|

Lerner Index

The Lerner index, formalized in 1934 by British economist of Russian origin Abba Lerner, is a measure of a firm's market power. Definition The Lerner index is defined by: L=\frac where P is the market price set by the firm and MC is the firm's marginal cost. The index ranges from 0 to 1. A perfectly competitive firm charges P = MC, L = 0; such a firm has no market power. An oligopolist or monopolist charges P > MC, so its index is L > 0, but the extent of its markup depends on the elasticity (the price-sensitivity) of demand and strategic interaction with competing firms. The index rises to 1 if the firm has MC = 0. The following factors affect the value of the Lerner index: * the price elasticity of demand for goods produced by the company — the smaller the fluctuations in demand under the influence of prices, the smaller the elasticity and the greater the value of L; * the interaction with competitors — the more of them and the larger their size, the less the company' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abba Lerner

Abraham "Abba" Ptachya Lerner (also Abba Psachia Lerner; 28 October 1903 – 27 October 1982) was a Russian-born American-British economist. Biography Born in Novoselytsia, Bessarabia, Russian Empire, Lerner grew up in a Jewish family, which emigrated to Great Britain when Lerner was three years old. Lerner grew up in London's East End and from age 16 worked as a machinist, a teacher in Hebrew schools, and as an entrepreneur. In 1929, Lerner entered the London School of Economics, where he studied under Friedrich Hayek. A six-month stay at Cambridge in 1934–1935 brought him into contact with John Maynard Keynes. In 1937, Lerner emigrated to the United States. While in the US, he befriended intellectual opponents Milton Friedman and Barry Goldwater. Lerner never stayed at one institution long, serving on the faculties of nearly a dozen universities and accepting over 20 visiting appointments. Lerner was 62 when he was given a professorship at the University of California, Ber ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue. This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. The size of the gap, which encapsulates the firm's level of market dominance, is determined by the residual demand curve's form. A steeper reverse demand indicates higher earnings and more dominance in the market. Such propensities contradict Perfect competition, perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Maximization

