|

Intertemporal Consumption

Economic theories of intertemporal consumption seek to explain people's preferences in relation to consumption (economics), consumption and saving over the course of their lives. The earliest work on the subject was by Irving Fisher and Roy Harrod, who described 'hump saving', hypothesizing that savings would be highest in the middle years of a person's life as they saved for retirement. In the 1950s, more well-defined models were built on discounted utility theory and approached the question of inter-temporal consumption as a lifetime income optimization problem. Solving this problem mathematically, assuming that individuals are rational and have access to complete markets, Franco Modigliani, Modigliani & Brumberg (1954), Albert K. Ando, Albert Ando, and Milton Friedman (1957) developed what became known as the life-cycle model. See for details. The life-cycle model of consumption suggests that consumption is based on average Natural borrowing limit, lifetime income instead of i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preferences

In psychology, economics and philosophy, preference is a technical term usually used in relation to choosing between alternatives. For example, someone prefers A over B if they would rather choose A than B. Preferences are central to decision theory because of this relation to behavior. Some methods such as Ordinal Priority Approach use preference relation for decision-making. As connative states, they are closely related to desires. The difference between the two is that desires are directed at one object while preferences concern a comparison between two alternatives, of which one is preferred to the other. In insolvency, the term is used to determine which outstanding obligation the insolvent party has to settle first. Psychology In psychology, preferences refer to an individual's attitude towards a set of objects, typically reflected in an explicit decision-making process. The term is also used to mean evaluative judgment in the sense of liking or disliking an object, as i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioural Life Cycle

Behavior (American English) or behaviour (British English) is the range of actions of individuals, organisms, systems or artificial entities in some environment. These systems can include other systems or organisms as well as the inanimate physical environment. It is the computed response of the system or organism to various stimuli or inputs, whether internal or external, conscious or subconscious, overt or covert, and voluntary or involuntary. While some behavior is produced in response to an organism's environment (extrinsic motivation), behavior can also be the product of intrinsic motivation, also referred to as "agency" or "free will". Taking a behavior informatics perspective, a behavior consists of actor, operation, interactions, and their properties. This can be represented as a behavior vector. Models Biology Definition Behavior may be defined as "the internally coordinated responses (actions or inactions) of whole living organisms (individuals or groups) to in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Elasticity Of Demand

The wealth elasticity of demand, in microeconomics and macroeconomics, is the proportional change in the consumption of a good relative to a change in consumers' wealth (as distinct from changes in personal income{{Broken anchor, date=2024-12-14, bot=User:Cewbot/log/20201008/configuration, target_link=income#Meaning in economics and use in economic theory, reason= The anchor (Meaning in economics and use in economic theory) has been deleted.). Measuring and accounting for the variability in this elasticity is a continuing problem in behavioral finance and consumer theory. Definition The wealth elasticity of consumption quantity for some good will determine the size of the expenditure shift due to ''unexpected'' changes in net personal wealth, ''ceteris paribus'' (i.e. the size of the so-called "wealth effect" for a given good). It is calculated as ''the ratio of the percent change in consumption to the percent change in wealth that caused it.'' This is analogous to the definiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Temporal Discounting

In behavioral economics, time preference (or time discounting,. delay discounting, temporal discounting, long-term orientation) is the current relative valuation placed on receiving a good at an earlier date compared with receiving it at a later date. Applications for these preferences include finance, health, and climate change. Time preferences are captured mathematically in the discount function. The main models of discounting include exponential, hyperbolic, and quasi hyperbolic. The higher the time preference, the higher the discount placed on returns receivable or costs payable in the future. Several factors correlate with an individual’s time preference, including age, income, race, risk, and temptation. On a larger level, ideas such as sign effects, sub-additivity, and the elicitation method can influence how people display time preference. Time preference can also inform wider preferences about real world behavior and attitudes, such as pro-social behavior. Cultural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the consumption function, formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of the Consumption Function'', published in 1957 and subsequently formalized by Robert Hall (economist), Robert Hall in a rational expectations model. Originally applied to Consumption (economics), consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Neoclassical synthesis, Keynesian orthodoxy. Friedman's predictions o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intertemporal Choice

In economics, intertemporal choice is the study of the relative value people assign to two or more payoffs at different points in time. This relationship is usually simplified to today and some future date. Intertemporal choice was introduced by Canadian economist John Rae in 1834 in the "Sociological Theory of Capital". Later, Eugen von Böhm-Bawerk in 1889 and Irving Fisher in 1930 elaborated on the model. Fisher model Assumptions of the model # consumer's income is constant # maximization of the utility # anything above the line is out of explanation # investments are generators of savings # any property is indivisible and unchangeable According to this model there are three types of consumption: past, present and future. When making decisions between present and future consumption, the consumer takes his/her previous consumption into account. This decision making is based on an '' indifference map with negative slope'' because if he consumes something today it means th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dissaving

Dissaving is negative saving. If spending is greater than disposable income, dissaving is taking place. This spending is financed by already accumulated savings, such as money in a savings account, or it can be borrowed. Household dissaving therefore corresponds to an absolute decrease in their financial investments. Usually dissavings start after retirement, when an individual starts deducting money from the amount that he has been saving during his life time. There are also other reasons for dissavings; like big purchases, huge events, and emergencies. On the macro level, also governments could reach a certain situation where they start dissaving from their accumulated funds. Why people save Savings is when an income contributor keeps a certain amount of the income on a side (saving account) and start having an accumulative amount of money based on their savings. People usually save money for certain reasons such as: 1- Emergencies are those unexpected emerging events that might ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superannuation

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a "Defined benefit pension plan, defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a "defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "Retirement plans in the United States, retirement plan" and "Superannuation in Australia, superann ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

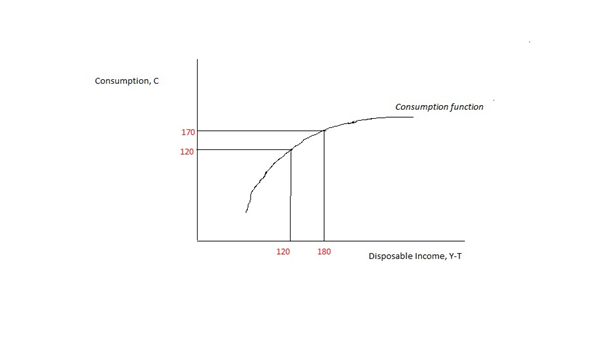

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Current Asset

In accounting, a current asset is an asset that can reasonably be expected to be sold, consumed, or exhausted through the normal operations of a business within the current fiscal year, operating cycle, or financial year. In simple terms, current assets are assets that are held for a short period. Current assets include cash, cash equivalents, short-term investments in companies in the process of being sold, accounts receivable, stock inventory, supplies, and the prepaid liabilities that will be paid within a year. Such assets are expected to be realised in cash or consumed during the normal operating cycle of the business. On a balance sheet, assets will typically be classified into current assets and long-term fixed assets. The current ratio is calculated by dividing total current assets by total current liabilities. It is frequently used as an indicator of a company's accounting liquidity, which is its ability to meet short-term obligations. The difference between curr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mental Accounting

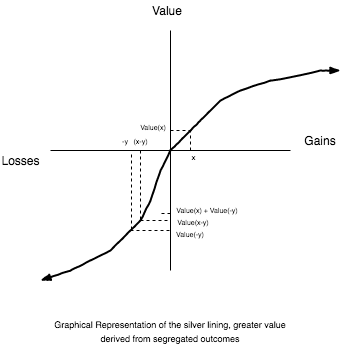

Mental accounting (or psychological accounting) is a model of consumer behaviour developed by Richard Thaler that attempts to describe the process whereby people code, categorize and evaluate economic outcomes. Mental accounting incorporates the economic concepts of prospect theory antransactional utility theoryto evaluate how people create distinctions between their financial resources in the form of mental accounts, which in turn impacts the buyer decision process and reaction to economic outcomes. People are presumed to make mental accounts as a self control strategy to manage and keep track of their spending and resources. People budget money into mental accounts for savings (e.g., saving for a home) or expense categories (e.g., gas money, clothing, utilities). People also are assumed to make mental accounts to facilitate savings for larger purposes (e.g., a home or college tuition). Mental accounting can result in people demonstrating greater loss aversion for certain ment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |