|

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some taxpayers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HMRC Self Assessment Tax Return

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a department of the UK government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the Tudor Crown enclosed within a circle. Departmental responsibilities The department is responsible for the administration and collection of direct taxes including Income Tax, Corporation Tax, Capital Gains Tax (CGT) and Inheritance Tax (IHT), indirect taxes including Value Added Tax (VAT), excise duties and Stamp Duty Land Tax (SDLT), and environmental taxes such as Air Passenger Duty and the Climate Change Levy. Other aspects of the department's responsibili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Code (PAYE)

In the UK, every person paid under the PAYE scheme is allocated a tax code by HM Revenue and Customs. This is usually in the form of a number followed by a letter suffix, though other 'non-standard' codes are also used. This code describes to employers how much tax to deduct from an employee. The code is normally based provided to HMRC by the taxpayer or their employer. Tax codes are usually adjusted once a year to take into account any changes made in the National Budget, but can be altered more often to reflect an employee's circumstances. Tax codes can be changed if someone has paid too much or too little tax the previous tax year, if an employee receives state benefits, or has non-PAYE income (for example, self-employed earnings). Changes in a tax code are to ensure the employee has paid the correct amount of tax by the end of each tax year. Tax codes are passed between periods of employment by a P45, which is generated when a person leaves a job. If a P45 is mislaid or not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Canada)

Tax returns in Canada refer to the obligatory forms that must be submitted to the Canada Revenue Agency (CRA) each financial year for individuals or corporations earning an income in Canada. The return paperwork reports the sum of the previous year's (January to December) taxable income, tax credits, and other information relating to those two items. The return is the method by which the Canadian government determines the appropriate amount of tax that should be paid by individuals and corporations. The result of filing a return with the federal government can result in either a refund (money owed to the person or corporation filing the return), or an amount due to be paid. Under the '' Income Tax Act'', there is a penalty for not filing a tax return, if tax is due. In generalised terms, a tax return refers to the yearly income declaration created by the taxpayer for every individual in the country. This enables tax authorities to declare if an individual is eligible to be given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Australia)

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year. Australian individual taxpayers can file their return online with the ATO's myTax software, by ordering a printed copy of the tax return form, or with the assistance of a tax agent. Until 2011, the Australian Taxation Office (ATO) published TaxPack, a free document designed to help individuals complete their return. In 2012, TaxPack was replaced with a smaller instruction document, due to increased usage of the e-tax software. Extensions of the deadline for lodging a tax return are automatically available to those individuals using a Registered Tax Agent operating on an extended lodgement system, and extensions can be made available under some circumstances. In Australia, individuals and taxpaying entities with taxable income might need to lodge different returns with the ATO in respect of various forms of taxation. Se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Attlee ministry in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of sixteen years, until the age they become eligible for the State Pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute through a percentage of net profits above a threshold, which is reviewed periodically. Individuals may also make volunt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PAYE

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax. United Kingdom Origins Devised by Sir Paul Chambers, PAYE was introduced into the UK in 1944, following trials in 1940–1941. As with many of the United Kingdom's institutional arrangements, the way in which the state collects income tax through PAYE owes much of its form and structure to the peculiarities of the era in which it was devi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary (trust)

In trust law, a beneficiary (also known by the Law French terms and trust), is the person or persons who are entitled to the benefit of any trust arrangement. A beneficiary will normally be a natural person, but it is perfectly possible to have a company (law), company as the beneficiary of a trust, and this often happens in sophisticated commercial transaction structures. With the exception of charitable trusts, and some specific anomalous purpose trust, non-charitable purpose trusts, all trusts are required to have ascertainable beneficiaries. Generally speaking, there are no strictures as to who may be a beneficiary of a trust; a beneficiary can be a minor, or under a mental disability (in fact many trusts are created specifically for persons with those legal disadvantages). It is also possible to have trusts for unborn children, although the trusts must Vesting, vest within the applicable perpetuity period. Categorization There are various ways in which beneficiaries of tru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Representative

In common law jurisdictions, a personal representative or legal personal representative is a person appointed by a court to administer the estate of another person. If the estate being administered is that of a deceased person, the personal representative is either an executor if the deceased person left a will or an administrator of an intestate estate. In other situations, the personal representative may be a guardian or trustee, or other position. As a fiduciary, a personal representative has the duties of loyalty, candor or honesty, and good faith. In the United States, ''punctilio of honor'', or the highest standard of honor, is the level of scrupulousness that a fiduciary must abide by.'' Meinhard v. Salmon'', 164 N.E. 545 (N.Y. 1928). In either case of a deceased estate, a probate court of competent jurisdiction issues a finding of fact, including that a will has or has not been filed, and that an executor or administrator has been appointed. These are often referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Company

In a limited company, the Legal liability, liability of members or subscribers of the company is limited to what they have invested or guaranteed to the company. Limited companies may be limited by Share (finance), shares or by guarantee. In a company limited by shares, the liability of members is limited to the unpaid value of shares. In a company limited by guarantee, the liability of owners is limited to such amount as the owners may undertake to contribute to the assets of the company, in the event of being wound up. The former may be further divided in public companies (public limited company, public limited companies) and private companies (private limited company, private limited companies). Who may become a member of a private limited company is restricted by law and by the company's rules. In contrast, anyone may buy shares in a public limited company. Limited companies can be found in most countries, although the detailed rules governing them vary widely. It is also com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Person

In law, a legal person is any person or legal entity that can do the things a human person is usually able to do in law – such as enter into contracts, lawsuit, sue and be sued, ownership, own property, and so on. The reason for the term "''legal'' person" is that some legal persons are not human persons: Company, companies and corporations (i.e., business entities) are ''persons'', legally speaking (they can legally do most of the things an ordinary person can do), but they are not, in a literal sense, human beings. Legal personhood is a prerequisite to capacity (law), legal capacity (the ability of any legal person to amend – i.e. enter into, transfer, etc. – rights and Law of obligations, obligations): it is a prerequisite for an international organization being able to sign treaty, international treaties in its own legal name, name. History The concept of legal personhood for organizations of people is at least as old as Ancient Rome: a variety of Coll ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

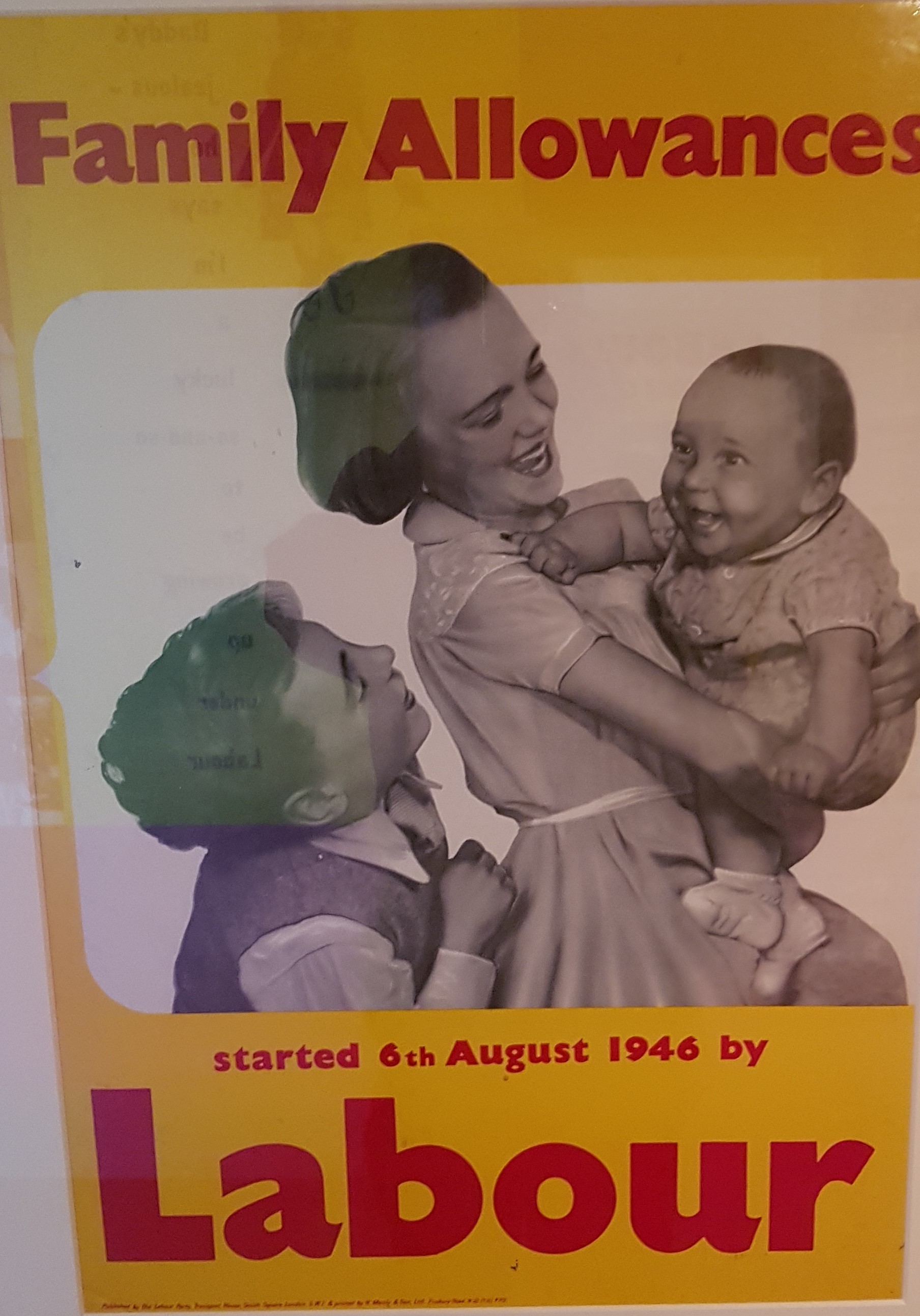

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefit. In most child benefit is means-testing, means-tested and the amount paid is usually dependent on the number of children. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, the system of child benefit payments, once termed child endowment and currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit, is income tested and linked to the Income tax in Australia#Family Tax Benefit, Australian Income tax system. It can be clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Allowance

In the UK tax system, personal allowance is the threshold above which income tax is levied on an individual's income. A person who receives less than their own personal allowance in taxable income (such as earnings and some benefits) in a given tax year does not pay income tax; otherwise, tax must be paid according to how much is earned above this level. Certain residents are entitled to a larger personal allowance than others. Such groups include: the over-65s (followed by a further increased allowance for over-75s), blind people, and married couples where at least one person in the marriage (or civil partnership) was born before 6 April 1935. People earning over £100,000 a year have a smaller personal allowance. For every £2 earned above £100,000, £1 of the personal allowance is lost; meaning that incomes high enough will not have a personal allowance. Personal allowance tapering On 22 April 2009, the then Chancellor Alistair Darling announced in the 2009 Budget sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |