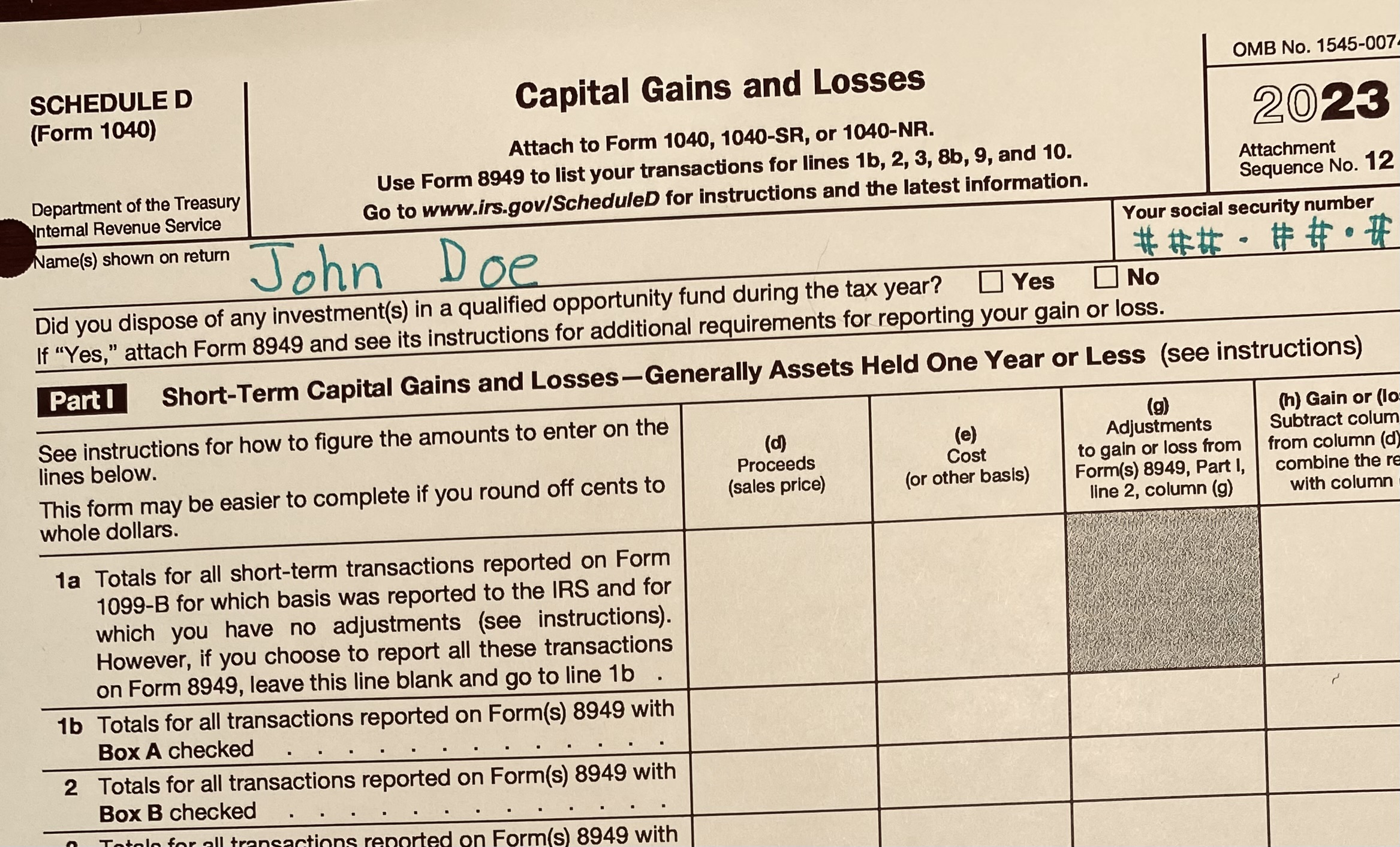

Tax schedule

In the United States, a tax schedule is a form that the Internal Revenue Service (IRS) requires taxpayers to fill out in addition to the tax return. It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.

Tax schedules are used by both taxpayers and taxation authorities such as the IRS. Simple tax returns can be filed using the

In the United States, a tax schedule is a form that the Internal Revenue Service (IRS) requires taxpayers to fill out in addition to the tax return. It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.

Tax schedules are used by both taxpayers and taxation authorities such as the IRS. Simple tax returns can be filed using the Form 1040

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax forms, IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and deter ...

whereas complex tax returns additionally require a tax schedule to be completed with the tax return. There are different types of schedules such as Schedule A, Schedule B, Schedule C, Schedule D, Schedule EIC, and Schedule SE. Specific tax forms can be used by taxpayer

A taxpayer is a person or organization (such as a company) subject to pay a tax. Modern taxpayers may have an identification number, a reference number issued by a government to citizens or firms.

The term "taxpayer" generally characterizes o ...

s or private entities that are required to report information on their tax liabilities, including income earners, businesses, and companies.

See also

*Tax revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural reso ...

* Tax information reporting

* Tax returns in Australia

* Tax returns in Canada

* Tax returns in India

* Tax returns in the United Kingdom

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently ...

* Tax returns in the United States

* Taxation in Greece

Taxation in Greece is based on the direct and indirect systems. The total tax revenue in 2017 was €47.56 billion from which €20.62 billion came from direct taxes and €26.94 billion from indirect taxes. The total tax revenue represented 39.4% ...

* Taxation in Iran

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas reve ...

* Taxation in Peru

* Taxation in Spain

Taxes in Spain are levied by national (central), regional and local governments. Tax revenue in Spain stood at 36.3% of GDP in 2013. A wide range of taxes are levied on different sources, the most important ones being income tax, social securi ...

* Taxation in the United Kingdom

In the United Kingdom, taxation may involve payments to at least three different levels of government: Government of the United Kingdom, central government (HM Revenue and Customs), Devolution in the United Kingdom, devolved governments and Loc ...

* Income tax in China

* Income tax in Scotland

Income tax in Scotland is a tax of personal income gained through employment. This is a tax controlled by the Scottish Parliament, and collected by the UK government agency HM Revenue & Customs.

Since 2017, the Scottish Parliament has had the ...

* Income tax in Singapore

* Income tax in the Netherlands

* Papal income tax

* Tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

References

{{Authority control