|

Social Security Wage Base

For the Old Age, Survivors and Disability Insurance (OASDI) tax or Social Security tax in the United States, the Social Security Wage Base (SSWB) is the maximum earned gross income or upper threshold on which a wage earner's Social Security tax may be imposed. The Social Security tax is one component of the Federal Insurance Contributions Act tax (FICA) and Self-employment tax, the other component being the Medicare tax. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated to determine a worker's Social Security benefit. In 2020, the Social Security Wage Base was $137,700, and in 2021, it was $142,800; the Social Security tax rate was 6.20% paid by the employee and 6.20% paid by the employer.Publication 15, ''Employer's Tax Guide (Circular E)'' (April. 2018), p. 23, Internal Revenue Service, U.S. Dep't of the Treasury. A person with $10,000 of gross income had $620.00 withheld as Social Security tax from his check and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Fle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-employment Tax

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from a profession, a tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

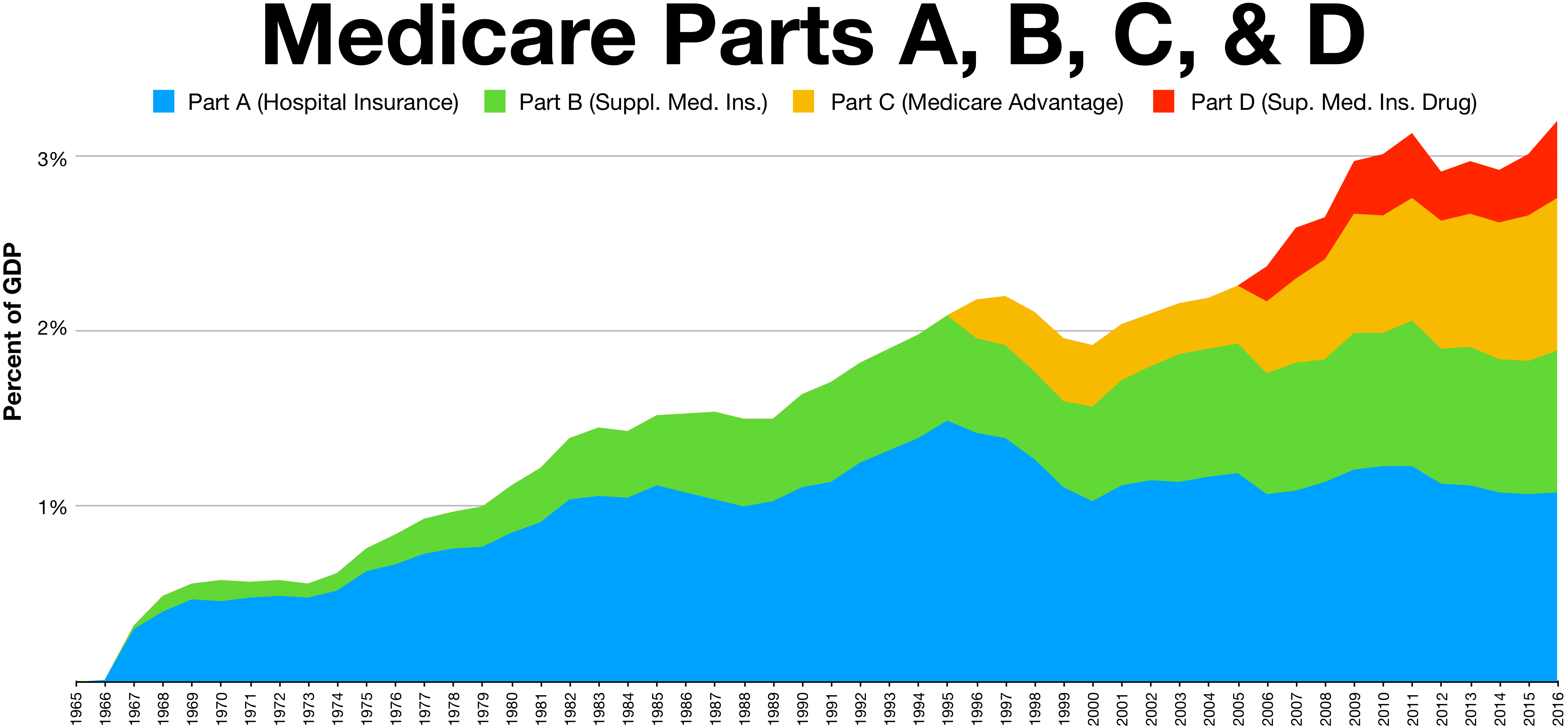

Medicare (United States)

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

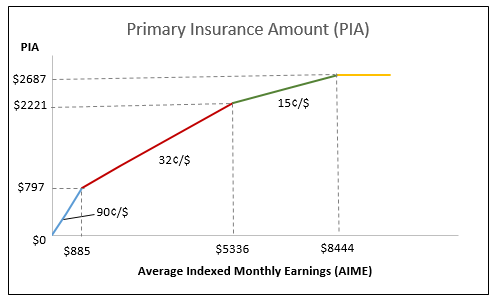

Average Indexed Monthly Earnings

The Average Indexed Monthly Earnings (AIME) is used in the United States' Social Security system to calculate the Primary Insurance Amount which decides the value of benefits paid under Title II of the Social Security Act under the 1978 New Start Method. Specifically, Average Indexed Monthly Earnings is an average of monthly income received by a beneficiary during their work life, adjusted for inflation. Each calendar year, the wages of each ''covered worker'' up to the Social Security Wage Base (SSWB) are recorded along with the calendar by the Social Security Administration. If a worker has 35 or fewer years of earnings, then the Average Indexed Monthly Earnings is the numerical average of those 35 years of covered wages; with zeros used to calculate the average for the number of years less than 35. However, because of wage inflation the federal government indexes wages so that $35,648.55 earned in year 2004 is exactly the same as $23,753.53 earned in 1994. Those two figures ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Insurance Amount

The Primary Insurance Amount (PIA) is a component of Social Security provision in the United States. Eligibility for receiving Social Security benefits, for all persons born after 1929, requires accumulating a minimum of 40 Social Security credits. Typically this is accomplished by earning income from work on which Federal Insurance Contributions Act (FICA) tax is assessed, up to a maximum taxable earnings threshold. For the purposes of the United States Social Security Administration, PIA is used as the beginning point in calculating the annuity payment of benefits that is provided to an eligible recipient each month during retirement until the recipient's death. Generally, the more a person pays in FICA taxes during their life, the higher their PIA will be. However, specific rules in its computation may deviate from this general rule. Computation The main determinant of PIA is the Average Indexed Monthly Earnings (AIME). To calculate AIME, the individual's wages are first exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Relief, Unemployment Insurance Reauthorization, And Job Creation Act Of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (), also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on December 17, 2010. The Act centers on a temporary, two-year reprieve from the sunset provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), together known as the " Bush tax cuts." Income taxes would have returned to Clinton administration-era rates in 2011 had Congress not passed this law. The Act also extends some provisions from the American Recovery and Reinvestment Act of 2009 (ARRA or 'the Stimulus'). The act also includes several other tax- and economy-related measures intended to have a new stimulatory effect, mostly notably an extension of unemployment benefits and a one-year reduction in the FICA payroll tax, as part of a compromise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dollars & Sense

''Dollars & Sense'' is a magazine focusing on economics from a progressive perspective, published by Dollars & Sense, Inc, which also publishes textbooks in the same genre. ''Dollars & Sense'' describes itself as publishing "economic news and analysis, reports on economic justice activism, primers on economic topics, and critiques of the mainstream media's coverage of the economy." Dollars & Sense. Published since 1974 (it was originally a monthly; now it is bimonthly), it is edited by a of economists, journalists, and activists committed to the ideals of and |

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |