In the United States,

student loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest ...

s are a form of

financial aid

Student financial aid in the United States is funding that is available exclusively to students attending a post-secondary educational institution in the United States. This funding is used to assist in covering the many costs incurred in purs ...

intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses.

With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as

scholarship

A scholarship is a form of Student financial aid, financial aid awarded to students for further education. Generally, scholarships are awarded based on a set of criteria such as academic merit, Multiculturalism, diversity and inclusion, athleti ...

s and

bursaries

A bursary is a monetary award made by any educational institution or funding authority to individuals or groups. It is usually awarded to enable a student to attend school, university or college when they might not be able to, otherwise. Some awar ...

which are not repaid, and

grants

Grant or Grants may refer to:

People

* Grant (given name), including a list of people and fictional characters

* Grant (surname), including a list of people and fictional characters

** Ulysses S. Grant (1822–1885), the 18th president of the U ...

, which rarely have to be repaid. Student loans may be discharged through

bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

, but this is difficult. Research shows that access to student loans increases credit-constrained students' degree completion and later-life earnings while having no impact on overall debt.

Student loan debt

Student debt refers to the debt incurred by an individual to pay for education-related expenses. This debt is most commonly assumed to pay for tertiary education, such as university.

The amount loaned or the loan agreement is often referred to as ...

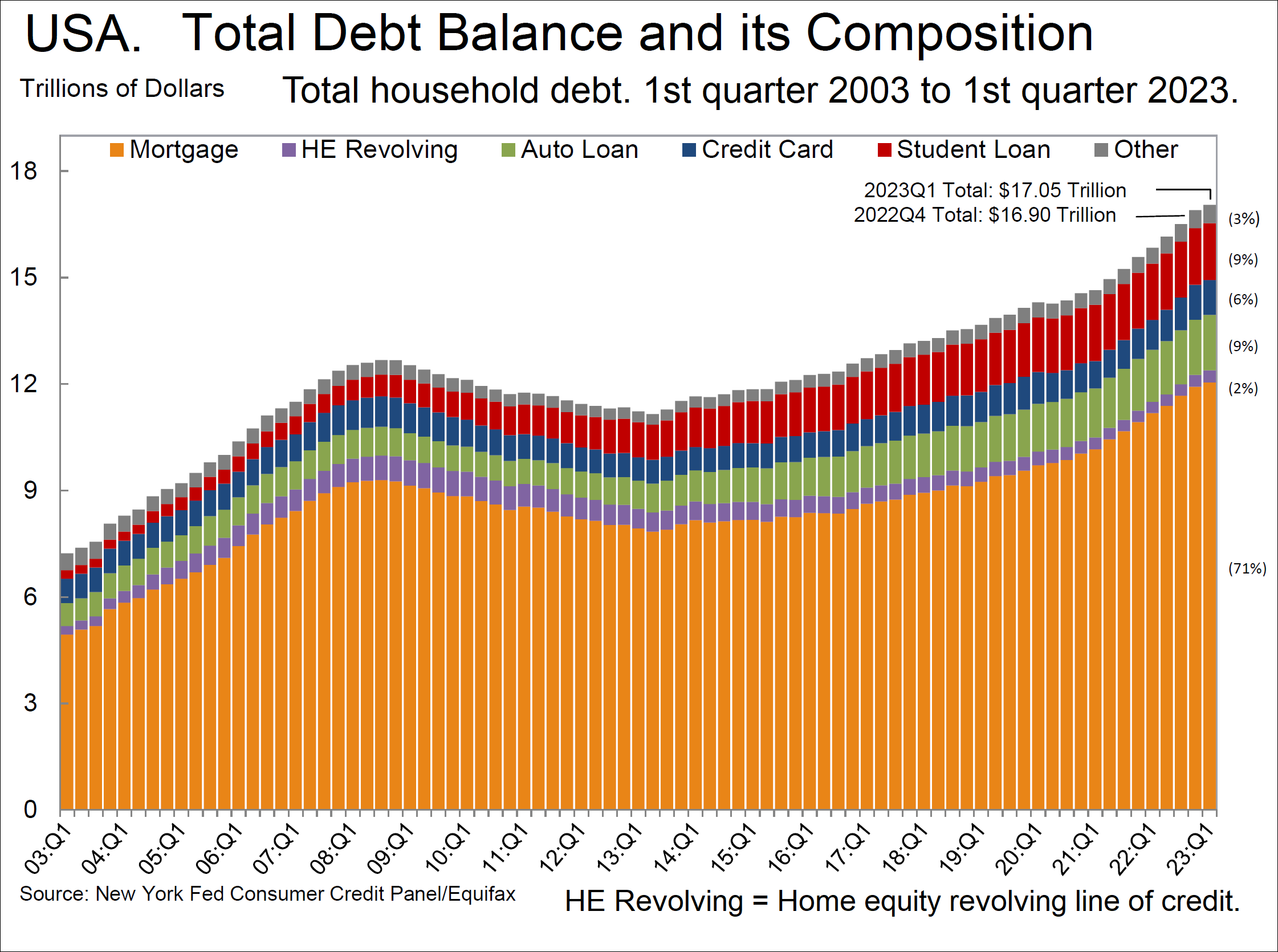

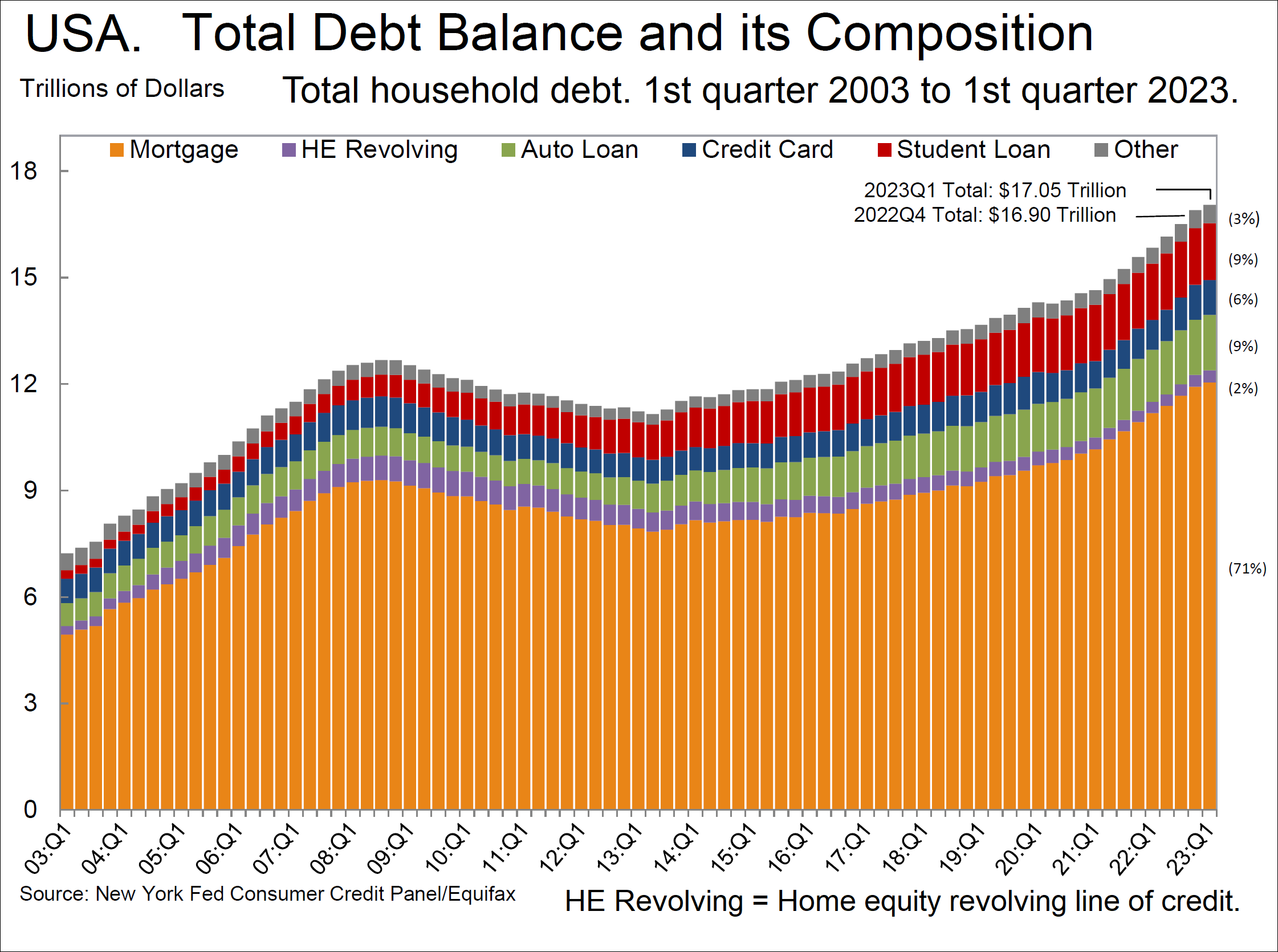

has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor's degree had about $30,000 of debt upon graduation.

Almost half of all loans are for graduate school, typically in much higher amounts.

Loan amounts vary widely based on

race,

social class

A social class or social stratum is a grouping of people into a set of Dominance hierarchy, hierarchical social categories, the most common being the working class and the Bourgeoisie, capitalist class. Membership of a social class can for exam ...

, age,

institution type, and

degree sought. As of 2017, student debt constituted the largest non-mortgage liability for US households.

Research indicates that increasing borrowing limits drives tuition increases.

Student loan defaults are disproportionately common in the

for-profit college

Proprietary colleges are for-profit colleges and universities generally operated by their owners, investors, or shareholders in a manner prioritizing shareholder primacy as opposed to education provided by non-profit institution (such as non-se ...

sector.

Around 2010, about 10 percent of college students attended for-profit colleges, but almost 40 percent of all defaults on federal student loans were to for-profit attendees. The schools whose students have the highest amount of debt are

University of Phoenix

University of Phoenix (UoPX) is a Private university, private For-profit higher education in the United States, for-profit university headquartered in Phoenix, Arizona. Founded in 1976, the university confers certificates and degrees at the Ac ...

,

Walden University

Walden University is a private for-profit online university headquartered in Minneapolis, Minnesota. It offers bachelor's, master's, doctoral, and specialist degrees. The university is owned by Adtalem Global Education, which purchased the un ...

,

Nova Southeastern University

Nova Southeastern University (NSU) is a Private university, private research university in Florida with its main campus in Fort Lauderdale-Davie, Florida, Davie, Florida, United States. The university consists of 14 colleges, offering over ...

,

Capella University

Capella University is a private for-profit, online university headquartered in Minneapolis, Minnesota. The school is owned by the publicly traded Strategic Education, Inc.

Capella has 47 degree programs with over 1,600 courses. Approximately ...

, and

Strayer University

Strayer University is a private for-profit university headquartered in Washington, D.C. It was founded in 1892 as Strayer's Business College and later became Strayer College, before being granted university status in 1998.

Strayer University ...

. Except for Nova Southeastern, they are all for-profit. In 2018, the

National Center for Education Statistics

The National Center for Education Statistics (NCES) is the principal federal agency responsible for collecting, analyzing, and reporting data on education in the United States. Established under , it operates within the Institute of Education S ...

reported that the 12-year student loan default rate for colleges was 52 percent.

The default rate for borrowers who do not complete their degree is three times the rate for those who did. A Brookings Institution study from 2023 revealed that when the government pauses repayment on student loans, it most often "...benefit

affluent borrowers the most..." primarily due to affluent borrowers holding the largest student debt balances.

History

Federal student loans were first offered in 1958 under the

National Defense Education Act

The National Defense Education Act (NDEA) was signed into law on September 2, 1958, providing funding to United States education institutions at all levels.Schwegler 1

NDEA was among many science initiatives implemented by President Dwight ...

(NDEA). They were available only to select categories of students, such as those studying engineering, science, or education. The program was established in response to the

Soviet Union

The Union of Soviet Socialist Republics. (USSR), commonly known as the Soviet Union, was a List of former transcontinental countries#Since 1700, transcontinental country that spanned much of Eurasia from 1922 until Dissolution of the Soviet ...

's launch of the

Sputnik

Sputnik 1 (, , ''Satellite 1''), sometimes referred to as simply Sputnik, was the first artificial Earth satellite. It was launched into an elliptical low Earth orbit by the Soviet Union on 4 October 1957 as part of the Soviet space progra ...

satellite. It addressed the widespread perception that the United States had fallen behind in science and technology. Student loans became more broadly available in the 1960s under the

Higher Education Act of 1965

The Higher Education Act of 1965 (HEA) () was legislation signed into Law of the United States, United States law on November 8, 1965, as part of President Lyndon Johnson's Great Society domestic agenda. Johnson chose Texas State University (t ...

, with the goal of encouraging greater social mobility and equal opportunity.

In 1967, the publicly owned

Bank of North Dakota

The Bank of North Dakota (BND) is a State-owned enterprise, state-owned, state-run financial institution based in Bismarck, North Dakota, Bismarck, North Dakota. It is the only government-owned general-service bank in the United States. It is th ...

made the first federally-insured student loan.

The US first major government loan program was the

Student Loan Marketing Association

A student is a person enrolled in a school or other educational institution, or more generally, a person who takes a special interest in a subject.

In the United Kingdom and most commonwealth countries, a "student" attends a secondary school ...

(Sallie Mae), formed in 1973.

Before 2010, federal loans included:

* loans originated and funded directly by the

Department of Education

An education ministry is a national or subnational government agency politically responsible for education. Various other names are commonly used to identify such agencies, such as Ministry of Education, Department of Education, and Ministry of Pub ...

(ED)

* government guaranteed loans originated and funded by private investors.

Direct-to-consumer private loans were the fastest-growing segment of education finance. The "percentage of undergraduates obtaining private loans from 2003–04 to 2007–08 rose from 5 percent to 14 percent" and was under legislative scrutiny due to the lack of school certification.

[SANTO JR., G. F., & RALL, L. L. (2010). Private Student Loan Financing in an Era of Needs and Challenges. Journal of Structured Finance, 16(3), 106-115.]

2010s

The rules for disability discharge underwent major changes as a result of the

Higher Education Opportunity Act of 2008

The Higher Education Act of 1965 (HEA) () was legislation signed into United States law on November 8, 1965, as part of President Lyndon Johnson's Great Society domestic agenda. Johnson chose Texas State University (then called " Southwest Tex ...

. The regulations took effect July 1, 2010. In June 2010, the amount of student loan debt held by Americans exceeded the amount of

credit card debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt grows through the accrual of interest and penalties when the consumer fails to repay the company for the money they ha ...

held by Americans. At that time, student loan debt totalled at least $830 billion, of which approximately 80% was federal and 20% was private. By the fourth quarter of 2015, total outstanding student loans owned and securitized had surpassed $1.3 trillion.

Guaranteed loans were eliminated in 2010 through the

Student Aid and Fiscal Responsibility Act

The Student Aid and Fiscal Responsibility Act of 2009 (SAFRA; ) is a bill introduced in the U.S. House of Representatives of the 111th United States Congress by Congressman George Miller that would expand federal Pell Grants to a maximum of ...

and replaced with direct loans. The

Obama administration

Barack Obama's tenure as the 44th president of the United States began with his first inauguration on January 20, 2009, and ended on January 20, 2017. Obama, a Democrat from Illinois, took office following his victory over Republican nomine ...

claimed that guaranteed loans benefited private companies at taxpayer expense but did not reduce student costs.

The

Health Care and Education Reconciliation Act of 2010 (HCERA) ended private-sector lending under the

Federal Family Education Loan Program

The Federal Family Education Loan (FFEL) Program was a system of private student loans which were subsidized and guaranteed by the United States federal government. The program issued loans from 1965 until it was ended in 2010. Similar loans ...

(FFELP) starting July 1, 2010; all subsidized and unsubsidized Stafford loans, PLUS loans, and Consolidation loans are under the Federal Direct Loan Program.

As of July 1, 2013, borrowers determined to be disabled by the

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

would be accepted for loan discharge if the SSA placed the individual on a five- to seven-year review cycle.

As of January 1, 2018, the

Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

established that debt discharged due to the death or disability of the borrower was no longer treated as

taxable income

Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. T ...

.

(This provision is scheduled to

sunset

Sunset (or sundown) is the disappearance of the Sun at the end of the Sun path, below the horizon of the Earth (or any other astronomical object in the Solar System) due to its Earth's rotation, rotation. As viewed from everywhere on Earth, it ...

on December 31, 2025.)

In an effort to improve the student loan market,

LendKey,

SoFi (Social Finance, Inc.) and

CommonBond began offering student loans and refinancing at lower rates than traditional lenders, using an alumni-funded model. According to a 2016 analysis by online student loan marketplace

Credible

Credibility comprises the objective and subjective components of the believability of a source or message. Credibility is deemed essential in many fields to establish expertise. It plays a crucial role in journalism, teaching, science, medicin ...

, about 8 million borrowers could qualify for refinancing.

The

Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the New York (state), State of New York, the 12 norther ...

's February 2017 ''Quarterly Report on Household Debt and Credit'' reported 11.2% of aggregate student loan debt was 90 or more days delinquent.

On July 25, 2018, Education Secretary

Betsy DeVos

Elisabeth Dee DeVos ( ; ' Prince; born January 8, 1958) is an American politician, philanthropist, and former government official who served as the 11th United States Secretary of Education, United States secretary of education from 2017 to 2021 ...

issued an order declaring that the Borrower Defense Program (enacted in November 2016), would be replaced with a stricter repayment policy, effective July 1, 2019. When a school closes for fraud before conferring degrees, students would have to prove that they were financially harmed. As of 2018, 10% of borrowers were in default after three years and 16 percent after five years.

In 2019, President

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

ordered loan forgiveness for permanently disabled veterans, saving 25,000 veterans an average of $30,000 each. The same year, Theresa Sweet and other student loan debtors filed a claim against the US Department of Education, arguing that they had been defrauded by their colleges. The debtors filed under a rule known as Borrower Defense to Repayment.

2020s

Starting in March 2020, federal student loan borrowers received temporary

relief

Relief is a sculpture, sculptural method in which the sculpted pieces remain attached to a solid background of the same material. The term ''wikt:relief, relief'' is from the Latin verb , to raise (). To create a sculpture in relief is to give ...

from student loan payments during the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

. This relief was subsequently extended multiple times, and expired at the end of June 2023. According to repayment data released by the Education Department, in December 2021, just 1.2 percent of borrowers were continuing to pay down their loans during the over two years of optional deferment.

In 2021, student loan servicers began dropping out of the federal student loan business, including

FedLoan Servicing on July 8, Granite State Management and Resources on July 20, and

Navient

Navient Corporation is an American financial services company and former student loan servicer based in Wilmington, Delaware. The company was formed in 2014 by the split of Sallie Mae into two distinct entities: Sallie Mae Bank and Navient. Th ...

on September 28.

According to Sallie Mae, as of 2021, 1 in 8 families are using private student loans when federal financing does not cover all college costs.

In July 2021, the

U.S. Second Circuit Court of Appeals ruled that private student loans are dischargeable in bankruptcy,

following two other cases.

In August 2021, the

Biden administration

Joe Biden's tenure as the List of presidents of the United States, 46th president of the United States began with Inauguration of Joe Biden, his inauguration on January 20, 2021, and ended on January 20, 2025. Biden, a member of the Democr ...

announced it would use

executive action to cancel $5.8 billion in student loans held by 323,000 people who are permanently

disabled

Disability is the experience of any condition that makes it more difficult for a person to do certain activities or have equitable access within a given society. Disabilities may be cognitive, developmental, intellectual, mental, physica ...

.

In November 2022, federal judge William Alsup ruled for immediate relief for about 200,000 student debtors and in April 2023 US Supreme Justice

Elena Kagan

Elena Kagan ( ; born April 28, 1960) is an American lawyer who serves as an Associate Justice of the Supreme Court of the United States, associate justice of the Supreme Court of the United States. She was Elena Kagan Supreme Court nomination ...

declined to grant emergency relief to three for-profit colleges.

In the 30 years from 1991–1992 to 2021–2022, private college tuitions (adjusted for inflation) doubled, while public school tuitions increased by 2.5 times. In 1991–1992, state and local governments covered about three-quarters of the cost of public college, with tuition paying for the remaining quarter, but by 2021–2022, significant funding cuts to higher education resulted in governments only covering about half the current costs. In addition, since federal student loans do not limit the amount a lender can borrow, this has allowed public as well as private colleges to increase their tuitions.

In February 2023, the

U.S. Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

heard oral arguments in ''

Biden v. Nebraska'' concerning President Biden's order to cancel student loan debt for an estimated 40 million debtors. In June 2023, the U.S. Supreme Court ruled in favor of Nebraska to block Biden's plan to forgive federal student loans.

In April 2025, Linda McMahon announced that the Department of Education would resume garnishment of the wages of student debtors whose loans are in default.

Overview

Student loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest ...

s play a significant role in

U.S. higher education. Nearly 20 million Americans attend college each year, of whom close to 12 million or 60% borrow annually to help cover costs.

As of 2021, approximately 45 million Americans held student debt, with an average balance of approximately $30,000.

In Europe, higher education receives more government funding, making student loans less common.

In parts of Asia and Latin America government funding for post-secondary education is lower usually limited to flagship universities, like

UNAM

The National Autonomous University of Mexico (, UNAM) is a public research university in Mexico. It has several campuses in Mexico City, and many others in various locations across Mexico, as well as a presence in nine countries. It also has 34 ...

in Mexico and government programs under which students can borrow money are uncommon.

In the United States, college is funded by government grants, scholarships, loans. The primary grant program is

Pell grants.

[Michael Simkovic]

Risk-Based Student Loans

(2012)

Student loans come in several varieties, but are basically either federal loans or

private student loans. Federal loans are either subsidized (the government pays the interest) or unsubsidized.

Federal student loans are subsidized for undergraduates only. Subsidized loans generally defer payments and interest until some period (usually six months) after the student has left school. Some states have their own loan programs, as do some colleges. In almost all cases, these student loans have better conditions than private loans.

Student loans may be used for college-related expenses, including tuition, room and board, books, computers, and transportation.

Demographics

Approximately 30% of all college students do not borrow.

In 2019, the average undergraduate who had taken on debt had a loan balance of about $30,000 upon graduation. Almost half of the student loans are for graduate education, and those loan amounts are typically much higher.

Social class

According to the Saint Louis Federal Reserve Bank, "existing racial wealth disparities and soaring higher education costs may replicate racial wealth disparities across generations by driving racial disparities in student loan debt load and repayment."

Low-income students often prefer grants and scholarships over loans because of their difficulty repaying them. In 2004, 88.5% of Pell Grant recipients who had bachelor's degrees graduated with student loan debt. After college, students struggle to break into a higher income bracket because of the loans they owe. Though, it's been shown that when it comes to student loan forgiveness and advocacy around this issue, lower-socioeconomic groups are the ones most motivated to contact their legislators about student loans. In 1995, 64 percent of students whose family incomes falling below $35,000 were contacting their legislators concerning student loans.

Race and gender

According to the

New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

, "recent black graduates of four-year colleges owe, on average, $7,400 more than their white peers. Four years after graduation, they still owe an average of $53,000, almost twice as much as whites."

According to an analysis by

Demos

Demos may refer to:

Computing

* DEMOS, a Soviet Unix-like operating system

* DEMOS (ISP), the first internet service provider in the USSR

* Demos Commander, an Orthodox File Manager for Unix-like systems

* Plural for Demo (computer programming ...

, 12 years after entering college:

* White men paid off 44 percent of their student-loan balance

* White women paid off 28 percent

* Black men saw their balances grow 11 percent

* Black women saw their loan balances grow 13 percent

Age

According to a

CNBC

CNBC is an American List of business news channels, business news channel owned by the NBCUniversal News Group, a unit of Comcast's NBCUniversal. The network broadcasts live business news and analysis programming during the morning, Day ...

analysis, the highest student debt balances are carried by adults aged 25–49, with the lowest debt loads held by those aged 62 and older.

As of 2021, approximately 7.8 million Americans from 18 to 25 carry student loan debt, with an average balance of almost $15,000. For adults between the ages of 35 and 49, the average individual balance owed exceeded $42,000. The average debt for adults between 50 and 61 is slightly lower. These balances include loans for their education and their children.

Federal loans

Loans to students

Stafford

Stafford () is a market town and the county town of Staffordshire, England. It is located about south of Stoke-on-Trent, north of Wolverhampton, and northwest of Birmingham. The town had a population of 71,673 at the 2021–2022 United Kingd ...

and

Perkins

Perkins is a surname derived from the Anglo-Saxon corruption of the kin of Pierre (from Pierre kin to Pierrekin to Perkins), introduced into England by the Norman Conquest. It is found throughout mid- and southern England.

Another derivation com ...

loans were federal loans made to students. These loans did not consider credit history (most students have no credit history); approval was automatic if the student met program requirements. Nearly all students are eligible to receive federal loans.

Payment and discharge

The student makes no payments while enrolled at least half-time. If a student drops below half time or graduates, a six-month deferment begins. If the student returns to least half-time status, the loans are again deferred, but a second episode no longer qualifies and repayment must begin. All Perkins loans and some undergraduate Stafford loans are subsidized. Loan amounts are limited.

Many deferment and forbearance options are offered in the Federal Direct Student Loan program.

Disabled borrowers have the possibility of discharge. Other discharge provisions are available for teachers in specific critical subjects or in a school that has more than 30% of its students on

reduced-price lunch. They qualify for discharge of Stafford, Perkins, and Federal Family Education Loan Program loans up to $77,500.

Any person employed full-time by a 501(c)(3) non-profit group, or another qualifying public service organization, or serving in a full-time

AmeriCorps

AmeriCorps ( ; officially the Corporation for National and Community Service or CNCS) is an Independent agencies of the United States government, independent agency of the United States government that engages more than five million Americans in ...

or

Peace Corps

The Peace Corps is an Independent agency of the U.S. government, independent agency and program of the United States government that trains and deploys volunteers to communities in partner countries around the world. It was established in Marc ...

position, qualifies for discharge after 120 qualifying payments. However, loan discharge is considered taxable income. Loans discharged that were not the result of long-term public service employment constitute taxable income.

Student loan borrowers may have their existing federal student loan debt removed if they can prove that their school misled them. The program is called Borrower Defense to Repayment or Borrower Defense.

Subsidies are conditional depending on financial need. Pricing and loan limits are determined by Congress. Undergraduates typically receive lower interest rates, while graduate students typically can borrow more. Disregarding risk has been criticized as contributing to inefficiency.

Financial needs may vary from school to school. The government covers interest charges while the student is in college. For example, those who borrow $10,000 during college owe $10,000 upon graduation.

Terms

Loans are guaranteed by DOE, either directly or through guarantee agencies.

The dependent undergraduate limits are $5,500 per year for freshman undergraduates, $6,500 for sophomore undergraduates, and $7,500 per year for junior and senior undergraduates, as well as students enrolled in

teacher certification

A certified teacher (also known as registered teacher, licensed teacher, or professional teacher based on jurisdiction) is an educator who has earned credentials from an authoritative source, such as a government's regulatory authority, an educ ...

or coursework preparatory for graduate programs.

For independent undergraduates, the limits are $9,500 per year for freshmen, $10,500 for sophomores, and $12,500 per year for juniors and seniors, as well as students enrolled in teacher certification or preparatory coursework for graduate programs.

Unsubsidized loans are also guaranteed, but interest accrues during study. Nearly all students are eligible for these loans regardless of financial need. Those who borrow $10,000 during college owe $10,000 plus interest upon graduation. Accrued interest is added to the loan amount, and the borrower makes payments on the total. Students can make payments while studying.

Graduate students have higher limits: $8,500 for subsidized Stafford and $12,500 (varying by course of study) for unsubsidized Stafford. For graduate students, the Perkins limit is $6,000 per year.

Stafford loan aggregate limits

Stafford borrowers cannot exceed aggregate limits for subsidized and unsubsidized loans. For dependent undergraduates, the aggregate limit is $57,500, while subsidized loans are limited to $23,000. Students who reach the maximum in subsidized loans may (based on grade level—undergraduate, graduate/professional, etc.) add a loan of less than or equal to the amount they would have been eligible for in subsidized loans. Once aggregate limits are met, the student is ineligible for additional Stafford loans until they pay back a portion of the borrowed funds. A student who has paid back some of these amounts regains eligibility up to the aggregate limits as before. Graduate students have a lifetime aggregate loan limit of $138,500.

Debt statistics

* Direct loans ($1.15 trillion, 34.2 million borrowers)

* FFEL loans ($281.8 billion, 13.5 million borrowers). The program ended in 2010.

* Perkins loans ($7.1 billion, 2.3 million borrowers). The program ended in 2018.

* Total ($1.4392 trillion, 42.9 million borrowers)

Loans to parents

PLUS loan

A PLUS Loan is a student loan, which is part of the Federal Direct Student Loan Program, offered to parents of students enrolled at least half time, or graduate and professional students, at participating and eligible post-secondary institutions. ...

s are federal education loans made to parents. These have much higher loan limits, usually enough to cover costs that exceed student financial aid. Payments start immediately after education ends, although prepayment is allowed. Credit history is considered; thus, approval is not automatic.

Interest accrues during the time the student is in school. PLUS interest rates as of 2017 were 7%.

The parents are personally responsible for repayment. The parents sign the master promissory note and are accountable. Parents are advised to consider their monthly payments. Loan documents reflect the repayment schedule for a single year. Since most students borrow again each year, the ultimate payments are much higher. PLUS loans consider credit history, making it more difficult for low-income parents to qualify.

Graduate students are eligible to receive PLUS loans in their own names. Graduate PLUS loans have the same interest rates and terms as those to parents.

Federal Direct Student Loans, also known as Direct Loans or FDLP loans, originate with the United States Treasury. FDLP loans are distributed by the DOE, then to the college or university and then to the student.

Debt levels

Loan limits are below the cost of most four-year private institutions and most public universities. Students add private student loans to make up the difference.

The maximum amount that any student can borrow is adjusted as federal policies change.

Defaults

Out of 100 students who ever attended a for-profit institution, 23 defaulted in the 1996 cohort compared to 43 in the 2004 cohort (compared to an increase from 8 to 11 among borrowers who never attended a for-profit).

As of 2018 black BA graduates defaulted at five times the rate of white BA graduates (21 versus 4 percent), and were more likely to default than white dropouts.

Private loans

Private loans are offered by banks or finance companies. They are not guaranteed by a government agency. Private loans cost more, offer less favorable terms, and are generally used only when students have exhausted the federal borrowing limit. They are not eligible for Income-Based Repayment plans, and frequently have less flexible payment terms, higher fees, and more penalties, than federal student loans.

[Philip G. Schrag & Charles W. Pruett, Coordinating Loan Repayment Assistance Programs with New Federal Legislation, 60 J. LEGAL EDUC. 583, 590-597 (2010)] Private loans may be difficult to discharge through

bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

.

Private loans are made to students or parents. They have higher limits and no payments until after education, although interest starts to accrue immediately and the deferred interest is added to the principal. Interest rates are higher on federal loans, which are set by the

United States Congress

The United States Congress is the legislature, legislative branch of the federal government of the United States. It is a Bicameralism, bicameral legislature, including a Lower house, lower body, the United States House of Representatives, ...

.

The advantage of private student loans is that they do not include loan or total debt limits. They typically offer a no-payment grace period of six months (occasionally 12 months).

Most experts recommend private loans only as a last resort, because of the less favorable terms.

Loan servicers

The U.S. Department of Education contracts with companies to manage, or service, the loans it owns. These companies are the primary point of contact for borrowers after they graduate and enter repayment.

A student loan servicer is a company which facilitates different aspects of a loan. The servicing group will typically be responsible for maintaining records on a particular loan, handling loan distribution, and providing requested information to the loan recipient. US student loan servicers include

Navient

Navient Corporation is an American financial services company and former student loan servicer based in Wilmington, Delaware. The company was formed in 2014 by the split of Sallie Mae into two distinct entities: Sallie Mae Bank and Navient. Th ...

,

FedLoan Servicing (PHEAA),

MOHELA

The Higher Education Loan Authority of the State of Missouri, also known as the Missouri Higher Education Loan Authority or MOHELA is one of the largest holders and servicers of student loans in the United States. Its headquarters are in St. Lo ...

, HESC/EdFinancial, Granite State - GSMR, OSLA Servicing, and Debt Management and Collections System.

In recent years, some student loan servicers have gone under legal scrutiny for alleged wrongdoing. Navient, formerly Sallie Mae, was charged with multiple class action lawsuits for their loan servicing methods. Navient was also sued by the Consumer Financial Protection Bureau (CFPB) for improper handling of borrower relations. FedLoan has also received public pressure for possible mistreatment of loan recipients.

, the four companies which service the majority of student loans are

Aidvantage,

EdFinancial Services

EdFinancial Services is a financial company which provides student loans servicing for 15 of the top 100 lenders in the USA, including regional and national banks, secondary markets, state agencies and other student loan providers. It is headquart ...

, MOHELA (Higher Education Loan Authority of the State of Missouri) and

Nelnet

Nelnet, Inc. is a United States–based conglomerate that primary focused on financial services including student and consumer loan origination and servicing. Additionally, the company operates an investing arm, an internet bank and has a 26% ...

.

ECSI (Educational Computer Systems, Inc.) is the exclusive servicer for the remaining Perkins Loans. Borrowers who have defaulted on loans are assigned to the Department of Education's Default Resolution Group for servicing.

Student loan asset-backed securities (SLABS)

FFELP and private loans are bundled, securitized, rated, then sold to institutional investors as student loan asset-backed securities (SLABS). Navient and Nelnet are two major private lenders.

Wells Fargo Bank

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important fi ...

,

JP MorganChase,

Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

and other large banks package and sell SLABS in bundles.

Moody's

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its histo ...

,

Fitch Ratings

Fitch Ratings Inc. is an American credit rating agency. It is one of the three nationally recognized statistical rating organizations (NRSRO) designated by the U.S. Securities and Exchange Commission and is considered as being one of the " Bi ...

, and

Standard and Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is cons ...

rate SLAB quality.

The

Asset-Backed Security

An asset-backed security (ABS) is a Security (finance), security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets.

The pool of assets is typically a group of sma ...

(ABS) industry received financial relief in 2008 and in 2020 through the

Term Asset-Backed Securities Loan Facility

The Term Asset-Backed Securities Loan Facility (TALF) is a program created by the U.S. Federal Reserve (the Fed) to spur consumer credit lending. The program was announced on November 25, 2008, and was to support the issuance of asset-backed sec ...

(TALF) program, which was created to preserve the flow of credit to consumers and businesses, including student loans. In 2020, critics argued that the SLAB market was poorly regulated and could be headed toward a significant downturn, despite perceptions that it was low risk.

Repayment and default

Metrics

The industry metrics are repayment rate and default rate, such as the one-, three-, five-,

[ and seven-year default rates.]College Scorecard

The College Scorecard is an online tool, created by the United States government, for consumers to compare the cost and value of higher education institutions in the United States. At launch, it displayed data in five areas: cost, graduation rate ...

includes the following repayment statuses:

* Making Progress

* Forbearance

* Deferment

* Not Making Progress

* Delinquent

* Defaulted

* Paid In Full

* Discharged

Repayment rate

The three-year repayment rate for each school that receives Title IV

Title IV of the Higher Education Act of 1965 (HEA) covers the administration of the United States federal student financial aid programs.

American colleges and universities are generally classified with regard to their inclusion under Title IV, ...

funding is available at DOE's College Scorecard.

Default rate

The default rate for borrowers who did not complete their degree is three times as high as the rate for those who did.

Standard repayment

Federal loans are initially designated as standard repayment. Standard repayment borrowers have 10 years to repay. The loan servicer

Loan servicing is the process by which a company (mortgage bank, servicing firm, etc.) collects interest, principal, and escrow payments from a borrower. In the United States, the vast majority of mortgages are backed by the government or governm ...

calculates the monthly payment amount that will pay off the original loan amount plus all accrued interest after 120 equal payments.

Payments cover interest and part of the principal. Some loan terms may be shorter than 10 years. The minimum monthly payment varies in amount, but is usually within the range of $50-100.

Income-related repayment

Income-based repayment

Income-based repayment options in the United States consist four plans:

Four IDRs are available:

* Income-Based Repayment (IBR)

* Pay As You Earn (PAYE)

* Saving on a Valuable Education (SAVE), which replaced Revised Pay As You Earn (REPAYE) in 2023

* Income-Contingent Repayment (ICR)

These plans limit monthly payments to a percentage of discretionary income

Disposable income is total personal income minus current taxes on income. In national accounting, personal income minus personal current taxes equals disposable personal income or household disposable income. Subtracting personal outlays ( ...

and forgive unpaid balances after a certain number of years.

Income share agreements

An income share agreement is an alternative to a traditional loan. The borrower agrees to pay a percentage of their salary to the educational institution after graduation. Purdue University

Purdue University is a Public university#United States, public Land-grant university, land-grant research university in West Lafayette, Indiana, United States, and the flagship campus of the Purdue University system. The university was founded ...

offers income share agreements.

Defenses to repayment

Under some circumstances, debt can be cancelled. For example, students who attended a school when it closed or the student was enrolled based on false claims may be able to escape repayment.

Leaving the country to evade repayment

Debt evasion Debt evasion is the intentional act of trying to avoid attempts by creditors to collect or pursue one's debt. At an elementary level, this includes the refusal to answer one's phone by screening one's calls or by ignoring mailed notices informing ...

is the intentional act of trying to avoid attempts by creditors to collect a debt. News accounts report that some individuals are departing the US to escape their debt. Emigration does not discharge the loan or stop interest and penalties from accruing.

Nations may enter into agreements with the US to facilitate the collection of student loans.

After default, co-signers remain liable for repayment.

Bankruptcy

Federal loans and some private loans can be discharged

Discharge may refer to:

* The act of firing a gun

* Termination of employment, the end of an employee's duration with an employer

* Military discharge, the release of a member of the armed forces from service

Flow

* Discharge (hydrology), the a ...

in bankruptcy by demonstrating that the loan does not meet the requirements of section 523(a)(8) of the bankruptcy code or by showing that repayment of the loan would constitute "undue hardship". While credit card debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt grows through the accrual of interest and penalties when the consumer fails to repay the company for the money they ha ...

often can be discharged through bankruptcy proceedings, this option is not generally available for federally subsidize or insured student loans. Unless the loan can be proven not to be an educational benefit, those seeking to discharge their debt must initiate an adversary proceeding, a separate lawsuit within the bankruptcy case where they illustrate the required hardship. Many borrowers cannot afford the costs to retain an attorney or litigation costs associated with an adversary proceeding, such as a bankruptcy case. The undue hardship standard varies from jurisdiction to jurisdiction, but is generally difficult to meet. In most circuit courts discharge depends on meeting the three prongs in the ''Brunner'' test:As noted by the district court, there is very little appellate authority on the definition of "undue hardship" in the context of 11 U.S.C. § 523(a)(8)(B). Based on legislative history and the decisions of other district and bankruptcy courts, the district court adopted a standard for "undue hardship" requiring a three-part showing: (1) that the debtor cannot maintain, based on current income and expenses, a "minimal" standard of living for herself and her dependents if forced to repay the loans; (2) that additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans; and (3) that the debtor has made good faith efforts to repay the loans. For the reasons set forth in the district court's order, we adopt this analysis. The first part of this test has been applied frequently as the minimum necessary to establish "undue hardship." See, e.g., Bryant v. Pennsylvania Higher Educ. Assistance Agency (In re Bryant), 72 B.R. 913, 915 (Bankr.E.D.Pa.1987); North Dakota State Bd. of Higher Educ. v. Frech (In re Frech), 62 B.R. 235 (Bankr.D.Minn.1986); Marion v. Pennsylvania Higher Educ. Assistance Agency (In re Marion), 61 B.R. 815 (Bankr.W.D.Pa.1986). Requiring such a showing comports with common sense as well.

Federal student loans may be eligible for administrative discharge. Those provisions do not apply to private loans, although private loans may be subject to discharge in bankruptcy.Creditors are settling unfavorable cases to avoid adverse precedent and litigating good cases to cultivate favorable precedent. Ultimately, this litigation strategy has distorted the law and cultivated the myth of nondischargeability.

The study found that debtors who obtain favorable outcomes do not possess unique characteristics differentiating them from those who do not seek discharge and estimates that 64,000 individuals who filed for bankruptcy in 2019 would have met the hardship standard. It concluded about half of all bankrupt debtors could obtain relief, except that they had become convinced that loans were not dischargeable.Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

, are eligible if the SSA placed the individual on a five- to seven-year review cycle.

Criticisms

School effects

Some critics of financial aid in general claim that it allows schools to raise their fees, to accept unprepared students, and to produce too many graduates in some fields of study.William Bennett

William John Bennett (born July 31, 1943) is an American conservative politician and political commentator who served as the third United States secretary of education from 1985 to 1988 under President Ronald Reagan. He also held the post of d ...

argued that "... increases in financial aid in recent years have enabled colleges and universities blithely to raise tuition, confident that Federal loan subsidies would help cushion the increase." This statement came to be known as the "Bennett Hypothesis".

In July 2015, a Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the New York (state), State of New York, the 12 norther ...

Staff Report concluded that institutions more exposed to increases in student loan program maximums tended to respond with disproportionate tuition increases. Pell Grant, subsidized, and unsubsidized loans led to increases of about 40, 60, and 15 cents on the dollar, respectively. In the 20 years between 1987 and 2007, tuition costs rose 326%. Public universities increased their fees by 27% over the five years ending in 2012, or 20% adjusted for inflation. Public university students paid an average of almost $8,400 annually for in-state tuition, while out-of-state students paid more than $19,000. For the two decades ending in 2013, college costs rose 1.6% more than inflation each year. By contrast, government funding per student fell 27% between 2007 and 2012.

Many students cannot get loans or determine that the cost of going to school is not worth the debt, believing that they would still be unable to make enough income to pay it back.

Some universities steered borrowers to preferred lenders that charged higher interest rates. Some of these lenders allegedly paid kick backs to university financial aid staff. After the behavior became public, many universities rebated fees to affected borrowers.

Interest rates

The federal student loan program was criticized for not adjusting interest rates according to factors under students' control, such as the choice of academic major

An academic major is the academic discipline to which an undergraduate student formally commits. A student who successfully completes all courses required for the major qualifies for an undergraduate degree. The word ''major'' (also called ''con ...

. Critics have contended that flat-rate pricing contributes to inefficiency and misallocation of resources in higher education and lower productivity in the labor market.

Bankruptcy

In 2009 student loans' non-dischargeability was claimed to provide a credit risk-free loan for the lender, averaging 7 percent a year.

Long-term debt and default

About one-third of borrowers never pay off their loans. Those who default shift their burden to taxpayers.Harvard Business School

Harvard Business School (HBS) is the graduate school, graduate business school of Harvard University, a Private university, private Ivy League research university. Located in Allston, Massachusetts, HBS owns Harvard Business Publishing, which p ...

researchers, "when student debt is erased, a huge burden is lifted and people take big steps to improve their lives: They seek higher-paying careers in new states, improve their education, get their other finances in order, and make more substantial contributions to the economy."

A June 2023 report by the Jain Family Institute concluded that much of the outstanding 1.8 trillion in student loan debt will never be repaid, as more and more borrowers are unable to repay, and the cancelling of a large portion of outstanding student debt will be inevitable. The increased necessity of higher education to attain employment means more and more people are forced to take out loans. Stagnating wages, rising tuition, and the shrinking of government funding for higher education result in more and more borrowers being unable to repay and are forced to carry that debt burden well into the future, "impairing economic well-being for a widening and diversifying swath of the population, inhibiting savings, increasing precarity, and draining the very incomes the student debt was supposed to increase." The report says that, unless something changes, future generations will suffer the same consequences of student loan debt as millennials have, including "delayed marriages, reduced childbearing, less entrepreneurship, and decreased retirement security, among others."

Sallie Mae and Nelnet

Sallie Mae

SLM Corporation (commonly known as Sallie Mae; originally the Student Loan Marketing Association) is a publicly traded U.S. corporation that provides consumer banking. Its nature has changed dramatically since it was set up in the early 1970s; i ...

and Nelnet

Nelnet, Inc. is a United States–based conglomerate that primary focused on financial services including student and consumer loan origination and servicing. Additionally, the company operates an investing arm, an internet bank and has a 26% ...

are the largest lenders and are frequently defendants in lawsuits. The False Claims Suit was filed on behalf of the federal government by former DOE researcher Dr. Jon Oberg against Sallie Mae, Nelnet, and other lenders. Oberg argued that the lenders overcharged the United States Government and defrauded taxpayers of over $22 million. In August 2010, Nelnet settled and paid $55 million. Ultimately seven lenders returned taxpayer funds as a result of his lawsuits.

School quality

In April 2019, Brookings Institution fellow Adam Looney, a long-time analyst of student loans, claimed that:It is an outrage that the federal government offers loans to students at low-quality institutions even when we know those schools don't boost their earnings and that those borrowers won't be able to repay their loans. It is an outrage that we make parent PLUS loans to the poorest families when we know they almost surely will default and have their wages and social security benefits garnished and their tax refunds confiscated, as $2.8 billion was in 2017. It is an outrage that we saddled several million students with loans to enroll in untested online programs that seem to have offered no labor market value. It is an outrage that our lending programs encourage schools like USC USC may refer to:

Education

United States

* Universidad del Sagrado Corazón, Santurce, Puerto Rico

* University of South Carolina, Columbia, South Carolina

** University of South Carolina System, a state university system of South Carolina

* ...

to charge $107,484 (and students to blithely enroll) for a master's degree in social work (220 percent more than the equivalent course at UCLA

The University of California, Los Angeles (UCLA) is a public land-grant research university in Los Angeles, California, United States. Its academic roots were established in 1881 as a normal school then known as the southern branch of the C ...

) in a field where the median wage is $47,980. It's no wonder many borrowers feel their student loans led to economic catastrophe.

Potential consequences of student loan debt

While college grads earn about 70% more than people with only a high school degree, student loan debt has been associated with several social, economic, and psychological consequences, including:

* having to choose less satisfying work that pays more

* lower credit ratings from missed payments that may disqualify borrowers from work opportunities given poor payment history

* reduced wealth accumulation

* reduced housing access

* delayed marriage

* delayed childbirth

* decreased retirement security

Reform proposals

Organizations that advocate for student loan reform include the Debt Collective and Student Loan Justice.Bernie Sanders

Bernard Sanders (born September8, 1941) is an American politician and activist who is the Seniority in the United States Senate, senior United States Senate, United States senator from the state of Vermont. He is the longest-serving independ ...

(I-Vt.) and Rep. Pramila Jayapal

Pramila Jayapal (born September 21, 1965) is an American politician serving as the U.S. representative from since 2017. A member of the Democratic Party, she represents most of Seattle, as well as some suburban areas of King County. Jayapal ...

(D-Wash.) introduced legislation in 2017 to "make public colleges and universities tuition-free for working families and to significantly reduce student debt." The policy would eliminate undergraduate tuition and fees at public colleges and universities, lower interest rates, and allow those with existing debt to refinance. Sanders offered a new proposal in 2019 that would cancel $1.6 trillion of student loan, undergraduate and graduate debt for around 45 million Americans.

Senator Brian Schatz

Brian Emanuel Schatz ( ; born October 20, 1972) is an American educator and politician serving as the Seniority in the United States Senate, senior United States Senate, United States senator from Hawaii, a seat he has held since 2012. A member ...

(D-Hawaii) reintroduced the Debt Free College Act in 2019.

In 2020, a majority of economists surveyed by the Initiative on Global Markets

The Initiative on Global Markets (IGM) is a research center at the University of Chicago Booth School of Business in the United States. The initiative supports original research on international business, financial markets, and public policy. The I ...

felt that forgiving all student loans would be more beneficial to higher income earners than lower income earners.Joe Biden

Joseph Robinette Biden Jr. (born November 20, 1942) is an American politician who was the 46th president of the United States from 2021 to 2025. A member of the Democratic Party (United States), Democratic Party, he served as the 47th vice p ...

said he planned to allow $10,000 in debt forgiveness to all student debtors. On August 24, 2022, Biden announced that he would forgive an amount of $10,000 for an estimated 43 million borrowers, and an additional $10,000 for Pell Grant recipients, with this relief limited to singles earning under $125,000 and married couples earning under $250,000, including refunding payments during the forbearance period by any borrower who requests it. This would reduce debt for an estimated 43 million borrowers and eliminate student loan debt for an estimated 20 million. The Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

estimated that it would cost the government about $400 billion.income-driven repayment

Income-based repayment or income-driven repayment (IDR), is a student loan repayment program in the United States that regulates the amount that one needs to pay each month based on one's current income and family size.

The phrase is an umbrel ...

plan. The U.S. Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

ruled June 30, 2023 in '' Biden v. Nebraska'' that Biden's plan required action by Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

and that the Higher Education Relief Opportunities For Students Act did not permit the administration to act on its own.

Some borrowers still have loans issued under the Federal Family Education Loan Program

The Federal Family Education Loan (FFEL) Program was a system of private student loans which were subsidized and guaranteed by the United States federal government. The program issued loans from 1965 until it was ended in 2010. Similar loans ...

which closed in 2010. The Biden forgiveness plan originally allowed these borrowers to receive forgiveness by consolidating into Direct Loans, but due to potential lawsuits stopped allowing this on September 29, 2022, potentially excluding 800,000 FFEL borrowers.

In February 2024, the Biden administration announced it would cancel $1.2 billion of student debt. The debt cancellation applies only to those enrolled in the Saving on a Valuable Education (SAVE) repayment plan who have been making payments for at least 10 years and who originally borrowed $12,000 or less for school. In April 2024, Biden announced plans to ease student loan debt, benefiting 23 million Americans. The plans included cancellation of up to $20,000 of accrued interest, regardless of income and automatic cancellation of debt for borrowers who were eligible for certain forgiveness programs, who had entered repayment decades ago, who had enrolled in low financial value programs, or who had been experiencing hardship.

See also

* Student financial aid in the United States

Student financial aid in the United States is funding that is available exclusively to students attending a post-secondary educational institution in the United States. This funding is used to assist in covering the many costs incurred in purs ...

* College tuition in the United States

College tuition in the United States is the cost of higher education collected by educational institutions in the United States, and paid by individuals. It does not include the tuition covered through general taxes or from other government funds, ...

* EdFund

EdFund is the United States' second largest provider of student loan guarantee services under the Federal Family Education Loan Program (FFELP). It is organized as a non-profit public-benefit corporation. EdFund offers students and their families ...

* Free education

Free education is education funded through government spending or charitable organizations rather than tuition funding. Primary school and other comprehensive or compulsory education is free in most countries (often not including primary textboo ...

* Higher Education Price Index

The Higher Education Price Index (HEPI) is a measure of the inflation rate applicable to United States higher education. HEPI measures the average relative level in the prices of a fixed market basket of goods and services typically purchased by ...

* Tertiary education

Tertiary education (higher education, or post-secondary education) is the educational level following the completion of secondary education.

The World Bank defines tertiary education as including universities, colleges, and vocational schools ...

* Private university

Private universities and private colleges are higher education institutions not operated, owned, or institutionally funded by governments. However, they often receive tax breaks, public student loans, and government grants. Depending on the count ...

* Student debt

Student debt refers to the debt incurred by an individual to pay for education-related expenses. This debt is most commonly assumed to pay for tertiary education, such as university.

The amount loaned or the loan agreement is often referred to as ...

* Student loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest ...

* Tuition payments

Tuition payments, usually known as tuition in American English and as tuition fees in Commonwealth English, are fees charged by education institutions for instruction or other services. Besides public spending (by governments and other public bo ...

* Tuition freeze

Tuition freeze is a government policy restricting the ability of administrators of post-secondary educational facilities (i.e. colleges and universities) to increase tuition fees for students. Although governments have various reasons for impleme ...

References

Further reading

* Best, J. and Best, E. (2014) The Student Loan Mess: How Good Intentions Created a Trillion-Dollar Problem. Atkinson Family Foundation.

* Hopkins, Britain. 2024. " The Origins of the Student Loan Industry in the United States: Richard Cornuelle, United Student Aid Funds, and the Creation of the Guaranteed Student Loan Program." ''Journal of American History'' 110(4): 667–688.

* Loonin, Deanne. Student loan law: Collections, intercepts, deferments, discharges, repayment plans, and trade school abuses. Boston: National Consumer Law Center

The National Consumer Law Center (NCLC) is an American nonprofit organization headquartered in Boston, Massachusetts

Massachusetts ( ; ), officially the Commonwealth of Massachusetts, is a U.S. state, state in the New England region o ...

, June 30, 2006.

*

* Student loan program: A journey through the world of educational lending, collection, and litigation. Mechanicsburg, Pennsylvania

Mechanicsburg is a Borough (Pennsylvania), borough in Cumberland County, Pennsylvania, United States. The borough is west of Harrisburg, Pennsylvania, Harrisburg. It is part of the Harrisburg–Carlisle metropolitan statistical area. As of the ...

Pennsylvania Bar Institute, c2003. vii, 300 p. : forms; 28 cm. ASIN B000IB82QA

* Wear Simmons, Charlene.

Student Loans for Higher Education

'. Sacramento, California: California Research Bureau, California State Library, 2008. 59 pages.

External links

"College, Inc."

PBS FRONTLINE documentary, May 4, 2010

"Student Loan Debt Clock

{{DEFAULTSORT:Student Loans In The United States

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

Education finance in the United States

In the United States,

In the United States,

Loan limits are below the cost of most four-year private institutions and most public universities. Students add private student loans to make up the difference.

The maximum amount that any student can borrow is adjusted as federal policies change.

Loan limits are below the cost of most four-year private institutions and most public universities. Students add private student loans to make up the difference.

The maximum amount that any student can borrow is adjusted as federal policies change.