Foreign Direct Investment In Iran on:

[Wikipedia]

[Google]

[Amazon]

Foreign direct investment in Iran (FDI) has been hindered by unfavorable or complex operating requirements and by

Foreign direct investment in Iran (FDI) has been hindered by unfavorable or complex operating requirements and by

. '' Global Competitiveness Report'',

''Wall Street Journal'', 12 March 2014. Retrieved 13 March 2014.Dean A. DeRosa & Gary Clyde Hufbauer

"Normalization of Economic Relations"

(U.S.) National Foreign Trade Council. 21 November 2008. Retrieved 30 March 2012.

Stock of FDI in Iran equaled $16.82 billion (at home) and $2.075 billion (abroad) according to ''

Stock of FDI in Iran equaled $16.82 billion (at home) and $2.075 billion (abroad) according to ''

According to

According to

Foreign Investment Promotion and Protection Act (FIPPA)

include: *Allowing foreign investment in all sectors opened to Iranian private companies. *A review of the definition of "Foreign Investor" to include Iranian expatriates provided that their investment capital originates from abroad. *Allowing repatriation of local sales related profits in addition to export-related profits in hard currency at the current official exchange rate. *Fair compensation in case of

In the 1990s and early 2000s, some indirect oilfield development agreements were made with foreign firms. Buyback contracts in the oil sector, for instance, were arranged in which the contractor funded all the investments, and then received remuneration from the National Iranian Oil Company (NIOC) in the form of an allocated production share, then transferred operation of the field to NIOC after a set number of years, at which time the contract was completed.

In February 2007 the government unveiled its new buyback-contract formula, which significantly extended the length of the contracts to as long as 20 years. The buy-back scheme is a formula used by the Iranian government to attract foreign investment. Following the end of the

In the 1990s and early 2000s, some indirect oilfield development agreements were made with foreign firms. Buyback contracts in the oil sector, for instance, were arranged in which the contractor funded all the investments, and then received remuneration from the National Iranian Oil Company (NIOC) in the form of an allocated production share, then transferred operation of the field to NIOC after a set number of years, at which time the contract was completed.

In February 2007 the government unveiled its new buyback-contract formula, which significantly extended the length of the contracts to as long as 20 years. The buy-back scheme is a formula used by the Iranian government to attract foreign investment. Following the end of the

Iran's interest in free zones can be traced back to the 1970s.

Iran's interest in free zones can be traced back to the 1970s.

Doing business in Iran: trade and export guide

– U.K. Government

Ministry of Economic Affairs and Finance Of Iran

– Official Website

Ministry of Industry , Mine & Trade Of Iran

– Official Website

Organization For Investment, Economic and Technical Assistance of Iran

– Government "one-stop institution" for FDI in Iran

Iran Foreign Investment Company (IFIC)

– (In charge of managing Iran's holdings abroad)

Trade Promotion Organization Of Iran

– Affiliated with the Ministry of Industry, Mine and Trade of Iran

High Council of Iran Free Trade-Industrial Zone

– Official site with information on Iran's Free Trade Zones laws and current projects

Business consulting information

– Affiliated to the Iran Chamber of Commerce Industries and Mines

Information on the Foreign Investment Promotion and Protection Act (FIPPA) and Taxes

– Ministry of Economic Affairs and Finance (Iran)

Buy-backs in Iran's oil industry

– Atieh Bahar Group (2002) ;General

Business Year – Iran

(VIP interviews, economic data, sector reports)

Iran Investment Organization

– Consulting services

– U.K.-Iran Chamber of Commerce

Iran Business Forecast Report

– Business Monitor International (Economic & sector reports updated quarterly)

Global Investment in Iran

–

FDI.net

– Information about FDI in Iran from the World Bank. * – Information on business etiquette in Iran {{DEFAULTSORT:Foreign Direct Investment in Iran Foreign trade of Iran Foreign relations of Iran

Foreign direct investment in Iran (FDI) has been hindered by unfavorable or complex operating requirements and by

Foreign direct investment in Iran (FDI) has been hindered by unfavorable or complex operating requirements and by international sanctions

International sanctions are political and economic decisions that are part of diplomatic efforts by countries, multilateral or regional organizations against states or organizations either to protect national security interests, or to protect i ...

, although in the early 2000s the Iranian government liberalized investment regulations. Iran ranks 62nd in the World Economic Forum

The World Economic Forum (WEF) is an international non-governmental organization, international advocacy non-governmental organization and think tank, based in Cologny, Canton of Geneva, Switzerland. It was founded on 24 January 1971 by German ...

's 2011 analysis of the global competitiveness of 142 countries.Iran ranks 69th out of 139 in global competitiveness. '' Global Competitiveness Report'',

World Economic Forum

The World Economic Forum (WEF) is an international non-governmental organization, international advocacy non-governmental organization and think tank, based in Cologny, Canton of Geneva, Switzerland. It was founded on 24 January 1971 by German ...

(2010). Retrieved 18 September 2010. In 2010, Iran ranked sixth globally in attracting foreign investments.

Foreign investors have concentrated their activity in a few sectors of the economy: the oil and gas industries, vehicle manufacture, copper

Copper is a chemical element; it has symbol Cu (from Latin ) and atomic number 29. It is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. A freshly exposed surface of pure copper has a pinkish-orang ...

mining

Mining is the Resource extraction, extraction of valuable geological materials and minerals from the surface of the Earth. Mining is required to obtain most materials that cannot be grown through agriculture, agricultural processes, or feasib ...

, petrochemicals, foods, and pharmaceuticals

Medication (also called medicament, medicine, pharmaceutical drug, medicinal product, medicinal drug or simply drug) is a drug used to diagnose, cure, treat, or prevent disease. Drug therapy ( pharmacotherapy) is an important part of the ...

. Iran absorbed US$24.3 billion of foreign investment from 1993 to 2007 and US$34.6 billion for 485 projects from 1992 to 2009.

Opening Iran's market place to foreign investment could also be a boon to competitive multinational firms operating in a variety of manufacturing and service sectors, worth $600 billion to $800 billion in new investment opportunities over the next decade.Asa Fitch: Post-Sanctions Iran Could Be A Turkey-Size Win for Investors''Wall Street Journal'', 12 March 2014. Retrieved 13 March 2014.Dean A. DeRosa & Gary Clyde Hufbauer

"Normalization of Economic Relations"

(U.S.) National Foreign Trade Council. 21 November 2008. Retrieved 30 March 2012.

FDI statistics

Countries

Firms from over 50 countries have invested in Iran in the past 16 years (1992–2008), with Asia and Europe receiving the largest share, as follows:Sectors

As of 2007, Asian entrepreneurs made the largest investments in the Islamic state by investing in 40 out of 80 projects funded by foreigners. The largest amount of foreign investment was in the industrial sector, including food and beverage, tobacco, textiles, clothing, leather, chemical, steel and oil derivates. The figure exceeded US$8.76 billion. Water, electricity and gas sector ranked second, attracting $874.83 million. In the third place, the real estate sector absorbed more than $406 million. Investments in service, telecommunication, transportation and mines reached $193 million, $14.3 million and $14.2 million respectively. Asian countries invested $7.666 billion in various projects followed by several multinational consortia. Investments by these multinational companies exceeded $1.39 billion (in four projects). Although European entrepreneurs were involved in 34 projects, they invested only in the range of $1.2 billion in the Islamic Republic. American countries also committed $12.329 million in the country; while investments by African states registered close to $4 million.Amounts

Stock of FDI in Iran equaled $16.82 billion (at home) and $2.075 billion (abroad) according to ''

Stock of FDI in Iran equaled $16.82 billion (at home) and $2.075 billion (abroad) according to ''The World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a Reference work, reference resource produced by the United States' Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The off ...

'' statistics in 2010.

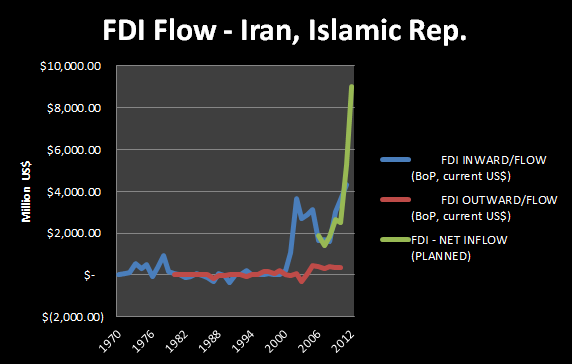

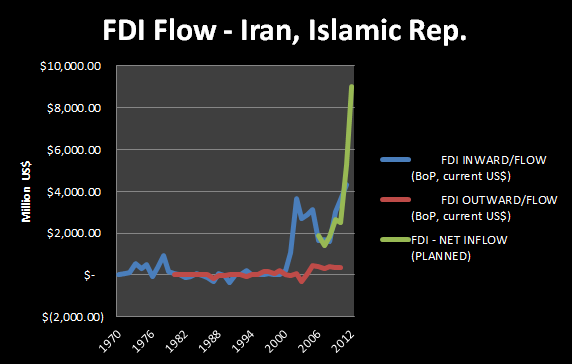

According to the United Nations Conference on Trade and Development

UN Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembl ...

(UNCTAD), foreign direct investment (FDI) in Iran hit a new record in 2010 and surpassed 3.6 billion dollars despite sanctions imposed on the Islamic Republic. The EIU estimates that Iran's net FDI flow will rise by 100 per cent within the next four years (2010–14). The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

estimates that FDI (net inflow) in Iran was $1.4 billion in 2011 (equivalent to 0.3% of GDP) down from $3.2 billion in 2010. The report forecasts this figure for 2012 to fall to $1.25 billion, but increase again for the next 3 years and to reach $1.8 billion in 2015. The Government of Iran says ''planned'' FDI in 2011 was $4.3 billion and planned FDI will reach $8–10 billion in 2012–13. However, UNCTAD later reported that FDI ''inflow'' in Iran was $3.05 billion in 2013, while Iran's FDI in other countries (i.e. ''outflow'' FDI) was $380 million.

