FICA 2016 on:

[Wikipedia]

[Google]

[Amazon]

The Federal Insurance Contributions Act (FICA ) is a

The Federal Insurance Contributions Act (FICA ) is a

(pdf). ''Supreme Court of the United States.'' January 11, 2011. A student enrolled and regularly attending classes at a school, college, or university who performs work as a cook, waiter, butler, maid, janitor, laundress, furnaceman, handyman, gardener, housekeeper, housemother, or similar duties in or around the club rooms or house of a local college club, or in or about the club rooms or house of a local chapter of a college fraternity or sorority, are exempt from FICA tax.26 CFR 31.3121(b)(2)-1

. via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018. If the location's primary purpose is to provide room or board, however, then the work is subject to FICA tax. Performing these services for an alumni club or alumni chapter also does not qualify for the exemption from FICA tax.

. ''Internal Revenue Service''. November 2004. p. 2-6. If a member of a federally recognized Native American tribe that has recognized fishing rights or a qualified Native American entity employs another member of the same Native American tribe for a fishing rights-related activity, the wages are exempt from FICA.

. ''Internal Revenue Service''. August 23, 2016. Retrieved May 12, 2017. * Nonresident aliens who are employed by a foreign employer as a crew member are exempt from FICA on wages paid for working on a foreign ship or foreign aircraft. * Nonresident aliens who are students, scholars, professors, teachers, trainees, researchers, physicians, au pairs, or summer camp workers and are temporarily in the United States in F-1, J-1, M-1, Q-1, or Q-2 nonimmigrant status are exempt from FICA on wages paid to them for services that are allowed by their visa status and are performed to carry out the purposes the visa status. * Nonresident aliens who are employees of international organizations are exempt from FICA on wages paid by international organizations. * Nonresident aliens who are on an

" ''Social Security Administration''. January 9, 2017. Form 4029: Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits

. ''

. ''Social Security Administration''. Retrieved May 12, 2017. In order to relieve a person of double-taxation, the certain countries and the United States have entered into tax treaties, known as totalization agreements. Aliens whose employer sends them to the United States on a temporary work assignment may be exempt from paying FICA tax on their earnings from working in the United States if there is a totalization agreement between the United States and the worker's home country. Countries who have such a tax treaty with the United States include

. ''Internal Revenue Service''. 2017. p. 12–13. The exemption also applies when a child is employed by a

. ''Internal Revenue Service''. 2017. p. 37.

. ''Internal Revenue Service''. October 31, 2016. If an employee is a U.S. citizen, then the employee must typically pay self-employment tax on earnings from work performed in the United States.

. ''Internal Revenue Service''. Retrieved November 19, 2018. The services must not be performed by individuals under other types of programs. Payments are not exempt from FICA tax if the program's primary purpose is to increase an individual's chances of employment by providing training and work experience.

. ''Internal Revenue Service''. Retrieved November 19, 2018.Publication 963

. ''Internal Revenue Service''. November 2011. p. 3-22.Bowen, Denise Y. (January 2006). "Amounts Paid to Inmates". ''Federal, State and Local Governments (FSLG) Newsletter''. Internal Revenue Service. p. 3–5. Services performed as part of a work-release program are exempt from FICA tax if and only if the individuals are not considered employees under common law, such as when the individual has control over what work is done and how the work it is done.

. ''Internal Revenue Service''. Retrieved November 19, 2018.Publication 15: (Circular E), Employer's Tax Guide

. ''Internal Revenue Service''. 2017. p. 38. In order to qualify for the exemption from FICA tax, the employee must have been hired to work temporarily in connection with an unforeseen emergency, such as an individual temporarily hired to battle a major forest fire, to respond to a volcano eruption, or to help people affected by a severe earthquake or flood. Regular long-term police employees and regular long-term fire employees do not qualify under this particular exemption from FICA tax.

. ''Internal Revenue Service''. 2017. p. 39.

. ''Internal Revenue Service''. 2017. p. 40.Publication 15-A: Employer's Supplemental Tax Guide

. ''Internal Revenue Service''. 2017. p. 6–7. The compensation is exempt if substantially all compensation is directly related to sales or other output, rather than to the number of hours worked, and there is a written contract stating that the individuals will not be treated as employees for federal tax purposes. The individual must typically pay self-employment tax on the compensation.

Prior to the

Prior to the

Social Security Administration * The U.S. had no federally mandated retirement savings; consequently, for those people who had not voluntarily saved money throughout their working lives, the end of their work careers was the end of all income. * Similarly, the U.S. had no federally mandated disability income insurance to provide for citizens disabled by injuries (of any kind—non-work-related); consequently, for most people, a disabling injury meant no more income (since most people have little to no income except earned income from work). * In addition, there was no federally mandated disability income insurance to provide for people unable to ever work during their lives, such as anyone born with severe

United States v. Quality Stores, Inc.

', 572 U.S. 141 (2014). In August

The Social Security component of the FICA tax is regressive. That is, the effective tax rate regresses, or decreases, as income increases beyond the compensation limit or wage base limit amount. The Social Security component is a

The Social Security component of the FICA tax is regressive. That is, the effective tax rate regresses, or decreases, as income increases beyond the compensation limit or wage base limit amount. The Social Security component is a

by the

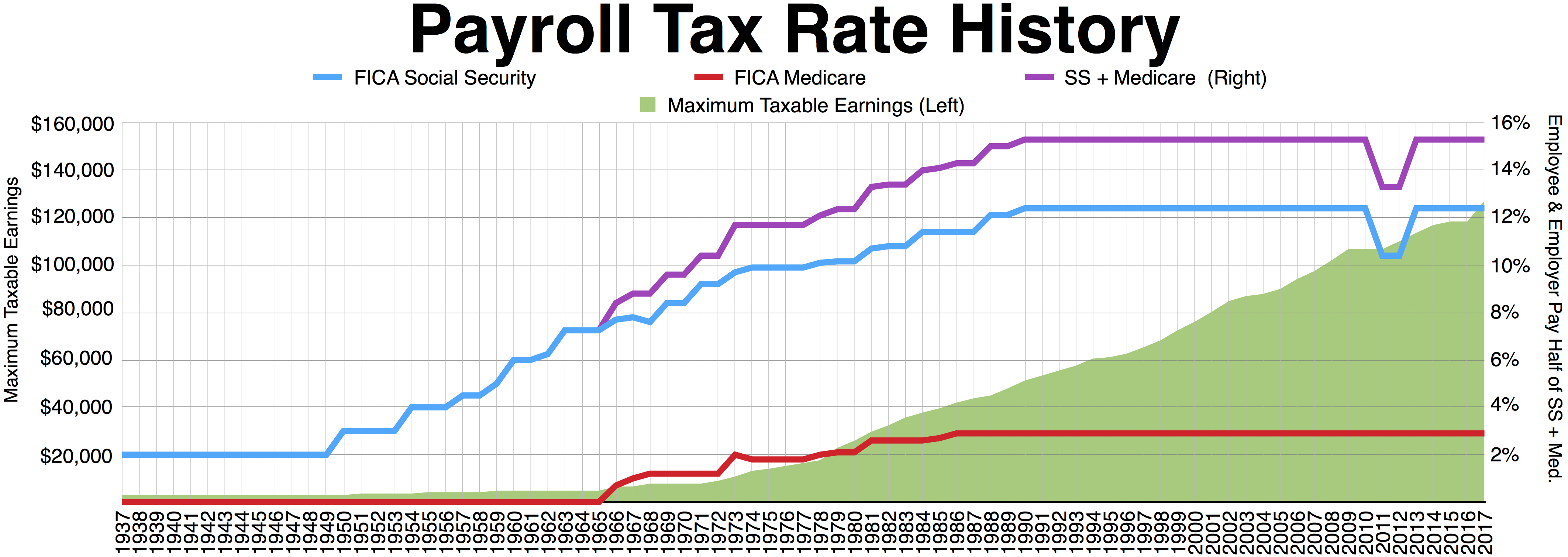

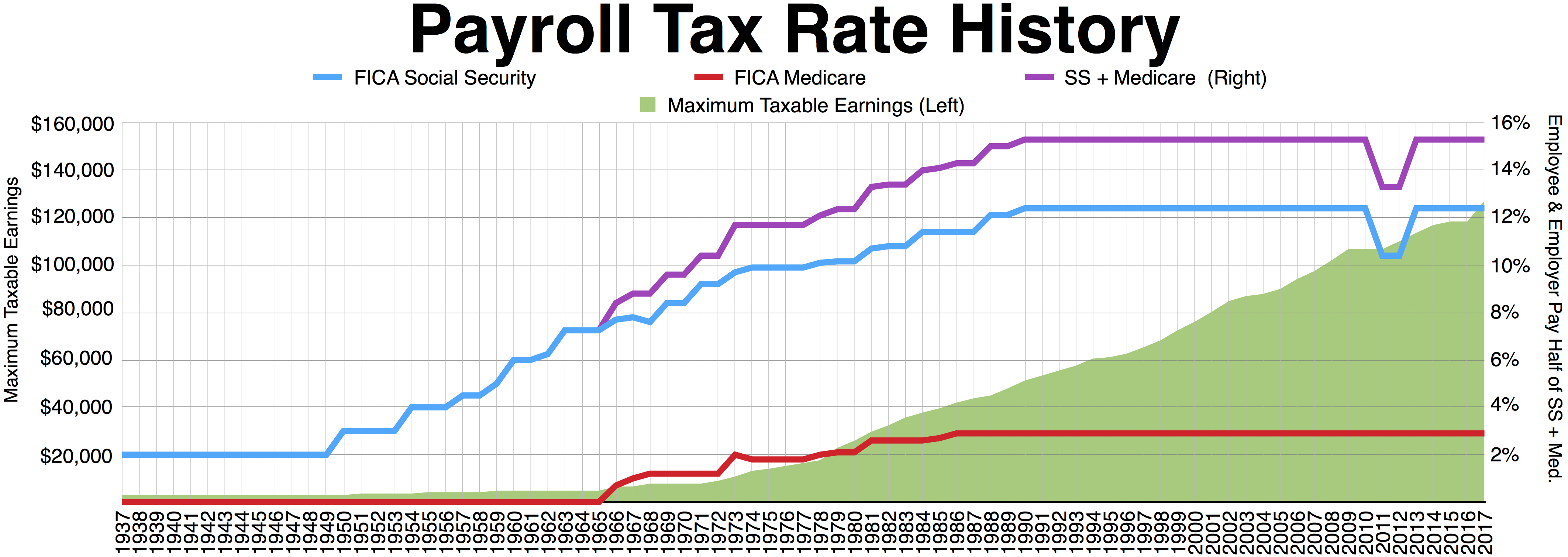

Annual maximum taxable earnings and contribution rates, 1937-2006

from the

Summary of Social Security Amendments of 1983

from the

Student Exception to FICA Tax

from the

Go Ahead and Lift the Cap

discussing 2008 US presidential campaign plans regarding payroll taxes, from ''

The Federal Insurance Contributions Act (FICA ) is a

The Federal Insurance Contributions Act (FICA ) is a United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

federal payroll

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time ...

(or employment) tax payable by both employees and employers to fund Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Calculation

Overview

The Federal Insurance Contributions Act is a tax mechanism codified inTitle 26

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, cov ...

, Subtitle C, Chapter 21 of the United States Code

The United States Code (formally The Code of Laws of the United States of America) is the official Codification (law), codification of the general and permanent Law of the United States#Federal law, federal statutes of the United States. It ...

.

Social security benefits include old-age, survivors, and disability insurance

Disability Insurance, often called DI or disability income insurance, or income protection, is a form of insurance that insures the beneficiary's earned income against the risk that a disability creates a barrier for completion of core work func ...

(OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett

Kevin Allen Hassett (born March 20, 1962) is an American economist who has been the director of the National Economic Council since 2025. He was the senior advisor and chairman of the Council of Economic Advisers from 2017 to 2019.

Hassett has ...

wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

ruled in '' Flemming v. Nestor'' (1960) that the Social Security system is neither a pension nor an insurance program and that no one has an accrued property right to benefits from the system regardless of how much that person may have contributed. FICA therefore behaves as a tax for all practical purposes, earmarked for particular uses by Congress but fully subject to Congressional authority, including redirection.

The FICA tax applies to earned income only and is not imposed on investment income such as rental income, interest, or dividends. The Hospital Insurance (HI) portion of FICA, which funds Medicare Part A hospital benefits, applies to all earned income, while the OASDI portion of the tax is imposed on earned income only up to cap annually set by Congress ($160,200 in 2023). In 2004, the Center on Budget and Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the organization's stated mission is to "advanc ...

stated that three-quarters of taxpayers pay more in payroll taxes than they do in income taxes. FICA is subject to neither the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

nor any personal exemption and so is generally considered to be a regressive tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high t ...

.

Regularly employed people

Since 1990, the employee's share of the Social Security portion of the FICA tax has been 6.2% of gross compensation up to a limit that adjusts with inflation. The taxation limit in 2020 was $137,700 of gross compensation, resulting in a maximum Social Security tax for 2020 of $8,537.40. This limit, known as theSocial Security Wage Base

For the Old Age, Survivors and Disability Insurance (OASDI) tax or Social Security tax in the United States, the Social Security Wage Base (SSWB) is the maximum earned gross income or upper threshold on which a wage earner's Social Security tax ma ...

, goes up each year based on average national wages and, in general, at a faster rate than the Consumer Price Index

A consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption purposes by households. It is calculated as the weighted average price of a market basket of Goods, consumer goods and ...

(CPI-U). The employee's share of the Medicare portion of the tax is 1.45% of wages, with no limit on the amount of wages subject to the Medicare portion of the tax. Because some payroll compensation may be subject to federal and state income tax withholding in addition to Social Security tax withholding and Medicare tax withholding, the Social Security and Medicare taxes often account for only a portion of the total an employee pays.

The employer is also liable for 6.2% Social Security and 1.45% Medicare taxes, making the total Social Security tax 12.4% of wages and the total Medicare tax 2.9%. (Self-employed people are responsible for the entire FICA percentage of 15.3% (= 12.4% + 2.9%), since they are in a sense both the employer and the employed; see the section on self-employed people

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return ...

for more details.)

If a worker starts a new job

Work, labor (labour in Commonwealth English), occupation or job is the intentional activity people perform to support the needs and desires of themselves, other people, or organizations. In the context of economics, work can be seen as the huma ...

halfway through the year and during that year has already earned an amount exceeding the Social Security tax wage base limit with the old employer, the new employer is not allowed to stop withholding

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the ...

until the wage base limit has been earned with the new employer (that is, without regard to the wage base limit earned under the old employer). There are some limited cases, such as a successor-predecessor employer transfer, in which the payments that have already been withheld can be counted toward the year-to-date total.

If a worker has overpaid toward Social Security by having more than one job or by having switched jobs during the year, that worker can file a request to have that overpayment counted as a credit for tax paid when he or she files a federal income tax return. If the taxpayer is due a refund, then the FICA tax overpayment is refunded.

Self-employed people

A tax similar to the FICA tax is imposed on the earnings ofself-employed

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return ...

individuals, such as independent contractor

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any oth ...

s and members of a partnership

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations ...

. This tax is imposed not by the Federal Insurance Contributions Act but instead by the Self-Employment Contributions Act of 1954 (SECA), which is codified as Chapter 2 of Subtitle A of the Internal Revenue Code, through (the "SE Tax Act"). Under the SE Tax Act, self-employed people are responsible for the entire percentage of 15.3% (= 12.4% oc. Sec.+ 2.9% edicare; however, the 15.3% multiplier is applied to 92.35% of the business's ''net earnings from self-employment'', rather than 100% of the gross earnings; the difference, 7.65%, is half of the 15.3%, and makes the calculation fair in comparison to that of regular (non-self-employed) employees.

SECA requires self-employed individuals in the United States to pay Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

and Medicare taxes. If a self-employed individual has net earnings of $400 or more in a tax year, they are generally required to pay SECA taxes. Self-employed individuals are responsible for paying both the employer and employee portions of these taxes. However, exceptions and specific rules may apply based on the nature of self-employment and individual circumstances.

Exemptions

Some students

Some student workers are exempt from FICA tax. Students enrolled at least half-time in a university and working part-time for the same university are exempted from FICA payroll taxes if and only if their relationship with the university is primarily an educational one. In order to be exempt from FICA payroll taxes, a student's work must be "incident to" the pursuit of a course of study, which is rarely the case with full-time employment. However full-time college students are never exempt from FICA taxes on work performed off-campus.Medical resident

Residency or postgraduate training is a stage of graduate medical education. It refers to a qualified physician (one who holds the degree of MD, DO, MBBS/MBChB), veterinarian ( DVM/VMD, BVSc/BVMS), dentist ( DDS or DMD), podiatrist ( DPM), o ...

s working full-time are not considered students and are not exempt from FICA payroll taxes, according to a United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

ruling in 2011.Mayo Foundation for Medical Education and Research Et Al. v. United States(pdf). ''Supreme Court of the United States.'' January 11, 2011. A student enrolled and regularly attending classes at a school, college, or university who performs work as a cook, waiter, butler, maid, janitor, laundress, furnaceman, handyman, gardener, housekeeper, housemother, or similar duties in or around the club rooms or house of a local college club, or in or about the club rooms or house of a local chapter of a college fraternity or sorority, are exempt from FICA tax.26 CFR 31.3121(b)(2)-1

. via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018. If the location's primary purpose is to provide room or board, however, then the work is subject to FICA tax. Performing these services for an alumni club or alumni chapter also does not qualify for the exemption from FICA tax.

Employees of some state governments and local governments

A number of state and local employers and their employees in the states of Alaska, California, Colorado, Illinois, Louisiana, Maine, Massachusetts, Nevada, Ohio, and Texas are currently exempt from paying the Social Security portion of FICA taxes. They provide alternative retirement and pension plans to their employees. FICA initially did not apply to state and local governments, which were later given the option of participating. Over time, most have elected to participate, but a substantial number remain outside the system.Certain payments by Native Americans, Native Americans tribal governments, and Native Americans entities

Payments to members of a federally recognized Native American tribe for services performed as council members are not subject to FICA.Federal-State Reference Guide. ''Internal Revenue Service''. November 2004. p. 2-6. If a member of a federally recognized Native American tribe that has recognized fishing rights or a qualified Native American entity employs another member of the same Native American tribe for a fishing rights-related activity, the wages are exempt from FICA.

Some nonresident aliens

Somenonresident alien

In law, an alien is generally any person (including an organization) who is not a citizen or a national of a specific country, although definitions and terminology differ across legal systems.

Lexicology

The term "alien" is derived from the La ...

s are exempt from FICA tax.

* Nonresident aliens who are employees of foreign governments are exempt from FICA on wages paid in their official capacities as foreign government employees.Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees. ''Internal Revenue Service''. August 23, 2016. Retrieved May 12, 2017. * Nonresident aliens who are employed by a foreign employer as a crew member are exempt from FICA on wages paid for working on a foreign ship or foreign aircraft. * Nonresident aliens who are students, scholars, professors, teachers, trainees, researchers, physicians, au pairs, or summer camp workers and are temporarily in the United States in F-1, J-1, M-1, Q-1, or Q-2 nonimmigrant status are exempt from FICA on wages paid to them for services that are allowed by their visa status and are performed to carry out the purposes the visa status. * Nonresident aliens who are employees of international organizations are exempt from FICA on wages paid by international organizations. * Nonresident aliens who are on an

H-2A

H-IIA (H-2A) is an active expendable launch system operated by Mitsubishi Heavy Industries (MHI) for the Japan Aerospace Exploration Agency. These liquid fuel rockets have been used to launch satellites into geostationary orbit; lunar orbi ...

, H-2B

H-IIB (H2B) was an expendable space launch system jointly developed by the Japanese government's space agency JAXA and Mitsubishi Heavy Industries. It was used to launch the H-II Transfer Vehicle (HTV, or ''Kōnotori'') cargo spacecraft for ...

, or H-2R visa and are residents of the Philippines

The Philippines, officially the Republic of the Philippines, is an Archipelagic state, archipelagic country in Southeast Asia. Located in the western Pacific Ocean, it consists of List of islands of the Philippines, 7,641 islands, with a tot ...

are exempt from FICA on wages paid for work performed in Guam

Guam ( ; ) is an island that is an Territories of the United States, organized, unincorporated territory of the United States in the Micronesia subregion of the western Pacific Ocean. Guam's capital is Hagåtña, Guam, Hagåtña, and the most ...

.

* Nonresident aliens who are on an H-2A visa are exempt from FICA.

Members of some religious groups

Members of certain religious groups, such as theMennonites

Mennonites are a group of Anabaptism, Anabaptist Christianity, Christian communities tracing their roots to the epoch of the Radical Reformation. The name ''Mennonites'' is derived from the cleric Menno Simons (1496–1561) of Friesland, part of ...

and the Amish

The Amish (, also or ; ; ), formally the Old Order Amish, are a group of traditionalist Anabaptism, Anabaptist Christianity, Christian Christian denomination, church fellowships with Swiss people, Swiss and Alsace, Alsatian origins. As they ...

, may apply to be exempt from paying FICA tax.Are members of religious groups exempt from paying Social Security taxes?" ''Social Security Administration''. January 9, 2017. Form 4029: Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits

. ''

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

''. September 2014. These religious groups consider insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

to be a lack of trust in God, and see it as their religious duty to provide for members who are sick, disabled, or elderly.

In order to apply to become exempt from paying FICA tax under this provision, the person must file Form 4029, which certifies that the person:

* Waives the person's rights to all benefits under the Social Security Act

The Social Security Act of 1935 is a law enacted by the 74th United States Congress and signed into law by U.S. President Franklin D. Roosevelt on August 14, 1935. The law created the Social Security (United States), Social Security program as ...

;

* Is a member of a recognized religious group that is conscientiously opposed to accepting benefits under a private plan or system that makes payments in the event of death, disability, or retirement, or which makes payments towards the costs of or provides for medical care, including the benefits of any insurance system established by Social Security;

* Is a member of a religious group that makes a reasonable provision of food, shelter, and medical care for its dependent members and has done so continuously since December 31, 1950; and

* Has never received or been entitled to any benefits payable under Social Security programs.

People who claim the above exemption must agree to notify the Internal Revenue Service within 60 days of either leaving the religious group or no longer following the established teachings of the religious group.

Some aliens on temporary work assignment

When a person temporarily works outside their country of origin, the person may be covered under two different countries' social security programs for the same work.International Agreements: U.S. International Social Security Agreements. ''Social Security Administration''. Retrieved May 12, 2017. In order to relieve a person of double-taxation, the certain countries and the United States have entered into tax treaties, known as totalization agreements. Aliens whose employer sends them to the United States on a temporary work assignment may be exempt from paying FICA tax on their earnings from working in the United States if there is a totalization agreement between the United States and the worker's home country. Countries who have such a tax treaty with the United States include

Australia

Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ...

, Austria

Austria, formally the Republic of Austria, is a landlocked country in Central Europe, lying in the Eastern Alps. It is a federation of nine Federal states of Austria, states, of which the capital Vienna is the List of largest cities in Aust ...

, Belgium

Belgium, officially the Kingdom of Belgium, is a country in Northwestern Europe. Situated in a coastal lowland region known as the Low Countries, it is bordered by the Netherlands to the north, Germany to the east, Luxembourg to the southeas ...

, Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

, Chile

Chile, officially the Republic of Chile, is a country in western South America. It is the southernmost country in the world and the closest to Antarctica, stretching along a narrow strip of land between the Andes, Andes Mountains and the Paci ...

, Czech Republic

The Czech Republic, also known as Czechia, and historically known as Bohemia, is a landlocked country in Central Europe. The country is bordered by Austria to the south, Germany to the west, Poland to the northeast, and Slovakia to the south ...

, Denmark

Denmark is a Nordic countries, Nordic country in Northern Europe. It is the metropole and most populous constituent of the Kingdom of Denmark,, . also known as the Danish Realm, a constitutionally unitary state that includes the Autonomous a ...

, Finland

Finland, officially the Republic of Finland, is a Nordic country in Northern Europe. It borders Sweden to the northwest, Norway to the north, and Russia to the east, with the Gulf of Bothnia to the west and the Gulf of Finland to the south, ...

, France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

, Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

, Greece

Greece, officially the Hellenic Republic, is a country in Southeast Europe. Located on the southern tip of the Balkan peninsula, it shares land borders with Albania to the northwest, North Macedonia and Bulgaria to the north, and Turkey to th ...

, Hungary

Hungary is a landlocked country in Central Europe. Spanning much of the Pannonian Basin, Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Croatia and ...

, Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelan ...

, Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

, Luxembourg

Luxembourg, officially the Grand Duchy of Luxembourg, is a landlocked country in Western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France on the south. Its capital and most populous city, Luxembour ...

, Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Nether ...

, Norway

Norway, officially the Kingdom of Norway, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. The remote Arctic island of Jan Mayen and the archipelago of Svalbard also form part of the Kingdom of ...

, Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It extends from the Baltic Sea in the north to the Sudetes and Carpathian Mountains in the south, bordered by Lithuania and Russia to the northeast, Belarus and Ukrai ...

, Portugal

Portugal, officially the Portuguese Republic, is a country on the Iberian Peninsula in Southwestern Europe. Featuring Cabo da Roca, the westernmost point in continental Europe, Portugal borders Spain to its north and east, with which it share ...

, Slovakia

Slovakia, officially the Slovak Republic, is a landlocked country in Central Europe. It is bordered by Poland to the north, Ukraine to the east, Hungary to the south, Austria to the west, and the Czech Republic to the northwest. Slovakia's m ...

, South Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia. It constitutes the southern half of the Korea, Korean Peninsula and borders North Korea along the Korean Demilitarized Zone, with the Yellow Sea to the west and t ...

, Spain

Spain, or the Kingdom of Spain, is a country in Southern Europe, Southern and Western Europe with territories in North Africa. Featuring the Punta de Tarifa, southernmost point of continental Europe, it is the largest country in Southern Eur ...

, Sweden

Sweden, formally the Kingdom of Sweden, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. It borders Norway to the west and north, and Finland to the east. At , Sweden is the largest Nordic count ...

, Switzerland

Switzerland, officially the Swiss Confederation, is a landlocked country located in west-central Europe. It is bordered by Italy to the south, France to the west, Germany to the north, and Austria and Liechtenstein to the east. Switzerland ...

, and United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

.

In order to claim an exemption from paying FICA tax, the alien worker must be on a temporary assignment of no more than five years and the alien worker must have a certificate from the country stating that the worker will continue to be covered by the country's social security system while the worker is in the United States.

Some family employees

When a parent employs a child under age 18 (or under age 21 fordomestic service

A domestic worker is a person who works within a residence and performs a variety of household services for an individual, from providing cleaning and household maintenance, or cooking, laundry and ironing, or care for children and elderly ...

), payments to the child are exempt from FICA tax.Publication 15: (Circular E), Employer's Tax Guide. ''Internal Revenue Service''. 2017. p. 12–13. The exemption also applies when a child is employed by a

partnership

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations ...

in which each partner is a parent of the child. The exemption does not apply when the child is employed by a corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

or a partnership with partners who are not the child's parent.

Foreign governments and some international organizations

Foreign governments are exempt from FICA tax on payments to their employees.Publication 15: (Circular E), Employer's Tax Guide. ''Internal Revenue Service''. 2017. p. 37.

International organization

An international organization, also known as an intergovernmental organization or an international institution, is an organization that is established by a treaty or other type of instrument governed by international law and possesses its own le ...

s are also exempt if the organization is listed in the International Organizations Immunities Act.Persons Employed by a Foreign Government or International Organization - Federal Insurance Contributions Act (FICA). ''Internal Revenue Service''. October 31, 2016. If an employee is a U.S. citizen, then the employee must typically pay self-employment tax on earnings from work performed in the United States.

Services performed by certain individuals hired to be relieved from unemployment

If a state or local government pays individuals for services performed to be relieved from unemployment, the payments to the individuals are exempt from FICA tax.. ''Internal Revenue Service''. Retrieved November 19, 2018. The services must not be performed by individuals under other types of programs. Payments are not exempt from FICA tax if the program's primary purpose is to increase an individual's chances of employment by providing training and work experience.

Services performed by inmates

Payments to inmates of a prison for services performed for the state or local government that operates the prison are exempt from FICA tax, regardless of the location where the services are performed.. ''Internal Revenue Service''. Retrieved November 19, 2018.Publication 963

. ''Internal Revenue Service''. November 2011. p. 3-22.Bowen, Denise Y. (January 2006). "Amounts Paid to Inmates". ''Federal, State and Local Governments (FSLG) Newsletter''. Internal Revenue Service. p. 3–5. Services performed as part of a work-release program are exempt from FICA tax if and only if the individuals are not considered employees under common law, such as when the individual has control over what work is done and how the work it is done.

Services performed by patients

Payments to patients of an institution for services performed for the state of local government that operates the institution are exempt from FICA tax. Services performed by patients as part of an institution's rehabilitative program or therapeutic program are exempt from FICA tax.Certain emergency workers

If a state or local government's employees were hired on a temporary basis in response to a specific unforeseen fire, storm, snow, earthquake, flood, or a similar emergency, and the employee is not intended to become a permanent employee, then payments to that employee are exempt from FICA tax.. ''Internal Revenue Service''. Retrieved November 19, 2018.Publication 15: (Circular E), Employer's Tax Guide

. ''Internal Revenue Service''. 2017. p. 38. In order to qualify for the exemption from FICA tax, the employee must have been hired to work temporarily in connection with an unforeseen emergency, such as an individual temporarily hired to battle a major forest fire, to respond to a volcano eruption, or to help people affected by a severe earthquake or flood. Regular long-term police employees and regular long-term fire employees do not qualify under this particular exemption from FICA tax.

Certain newspaper carriers

Payments tonewspaper carrier

A paperboy is someoneoften an older child or adolescentwho distributes printed newspapers to homes or offices on a regular route, usually by bicycle or automobile. In Western nations during the heyday of print newspapers during the early 20th cen ...

s under age 18 are exempt from FICA tax.Publication 15: (Circular E), Employer's Tax Guide. ''Internal Revenue Service''. 2017. p. 39.

Some real estate agents and salespeople

Compensation forreal estate agent

Real estate agents and real estate brokers are people who represent sellers or buyers of real estate or real property. While a broker may work independently, an agent usually works under a licensed broker to represent clients. Brokers and age ...

s and salespeople

Sales are activities related to selling or the number of goods sold in a given targeted time period. The delivery of a service for a cost is also considered a sale. A period during which goods are sold for a reduced price may also be referred ...

is exempt from FICA tax under certain circumstances.Publication 15: (Circular E), Employer's Tax Guide. ''Internal Revenue Service''. 2017. p. 40.Publication 15-A: Employer's Supplemental Tax Guide

. ''Internal Revenue Service''. 2017. p. 6–7. The compensation is exempt if substantially all compensation is directly related to sales or other output, rather than to the number of hours worked, and there is a written contract stating that the individuals will not be treated as employees for federal tax purposes. The individual must typically pay self-employment tax on the compensation.

History

Prior to the

Prior to the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, the following presented difficulties for Americans:

Historical Background and Development of Social SecuritySocial Security Administration * The U.S. had no federally mandated retirement savings; consequently, for those people who had not voluntarily saved money throughout their working lives, the end of their work careers was the end of all income. * Similarly, the U.S. had no federally mandated disability income insurance to provide for citizens disabled by injuries (of any kind—non-work-related); consequently, for most people, a disabling injury meant no more income (since most people have little to no income except earned income from work). * In addition, there was no federally mandated disability income insurance to provide for people unable to ever work during their lives, such as anyone born with severe

intellectual disability

Intellectual disability (ID), also known as general learning disability (in the United Kingdom), and formerly mental retardation (in the United States), Rosa's Law, Pub. L. 111-256124 Stat. 2643(2010).Archive is a generalized neurodevelopmental ...

.

* Further, the U.S. had no federally mandated health insurance for the elderly; consequently, for many people, the end of their work careers was the end of their ability to pay for medical care.

In the 1930s, the New Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

introduced Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

to rectify the first three problems (retirement, injury-induced disability, or congenital disability). It introduced the FICA tax as the means to pay for Social Security.

In the 1960s, Medicare was introduced to rectify the fourth problem (health care for the elderly). The FICA tax was increased in order to pay for this expense.

In December 2010, as part of the legislation that extended the Bush tax cuts (called the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (), also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on Decem ...

), the government negotiated a temporary, one-year reduction in the FICA payroll tax. In February 2012, the tax cut was extended for another year.

Under FICA, the payroll tax applies to "wages" (defined by the act as "remuneration for employment"). In 2014, the Supreme Court unanimously held in ''United States v. Quality Stores, Inc.'' that severance pay is taxable wages for FICA purposes.United States v. Quality Stores, Inc.

', 572 U.S. 141 (2014). In August

2020

The year 2020 was heavily defined by the COVID-19 pandemic, which led to global Social impact of the COVID-19 pandemic, social and Economic impact of the COVID-19 pandemic, economic disruption, mass cancellations and postponements of even ...

, President Donald Trump signed an executive order to temporarily suspend collection of the tax from September to December 2020. Critics feared this would lead to more underfunding of the Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and ...

and Medicare trust fund.

Criticism

The Social Security component of the FICA tax is regressive. That is, the effective tax rate regresses, or decreases, as income increases beyond the compensation limit or wage base limit amount. The Social Security component is a

The Social Security component of the FICA tax is regressive. That is, the effective tax rate regresses, or decreases, as income increases beyond the compensation limit or wage base limit amount. The Social Security component is a flat tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressi ...

for wage levels under the Social Security Wage Base (see "Regular" employees above). Because no tax is owed on wages above the wage base limit amount, the total tax rate declines as wages increase beyond that limit. In other words, for wage levels above the limit, the absolute dollar amount of tax owed remains constant.

The earnings above the wage base limit amount are not, however, taken into account in the Primary Insurance Amount (PIA) to determine benefits payable under the various insurance programs of social security.

The FICA tax also is not imposed on unearned income

Unearned income is a term coined by Henry George to refer to income gained through ownership of land and other monopoly. Today the term often refers to income received by virtue of owning property (known as property income), inheritance, pensio ...

, including interest on savings deposits, stock dividends, and capital gains such as profits from the sale of stock or real estate. The proportion of total income that is exempt from FICA tax as "unearned income" tends to rise with higher income brackets.

Some, including Third Way

The Third Way is a predominantly centrist political position that attempts to reconcile centre-right and centre-left politics by advocating a varying synthesis of Right-wing economics, right-wing economic and Left-wing politics, left-wing so ...

, argue that since Social Security taxes are eventually returned to taxpayers, with interest, in the form of Social Security benefits, the regressiveness of the tax is effectively negated. That is, the taxpayer gets back (more or less) what they put into the Social Security system. Others, including ''The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'' and the Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

, point out that the Social Security system as a whole is progressive in the lower income brackets. Individuals with lower lifetime average wages receive a larger benefit (as both a percentage of their lifetime average wage income and a percentage of Social Security taxes paid) than do individuals with higher lifetime average wages; but for some lower earners, shorter lifetimes may negate the benefits.Is Social Security Progressive?by the

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

, retrieved July 23, 2008

See also

*Cafeteria plan

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest versions of such plans, which allowed employees to choose ...

*FICO

FICO (legal name: Fair Isaac Corporation), originally Fair, Isaac and Company, is an American data analytics company based in Bozeman, Montana, focused on credit scoring services. It was founded by Bill Fair and Earl Isaac in 1956. Its FIC ...

, a similar initialism sometimes confused with FICA

*Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee ...

*Income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

*Medicare (United States)

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosi ...

* National Insurance contribution (NIC), a somewhat similar tax in the United Kingdom

*Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed ...

*Trust Fund Recovery Penalty

In the United States, the term trust fund recovery penalty refers to a tax penalty assessed against the directors or officers of a business entity which failed to pay a required tax on behalf of its employees. Common violations can come in the f ...

, the personal liability of employers who fail to pay the tax

Notes

References

External links

Annual maximum taxable earnings and contribution rates, 1937-2006

from the

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

Summary of Social Security Amendments of 1983

from the

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United ...

Student Exception to FICA Tax

from the

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

Go Ahead and Lift the Cap

discussing 2008 US presidential campaign plans regarding payroll taxes, from ''

Dollars & Sense

''Dollars & Sense'' is a magazine focusing on economics from a progressive perspective, published by Dollars & Sense, Inc, which also publishes textbooks in the same genre.

''Dollars & Sense'' describes itself as publishing "economic news and an ...

'' magazine

{{ssusa

United States federal taxation legislation

Social security in the United States

Medicare and Medicaid (United States)

United States federal welfare and public assistance legislation

Withholding taxes