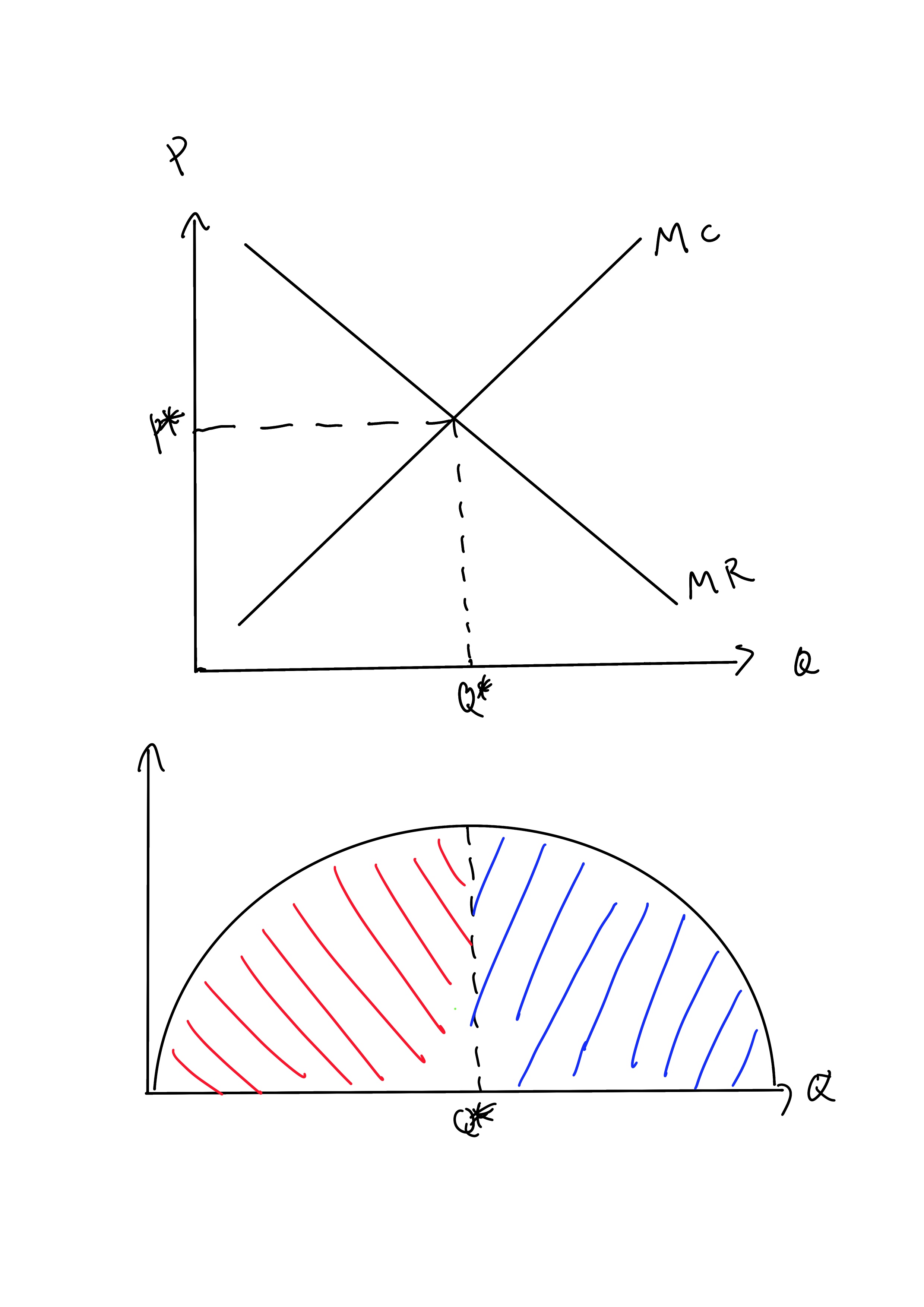

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economies Of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of Productivity, output produced per unit of cost (production cost). A decrease in unit cost, cost per unit of output enables an increase in scale that is, increased production with lowered cost. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of Market (economics), market control. Economies of scale arise in a variety of organizational and business situations and at various levels, such as a production, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale occur. Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. The economic concept dates back to Adam Smith and the idea o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ramsey Problem

The Ramsey problem, or Ramsey pricing, or Ramsey–Boiteux pricing, is a second-best policy problem concerning what prices a public monopoly should charge for the various products it sells in order to maximize social welfare (the sum of producer and consumer surplus) while earning enough revenue to cover its fixed costs. Under Ramsey pricing, the price markup over marginal cost is inversely related to the price elasticity of demand and the Price elasticity of supply: the more elastic the product's demand or supply, the smaller the markup. Frank P. Ramsey discovered this principle in 1927 in the context of Optimal taxation: the more elastic the demand or supply, the smaller the optimal tax. The rule was later applied by Marcel Boiteux (1956) to natural monopolies (industries with decreasing average cost). A natural monopoly earns negative profits if it sets prices equal to marginal cost, so it must set prices for some or all of the products it sells above marginal cost if it is to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amoroso–Robinson Relation

The Amoroso–Robinson relation, named after economists Luigi Amoroso and Joan Robinson, describes the relation between price, marginal revenue, and price elasticity of demand. \frac=p\left( 1+\frac\right), where *\scriptstyle \frac is the marginal revenue, *x is the particular Good (economics), good, *p is the good's price, *\epsilon_<0 is the price elasticity of demand. Extension and generalization In 1967, Ernst Lykke Jensen published two extensions, one deterministic, the other probabilistic, of Amoroso–Robinson's formula.See also * Lerner index * Ramsey problemReferences Citations Bibliography * *Further reading * Revenue {{microeconomics-stub ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Segmentation Index

Market segmentation index—or the Celli index of market segmentation, named after the Italian economist Gianluca Celli—is a measure of market segmentation. This Index, is a comparative measure of the degree of monopoly power in two distinctive markets for products that have the same marginal costs. Definition The degree of market segmentation is defined as the degree of monopoly power of the producing firm or exporting country. The higher the average unit value (AUV) of the same product sold in the main market compared to the benchmark market, the greater the degree of monopoly power in that market and therefore higher is the degree of market segmentation, expressed in the following formula: Pp/Ps = C, p ≠ s (1) Pp and Ps are respectively the prices the producing country set in the primary market (primary market or market of interest) Mp and the secondary market (benchmark) Ms. C is the market segmentation index (MSI), which measures the degree of segmentation of the prod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eponyms In Economics

An eponym is a noun after which or for which someone or something is, or is believed to be, named. Adjectives derived from the word ''eponym'' include ''eponymous'' and ''eponymic''. Eponyms are commonly used for time periods, places, innovations, biological nomenclature, astronomical objects, works of art and media, and tribal names. Various orthographic conventions are used for eponyms. Usage of the word The term ''eponym'' functions in multiple related ways, all based on an explicit relationship between two named things. ''Eponym'' may refer to a person or, less commonly, a place or thing for which someone or something is, or is believed to be, named. ''Eponym'' may also refer to someone or something named after, or believed to be named after, a person or, less commonly, a place or thing. A person, place, or thing named after a particular person share an eponymous relationship. In this way, Elizabeth I of England is the eponym of the Elizabethan era, but the Elizabethan e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |