Effective Federal Funds Rate on:

[Wikipedia]

[Google]

[Amazon]

In the United States, the federal funds rate is the

In the United States, the federal funds rate is the

CME Group FedWatch tool

allows market participants to view the probability of an upcoming Fed Rate hike. One set of such ''implied probabilities'' is published by the Cleveland Fed.

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 1.00% to 5.25%. The target rate remained at 5.25% for over a year, until the Federal Reserve began lowering rates in September 2007. The last cycle of easing monetary policy through the rate was conducted from September 2007 to December 2008 as the target rate fell from 5.25% to a range of 0.00–0.25%. Between December 2008 and December 2015 the target rate remained at 0.00–0.25%, the lowest rate in the Federal Reserve's history, as a reaction to the

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 1.00% to 5.25%. The target rate remained at 5.25% for over a year, until the Federal Reserve began lowering rates in September 2007. The last cycle of easing monetary policy through the rate was conducted from September 2007 to December 2008 as the target rate fell from 5.25% to a range of 0.00–0.25%. Between December 2008 and December 2015 the target rate remained at 0.00–0.25%, the lowest rate in the Federal Reserve's history, as a reaction to the

Historical Data: Effective Federal Funds Rate

(interactive graph) from the

Federal Reserve Web Site: Federal Funds Rate Historical Data (including the current rate), Monetary Policy, and Open Market Operations

* [https://web.archive.org/web/20070427113539/http://www.intelligentguess.com/blog/2007/03/01/usa-comparism-of-gdp-growth-versus-fed-rate-since-1954/ Historical data (since 1954) comparing the US GDP growth rate versus the US Fed Funds Rate - in the form of a chart/graph ]

Federal Reserve Bank of Cleveland: Fed Fund Rate Predictions

Federal Funds Rate Data including Daily effective overnight rate and Target rate

{{DEFAULTSORT:Federal Funds Rate Banking Federal Reserve System Interest rates

In the United States, the federal funds rate is the

In the United States, the federal funds rate is the interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

at which depository institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumer ...

s (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets and central to the conduct of monetary policy in the United States as it influences a wide range of market interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, t ...

s.

The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York.

The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System (the Fed) that is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United Stat ...

(FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings and implement target rate changes outside of its normal schedule.

The Federal Reserve adjusts its administratively set interest rates, mainly the interest on reserve balances (IORB), to bring the effective rate into the target range. Additional tools at the Fed's disposal are: the overnight reverse repurchase agreement facility, discount rate, and open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open ...

. The target range is chosen to influence market interest rates generally and in turn ultimately the level of activity, employment

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a cor ...

and inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

in the U.S. economy

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth ...

.

Mechanism

Financial institutions are obligated by law to holdliquid

Liquid is a state of matter with a definite volume but no fixed shape. Liquids adapt to the shape of their container and are nearly incompressible, maintaining their volume even under pressure. The density of a liquid is usually close to th ...

assets that can be used to cover sustained net cash outflows. Among these assets are the deposits that the institutions maintain, directly or indirectly, with a Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

. An institution that is below its desired level of liquidity can address this temporarily by borrowing from institutions that have Federal Reserve deposits in excess of their requirement. The interest rate that a borrowing bank pays to a lending bank to borrow the funds is negotiated between the two banks, and the weighted average of this rate across all such transactions is the ''effective'' federal funds rate.

The Federal Open Market Committee regularly sets a target range for the federal funds rate according to its policy goals and the economic conditions of the United States. It directs the Federal Reserve Banks to influence the rate toward that range with adjustments to their own deposit interest rates. Although this is commonly referred to as "setting interest rates," the effect is not immediate and depends on the banks' response to money market conditions.

Future contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item tr ...

s in the federal funds rate trade on the Chicago Board of Trade

The Chicago Board of Trade (CBOT), is an American futures exchange, futures and options exchange that was founded in 1848. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other excha ...

(CBOT), and the financial press refer to these contracts when estimating the probabilities of upcoming FOMC actions.

How the Fed attains its target rates

Interest on Reserve Balances (IORB) is the primary tool for achieving the target federal funds rate. It is an interest rate the Fed pays to banks for holding their funds at the Federal Reserve Bank. Because this offers a risk-free way to earn interest on their funds, banks do not tend to lend to each other at rates below the IORB, effectively setting a floor for the federal funds rate. Overnight Reverse Repurchase Agreement Facility is how the Fed sets rates for financial institutions which do not qualify to earn the IORB. It does this by allowing them to earn an interest on their funds via reverse repurchase agreements with the Fed. This helps further ensure a floor to the federal funds rate. Discount rate is the interest rate at which the Fed loans out its funds to eligible institutions via thediscount window

Discount may refer to:

Arts and entertainment

* Discount (band), punk rock band that formed in Vero Beach, Florida in 1995 and disbanded in 2000

* ''Discount'' (film), French comedy-drama film

* "Discounts" (song), 2020 single by American rapper C ...

. This makes it unlikely for banks or other institutions to make loans at higher rates, therefore effectively setting a ceiling to the federal funds rate.

Open Market Operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open ...

is when the Federal Reserve buys or sells government securities, thereby either adding or removing liquidity from the banking system. Without sufficient liquidity in the system, the other tools Fed uses become ineffective.

Applications

Interbank borrowing is essentially a way for banks to quickly raise money. For example, a bank may want to finance a major industrial effort but may not have the time to wait for deposits or interest (on loan payments) to come in. In such cases the bank will quickly raise this amount from other banks at an interest rate equal to or higher than the Federal funds rate. Raising the federal funds rate will dissuade banks from taking out such inter-bank loans, which in turn will make cash that much harder to procure. Conversely, dropping the interest rates will encourage banks to borrow money and therefore invest more freely. This interest rate is used as a regulatory tool to control how freely the U.S. economy operates. By setting a higher discount rate the Federal Reserve discourages banks from requisitioning funds from Federal Reserve Banks, yet positions itself as alender of last resort

In public finance, a lender of last resort (LOLR) is a financial entity, generally a central bank, that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank ...

.

Comparison with LIBOR

Though theLondon Interbank Offered Rate

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the primary b ...

(LIBOR), the Secured Overnight Financing Rate

Secured Overnight Financing Rate (SOFR) is a secured overnight interest rate. SOFR is a reference rate (that is, a rate used by parties in commercial contracts that is outside their direct control) established as an alternative to LIBOR. LIBOR had ...

(SOFR) and the federal funds rate are concerned with the same action, i.e. interbank loans, they are distinct from one another, as follows:

* The target federal funds rate is a target interest rate that is set by the FOMC for implementing U.S. monetary policies.

* The (effective) federal funds rate is achieved through open market operations at the Domestic Trading Desk at the Federal Reserve Bank of New York which deals primarily in domestic securities (U.S. Treasury and federal agencies' securities).

* LIBOR is based on a questionnaire where a selection of banks guess the rates at which they could borrow money from other banks.

* LIBOR may or may not be used to derive business terms. It is not fixed beforehand and is not meant to have macroeconomic ramifications.

Predictions by the market

Considering the wide impact a change in the federal funds rate can have on the value of the dollar and the amount of lending going to new economic activity, the Federal Reserve is closely watched by the market. The prices of Option contracts on fed funds futures (traded on theChicago Board of Trade

The Chicago Board of Trade (CBOT), is an American futures exchange, futures and options exchange that was founded in 1848. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other excha ...

) can be used to infer the market's expectations of future Fed policy changes. Based on CME Group 30-Day Fed Fund futures prices, which have long been used to express the market's views on the likelihood of changes in U.S. monetary policy, thCME Group FedWatch tool

allows market participants to view the probability of an upcoming Fed Rate hike. One set of such ''implied probabilities'' is published by the Cleveland Fed.

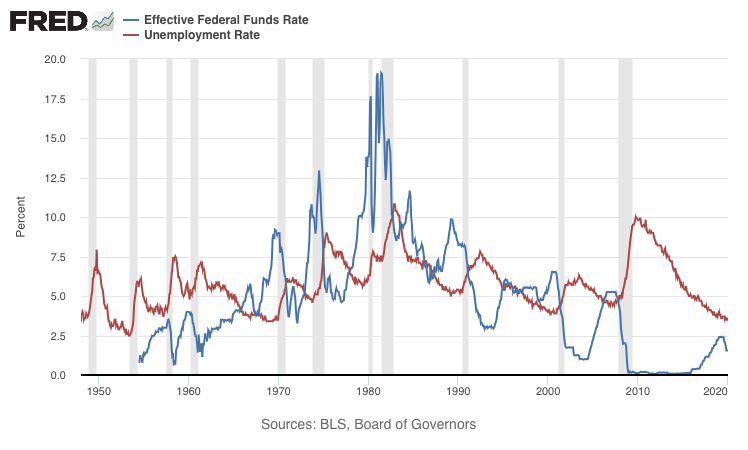

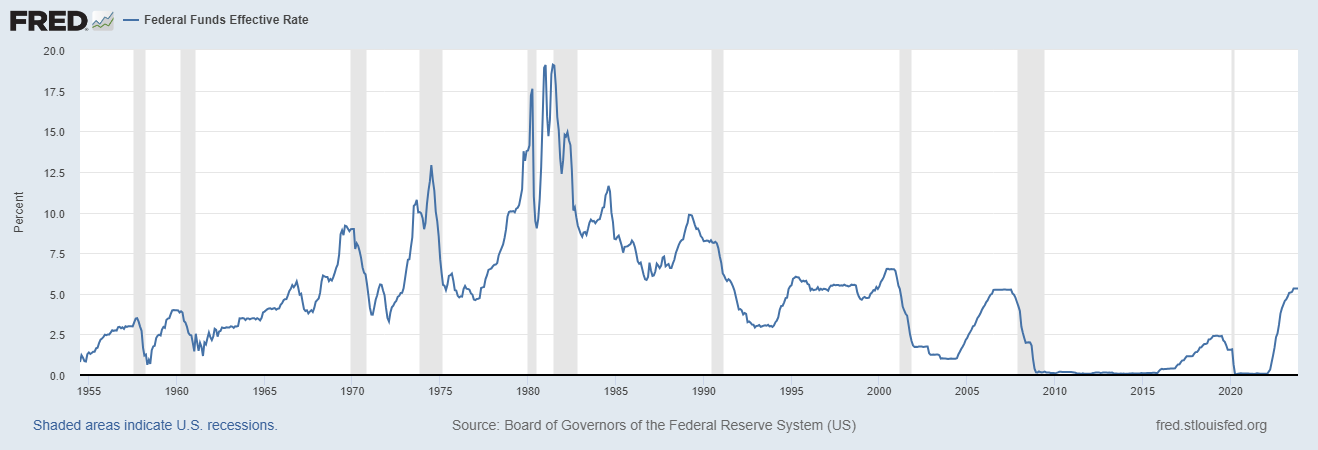

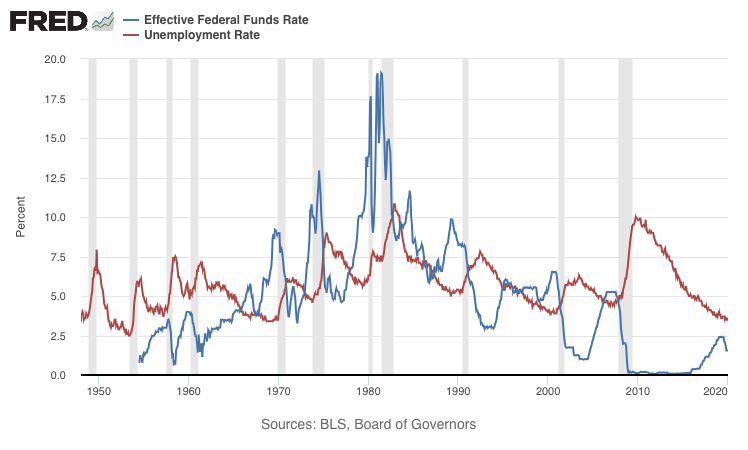

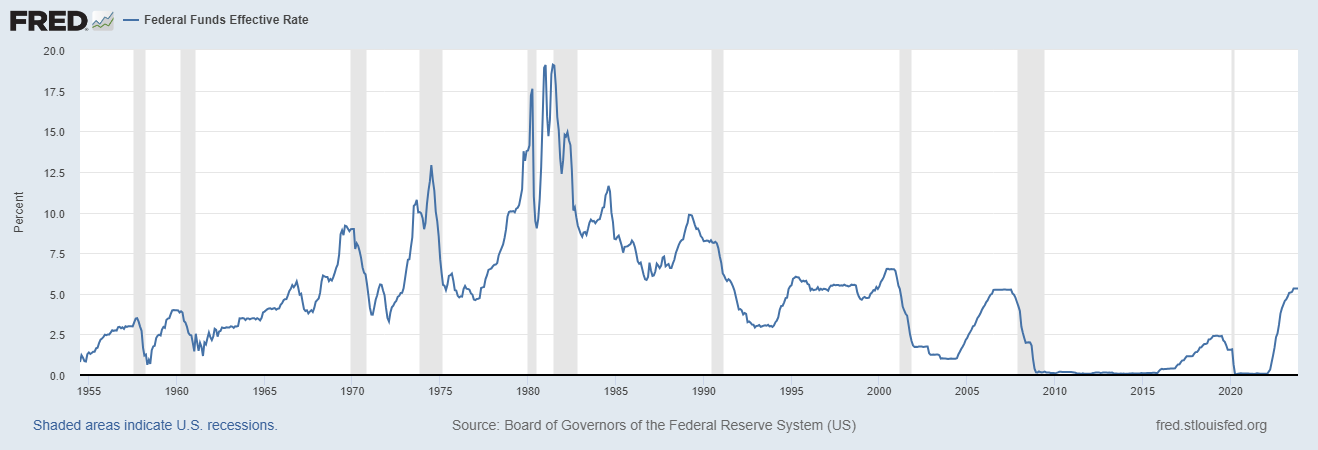

Historical rates

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 1.00% to 5.25%. The target rate remained at 5.25% for over a year, until the Federal Reserve began lowering rates in September 2007. The last cycle of easing monetary policy through the rate was conducted from September 2007 to December 2008 as the target rate fell from 5.25% to a range of 0.00–0.25%. Between December 2008 and December 2015 the target rate remained at 0.00–0.25%, the lowest rate in the Federal Reserve's history, as a reaction to the

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 1.00% to 5.25%. The target rate remained at 5.25% for over a year, until the Federal Reserve began lowering rates in September 2007. The last cycle of easing monetary policy through the rate was conducted from September 2007 to December 2008 as the target rate fell from 5.25% to a range of 0.00–0.25%. Between December 2008 and December 2015 the target rate remained at 0.00–0.25%, the lowest rate in the Federal Reserve's history, as a reaction to the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

and the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

. According to Jack A. Ablin, chief investment officer at Harris Private Bank, one reason for this unprecedented move of having a range, rather than a specific rate, was because a rate of 0% could have had problematic implications for money market funds, whose fees could then outpace yields. In October 2019 the target range for the Federal Funds Rate was 1.50–1.75%. On March 15, 2020, the target range for Federal Funds Rate was 0.00–0.25%, a full percentage point drop less than two weeks after being lowered to 1.00–1.25%.

In light of the 2021–2022 global inflation surge, the Federal Reserve has raised the FFR aggressively. In the latter half of 2022, the FOMC had hiked the FFR by 0.75 percentage points on 4 different consecutive occasions, and in its final meeting of 2022, hiked the FFR a further 0.5 percentage points. The FFR sat around 4.4% in 2022, and at the time the Fed foreshadowed that the rate would not be lowered until 2024 at the earliest.

In Sept. 2024, the Fed lowered its benchmark rate for the first time since 2020 by 50 basis points.

Explanation of federal funds rate decisions

When the FOMC wishes to reduce interest rates they will increase the supply of money by buyinggovernment securities

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occ ...

. When additional supply is added and everything else remains constant, the price of borrowed funds – the federal funds rate – falls. Conversely, when the Committee wishes to increase the federal funds rate, they will instruct the Desk Manager to sell government securities, thereby taking the money they earn on the proceeds of those sales out of circulation and reducing the money supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i ...

. When supply is taken away and everything else remains constant, the interest rate will normally rise.

The Federal Reserve has responded to a potential slow-down by lowering the target federal funds rate during recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

s and other periods of lower growth. In fact, the committee's lowering has recently predated recessions, in order to stimulate the economy and cushion the fall. Reducing the federal funds rate makes money cheaper, allowing an influx of credit into the economy through all types of loans.

The charts referenced below show the relation between S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

and interest rates.

* July 13, 1990 – Sept 4, 1992: 8.00–3.00% (Includes 1990–1991 recession)

* Feb 1, 1995 – Nov 17, 1998: 6.00–4.75

* May 16, 2000 – June 25, 2003: 6.50–1.00 (Includes 2001 recession)

* June 29, 2006 – Oct 29, 2008: 5.25–1.00

Bill Gross of PIMCO

Pacific Investment Management Company LLC (PIMCO) is an American investment management firm. While it has a specific focus on active fixed income management worldwide, it manages investments in many asset classes, including fixed income, share ca ...

suggested that in the prior 15 years ending in 2007, in each instance where the fed funds rate was higher than the nominal GDP

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance ...

growth rate, assets such as stocks and housing fell.

Rates since 2008 global economic downturn

* Dec 16, 2008: 0.0–0.25 * Dec 16, 2015: 0.25–0.50 * Dec 14, 2016: 0.50–0.75 * Mar 15, 2017: 0.75–1.00 * Jun 14, 2017: 1.00–1.25 * Dec 13, 2017: 1.25–1.50 * Mar 21, 2018: 1.50–1.75 * Jun 13, 2018: 1.75–2.00 * Sep 26, 2018: 2.00–2.25 *Dec 19, 2018: 2.25–2.50 * Jul 31, 2019: 2.00–2.25 * Sep 18, 2019: 1.75–2.00 * Oct 30, 2019: 1.50–1.75 * Mar 3, 2020: 1.00–1.25 * Mar 15, 2020: 0.00–0.25 * Mar 16, 2022: 0.25–0.50 * May 4, 2022: 0.75–1.00 * Jun 15, 2022: 1.50–1.75 * Jul 27, 2022: 2.25–2.50 * Sep 21, 2022: 3.00–3.25 * Nov 2, 2022: 3.75–4.00 * Dec 14, 2022: 4.25–4.50 * Feb 1, 2023: 4.50–4.75 * Mar 22, 2023: 4.75–5.00 * May 3, 2023: 5.00–5.25 * Jul 26, 2023: 5.25–5.50 * Sep 18, 2024: 4.75–5.00 * Nov 7, 2024: 4.50–4.75 * Dec 18, 2024: 4.25–4.50International effects

A low federal funds rate makes investments indeveloping countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. ...

such as China or Mexico more attractive. A high federal funds rate makes investments outside the United States less attractive. The long period of a very low federal funds rate from 2009 forward resulted in an increase in investment in developing countries. As the United States began to return to a higher rate in the end of 2015 investments in the United States became more attractive and the rate of investment in developing countries began to fall. The rate also affects the value of currency, a higher rate slowing the decrease of the U.S. dollar and decreasing the value of currencies such as the Mexican peso

The Mexican peso (Currency symbol, symbol: $; ISO 4217, currency code: MXN; also abbreviated Mex$ to distinguish it from peso, other peso-denominated currencies; referred to as the peso, Mexican peso, or colloquially varo) is the official curre ...

.

See also

* Austrian Business Cycle Theory *Bank rate

Bank rate, also known as discount rate in American English, and (familiarly) the base rate in British English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a numb ...

*Demand Management

Demand management is a planning methodology used to forecast, plan for and manage the demand for products and services. This can be at macro-levels as in economics and at micro-levels within individual organizations. For example, at macro-leve ...

*Eonia

Eonia (Euro Overnight Index Average) was computed as a weighted average of all overnight unsecured lending transactions in the interbank market, undertaken in the European Union and European Free Trade Association (EFTA) countries by a Panel of ba ...

*Equation of exchange

In monetary economics, the equation of exchange is the relation:

:M\cdot V = P\cdot Q

where, for a given period,

:M\, is the total money supply in circulation on average in an economy.

:V\, is the velocity of money, that is the average frequency ...

* Euro Interbank Offered Rate

*Federal Reserve Economic Data

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer p ...

*Inverted yield curve

In finance, an inverted yield curve is a yield curve in which short-term debt instruments (typically bonds) have a greater yield than longer term bonds. An inverted yield curve is an unusual phenomenon; bonds with shorter maturities generally ...

*Modern Monetary Theory

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial ass ...

*Monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

*Mortgage industry of the United States

The mortgage industry of the United States is a major financial sector. The federal government created several programs, or government sponsored entities, to foster mortgage lending, construction and encourage home ownership. These programs inc ...

*Official cash rate

The official cash rate (OCR) is the term used in Australia and New Zealand for the bank rate and is the rate of interest which the central bank charges on overnight loans between commercial banks. This allows the Reserve Bank of Australia and the ...

*Official bank rate

In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day. It is the Bank of England's key interest rate for enacting monetary policy. It is ...

*Real interest rate

The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is appro ...

*SARON

SARON stands for Swiss Average Rate Overnight and is a measurement of the overnight interest rate of the secured funding market denominated in Swiss Franc (CHF). It is based on transactions and quotes posted in the Swiss repo market, and is ad ...

* SONIA

*Taylor rule

The Taylor rule is a monetary policy targeting rule. The rule was proposed in 1992 by American economist John B. Taylor for central banks to use to stabilize economic activity by appropriately setting short-term interest rates. The rule considers ...

*Zero interest rate policy

Zero interest-rate policy (ZIRP) is a macroeconomic concept describing conditions with a very low nominal interest rate, such as those in contemporary Japan and in the United States from December 2008 through December 2015 and again from Mar ...

References

External links

Historical Data: Effective Federal Funds Rate

(interactive graph) from the

Federal Reserve Bank of St. Louis

The Federal Reserve Bank of St. Louis is one of 12 Federal Reserve System, regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main ...

Federal Reserve Web Site: Federal Funds Rate Historical Data (including the current rate), Monetary Policy, and Open Market Operations

* [https://web.archive.org/web/20070427113539/http://www.intelligentguess.com/blog/2007/03/01/usa-comparism-of-gdp-growth-versus-fed-rate-since-1954/ Historical data (since 1954) comparing the US GDP growth rate versus the US Fed Funds Rate - in the form of a chart/graph ]

Federal Reserve Bank of Cleveland: Fed Fund Rate Predictions

Federal Funds Rate Data including Daily effective overnight rate and Target rate

{{DEFAULTSORT:Federal Funds Rate Banking Federal Reserve System Interest rates