Bushehr province and Khuzestan province

Khuzestan province () is one of the 31 Provinces of Iran. Located in the southwest of the country, the province borders Iraq and the Persian Gulf, covering an area of . Its capital is the city of Ahvaz. Since 2014, it has been part of Iran's R ...

enjoy the highest volume of foreign investment which mostly goes for oil and gas sectors. In 2012, the provinces of Fars, Gilan, Tehran

Tehran (; , ''Tehrân'') is the capital and largest city of Iran. It is the capital of Tehran province, and the administrative center for Tehran County and its Central District (Tehran County), Central District. With a population of around 9. ...

, Kerman, Mazandaran and West Azerbaijan

West Azerbaijan province () is one of the 31 provinces of Iran, provinces of Iran, whose capital and largest city is Urmia.

It is in the Azerbaijan (Iran), northwest of the country, bordered by Turkey (Ağrı Province, Ağrı, Hakkâri Pr ...

ranked first to sixth place in attracting foreign investment in the country.

According to the government of Iran, Iran needs up to $300 billion in foreign direct investment to meet the objectives of its Five-Year Economic Development Plan (2010–2015), and reach eight percent economic growth rate. Turning to "Vision 2025", the plan has set an investment target of $3.7 trillion within two decades (2005–2025) of which $1.3 trillion should be in the form of foreign investment.

Companies

The Organization for Investment, Economic and Technical Assistance of Iran (OIETAI) is responsible for receiving and processing all foreign investment applications. OIETAI is also responsible for approving overseas Iranian investments. In other words, the organization is in charge of consolidating and implementing two-way foreign investment flows. According to Iranian President Rouhani cooperation with Iran is on the condition that foreign companies participate in joint investments, technology programs, and exporting from Iran. As at 2012, 400 foreign companies are directly investing in Iran. Among developed nations, the most active investors have been Germans, Norwegian, British, French, Japanese, Russian, South Korean, Swedish, and Swiss companies. The Swedish Svedala Industri has played a major role in developing Iran's copper mines since the late 1990s while Tata Steel of India has been investing in the steel sector. The Kia,Nissan

is a Japanese multinational Automotive industry, automobile manufacturer headquartered in Yokohama, Kanagawa, Japan. The company sells its vehicles under the ''Nissan'' and ''Infiniti'' brands, and formerly the ''Datsun'' brand, with in-house ...

, Peugeot

Peugeot (, , ) is a French automobile brand owned by Stellantis.

The family business that preceded the current Peugeot companies was established in 1810, making it the oldest car company in the world. On 20 November 1858, Émile Peugeot applie ...

, and Renault

Renault S.A., commonly referred to as Groupe Renault ( , , , also known as the Renault Group in English), is a French Multinational corporation, multinational Automotive industry, automobile manufacturer established in 1899. The company curr ...

of France auto companies have licensing agreements with Iranian auto manufacturers. Danone of France, Nestlé

Nestlé S.A. ( ) is a Swiss multinational food and drink processing conglomerate corporation headquartered in Vevey, Switzerland. It has been the largest publicly held food company in the world, measured by revenue and other metrics, since 20 ...

of Switzerland and Coca-Cola

Coca-Cola, or Coke, is a cola soft drink manufactured by the Coca-Cola Company. In 2013, Coke products were sold in over 200 countries and territories worldwide, with consumers drinking more than 1.8 billion company beverage servings ...

and PepsiCo

PepsiCo, Inc. is an American multinational corporation, multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase, New York, Purchase. PepsiCo's business encompasses all aspects of the f ...

of the United States have joint ventures with Iranian companies. TotalEnergies, Equinor, Shell

Shell may refer to:

Architecture and design

* Shell (structure), a thin structure

** Concrete shell, a thin shell of concrete, usually with no interior columns or exterior buttresses

Science Biology

* Seashell, a hard outer layer of a marine ani ...

, Gazprom

PJSC Gazprom ( rus, Газпром, , ɡɐsˈprom) is a Russian State-owned enterprise, majority state-owned multinational Energy industry, energy corporation headquartered in the Lakhta Center in Saint Petersburg. The Gazprom name is a contract ...

, and LG of South Korea have been active in Iran's natural gas industry. Iran's constitution prohibits direct concession of petroleum

Petroleum, also known as crude oil or simply oil, is a naturally occurring, yellowish-black liquid chemical mixture found in geological formations, consisting mainly of hydrocarbons. The term ''petroleum'' refers both to naturally occurring un ...

rights to foreign investors. Alcatel of France, MTN Group

MTN Group Limited (formerly M-Cell) is a South Africa, South African multinational corporation and mobile telecommunications provider. Its head office is in Johannesburg. MTN is among the List of mobile network operators, largest mobile netwo ...

of South Africa and Siemens of Germany gained major telecommunication

Telecommunication, often used in its plural form or abbreviated as telecom, is the transmission of information over a distance using electronic means, typically through cables, radio waves, or other communication technologies. These means of ...

s contracts in 2004 and 2005, respectively.

Front men

In 2015, ''The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'' and ''The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

'' reported that American companies (incl. Apple Inc. and Hewlett-Packard

The Hewlett-Packard Company, commonly shortened to Hewlett-Packard ( ) or HP, was an American multinational information technology company. It was founded by Bill Hewlett and David Packard in 1939 in a one-car garage in Palo Alto, California ...

) are using local (Iranian) front men to seal deals in Iran. In the oil and banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

business some "prime contracts" have already been signed while Iran is still under "international sanctions

International sanctions are political and economic decisions that are part of diplomatic efforts by countries, multilateral or regional organizations against states or organizations either to protect national security interests, or to protect i ...

". Boeing

The Boeing Company, or simply Boeing (), is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, and missiles worldwide. The company also provides leasing and product support s ...

, Microsoft

Microsoft Corporation is an American multinational corporation and technology company, technology conglomerate headquartered in Redmond, Washington. Founded in 1975, the company became influential in the History of personal computers#The ear ...

, Siemens, BP, Chevron, Gazprom

PJSC Gazprom ( rus, Газпром, , ɡɐsˈprom) is a Russian State-owned enterprise, majority state-owned multinational Energy industry, energy corporation headquartered in the Lakhta Center in Saint Petersburg. The Gazprom name is a contract ...

, Eni

Eni is an Italian oil and gas corporation.

Eni or ENI may refer to:

Businesses and organisations

* Escuela Nacional de Inteligencia, the Argentine intelligence academy

* Groupe des écoles nationales d’ingénieurs (Groupe ENI), a French engi ...

, Samsung

Samsung Group (; stylised as SΛMSUNG) is a South Korean Multinational corporation, multinational manufacturing Conglomerate (company), conglomerate headquartered in the Samsung Town office complex in Seoul. The group consists of numerous a ...

, Renault

Renault S.A., commonly referred to as Groupe Renault ( , , , also known as the Renault Group in English), is a French Multinational corporation, multinational Automotive industry, automobile manufacturer established in 1899. The company curr ...

. Peugeot

Peugeot (, , ) is a French automobile brand owned by Stellantis.

The family business that preceded the current Peugeot companies was established in 1810, making it the oldest car company in the world. On 20 November 1858, Émile Peugeot applie ...

, GM are also returning to Iran.

Economic profile

Business environment

United Nations Conference on Trade and Development

UN Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembl ...

, Iran ranked sixth globally in 2010 in attracting foreign investments. According to the head of the Organisation for Investment, Economic and Technical Assistance of Iran (OIETAI), in 2008 Iran ranked 142 among 181 countries in terms of working conditions last year. Iran stands 96 in terms of business start, 165 in getting permits, 147 in employment, 147 in registering assets, 84 in getting credits, 164 in legal support for investments, 104 in tax payment, 142 in overseas trade, 56 in feasibility of contracts and 107 in bankruptcy. Iran is a member of the World Bank's Multilateral Investment Guarantee Agency. Iran ranks 69th out of 139 in Global Competitiveness Report. Iran has more than 50 signed-bilateral investment treaties with other countries.

Natural resources

Iran is OPEC's second largest oil producer. It has approximately 9% of world oil reserves (some 94 billion barrels). It has the second largest reserves of natural gas in the world at some 812 trillion cubic feet. Iran is considered an energy superpower. Iran also possesses enormous mineral resources, including coal, copper, iron, zinc and gold. This has spawned a number of processing industries, particularly steel. Iran is already the third largest producer of copper in the world.Competitive advantages

Iran has made the development of non-oil exports a priority. The country has the advantage of a broad domestic industrial base,technology

Technology is the application of Conceptual model, conceptual knowledge to achieve practical goals, especially in a reproducible way. The word ''technology'' can also mean the products resulting from such efforts, including both tangible too ...

an educated and motivated workforce, cheap labor and energy resources and geographical location, which gives it access to an estimated population of some 300 million people in Caspian markets, Persian Gulf

The Persian Gulf, sometimes called the Arabian Gulf, is a Mediterranean seas, mediterranean sea in West Asia. The body of water is an extension of the Arabian Sea and the larger Indian Ocean located between Iran and the Arabian Peninsula.Un ...

states and countries further east. Iran has the consumer potential of Turkey

Turkey, officially the Republic of Türkiye, is a country mainly located in Anatolia in West Asia, with a relatively small part called East Thrace in Southeast Europe. It borders the Black Sea to the north; Georgia (country), Georgia, Armen ...

, the oil reserves

An oil is any chemical polarity, nonpolar chemical substance that is composed primarily of hydrocarbons and is hydrophobe, hydrophobic (does not mix with water) and lipophilicity, lipophilic (mixes with other oils). Oils are usually flammable ...

of Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in West Asia. Located in the centre of the Middle East, it covers the bulk of the Arabian Peninsula and has a land area of about , making it the List of Asian countries ...

, the natural gas reserves of Russia, and the mineral reserves of Australia. Iran's area roughly equals that of the United Kingdom, France, Spain, and Germany combined. Iran has a diverse climate which makes it suitable for a wide range of agricultural products.

Laws concerning foreign companies

Generally speaking, Iran has two types of laws concerning foreign companies. The first are laws that address issues concerning foreign companies directly such as the ''Foreign Investment Promotion and Protection Act'' (FIPPA) and the second are general laws of which certain articles or by-laws address foreign companies, for instance the Taxation Law and the Labor Law. Iran's environment is protected by strict laws and the Department of the Environment is in charge of evaluating the impact of the projects and their monitoring. General laws and regulations regarding foreign business in Iran could be regrouped under the following categories: *Contract work – A foreign company is allowed to be involved in contractual work in Iran. Such work may be performed either directly by the foreign company or through a registered branch in Iran. Branch offices in Iran do not have the separate legal status enjoyed by LLCs, and the parent company is responsible for the actions of the branch office. For legal and tax purposes, opening arepresentative office A representative office is an office established by a company or a legal entity to conduct marketing and other non-transactional operations, generally in a foreign country where a branch office or subsidiary is not warranted. Representative offices ...

in Iran, by itself, is not considered foreign direct investment

A foreign direct investment (FDI) is an ownership stake in a company, made by a foreign investor, company, or government from another country. More specifically, it describes a controlling ownership an asset in one country by an entity based i ...

. Establishing and setting up a legal presence in the Iranian market requires a local advisor who can provide a step-by-step advisory service regarding incorporation, office rental, recruitment, staff, business contracts, customs, and the laws in general. CMS Cameron McKenna is among the first major international law firms to open office in Iran.

*Direct sales – Most foreign companies are involved in direct sales to Iranian customers through letters of credit and, occasionally on the basis of Usance.

*Investments – In accordance with the terms of the ''Foreign Investment Promotion and Protection Act'' (FIPPA), foreign companies may invest in newly established factories and industries. Foreign companies are allowed to own 100 per cent of the businesses.

Investment by natural persons of foreign nationality

In 2006, Iranian citizens abroad's net worth was $1.3 trillion. In 2000, the Iran Press Service reported that Iranian expatriates had invested between $200 and $400 billion in the United States, Europe, and China, but almost nothing in Iran. InDubai

Dubai (Help:IPA/English, /duːˈbaɪ/ Help:Pronunciation respelling key, ''doo-BYE''; Modern Standard Arabic, Modern Standard Arabic: ; Emirati Arabic, Emirati Arabic: , Romanization of Arabic, romanized: Help:IPA/English, /diˈbej/) is the Lis ...

, Iranian expatriates have invested an estimated $200 billion (2006).

According to the Civil Code, foreign nationals will, subject to the existence of a treaty on reciprocity, enjoy the same rights and privileges of Iranians. The companies formed by such foreign nationals will be of Iranian nationality and subject to the same laws which regulate the activities of Iranian companies.

Foreign investment in the framework of the Commercial Code

The Iranian Commercial Code is divided into four parts: #merchant and trade activities, #trade companies, #negotiable instruments, #contracts and bankruptcy. Foreign nationals can, in the framework of the Commercial Code and subject to the observance of the relevant procedures, form and register companies in Iran. Iran's Commercial Code does not differentiate between Iranian and foreign stock holders of Iranian companies. In other words, there is no restriction regarding the nationality of those who want to establish companies in Iran. In this context, foreign exchange restrictions are equally applied to Iranian and foreign investors. Such companies, however, do not enjoy the privileges set out in FIPPA (see below).Company types

There are seven types of juridical entity or company which can be established under the Iranian Commercial Code as follows: #Joint-stock company

A joint-stock company (JSC) is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareho ...

may be either a public company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) co ...

(''Sherkat Sahami Am'') or a private company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equi ...

(''Sherkat Sahami Khass'')

#Limited liability company

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of ...

(LLC) (''Sherkat ba Masouliyat Mahdoud'')

# General partnership (''Sherkat Tazamoni'')

#Limited partnership

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnership ...

(''Sherkat Mokhtalet Gheyr Sahami'')

#Joint stock partnership (''Sherkat Mokhtalet Sahami'')

#Proportional liability partnership (''Sherkat Nesbi'')

#Manufacturing / Consumer Co-operative

A cooperative (also known as co-operative, coöperative, co-op, or coop) is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democr ...

(''Sherkat Ta’avoni va Masraf'')

From among all these different types, joint-stock company

A joint-stock company (JSC) is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareho ...

, in which the capital is divided by shares, is the most common and acceptable type of company which can be recommended to foreign investors.

FIPPA

Provisions of the 2002 Act entitleForeign Investment Promotion and Protection Act (FIPPA)

include: *Allowing foreign investment in all sectors opened to Iranian private companies. *A review of the definition of "Foreign Investor" to include Iranian expatriates provided that their investment capital originates from abroad. *Allowing repatriation of local sales related profits in addition to export-related profits in hard currency at the current official exchange rate. *Fair compensation in case of

nationalization

Nationalization (nationalisation in British English)

is the process of transforming privately owned assets into public assets by bringing them under the public ownership of a national government or state. Nationalization contrasts with p ...

. If an act of the government disrupts the business activity, the government will be under obligation to make payments for any loan installments that are due on behalf of the project company.

*FIPPA allows for international arbitration

International arbitration can refer to arbitration between companies or individuals in different states, usually by including a provision for future disputes in a contract (typically referred to as international commercial arbitration) or betwee ...

in legal disputes. There are two major arbitral institutions in Iran: the ''Tehran Regional Arbitration Centre'' (TRAC) and the Arbitration Centre of the Tehran Commercial Chamber.

*The establishment of a maximum 45-day period for the processing of individual foreign investment applications.

For the first time, project financing schemes such as buy back agreements and BOT projects (only under an operator status) are specifically covered under the foreign investment law.

Under the FIPPA, any foreign natural or legal person importing capital in Iran will enjoy the benefits and privileges of this law as long as:

*The investment leads to economic growth, promotes technology, promotes quality of products, increases employment opportunities, increases exports and entering the international markets.

*The investment does not jeopardize national security and public interests or harm the environment or interrupt national economy or disrupt products of domestic investments.

*The investment does not involve the granting of any special rights resulting in a monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ...

.

*The value ratio of goods and services produced by aggregate of foreign investments does not exceed 25% in each economic sector and in each economic branch shall not exceed 35%. FIPPA will be applicable based on the nationality of the Foreign Capital as opposed to the investor. As long as the capital comes from foreign sources, any one importing it will be eligible for FIPPA protection including Iranians residing in Iran or abroad.

Starting in 2014, foreign investors, who establish production lines in Iran and export 30 percent of their products, will be entitled to tax exemptions (up to 50%).

Potential approaches to the market

First and foremost, it is crucial to realize that Iranian authorities insist on a long-term commitment and a transfer of technology as a requisite for getting a share in the market. Foreign companies are therefore advised to adopt a medium- to long-term strategy for the Iranian market. Iran will almost never honor the interests of a company that does not show long-term commitment. Tenders are strictly required for government contracts for purchasing or projects. These are rarely competitive. Breaking up contracts into smaller parts is a common practice to try to incorporate at least 30% of the contract's value in local capability and also to negotiate on specific prices. Currently there are three main routes that a foreign company can follow to establish a long-term presence in Iran:Joint ventures

One possible strategy is for the foreign company to enter into a joint-venture agreement with a public or private Iranian partner. The existing level of technology and infrastructure makes many Iranian companies suitable for expansion and development in conjunction with foreign companies. Many Iranian companies, especially those in the private sector, are currently actively seeking joint-venture partners both to fill their technological as well as management gaps. Others are looking for a revival of their company through foreign capital. Should a company decide to adopt this approach to the market, it is advisable to look for products and services that have both domestic demand as well as regional export potential. If a joint-venture company can earn hard currency through export of its goods, it will not be too dependent on the Iranian banking system for the repatriation of profits and dividends. Some joint ventures consist purely of the transfer of technology to Iran by the foreign partner without any capital commitment. Since Iranian authorities are very keen on the introduction of modern technologies, this path can prove very constructive. In August 2010, the 25% ceiling set for joint venture companies in enjoying facilities from the foreign exchange reserve account has been eliminated. Industry and mines,agriculture

Agriculture encompasses crop and livestock production, aquaculture, and forestry for food and non-food products. Agriculture was a key factor in the rise of sedentary human civilization, whereby farming of domesticated species created ...

, transport

Transport (in British English) or transportation (in American English) is the intentional Motion, movement of humans, animals, and cargo, goods from one location to another. Mode of transport, Modes of transport include aviation, air, land tr ...

, services (such as tourism

Tourism is travel for pleasure, and the Commerce, commercial activity of providing and supporting such travel. World Tourism Organization, UN Tourism defines tourism more generally, in terms which go "beyond the common perception of tourism as ...

), IT and the export of goods and services are the sectors authorized to enjoy the new facilities from the Foreign Exchange Reserve Account.

Buy-back

In the 1990s and early 2000s, some indirect oilfield development agreements were made with foreign firms. Buyback contracts in the oil sector, for instance, were arranged in which the contractor funded all the investments, and then received remuneration from the National Iranian Oil Company (NIOC) in the form of an allocated production share, then transferred operation of the field to NIOC after a set number of years, at which time the contract was completed.

In February 2007 the government unveiled its new buyback-contract formula, which significantly extended the length of the contracts to as long as 20 years. The buy-back scheme is a formula used by the Iranian government to attract foreign investment. Following the end of the

In the 1990s and early 2000s, some indirect oilfield development agreements were made with foreign firms. Buyback contracts in the oil sector, for instance, were arranged in which the contractor funded all the investments, and then received remuneration from the National Iranian Oil Company (NIOC) in the form of an allocated production share, then transferred operation of the field to NIOC after a set number of years, at which time the contract was completed.

In February 2007 the government unveiled its new buyback-contract formula, which significantly extended the length of the contracts to as long as 20 years. The buy-back scheme is a formula used by the Iranian government to attract foreign investment. Following the end of the Iran–Iraq War

The Iran–Iraq War, also known as the First Gulf War, was an armed conflict between Iran and Iraq that lasted from September 1980 to August 1988. Active hostilities began with the Iraqi invasion of Iran and lasted for nearly eight years, unti ...

in 1988, Iran faced a major problem: it needed foreign investment if it did not want to lose its vital income from the oil and gas industry, yet its revolutionary ideology and Constitution

A constitution is the aggregate of fundamental principles or established precedents that constitute the legal basis of a polity, organization or other type of entity, and commonly determines how that entity is to be governed.

When these pri ...

forbid granting " concessions". A compromise solution was found in 1989 with the First Five-Year Economic, Social and Cultural Development Plan. Under Note 29 of the said plan, the Iranian government is allowed to employ " buybacks" in its effort to meet the industrial and mineral needs in connection with exports, production and investment. Put in laymen terms, a buy-back transaction is a method of trade where plants, machinery, production equipment and technology is supplied (by a domestic or foreign private firm), in exchange for the goods that will be produced directly or indirectly by means of such facilities.

Under this scheme, the foreign partner that makes the initial investment can repatriate the return on the investment (at a pre-agreed fixed rate) through goods and services produced by the project. While many foreign companies believe that this method is a mere financing instrument for Iran, it is more accurate to say that it is a compromise formula for foreign investment in the short-run. In the medium to long-term, more appropriate laws and regulations will probably replace the buy-back scheme. In other words, once the constitutional concerns have been dealt with, the foreign partners of buy-back agreements can take over the projects that they are involved in, or they can enter into a joint venture with an Iranian partner.

The Iranian (or Integrated) Petroleum Contract (IPC)

Some of the main criticisms of the buyback contracts include lack of flexibility of cost recovery and in some cases, the NIOC's limited expertise to reverse field decline rates in comparison to the International Oil Company (IOC) that developed the field. The Integrated Petroleum Contract (IPC) will require the IOCs to fulfill Iran's local content requirement, which will be 51% of the contract and transfer of technology. IPCs will be offered for work on somewhere between 34 and 74 oil fields and could last for the duration of a field's life. In 2013 Iran also announced for the first time since theIranian revolution

The Iranian Revolution (, ), also known as the 1979 Revolution, or the Islamic Revolution of 1979 (, ) was a series of events that culminated in the overthrow of the Pahlavi dynasty in 1979. The revolution led to the replacement of the Impe ...

of 1979, the offering of production sharing contracts (PSCs) for the most complicated and difficult projects, such as deep-water wells in the Caspian Sea

The Caspian Sea is the world's largest inland body of water, described as the List of lakes by area, world's largest lake and usually referred to as a full-fledged sea. An endorheic basin, it lies between Europe and Asia: east of the Caucasus, ...

(the details of which will be revealed in December 2015 in London).

Build-Operate-Transfer (BOT)

Recent regulations have introduced the Build–operate–transfer (BOT) scheme for Iranian projects. This is a rather new possibility in the Iranian market. In this scheme, the foreign partner invests in one project, which is then operated for a certain period of time by the foreign investor before it is fully transferred to the Iranian government. Iranian authorities are showing some flexibility regarding the BOT, which could potentially pave the way for more foreign investment in the market.Free trade zones and special economic zones

Iran's interest in free zones can be traced back to the 1970s.

Iran's interest in free zones can be traced back to the 1970s.

Advantages

Free-trade (FTZ) and special economic zones (SEZ) have been established to provide additional investment incentives such as: *20 years tax-exemption (15 years, before 2014); *no entry visa requirement; *100% foreign ownership possible; *flexible employment regulations; *flexible monetary & banking services; *extended legal guarantees & protection.Locations

As of January 2010, there were six free-trade zones (FTZ) and 16special economic zone

A special economic zone (SEZ) is an area in which the business and trade laws are different from the rest of the country. SEZs are located within a country's national borders, and their aims include increasing trade balance, employment, increas ...

s (SEZ) in Iran. More FTZ and SEZ are planned in Iran.

Outward FDI

Iran has made substantial investments abroad. The main agencies in charge are the Iran Foreign Investments Company (FDI) and the Central Bank of Iran (Forex

The foreign exchange market (forex, FX, or currency market) is a global decentralization, decentralized or Over-the-counter (finance), over-the-counter (OTC) Market (economics), market for the trading of currency, currencies. This market det ...

). Broadly speaking, these investments can be categorized as FDI and foreign portfolio investments:

Outward FDI include:

* Joint car factories abroad (e.g. Syria, Azerbaijan, Senegal, Belarus, Venezuela)

*Various joint petrochemical plants

*Various power plants

Portfolio investments include:

* National Development Fund portfolio investments abroad.

* Foreign exchange reserves held abroad (see also: Iranian frozen assets)

Partial ownership in:

* Daimler Benz (sold after its merger with Chrysler

FCA US, LLC, Trade name, doing business as Stellantis North America and known historically as Chrysler ( ), is one of the "Big Three (automobile manufacturers), Big Three" automobile manufacturers in the United States, headquartered in Auburn H ...

)

* Thyssen Krupp (Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

)

* Eurodif (see also: Nuclear program of Iran)

* Shah Deniz gas filed in the Caspian Sea

The Caspian Sea is the world's largest inland body of water, described as the List of lakes by area, world's largest lake and usually referred to as a full-fledged sea. An endorheic basin, it lies between Europe and Asia: east of the Caucasus, ...

* Oil and gas field in North sea (UK)

*Various hotels, hospitals and agricultural enterprises, mostly in the MENA and Africa regions.

* Skyscraper in Manhattan, New York (seized)

* All embassies and many commercial buildings belonging to the state including banks (e.g. Naftiran Intertrade in Switzerland

Switzerland, officially the Swiss Confederation, is a landlocked country located in west-central Europe. It is bordered by Italy to the south, France to the west, Germany to the north, and Austria and Liechtenstein to the east. Switzerland ...

)

* Oil pipelines in the ME, including in Israel (see also: Transport in Iran)

Besides, Iranians citizens and Iranian citizens abroad, as individuals, have made substantial investments in Dubai

Dubai (Help:IPA/English, /duːˈbaɪ/ Help:Pronunciation respelling key, ''doo-BYE''; Modern Standard Arabic, Modern Standard Arabic: ; Emirati Arabic, Emirati Arabic: , Romanization of Arabic, romanized: Help:IPA/English, /diˈbej/) is the Lis ...

(e.g. real estate, trading companies) and hold significant portfolio investments in various companies throughout Europe

Europe is a continent located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south, and Asia to the east ...

, China and the United States. Wealthy Iranians, companies

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specifi ...

and state-backed buyers will invest up to $8.5 billion in overseas real estate over the next five-to-10 years (2016).

See also

*Economy of Iran

Iran has a mixed economy, mixed, centrally planned economy with a large public sector."A survey of Iran: Stunted and distorted". ''The Economist'' (2003) It consists of hydrocarbon, agricultural and service sectors, in addition to manufacturing ...

* National Development Fund – Iran's sovereign wealth fund

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, Bond (finance), bonds, real estate, precious metals, or in alternative investments such as ...

* Asalouyeh

* Iran's outward FDI in oil fields

* Investment promotion agency

* List of Iranian companies

* Privatization in Iran

* Tehran Stock Exchange

* Iran Chamber of Commerce Industries and Mines – Including information on commercial dispute resolution

Dispute resolution or dispute settlement is the process of resolving disputes between parties. The term ''dispute resolution'' is '' conflict resolution'' through legal means.

Prominent venues for dispute settlement in international law incl ...

* Iran International Exhibitions Company

* Organization of Investment Economic and Technical Assistance of Iran

* Trade Promotion Organization of Iran

* Government of Iran

* Next Eleven – list of countries having a high potential of becoming the world's largest economies in the 21st century by Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

* EU-Iran Forum

References

Bibliography

;Books * * ;Investment guide * ;General statistics *External links

;Government relatedDoing business in Iran: trade and export guide

– U.K. Government

Ministry of Economic Affairs and Finance Of Iran

– Official Website

Ministry of Industry , Mine & Trade Of Iran

– Official Website

Organization For Investment, Economic and Technical Assistance of Iran

– Government "one-stop institution" for FDI in Iran

Iran Foreign Investment Company (IFIC)

– (In charge of managing Iran's holdings abroad)

Trade Promotion Organization Of Iran

– Affiliated with the Ministry of Industry, Mine and Trade of Iran

High Council of Iran Free Trade-Industrial Zone

– Official site with information on Iran's Free Trade Zones laws and current projects

Business consulting information

– Affiliated to the Iran Chamber of Commerce Industries and Mines

Information on the Foreign Investment Promotion and Protection Act (FIPPA) and Taxes

– Ministry of Economic Affairs and Finance (Iran)

Buy-backs in Iran's oil industry

– Atieh Bahar Group (2002) ;General

Business Year – Iran

(VIP interviews, economic data, sector reports)

Iran Investment Organization

– Consulting services

– U.K.-Iran Chamber of Commerce

Iran Business Forecast Report

– Business Monitor International (Economic & sector reports updated quarterly)

Global Investment in Iran

–

American Enterprise Institute

The American Enterprise Institute for Public Policy Research, known simply as the American Enterprise Institute (AEI), is a center-right think tank based in Washington, D.C., that researches government, politics, economics, and social welfare ...

(list of major international companies investing in Iran broken down by their nationality, sector of activity and amount invested)

* UN's global trade network, including list of English translations of Iranian laws

FDI.net

– Information about FDI in Iran from the World Bank. * – Information on business etiquette in Iran {{DEFAULTSORT:Foreign Direct Investment in Iran Foreign trade of Iran Foreign relations of Iran

Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the nort ...

Special economic zones

Investment by country