|

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to ci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an independent agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, Payday loans in the United States, payday lenders, mortgage-servicing operations, foreclosure relief services, debt collectors, for-profit colleges, and other financial companies operating in the United States. The agency was originally proposed in 2007 by Elizabeth Warren while she was a law professor and she played an instrumental role in its establishment. The CFPB's creation was authorized by the Dodd–Frank Wall Street Reform and Consumer Protection Act, whose passage in 2010 was a legislative response to the 2008 financial crisis and the subsequent Great Recession, and is an independent bureau within the Federal Reserve. The agency has established or proposed rules to cap overdraft charges and credit card late fees; prohibit medical debt f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loans Company

Student Loans Company Limited (SLC) is an executive non-departmental public body company in the United Kingdom that provides student loans. It is owned by the UK Government's Department for Education (85%), the Scottish Government (5%), the Welsh Government (5%) and the Northern Ireland Executive (5%). The SLC is funded entirely by the UK taxpayer. It is responsible for both providing loans to students, and collecting loan repayments alongside HM Revenue and Customs (HMRC). The SLC's head office is in Glasgow, with other offices in Darlington and Llandudno. Peter Lauener has been the organisation's non-executive chair since April 2020. Chris Larmer was appointed CEO in October 2022, prior to this he was the Executive Director of Operations. History The SLC was established in 1989 to provide loans and grants to students studying in the UK. From 1990 to 1998 these were mortgage-style loans, which were aimed at helping students with the cost of living and repaid directly to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loan Default In The United States

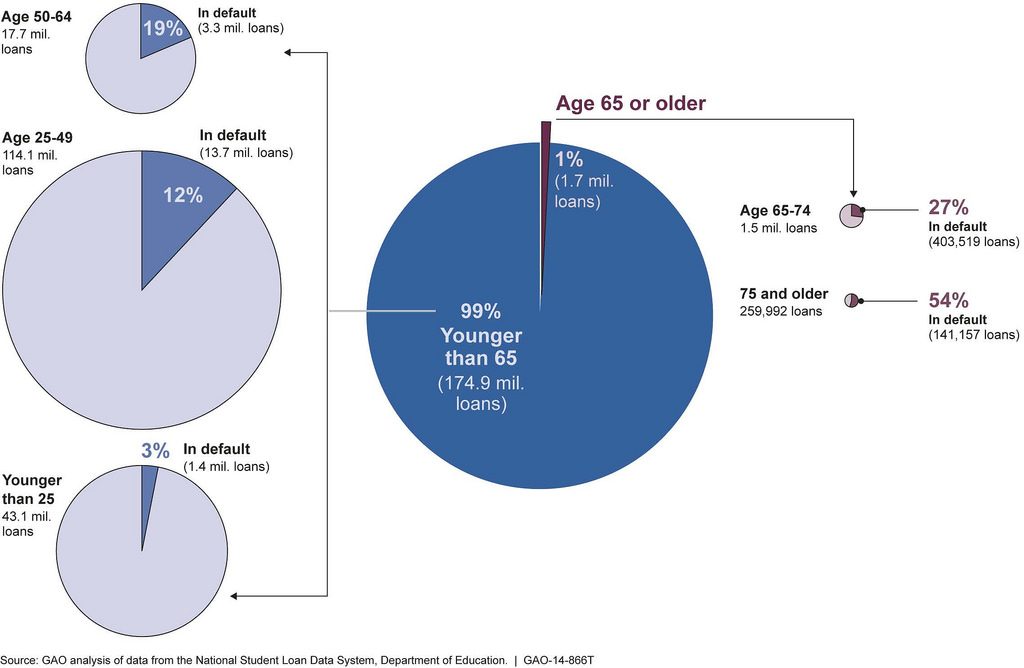

Defaulting on a loan happens when repayments are not made for a certain period of time as defined in the loan's terms of agreement, typically a promissory note. For federal student loans, default requires non-payment for a period of 270 days. For private student loans, default generally occurs after 120 days of non-payment. In 2021, outstanding student loan debt has reached a record more than $1.8 trillion. Defaulter demographics According to analysis of borrowers from the 2003-2004 academic year over a twelve-year period, defaulters generally tend to be older, lower income, and more financially independent than those who did not default. Borrowers typically owe $9,625, which is $8,500 less than the median loan balance of a non-defaulter. The majority of defaulters did not complete their bachelor's degree, but the median completed at least one year of study while maintaining grades in the C+/B- range. This shows that defaulters are able to complete college level work. Furthermore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit History

A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments. A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency. In many countries, when a customer submits an application for credit from a bank, credit card company, or a store, their information is forwarded to a credit bureau. The credit bureau matches the name, address and other identifying information on the credit applicant with information retained by the bureau in its files. The gathered records are then used by lenders to determine an individual's credit worthiness; that is, determining an individual's ability and track record of repaying a debt. The willingness to repay a debt is indicated by how timely past payments have been made to ot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Master Promissory Note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of money to the other (the ''payee''), subject to any terms and conditions specified within the document. Overview The terms of a note typically include the principal amount, the interest rate if any, the parties, the date, the terms of repayment (which could include interest) and the maturity date. Sometimes, provisions are included concerning the payee's rights in the event of a default, which may include foreclosure of the maker's assets. In foreclosures and contract breaches, promissory notes under CPLR 5001 allow creditors to recover prejudgement interest from the date interest is due until liability is established. For loans between individuals, writing and signing a promissory note are often instrumental for tax and record keeping. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scholarships

A scholarship is a form of financial aid awarded to students for further education. Generally, scholarships are awarded based on a set of criteria such as academic merit, diversity and inclusion, athletic skill, and financial need, research experience or specific professional experience. Scholarship criteria usually reflect the values and goals of the donor of the award. While scholarship recipients are not required to repay scholarships, the awards may require that the recipient continue to meet certain requirements during their period of support, such as maintaining a minimum grade point average or engaging in a certain activity (e.g., playing on a school sports team for athletic scholarship holders). Scholarships also range in generosity; some cover partial tuition, while others offer a 'full-ride', covering all tuition, accommodation, housing and others. Historically, scholarships originated as acts of religious and philanthropic charity in medieval Europe before evo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Financial Aid (United States)

A student is a person enrolled in a school A school is the educational institution (and, in the case of in-person learning, the Educational architecture, building) designed to provide learning environments for the teaching of students, usually under the direction of teachers. Most co ... or other educational institution, or more generally, a person who takes a special interest in a subject. In the United Kingdom and most The Commonwealth, commonwealth countries, a "student" attends a secondary school or higher (e.g., college or university); those in primary or elementary schools are "pupils". Africa Nigeria In Nigeria, Education in Nigeria, education is classified into four systems known as a 6-3-3-4 system of education. It implies six years in primary school, three years in junior secondary, three years in senior secondary and four years in the university. However, the number of years to be spent in university is mostly determined by the course of study. Some courses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Government

A state government is the government that controls a subdivision of a country in a federal form of government, which shares political power with the federal or national government. A state government may have some level of political autonomy, or be subject to the direct control of the federal government. This relationship may be defined by a constitution. The reference to "state" denotes country subdivisions that are officially or widely known as " states", and should not be confused with a "sovereign state". Most federations designate their federal units "state" or the equivalent term in the local language; however, in some federations, other designations are used such as Oblast or Republic. Some federations are asymmetric, designating greater powers to some federal units than others. Provinces are usually divisions of unitary states but occasionally the designation is also given to the federal units such as the Provinces of Argentina or Canada. Their governments, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Student Loans

A private student loan is a financing option for higher education in the United States that can supplement, but should not replace, federal loans, such as Stafford loans, Perkins loans and PLUS loans. Private loans, which are heavily advertised, do not have the forbearance and deferral options available with federal loans (which are never advertised). In contrast with federal subsidized loans, interest accrues while the student is in college, even if repayment does not begin until after graduation. While unsubsidized federal loans do have interest charges while the student is studying, private student loan rates are usually higher, sometimes much higher. Fees vary greatly, and legal cases have reported collection charges reaching 50% of amount of the loan. Since 2011, most private student loans are offered with zero fees, effectively rolling the fees into the interest rates. Interest rates and loan terms are set by the financial institution that underwrites the loan, typically ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government-sponsored Enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of Credit (finance), credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, Home mortgage, home finance and Education loan, education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac. Congress created the first GSE in 1916 with the creation of the Farm Credit System. It initiated GSEs in the home finance segment of the economy with the creation of the Federal Home Loan Banks in 1932; and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Guardian

''The Guardian'' is a British daily newspaper. It was founded in Manchester in 1821 as ''The Manchester Guardian'' and changed its name in 1959, followed by a move to London. Along with its sister paper, ''The Guardian Weekly'', ''The Guardian'' is part of the Guardian Media Group, owned by the Scott Trust Limited. The trust was created in 1936 to "secure the financial and editorial independence of ''The Guardian'' in perpetuity and to safeguard the journalistic freedom and liberal values of ''The Guardian'' free from commercial or political interference". The trust was converted into a limited company in 2008, with a constitution written so as to maintain for ''The Guardian'' the same protections as were built into the structure of the Scott Trust by its creators. Profits are reinvested in its journalism rather than distributed to owners or shareholders. It is considered a newspaper of record in the UK. The editor-in-chief Katharine Viner succeeded Alan Rusbridger in 2015. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |