Debt Market on:

[Wikipedia]

[Google]

[Amazon]

The bond market (also debt market or credit market) is a

SIFMA 1996 - 2016 Average Daily Trading Volume. Accessed April 15, 2016. However, a small number of bonds, primarily corporate ones, are listed on exchanges. Bond trading prices and volumes are reported on the

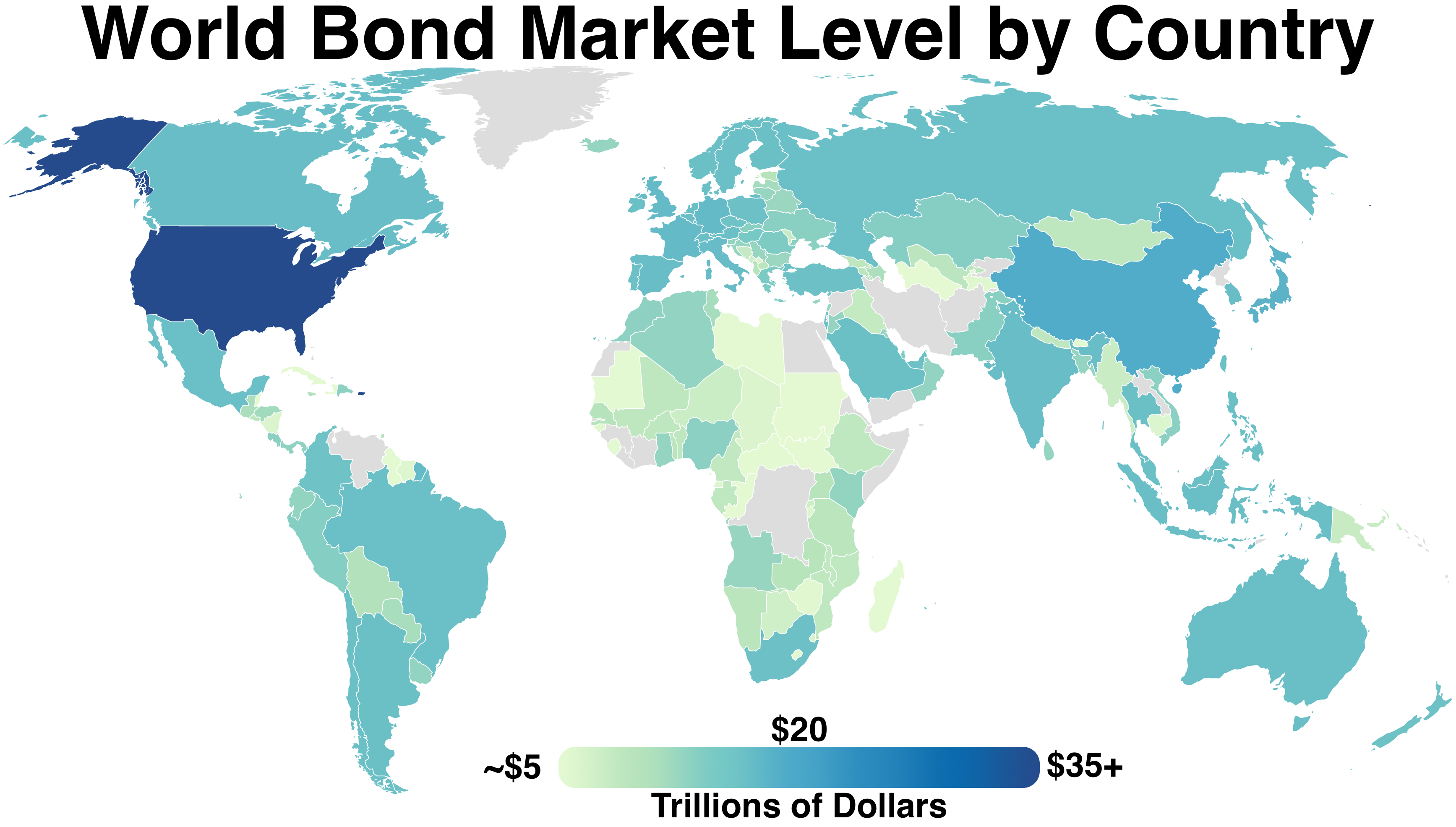

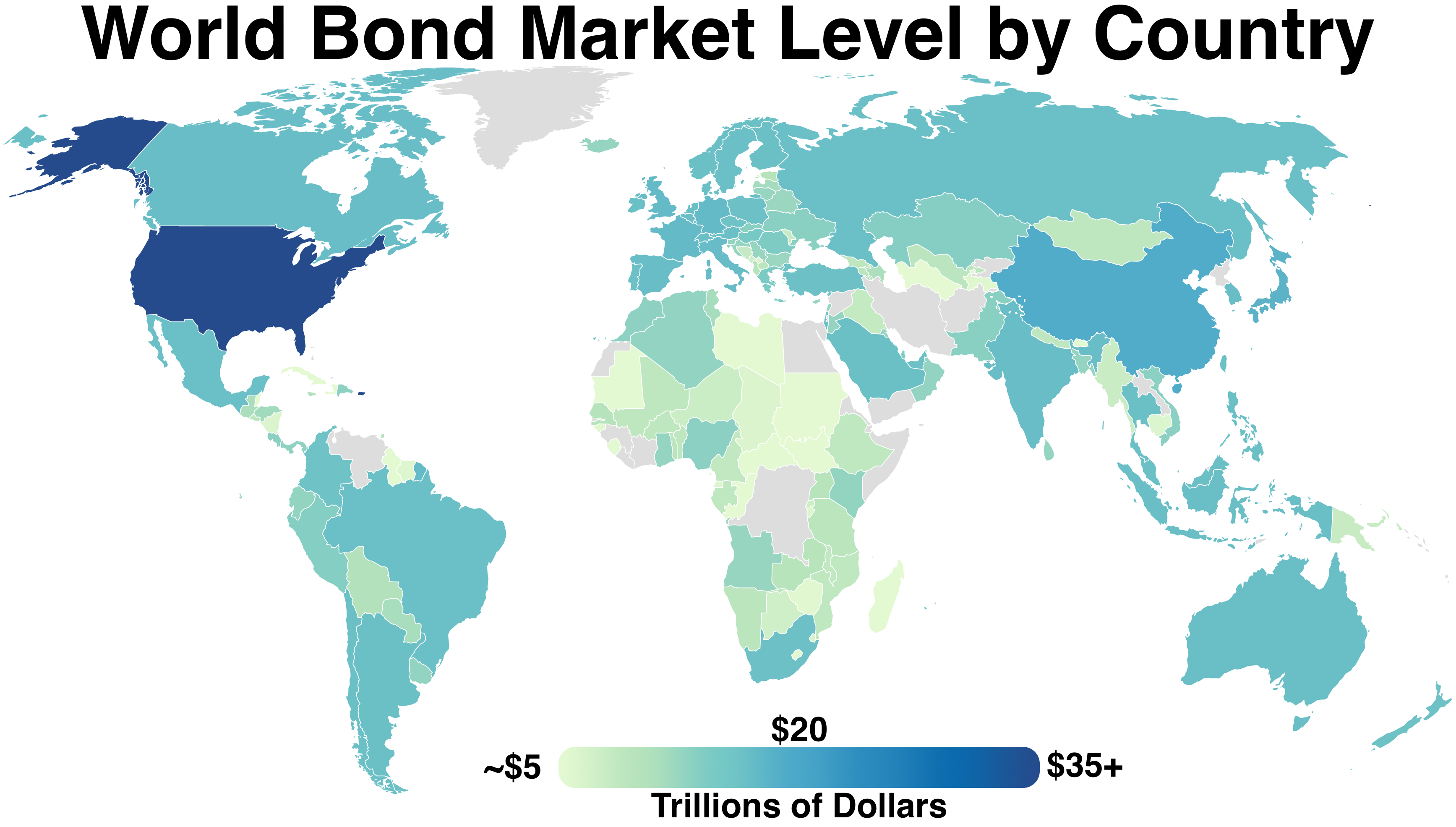

Amounts outstanding on the global bond market increased by 2% in the twelve months to March 2012 to nearly $100 trillion. Domestic bonds accounted for 70% of the total and international bonds for the remainder. The United States was the largest market with 33% of the total followed by

Amounts outstanding on the global bond market increased by 2% in the twelve months to March 2012 to nearly $100 trillion. Domestic bonds accounted for 70% of the total and international bonds for the remainder. The United States was the largest market with 33% of the total followed by

Bond Markets 2012 report

For market participants who own a bond, collect the coupon and hold it to maturity, market volatility is irrelevant; principal and interest are received according to a pre-determined schedule.

But participants who buy and sell bonds before maturity are exposed to many risks, most importantly changes in interest rates. When interest rates increase, the value of existing bonds falls, since new issues pay a higher yield. Likewise, when interest rates decrease, the value of existing bonds rises, since new issues pay a lower yield. This is the fundamental concept of bond market volatility—changes in bond prices are inverse to changes in interest rates. Fluctuating interest rates are part of a country's

For market participants who own a bond, collect the coupon and hold it to maturity, market volatility is irrelevant; principal and interest are received according to a pre-determined schedule.

But participants who buy and sell bonds before maturity are exposed to many risks, most importantly changes in interest rates. When interest rates increase, the value of existing bonds falls, since new issues pay a higher yield. Likewise, when interest rates decrease, the value of existing bonds rises, since new issues pay a lower yield. This is the fundamental concept of bond market volatility—changes in bond prices are inverse to changes in interest rates. Fluctuating interest rates are part of a country's

SIFMA. Accessed April 30, 2007.

financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial marke ...

in which participants can issue new debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

, known as the primary market The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, ...

, or buy and sell debt securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

, known as the secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of ...

. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. In 2021, the size of the bond market (total debt outstanding) was estimated to be $119 trillion

''Trillion'' is a number with two distinct definitions:

*1,000,000,000,000, i.e. one million 1,000,000, million, or (ten to the twelfth Exponentiation, power), as defined on the long and short scales, short scale. This is now the meaning in bot ...

worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

(SIFMA).

Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

. Bank loans are not securities under the U.S. Securities and Exchange Act, but bonds typically are and are therefore more highly regulated. Bonds are typically not secured by collateral (although they can be), and are sold in relatively small denominations of around $1,000 to $10,000. Unlike bank loans, bonds may be held by retail investor

There are two basic financial market participant distinctions, investors versus speculators and institutional versus retail. Action in financial markets by central banks is usually regarded as intervention rather than participation.

Sup ...

s. Bonds are more frequently traded than loans, although not as often as equity.

Nearly all of the average daily trading in the U.S. bond market takes place between broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and ...

s and large institutions in a decentralized over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid pres ...

(OTC) market.Avg Daily Trading VolumeSIFMA 1996 - 2016 Average Daily Trading Volume. Accessed April 15, 2016. However, a small number of bonds, primarily corporate ones, are listed on exchanges. Bond trading prices and volumes are reported on the

Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

's (FINRA) Trade Reporting And Compliance Engine, or TRACE.

An important part of the bond market is the government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

market, because of its size and liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quic ...

. Government bonds are often used to compare other bonds to measure credit risk

Credit risk is the chance that a borrower does not repay a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay ...

. Because of the inverse relationship between bond valuation

Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the s ...

and interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s (or yields), the bond market is often used to indicate changes in interest rates or the shape of the yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

, the measure of "cost of funding". The yield on government bonds in low risk countries such as the United States and Germany is thought to indicate a risk-free rate of default. Other bonds denominated in the same currencies (U.S. dollars or euros) will typically have higher yields, in large part because other borrowers are more likely than the U.S. or German central governments to default, and the losses to investors in the case of default are expected to be higher. The primary way to default is to not pay in full or not pay on time.

Types

TheSecurities Industry and Financial Markets Association

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

(SIFMA) classifies the broader bond market into five specific bond markets.

*Corporate

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the state to act as a single entity (a legal entity recognized by private and public law as "born out of s ...

*Government and agency

*Municipal

A municipality is usually a single administrative division having corporate status and powers of self-government or jurisdiction as granted by national and regional laws to which it is subordinate.

The term ''municipality'' may also mean the gov ...

* Mortgage-backed, asset-backed, and collateralized debt obligation

A collateralized debt obligation (CDO) is a type of structured finance, structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing Mortgage-backed se ...

s

*Funding

Participants

Bond market participants are similar to participants in mostfinancial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial marke ...

s and are essentially either buyers (debt issuer) of funds or sellers (institution) of funds and often both.

Participants include:

*Institutional investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked ...

s

*Governments

*Financial institutions

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial ins ...

*Individuals

Because of the specificity of individual bond issues, and the lack of liquidity in many smaller issues, the majority of outstanding bonds are held by institutions like pension funds

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income. The U.S. Government's Social Security Trust Fund, which oversees $2.57 trillion in assets, is the world' ...

, banks and mutual funds

A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investmen ...

. In the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, approximately 10% of the market is held by private individuals.

Size

Amounts outstanding on the global bond market increased by 2% in the twelve months to March 2012 to nearly $100 trillion. Domestic bonds accounted for 70% of the total and international bonds for the remainder. The United States was the largest market with 33% of the total followed by

Amounts outstanding on the global bond market increased by 2% in the twelve months to March 2012 to nearly $100 trillion. Domestic bonds accounted for 70% of the total and international bonds for the remainder. The United States was the largest market with 33% of the total followed by Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

(14%). As a proportion of global GDP, the bond market increased to over 140% in 2011 from 119% in 2008 and 80% a decade earlier. The considerable growth means that in March 2012 it was much larger than the global equity market which had a market capitalisation of around $53 trillion. Growth of the market since the start of the economic slowdown was largely a result of an increase in issuance by governments. In terms of number of bonds, there are over 500,000 unique corporate bonds in the US.

The outstanding value of international bonds increased by 2% in 2011 to $30 trillion. The $1.2 trillion issued during the year was down by around a fifth on the previous year's total. The first half of 2012 was off to a strong start with issuance of over $800 billion. The United States was the leading center in terms of value outstanding with 24% of the total followed by the UK 13%.Bond Markets 2012 report

U.S. bond market size

According to the Securities Industry and Financial Markets Association (SIFMA), SIFMA Statistics in the first quarter of 2017, the U.S. bond market size was (in billions): The total federal government debts recognized by SIFMA are significantly less than the total bills, notes and bonds issued by the U.S. Treasury Department, Treasury Bulletin of some $19.8 trillion at the time. This figure is likely to have excluded the inter-governmental debts such as those held by theFederal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

and the Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and ...

.

Volatility

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

and bond market volatility is a response to expected monetary policy and economic changes.

Economists' views of economic indicator

An economic indicator is a statistic about an Economics, economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. ...

s versus actual released data contribute to market volatility. A tight consensus is generally reflected in bond prices and there is little price movement in the market after the release of "in-line" data. If the economic release differs from the consensus view, the market usually undergoes rapid price movement as participants interpret the data. Uncertainty (as measured by a wide consensus) generally brings more volatility before and after a release. Economic releases vary in importance and impact depending on where the economy is in the business cycle

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, governmen ...

.

Bond investments

Bonds typically trade in $1,000 increments and are priced as a percentage ofpar value

In finance and accounting, par value means stated value or face value of a financial instrument. Expressions derived from this term include at par (at the par value), over par (over par value) and under par (under par value).

Bonds

A bond selli ...

(100%). Many bonds have minimums imposed by the bond or the dealer. Typical sizes offered are increments of $10,000. For broker/dealers, however, anything smaller than a $100,000 trade is viewed as an "odd lot".

Bonds typically pay interest at set intervals. Bonds with fixed coupons divide the stated coupon into parts defined by their payment schedule

The payment schedule defines the dates at which payments are made by one party to another on for example an invoice. It can be either customised or parameterised.

Parameterised Schedule

The schedule is generated based on a set of rules and market ...

, for example, semi-annual pay. Bonds with floating rate coupons have set calculation schedules where the floating rate is calculated shortly before the next payment. Zero-coupon bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zer ...

s do not pay interest. They are issued at a deep discount to account for the implied interest.

Because most bonds have predictable income, they are typically purchased as part of a more conservative investment scheme. Nevertheless, investors have the ability to actively trade bonds, especially corporate bonds and municipal bonds

A municipal bond, commonly known as a muni, is a Bond (finance), bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal ...

with the market and can make or lose money depending on economic, interest rate, and issuer factors.

Bond interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

is taxed as ordinary income, in contrast to qualified dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

income which receives favorable taxation rates, unlike ordinary dividends. However many government and municipal bonds are exempt from one or more types of taxation.

Investment companies allow individual investors the ability to participate in the bond markets through bond fund

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlyi ...

s, closed-end fund

A closed-end fund (CEF), also known as a closed-end mutual fund, is an investment vehicle fund that raises capital by issuing a fixed number of shares at its inception, and then invests that capital in financial assets such as stocks and bonds. ...

s and unit-investment trusts. In 2006, total bond fund net inflows increased 97% to $60.8 billion from a previous $30.8 billion in 2005.Bond fund flowsSIFMA. Accessed April 30, 2007.

Exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or comm ...

s (ETFs) are another alternative to trading or investing directly in a bond issue. These securities allow individual investors the ability to overcome large initial and incremental trading sizes.

Bond indices

A number of bond indices exist for the purposes of managing portfolios and measuring performance, similar to theS&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

or Russell Indexes

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell In ...

for stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporatio ...

s. The most common American benchmarks are the Barclays Capital Aggregate Bond Index

The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in ...

, Citigroup BIG The Salomon Broad Investment Grade Index (known as the Salomon BIG or Citigroup BIG) is a common American Bond index, akin to the S&P 500 for stocks, originally owned by Salomon Brothers, run by its successor, Citigroup and now by FTSE Russell. Th ...

and Merrill Lynch Domestic Master The Merrill Lynch Domestic Master is a common American bond index, analogous to the S&P 500 for stocks, owned by Merrill Lynch. The Domestic Master is similar to the Salomon BIG or the Barclays Capital Aggregate Bond Index (The Agg). The Domesti ...

. Most indices are parts of families of broader indices that can be used to measure global bond portfolios, or may be further subdivided by maturity or sector for managing specialized portfolios.

History

In ancientSumer

Sumer () is the earliest known civilization, located in the historical region of southern Mesopotamia (now south-central Iraq), emerging during the Chalcolithic and Early Bronze Age, early Bronze Ages between the sixth and fifth millennium BC. ...

, temples functioned both as places of worship and as banks, under the oversight of the priests and the ruler. Loans were made at a customary fixed 20% interest rate; this custom was continued in Babylon

Babylon ( ) was an ancient city located on the lower Euphrates river in southern Mesopotamia, within modern-day Hillah, Iraq, about south of modern-day Baghdad. Babylon functioned as the main cultural and political centre of the Akkadian-s ...

, Mesopotamia

Mesopotamia is a historical region of West Asia situated within the Tigris–Euphrates river system, in the northern part of the Fertile Crescent. Today, Mesopotamia is known as present-day Iraq and forms the eastern geographic boundary of ...

and written into the Code of Hammurabi

The Code of Hammurabi is a Babylonian legal text composed during 1755–1750 BC. It is the longest, best-organized, and best-preserved legal text from the ancient Near East. It is written in the Old Babylonian dialect of Akkadian language, Akkadi ...

.

The first known bond in history dates from circa 2400BC in Nippur

Nippur (Sumerian language, Sumerian: ''Nibru'', often logogram, logographically recorded as , EN.LÍLKI, "Enlil City;"I. E. S. Edwards, C. J. Gadd, N. G. L. Hammond, ''The Cambridge Ancient History: Prolegomena & Prehistory'': Vol. 1, Part 1, Ca ...

, Mesopotamia

Mesopotamia is a historical region of West Asia situated within the Tigris–Euphrates river system, in the northern part of the Fertile Crescent. Today, Mesopotamia is known as present-day Iraq and forms the eastern geographic boundary of ...

(modern-day Iraq

Iraq, officially the Republic of Iraq, is a country in West Asia. It is bordered by Saudi Arabia to Iraq–Saudi Arabia border, the south, Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq border, the east, the Persian Gulf and ...

). It guaranteed the payment of grain by the principal. The surety bond guaranteed reimbursement if the principal failed to make payment. Corn (grain) was often the currency priced.

In these ancient times, loans were initially made in cattle or grain from which interest could be paid from growing the herd or crop and returning a portion to the lender. Silver became popular as it was less perishable and allowed large values to be transported more easily, but unlike cattle or grain could not naturally produce interest. Taxation derived from human labor evolved as a solution to this problem.

By the Plantagenet

The House of Plantagenet ( /plænˈtædʒənət/ ''plan-TAJ-ə-nət'') was a royal house which originated from the French county of Anjou. The name Plantagenet is used by modern historians to identify four distinct royal houses: the Angev ...

era, the English Crown

This list of kings and reigning queens of the Kingdom of England begins with Alfred the Great, who initially ruled Wessex, one of the seven Anglo-Saxon kingdoms which later made up modern England. Alfred styled himself king of the Anglo-Sax ...

had long-standing links with Italian financiers and merchants such as Riccardi of Lucca in Tuscany. These trade links were based on loans, similar to modern-day Bank loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the debt ( ...

s; other loans were linked to the need to finance the Crusades

The Crusades were a series of religious wars initiated, supported, and at times directed by the Papacy during the Middle Ages. The most prominent of these were the campaigns to the Holy Land aimed at reclaiming Jerusalem and its surrounding t ...

and the city-states of Italy found themselves - uniquely - at the intersection of international trade, finance and religion. The loans of the time were however not yet securitized in the form of bonds. That innovation came from further north: Venice

Venice ( ; ; , formerly ) is a city in northeastern Italy and the capital of the Veneto Regions of Italy, region. It is built on a group of 118 islands that are separated by expanses of open water and by canals; portions of the city are li ...

.

In 12th Century Venice, the city-state's government began issuing war-bonds known as ''prestiti'', perpetuities paying a fixed rate of 5% These were initially regarded with suspicion but the ability to buy and sell them became regarded as valuable. Securities of this late medieval period were priced with techniques very similar to those used in modern-day Quantitative finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that requ ...

. The bond market had begun.

Following the Hundred Years' War

The Hundred Years' War (; 1337–1453) was a conflict between the kingdoms of Kingdom of England, England and Kingdom of France, France and a civil war in France during the Late Middle Ages. It emerged from feudal disputes over the Duchy ...

, monarchs of England

England is a Countries of the United Kingdom, country that is part of the United Kingdom. It is located on the island of Great Britain, of which it covers about 62%, and List of islands of England, more than 100 smaller adjacent islands. It ...

and France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

defaulted on very large debts to Venetian bankers causing a collapse of the system of Lombard banking

Lombard banking refers to the business of Italian moneylenders generally referred to as "Lombards" (in medieval times Northern Italy was referred as Lombardy, a much larger region than the modern Lombardy). The term was often used in a derogatory ...

in 1345. This economic set-back hit every part of economic life - including clothing, food and hygiene - and during the ensuing Black Death

The Black Death was a bubonic plague pandemic that occurred in Europe from 1346 to 1353. It was one of the list of epidemics, most fatal pandemics in human history; as many as people perished, perhaps 50% of Europe's 14th century population. ...

the European economy and bond market were depleted even further. Venice banned its bankers from trading government debt but the idea of debt as a tradable instrument and thus the bond market endured.

With their origins in antiquity, bonds are much older than the equity market which appeared with the first ever joint-stock corporation the Dutch East India Company

The United East India Company ( ; VOC ), commonly known as the Dutch East India Company, was a chartered company, chartered trading company and one of the first joint-stock companies in the world. Established on 20 March 1602 by the States Ge ...

in 1602 (although some scholars argue that something similar to the joint-stock corporation existed in Ancient Rome).

The first-ever Sovereign bond was issued in 1693 by the newly formed Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

. This bond was used to fund conflict with France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

. Other European governments followed suit.

The U.S.A. first issued sovereign Treasury bonds to finance the American Revolutionary War

The American Revolutionary War (April 19, 1775 – September 3, 1783), also known as the Revolutionary War or American War of Independence, was the armed conflict that comprised the final eight years of the broader American Revolution, in which Am ...

. Sovereign debt ("Liberty Bonds") was again used to finance its World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

efforts and issued in 1917 shortly after the U.S. declared war on Germany.

Each maturity of bond (one-year, two-year, five-year and so on) was thought of as a separate market until the mid-1970s when traders at Salomon Brothers

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York City. It was one of the five List of investment banks, largest investment banking enterprises in the United States and a very profitabl ...

began drawing a curve through their yields. This innovation - the yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

- transformed the way bonds were both priced and traded and paved the way for quantitative finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that requ ...

to flourish.

Starting in the late 1970s, non-investment grade public companies were allowed to issue corporate debt.

The next innovation was the advent of Derivatives in the 1980s and onwards, which saw the creation of Collateralized debt obligation

A collateralized debt obligation (CDO) is a type of structured finance, structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing Mortgage-backed se ...

s, Residential mortgage-backed securities and the advent of the Structured product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, an ...

s industry.

See also

* Bond *Bond market index

A bond index or bond market index is a method of measuring the investment performance and characteristics of the bond market. There are numerous indices of differing construction that are designed to measure the aggregate bond market and its var ...

*Bond valuation

Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the s ...

* Bond vigilante

*Corporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, mergers & acquisitions, or to expand business. It is a longer-term debt instrument indicating that a corpo ...

*Deferred financing costs

Deferred financing costs or debt issuance costs is an accounting concept meaning costs associated with issuing debt (loans and bonds), such as various fees and commissions paid to investment banks, law firms, auditors, regulators, and so on. Since ...

*Government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

*Interest rate risk

Interest rate risk is the risk that arises for bond owners from fluctuating interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The ...

*Primary market The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, ...

*Secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of ...

* Bullet strategy

* Barbell strategy

*War Bond

War bonds (sometimes referred to as victory bonds, particularly in propaganda) are Security (finance)#Debt, debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an un ...

Specific:

* US Savings Bonds

*Foreign exchange reserves of the People's Republic of China

The foreign exchange reserves of China are the state of foreign exchange reserves held by the People's Republic of China, comprising cash, bank deposits, bonds, and other financial assets denominated in currencies other than China's national ...

* Bill H. Gross

References

{{Authority control Fixed income Financial markets Foreign exchange market