|

Mudarabah

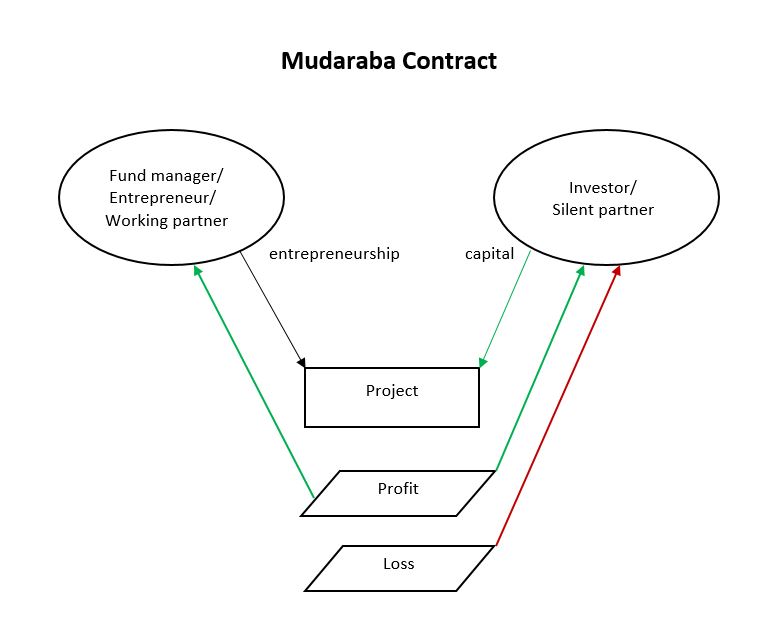

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include '' Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), '' Musharaka'' (joint venture), '' Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include '' Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), '' Musharaka'' (joint venture), '' Murabahah'' (cost-plus), and ''Ijara'' (leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mudaraba

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or " cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Khurshid Ahmad (scholar)

Khurshīd Ahmad ( ur, ; b. 23 March 1932) , is a Pakistani economist, philosopher, politician, and an Islamic activist who helped to develop Islamic economic jurisprudence as an academic discipline and one of the co-founders (along with Khurram Murad) of The Islamic Foundation in Leicester, UK. A senior conservative figure, he has been long-standing party worker of the Islamist Jamaat-e-Islami (JeI) party, where he successfully ran for Senate in the general elections held in 2002 on a platform of Muttahida Majlis-e-Amal (MMA). He served in the Senate until 2012. He played his role as a policy adviser in Zia administration when he chaired the Planning Commission, focusing on the role of Islamising the country's national economy in the 1980s. Biography Family, education, and early life Ahmad was born into an Urdu-speaking family in Delhi, British India, on 23 March 1932. He entered in the Anglo-Arabic College in Delhi. After the partition of India in 1947, the family mov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Muhammad Taqi Usmani Muhammad Taqi Usmani (born 5 October 1943) is a Pakistanis, Pakistani Ulama, Islamic scholar and former judge who is the current president of the Wifaq ul Madaris Al-Arabia, Pakistan, Wifaq ul Madaris Al-Arabia an |