|

Tax Returns In Canada

Tax returns in Canada refer to the obligatory forms that must be submitted to the Canada Revenue Agency (CRA) each financial year for individuals or corporations earning an income in Canada. The return paperwork reports the sum of the previous year's (January to December) taxable income, tax credits, and other information relating to those two items. The return is the method by which the Canadian government determines the appropriate amount of tax that should be paid by individuals and corporations. The result of filing a return with the federal government can result in either a refund (money owed to the person or corporation filing the return), or an amount due to be paid. Under the '' Income Tax Act'', there is a penalty for not filing a tax return, if tax is due. In generalised terms, a tax return refers to the yearly income declaration created by the taxpayer for every individual in the country. This enables tax authorities to declare if an individual is eligible to be given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of inco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Finance Minister

The minister of finance () is the minister of the Crown in the Canadian Cabinet, who is responsible for overseeing the Department of Finance and presenting the federal government's budget each year. It is one of the most important positions in the Cabinet. François-Philippe Champagne is the 42nd and current finance minister, assuming the role March 14, 2025 as a member of the new 30th Canadian Ministry of Mark Carney. Responsibilities In addition to being the head of the Department of Finance, the minister of finance is also the minister responsible for: *Bank of Canada *Canada Deposit Insurance Corporation *Canada Development Investment Corporation *Canada Pension Plan Investment Board *Canadian International Trade Tribunal *Office of the Superintendent of Financial Institutions *Financial Transactions and Reports Analysis Centre of Canada *Mission to the International Monetary Fund (serving as "Governor" voter) *Serving as a permanent member of the Treasury Board of Can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United States)

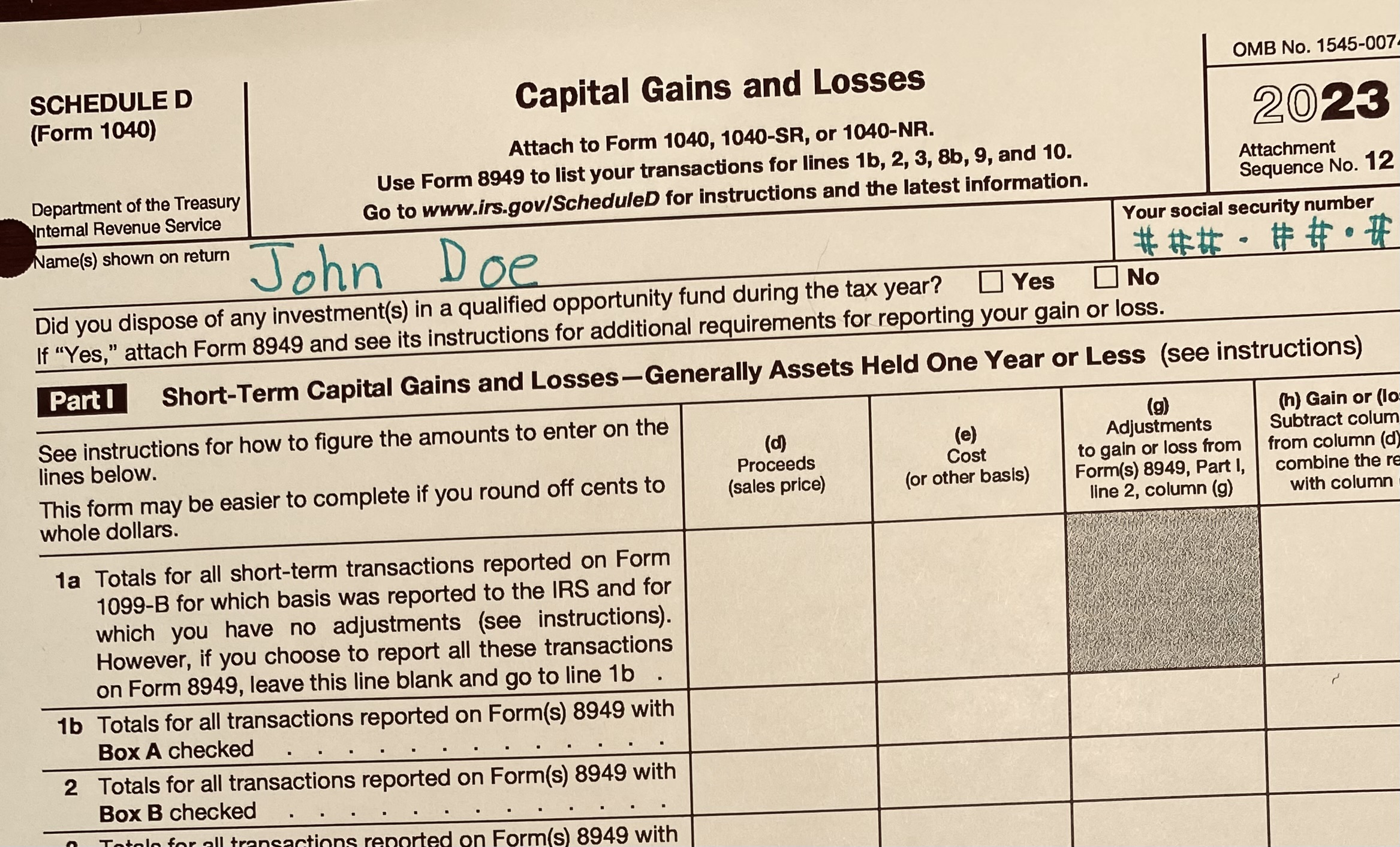

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency ( California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority. Federal returns Under the Internal Revenue Code returns can be classified as either ''tax returns'' or ''information returns'', although the term "tax return" is sometimes used to describe both kinds of returns in a broad sense. Tax returns, in the more narrow sense, are reports of tax liabilities and payments, often including financial information used to compute the tax. A very common federal tax form is IRS Form 1040. A tax return provides information so that the taxation authority can check on the taxpayer's calculations, or can determine the amount of tax owed if the taxpayer is not required to calculate that amount. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some taxpayers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Australia)

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year. Australian individual taxpayers can file their return online with the ATO's myTax software, by ordering a printed copy of the tax return form, or with the assistance of a tax agent. Until 2011, the Australian Taxation Office (ATO) published TaxPack, a free document designed to help individuals complete their return. In 2012, TaxPack was replaced with a smaller instruction document, due to increased usage of the e-tax software. Extensions of the deadline for lodging a tax return are automatically available to those individuals using a Registered Tax Agent operating on an extended lodgement system, and extensions can be made available under some circumstances. In Australia, individuals and taxpaying entities with taxable income might need to lodge different returns with the ATO in respect of various forms of taxation. Se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

T1 General

The T1 General or T1 (entitled ''Income Tax and Benefit Return'') is the form used in Canada by individuals to file their personal income tax return. Individuals with tax payable during a calendar year must use the T1 to file their ''total income'' from all sources, including employment and self-employment income, interest, dividends, and capital gains, rental income, and so on. Foreign income must also be declared and included in the total income. After applicable deductions and adjustments, the ''net income'' and ''taxable income'' are determined, from which the federal tax and the provincial or territorial tax are calculated to give the ''total payable''. Subtracting ''total credits'', which include the tax withheld, the filer will either receive a '' refund'' or have ''balance owing'', which may be zero. The T1 and any balance owing for each year are generally due by the end of April of the following year. The T1 filing deadline (April 30) is extended to June 15 where th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Efile

EFILE is the system used by the Canada Revenue Agency as a means for electronically transmitting tax returns. It became a national program in 1993. EFILE is only available to professional tax preparers and is not to be confused with the publicly available NETFILE. EFILE is a form of Electronic Data Interchange Electronic data interchange (EDI) is the concept of businesses electronically communicating information that was traditionally communicated on paper, such as purchase orders, advance ship notices, and invoices. Technical standards for EDI exist to .... Requirements * A form T183, ''Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return'', needs to be signed by the client. * Software meeting CRA certification standards, such as Intuit's Profile or Microsophic Inc.'s Visual Tax. * Must be a professional to qualify, along with passing the CRA screening of new applicants. Advantages {{cleanup rewrite, section=yes, date=October 2017 * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TurboTax

TurboTax is a software package for preparation of American and Canadian income tax returns, produced by Intuit. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993. The company has been subject of controversy over its political influence and deceptive business practices. Intuit, the maker of TurboTax, has engaged in a multi-million dollar lobbying campaign against the Internal Revenue Service (IRS) creating its own online system of tax filing like those that exist in most other wealthy countries. Intuit is under investigation by multiple state attorneys general, as well as New York State Department of Financial Services. As part of an agreement with the IRS Free File program, TurboTax allowed individuals making less than $39,000 a year to use a free version of TurboTax; a 2019 ProPublica investigation revealed that TurboTax delibe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intuit

Intuit Inc. is an American multinational business software company that specializes in financial software. The company is headquartered in Mountain View, California, and the CEO is Sasan Goodarzi. Intuit's products include the tax preparation application TurboTax, the small business accounting program QuickBooks, the credit monitoring and personal accounting service Credit Karma, and email marketing platform Mailchimp. more than 95% of its revenues and earnings come from its activities within the United States. Listed on Nasdaq, the company is a component of the Nasdaq-100, S&P 100, and S&P 500 stock market indices. Intuit offered a free online service called TurboTax Free File as well as a similarly named service called TurboTax Free Edition which is not free for most users. In 2019, investigations by ProPublica found that Intuit deliberately steered taxpayers from the free TurboTax Free File to the paid TurboTax Free Edition using tactics including search engine deli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

H&R Block

H&R Block, Inc., or H&R Block, is an American tax preparation company operating in Canada, the United States, and Australia. The company was founded in 1955 in Kansas City, Missouri, by brothers Henry W. Bloch and Richard Bloch. As of 2018, H&R Block operates approximately 12,000 retail tax offices staffed by tax professionals worldwide. The company offers payroll, and business consulting services, consumer tax software, and online tax preparation/IRS e-file, electronic filing from their website. History Founding During World War II, Henry W. Bloch was a young United States Army Air Forces, Army Air Forces navigator who wanted to start a family business with his brothers in Kansas City., Many Happy Returns, Thomas M. Bloch, 2010. Home from the war in 1946, Henry saw a pamphlet suggesting a bright future for companies serving small businesses, and it sparked his imagination. That year, Henry and his older brother, Leon, borrowed $5,000 and opened a small bookkeeping business on M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NETFILE

NETFILE is a transmission service that allows eligible Canadians to submit their personal income tax return to the Canada Revenue Agency using the Internet. Tax returns filed via NETFILE must first be prepared using a NETFILE-certified product. The software or Web application produces a .tax file, which must then be uploaded to the CRA independently to constitute a tax filing. NETFILE was introduced in 2001. According to CRA, 26% of total 2014 tax returns were sent by Netfile. To Netfile taxes, users need a certified tax program, which is listed on thCRA website Advantages According to the CRA website, ''Canadian Revenue Agency''. Retrieved 2015-03-24. filing directly through a NETFILE-certified tax software offers greater accuracy and immediate confirmation once the tax return is received. Receipt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interpretation Act

Interpretation Act (with its variations) is a stock short title used for legislation in Australia, Canada, Hong Kong, Malaysia, New Zealand, the Republic of Ireland, Singapore and the United Kingdom relating to interpretation of legislation. The Bill for an Act with this short title will have been known as the Interpretation Bill during its passage through Parliament. Interpretation Acts may be a generic name either for legislation bearing that short title or for all legislation which relates to interpretation. List Australia Commonwealth *The Acts Interpretation Act 1901 States and territories * Interpretation Act 1967 (ACT) * Legislation Act 2001 (ACT) * Interpretation Act 1987 (NSW) * Interpretation Act 1978 (NT) * Acts Interpretation Act 1954 (Qld) * The Acts Interpretation Act 1931 (Tas.) * Interpretation of Legislation Act 1984 (Vic.) * Interpretation Act 1984 (WA) Canada Federal *The Interpretation Act, RSC 1985, c I-21 Provinces and territories *The Interpretation Act, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |