|

Venture-capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed rounds are the initial stages of funding for a startup company, typically occurring early in its development. During a seed round, entrepreneurs seek investment fro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

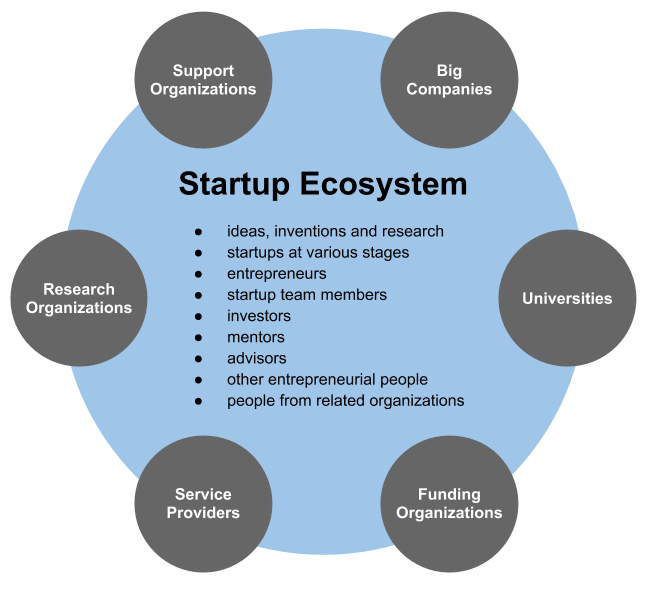

A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to Initial public offering, go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorn (finance), unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unicorn (finance)

In business, a unicorn is a startup company Valuation (finance), valued at over US$1 billion which is privately owned and not listed on a share market. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the unicorn, mythical animal to represent the statistical rarity of such successful ventures. Many unicorns saw their valuations fall in 2022 as a result of an economic slowdown caused by the COVID-19 pandemic, an increase in interest rates causing the cost of borrowing to grow, increased market volatility (finance), volatility, stricter regulatory scrutiny and underperformance. CB Insights identified 1,248 unicorns worldwide . Unicorns with over $10 billion in valuation have been designated as "decacorn" companies. For private companies valued over $100 billion, the terms "centicorn" and "hectocorn" have been used. History Aileen Lee originated the term "unicorn" in a 2013 ''TechCrunch'' article, "Welcome To The Unicorn Club: Learn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Start-up Company

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long perio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Secondary Market

In finance, the Private Equity Secondary Market (also often called Private Equity Secondaries or Secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds or the underlying private equity assets (e.g., credit secondaries). Unlike public markets, private-equity interests lack an established trading exchange, making transfers more complex and labor-intensive. Sellers of private-equity investments sell not only their holdings in a fund but also their remaining unfunded commitments. The private-equity asset class is inherently illiquid and is designed for long-term investment by institutional investors, such as pension funds, sovereign wealth funds, insurance companies, endowments, and family offices for wealthy individuals. The secondary market provides these investors with an avenue for liquidity, enabling them to manage their portfolios dynamically. The secondary market reached a transaction volume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital to a business or businesses, including startups, usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage (when the risk of their failure is relatively high), once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital and provide advice to their portfolio companies. The number of angel investors has greatly increased since the mid-20th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Crowdfunding

Equity crowdfunding is the online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. Because equity crowdfunding involves investment into a commercial enterprise, it is often subject to securities and financial regulation. Equity crowdfunding is also referred to as crowdinvesting, investment crowdfunding, or crowd equity. Equity crowdfunding is a mechanism that enables broad groups of investors to fund startup companies and small businesses in return for equity. Investors give money to a business and receive ownership of a small piece of that business. If the business succeeds, then its value goes up, as well as the value of a share in that business—the converse is also true. Coverage of equity crowdfunding indicates that its potential is greatest with startup businesses that are seeking smaller investments to achieve establishment, while follow-on funding (required for subsequent growth) may come fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investing

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital to a business or businesses, including startups A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses tha ..., usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage (when the risk of their failure is relatively high), once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mentoring

Mentorship is the patronage, influence, guidance, or direction given by a mentor. A mentor is someone who teaches or gives help and advice to a less experienced and often younger person. In an organizational setting, a mentor influences the personal and professional growth of a mentee. Most traditional mentorships involve having senior employees mentor more junior employees, but mentors do not necessarily have to be more senior than the people they mentor. What matters is that mentors have experience that others can learn from. According to the Business Dictionary, a mentor is a senior or more experienced person who is assigned to function as an advisor, counsellor, or guide to a junior or trainee. The mentor is responsible for offering help and feedback to the person under their supervision. A mentor's role, according to this definition, is to use their experience to help a junior employee by supporting them in their work and career, providing comments on their work, and, most cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Network

A business network is a complex, enduring, and interdependent web of business relationships among market and non-market actors that allow firms to co-create value in their business environment. Firms influence their markets by managing and signalling their network positions, facilitating entry of new actors, or removing other actors, for instance, through disintermediation, which means elimitating the middleman. When some actors within a business network have joint strategic intents and work together to achieve certain objectives, then the network is called a strategic business net. These objectives, which are strategic and operational, are adopted by business networks based on their role in the market. Definition Several descriptions of business networks stipulate different types of characteristics: * A business network is a form of inter-firm cooperation that allows companies, located in different regions or countries, to collaborate on a basis of common development object ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, public infrastructure, public transit, public education, along with public health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government. Employment The private sector employs most of the workforce in some countries. In private sector, activities are guided by the motive to earn money, i.e. operate by capitalist standards. A 2013 study by the International Finance Corporation (part of the World Bank Group) identified that 90 percent of jobs in developing countries are in the private sector. Diversification In free enterprise countries, such as the United States, the private sector is wider, and the state places fewer constraints on firms. In countries with more government authority, such as China, the public sector makes up most of the economy. Regulation States legally regulate the private sector. Businesses operating within a country must comply with the laws in that country. In some cases, usually involving multinati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |