Monopoly price on:

[Wikipedia]

[Google]

[Amazon]

In  Marginal cost (MC) relates to the firm's technical cost structure within production, and indicates the rise in total cost that must occur for an additional unit to be supplied to the market by the firm. The marginal cost is higher than the average cost because of diminishing marginal product in the short run. It can be calculated as , where .Henderson, James M., and Richard E. Quandt, "Micro Economic Theory, A Mathematical Approach. 3rd Edition", New York: McGraw-Hill Book Company, 1980. Glenview, Illinois: Scott, Foresmand and Company, 1988.

Usually, in many textbooks,

Marginal cost (MC) relates to the firm's technical cost structure within production, and indicates the rise in total cost that must occur for an additional unit to be supplied to the market by the firm. The marginal cost is higher than the average cost because of diminishing marginal product in the short run. It can be calculated as , where .Henderson, James M., and Richard E. Quandt, "Micro Economic Theory, A Mathematical Approach. 3rd Edition", New York: McGraw-Hill Book Company, 1980. Glenview, Illinois: Scott, Foresmand and Company, 1988.

Usually, in many textbooks,  Samuelson indicates this point on the consumer demand curve is where the price is equal to one over one plus the reciprocal of the

Samuelson indicates this point on the consumer demand curve is where the price is equal to one over one plus the reciprocal of the

This is done by equating the derivative of with respect to to 0. The profit of a firm is given by total revenue (price times quantity sold) minus total cost: , where * = quantity sold, * = the

which yields

where marginal revenue equals marginal cost. This is usually called the first order conditions for a profit maximum.

According to Samuelson,

By definition, is the reciprocal of the price elasticity of demand (or ), or

This gives the markup rule:

.

Note that the price elasticity of demand (and its reciprocal) is ''negative'', , so a more intuitive formula, using the absolute value of the elasticity, is

.

This shows clearly that the profit-maximizing price is set at a point where "demand is elastic", namely, the price elasticity of demand must be greater than unity in absolute terms, in order for the profit-maximizing price to be positive.

Letting be the reciprocal of the price elasticity of demand,

Thus the monopolistic firm chooses the quantity at which the demand price satisfies this rule. Since for a price setting firm, it means that a firm with market power will charge a price above marginal cost and earn a monopoly rent. On the other hand, a competitive firm by definition faces a perfectly elastic demand, , which means that it sets price equal to marginal cost.

The rule also implies that, absent menu costs, a monopolistic firm will never choose a point on the inelastic portion of its demand curve. For an

According to Samuelson,

By definition, is the reciprocal of the price elasticity of demand (or ), or

This gives the markup rule:

.

Note that the price elasticity of demand (and its reciprocal) is ''negative'', , so a more intuitive formula, using the absolute value of the elasticity, is

.

This shows clearly that the profit-maximizing price is set at a point where "demand is elastic", namely, the price elasticity of demand must be greater than unity in absolute terms, in order for the profit-maximizing price to be positive.

Letting be the reciprocal of the price elasticity of demand,

Thus the monopolistic firm chooses the quantity at which the demand price satisfies this rule. Since for a price setting firm, it means that a firm with market power will charge a price above marginal cost and earn a monopoly rent. On the other hand, a competitive firm by definition faces a perfectly elastic demand, , which means that it sets price equal to marginal cost.

The rule also implies that, absent menu costs, a monopolistic firm will never choose a point on the inelastic portion of its demand curve. For an

Monopoly pricing without perfect

Monopoly pricing without perfect

microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

, a monopoly price is set by a monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ...

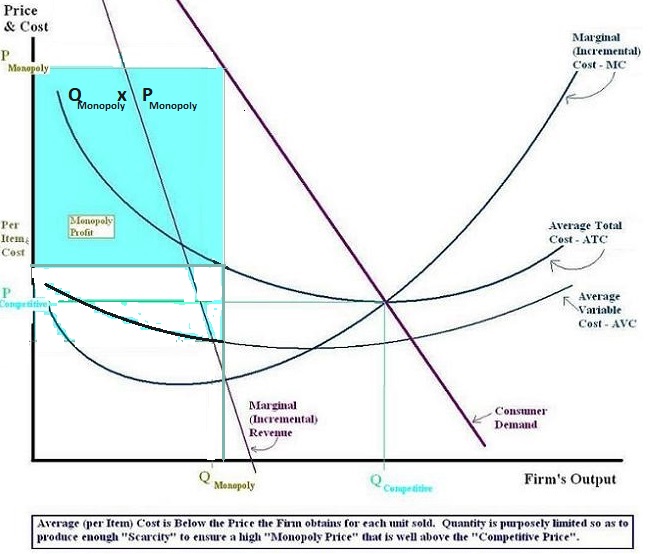

.Roger LeRoy Miller, ''Intermediate Microeconomics Theory Issues Applications, Third Edition'', New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988. A monopoly occurs when a firm lacks any viable competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, indi ...

and is the sole producer of the industry's product. Because a monopoly faces no competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, indi ...

, it has absolute market power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In othe ...

and can set a price above the firm's marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it ...

.

The monopoly ensures a monopoly price exists when it establishes the quantity of the product. As the sole supplier of the product within the market, its sales establish the entire industry's supply

Supply or supplies may refer to:

*The amount of a resource that is available

**Supply (economics), the amount of a product which is available to customers

**Materiel, the goods and equipment for a military unit to fulfill its mission

*Supply, as ...

within the market, and the monopoly's production and sales decisions can establish a single price for the industry without any influence from competing firms.John Black, "Oxford Dictionary of Economics", New York: Oxford University Press, 2003. The monopoly always considers the demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

for its product as it considers what price is appropriate, such that it chooses a production supply and price combination that ensures a maximum economic profit

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both explicit an ...

, which is determined by ensuring that the marginal cost (determined by the firm's technical limitations that form its cost structure) is the same as the marginal revenue

Marginal revenue (or marginal benefit) is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit.Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., ...

(MR) (as determined by the impact a change in the price of the product will impact the quantity demanded) at the quantity it decides to sell. The marginal revenue is solely determined by the demand for the product within the industry and is the change in revenue that will occur by lowering the price just enough to ensure a single additional unit is sold. The marginal revenue is positive, but it is lower than its associated price because lowering the price will increase the demand for its product and increase the firm's sales revenue, and lower the price paid by those who are willing to buy the product at the higher price, which ensures a lower sales revenue on the product sales than those willing to pay the higher price.

Marginal revenue can be calculated as , where . Marginal cost (MC) relates to the firm's technical cost structure within production, and indicates the rise in total cost that must occur for an additional unit to be supplied to the market by the firm. The marginal cost is higher than the average cost because of diminishing marginal product in the short run. It can be calculated as , where .Henderson, James M., and Richard E. Quandt, "Micro Economic Theory, A Mathematical Approach. 3rd Edition", New York: McGraw-Hill Book Company, 1980. Glenview, Illinois: Scott, Foresmand and Company, 1988.

Usually, in many textbooks,

Marginal cost (MC) relates to the firm's technical cost structure within production, and indicates the rise in total cost that must occur for an additional unit to be supplied to the market by the firm. The marginal cost is higher than the average cost because of diminishing marginal product in the short run. It can be calculated as , where .Henderson, James M., and Richard E. Quandt, "Micro Economic Theory, A Mathematical Approach. 3rd Edition", New York: McGraw-Hill Book Company, 1980. Glenview, Illinois: Scott, Foresmand and Company, 1988.

Usually, in many textbooks, economic cost Economic cost is the combination of losses of any goods that have a value attached to them by any one individual. Economic cost is used mainly by economists as means to compare the prudence of one course of action with that of another. The comparis ...

, here presented by , is divided into two categories; labor costs and capital costs:

, where

* = labor

Labour or labor may refer to:

* Childbirth, the delivery of a baby

* Labour (human activity), or work

** Manual labour, physical work

** Wage labour, a socioeconomic relationship between a worker and an employer

** Organized labour and the labour ...

hired,

* = wage

A wage is payment made by an employer to an employee for work (human activity), work done in a specific period of time. Some examples of wage payments include wiktionary:compensatory, compensatory payments such as ''minimum wage'', ''prevailin ...

rate,

* = total amount of capital

Capital and its variations may refer to:

Common uses

* Capital city, a municipality of primary status

** Capital region, a metropolitan region containing the capital

** List of national capitals

* Capital letter, an upper-case letter

Econom ...

financed by both debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

and equity,

* = cost of capital, including both interest expense and the minimum required rate of return on equity

* = = a function of the quantity of labor and capital employed in production Samuelson indicates this point on the consumer demand curve is where the price is equal to one over one plus the reciprocal of the

Samuelson indicates this point on the consumer demand curve is where the price is equal to one over one plus the reciprocal of the price elasticity of demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. Th ...

. This rule does not apply to competitive firms, as they are price takers and do not have the market power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In othe ...

to control either prices or industry-wide sales.

Although the term ''markup'' is sometimes used in economics to refer to the difference between a monopoly price and the monopoly's MC,Nicholson, Walter and Christopher Snyder, ''Microeconomic Theory: Basic Principles and Extensions'', Mason, OH: Thomson/South-Western, 2008. it is frequently used in American accounting and finance to define the difference between the price of the product and its per unit accounting cost. Accepted neo-classical micro-economic theory indicates the American accounting and finance definition of markup, as it exists in most competitive markets, ensures an accounting profit that is just enough to solely compensate the equity owners of a competitive firm within a competitive market for the economic cost (opportunity cost

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, ...

) they must bear if they hold on to the firm's equity. The economic cost of holding onto equity at its present value

In economics and finance, present value (PV), also known as present discounted value (PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money ha ...

is the opportunity cost the investor must bear when giving up the interest earnings on debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

of similar present value (they hold onto equity instead of the debt). Economists would indicate that a markup rule on economic cost used by a monopoly to set a monopoly price that will maximize its profit is excessive markup that leads to inefficiencies within an economic system.Henderson, James M., and Richard E. Quandt, "Micro Economic Theory, A Mathematical Approach. 3rd Edition", New York: McGraw-Hill Book Company, 1980. Glenview, Illinois: Scott, Foresmand and Company, 1988.Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., 1991.

Mathematical derivation: how a monopoly sets the monopoly price

Mathematically, the general rule a monopoly uses to maximize monopoly profit can be derived through simple calculus. The basic equation for economic profit, in which the total economic cost varies directly with the quantity produced, can be expressed as , where * = quantity sold, * = inverse demand function; the price at which can be sold given the existing demand * = total cost of producing . * = economic profitThis is done by equating the derivative of with respect to to 0. The profit of a firm is given by total revenue (price times quantity sold) minus total cost: , where * = quantity sold, * = the

partial derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant (as opposed to the total derivative, in which all variables are allowed to vary). P ...

of the inverse demand function, and the price at which can be sold given the existing demand

* = marginal cost, or the partial derivative of the total cost of producing

which yields

where marginal revenue equals marginal cost. This is usually called the first order conditions for a profit maximum.

equilibrium

Equilibrium may refer to:

Film and television

* ''Equilibrium'' (film), a 2002 science fiction film

* '' The Story of Three Loves'', also known as ''Equilibrium'', a 1953 romantic anthology film

* "Equilibrium" (''seaQuest 2032'')

* ''Equilibr ...

to exist in a monopoly or in an oligopoly

An oligopoly () is a market in which pricing control lies in the hands of a few sellers.

As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in ...

market, the price elasticity of demand must be less than negative one (), for marginal revenue to be positive. The mathematical profit maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, ...

conditions ("first order conditions") ensure the price elasticity of demand must be less than negative one, since no rational firm that attempts to maximize its profit would incur additional cost (a positive marginal cost) in order to reduce revenue (when MR < 0).

In the case of price elasticity of demand, it also called Lerner index

The Lerner index, formalized in 1934 by British economist of Russian origin Abba Lerner, is a measure of a firm's market power.

Definition

The Lerner index is defined by:

L=\frac

where P is the market price set by the firm and MC is the firm's ...

. The formula can be expressed:

,

means monopoly price set by firms

means the marginal cost of production

The Lerner index measures the level of market power and monopoly power that a firm owned.The higher Lerner index indicated the more monopoly power allows a company have chance to establish prices that are higher than their marginal costs and then lead a higher monopoly price.

In conclusion, a monopoly price is established by a monopolistic firm while they have no rivals in the market and feasible to raise price further above their marginal cost. In order to ensure a maximum economic return, the monopoly price is established at the point where marginal revenue equals marginal cost based on the firm's evaluation of the demand for its product. The Lerner index can be used to measured the degree of monopoly power and monopoly price.

In addition, monopoly price will prevent new business from entering the market and restrict innovation. A monopoly would not like to invest more on research and development or innovation due to it already has a captive market. Then the lack of innovation may block market competition and limit the industry’s growth potential in long run. The monopoly’s entrance restrictions also make it difficult for new businesses to enter the market, which reduces the scope for innovation and new ideas.

In sum up, monopoly pricing generally has negative consequences on consumers and the overall economy, resulting in higher costs, lower quantity desired, inefficiencies and a lack of innovation.

Properties

Objectives

Of the many price-setting methods, a monopoly will set the price with respect to market demand id estdemand-based pricing

Pricing is the Business process, process whereby a business sets and displays the price at which it will sell its products and services and may be part of the business's marketing plan. In setting prices, the business will take into account the ...

.

When a firm with absolute market power sets the monopoly price, the primary objective is to maximize its own profits by capturing consumer surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities:

* Consumer surplus, or consumers' surplus, is the monetary gain ...

and maximizing its own. A monopoly accomplishes this by setting a price above its marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it ...

and producing at a quantity that meets market demand and corresponds to the set price.

Nature

Monopoly Price and market inefficiencies

price discrimination

Price discrimination (differential pricing, equity pricing, preferential pricing, dual pricing, tiered pricing, and surveillance pricing) is a Microeconomics, microeconomic Pricing strategies, pricing strategy where identical or largely similar g ...

results in market inefficiencies when compared to other market structures. The inefficiencies in question are a loss of both consumer and producer surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities:

* Consumer surplus, or consumers' surplus, is the monetary gain ...

otherwise known as a deadweight loss

In economics, deadweight loss is the loss of societal economic welfare due to production/consumption of a good at a quantity where marginal benefit (to society) does not equal marginal cost (to society). In other words, there are either goods ...

. The loss in both surplus' are deemed allocatively inefficient and not socially optimal. In contrast, when the firm has more information and discrimination is present, monopoly pricing becomes increasingly efficient as it approaches perfect discrimination through the various forms of price discrimination:

* Quantity Discount

* Market Segregation

* Two-part tariff

A two-part tariff (TPT) is a form of price discrimination wherein the price of a product or service is composed of two parts – a lump-sum fee as well as a per-unit charge. In general, such a pricing technique only occurs in partially or fully ...

* Combination

In mathematics, a combination is a selection of items from a set that has distinct members, such that the order of selection does not matter (unlike permutations). For example, given three fruits, say an apple, an orange and a pear, there are ...

* User Controlled Price Discrimination

Theoretical Considerations

Dynamic Pricing for Monopolies

Much of the empirical literature suggest that setting a dynamic or variable monopoly price is market-efficient and can maximize total profits for the firm. However, this is only true when certain assumptions are made and specific circumstances are present. A paper written by Harris and Raviv advise firms who are restricted by productive capacity to set their prices on a priority-basis. If production capacity is capped and not only restricted, Harris and Raviv suggest pricing goods in an auction format to be optimal for maximizing profits. Both pricing schemes are argued to be effective under the assumptions that price adjustments are costless. Further studies by Rajan et al. (1993) have also concluded that a variable pricing scheme to be optimal for maximizing profits. Rajan argues that dynamic costs such as purchasing and carrying costs should lead to an increase in price. Additionally, He suggests goods that drop in value or decay should lead to a decrease in price as demand for said goods also decrease therefore the firm should drop the price as to maximize profits again and reclaim lost producer surplus.Market structure of monopoly

Amarket structure

Market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Market structure makes i ...

is defined by three factors which are barriers to entry, number of firms in the market, and product substitutability.

Below is the market structure for a monopoly:

Unlike perfect competition where firms can freely enter and exit the market, it is not the case for monopolistic competition. For a monopoly to exist, there must be high barriers to entry for new firms. Barriers to entry must be strong enough to discourage potential competitors from entering. However, if the number of firms in the market for a specific good or service increases, the perceived value of firms in the market will decrease. Therefore, the likelihood for firms to exit the market is higher, leaving one firm to monopolise the market.

The difference between the products or services of a perfect competition and one in a monopoly is if the products or services are differentiated. Thereby, the products or services sold in the monopolistic market are not perfect substitutes for one another.

Market power of monopoly

Market power is the firm's ability to affect terms and conditions of exchange. A monopoly possesses a substantial amount of market power, however, it is not unlimited. A monopoly is a price maker, not a price taker, meaning that a monopoly has the power to set the market price. The firm in monopoly is the market as it sets its price based on their circumstances of what best suits them.Summary of monopoly characteristics

To easily identify a monopoly, it would have one or more of these five characteristicsSee also

* Profit margins *Risk premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky Rate of retur ...

* Rate of return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment over a specified time period, such as i ...

References

{{reflist Financial economics