|

Endaka

Endaka (, lit. ''yen expensive'') or ''Endaka Fukyo'' (, lit. ''yen expensive recession'') is a state in which the value of the Japanese yen is high compared to other currencies. Since the economy of Japan is highly dependent on exports, this can cause Japan to fall into an economic recession. The opposite of ''endaka'' is ''en'yasu'' (, lit. ''yen cheap''), where the yen is low relative to other currencies. History Origins The origins of endaka began in 1971 with the Smithsonian Agreement. The term was coined with the first usage in 1985 during the Plaza Accord, in which the yen was revalued sharply overnight. However, its use in the context of recession was first used in 1992, when Japan's economy slowed down, and again in 1995, when the yen hit its then-postwar high of 79 to the dollar. Japan has struggled to keep its yen low to aid exporters. China, Singapore and Hong Kong typically have a target exchange rate, and they buy foreign currencies to maintain that target rate. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry Trade

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during a financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. Interest rates carry trade/maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry (investment)

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during a financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. Interest rates carry trade/maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Plaza Accord

The Plaza Accord was a joint agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s. Background The tight monetary policy of the Federal Reserve's Chairman Paul Volcker and the expansionary fiscal policy of President Ronald Reagan's first term in 1981–84 pushed up long-term interest rates and attracted capital inflow, appreciating the dollar. The French government was strongly in favor of currency intervention to reduce it, but US administration officials, such as Treasu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Asset Price Bubble

The was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and the country's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion.Kunio Okina, Masaaki Shirakawa, and Shigenori Shiratsuka (February 2001):The Asset Price Bubble and Monetary Policy: Japan's Experience in the Late 1980s and the Lessons More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time.Edgardo Demaestri, Pietro Masci (2003): Financial Crises in Japan and Latin America, Inter-American Development Bank Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro. Foreign exchange reserves assets can comprise banknotes, bank deposits, and government securities of the reserve currency, such as bonds and treasury bills. Some countries hold a part of their reserves in gold, and special drawing rights are also considered reserve assets. Often, for convenience, the cash or securities are retained by the central bank of the reserve or other currency and the "holdings" of the foreign country are tagged or otherwise identified as belonging to the other country without them ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2011 U

Eleven or 11 may refer to: *11 (number) * One of the years 11 BC, AD 11, 1911, 2011 Literature * ''Eleven'' (novel), a 2006 novel by British author David Llewellyn *''Eleven'', a 1970 collection of short stories by Patricia Highsmith *''Eleven'', a 2004 children's novel in The Winnie Years by Lauren Myracle *''Eleven'', a 2008 children's novel by Patricia Reilly Giff *''Eleven'', a short story by Sandra Cisneros Music * Eleven (band), an American rock band * Eleven: A Music Company, an Australian record label *Up to eleven, an idiom from popular culture, coined in the movie ''This Is Spinal Tap'' Albums * ''11'' (The Smithereens album), 1989 * ''11'' (Ua album), 1996 * ''11'' (Bryan Adams album), 2008 * ''11'' (Sault album), 2022 * ''Eleven'' (Harry Connick, Jr. album), 1992 * ''Eleven'' (22-Pistepirkko album), 1998 * ''Eleven'' (Sugarcult album), 1999 * ''Eleven'' (B'z album), 2000 * ''Eleven'' (Reamonn album), 2010 * ''Eleven'' (Martina McBride album), 2011 * ''Eleven'' (Mr F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. By trading volume, it is by far the largest market in the world, followed by the credit market. The main participants are the larger international banks. Financial centres function as anchors of trading between a range of multiple types of buyers and sellers around the clock, with the exception of weekends. As currencies are always traded in pairs, the market does not set a currency's absolute value, but rather determines its relative value by setting the market price of one currency if paid for with another. Example: 1 USD is worth 1.1 Euros or 1.2 Swiss Francs etc. The market works through financial institutions and operates on several levels. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance In Japan

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, is a field of Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability, and prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1985 Neologisms

The year 1985 was designated as the International Youth Year by the United Nations. Events January * January 1 ** The Internet's Domain Name System is created. ** Greenland withdraws from the European Economic Community as a result of a new agreement on fishing rights. * January 7 – Japan Aerospace Exploration Agency launches ''Sakigake'', Japan's first interplanetary spacecraft and the first deep space probe to be launched by any country other than the United States or the Soviet Union. * January 15 – Tancredo Neves is elected president of Brazil by the Congress, ending the 21-year military rule. * January 27 – The Economic Cooperation Organization (ECO) is formed, in Tehran. * January 28 – The charity single record "We Are the World" is recorded by USA for Africa. February * February 4 – The border between Gibraltar and Spain reopens for the first time since Francisco Franco closed it in 1969. * February 5 – Australia cancels its involvemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

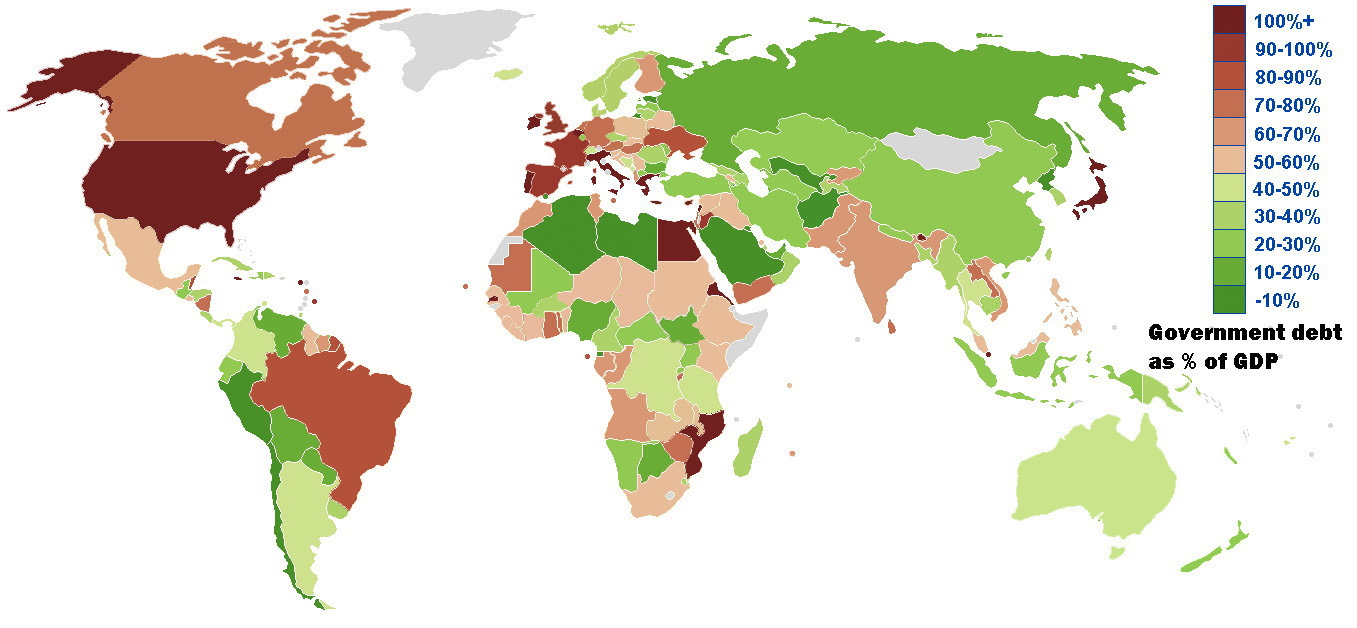

Euro Area Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone member states of Greece, Portugal, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

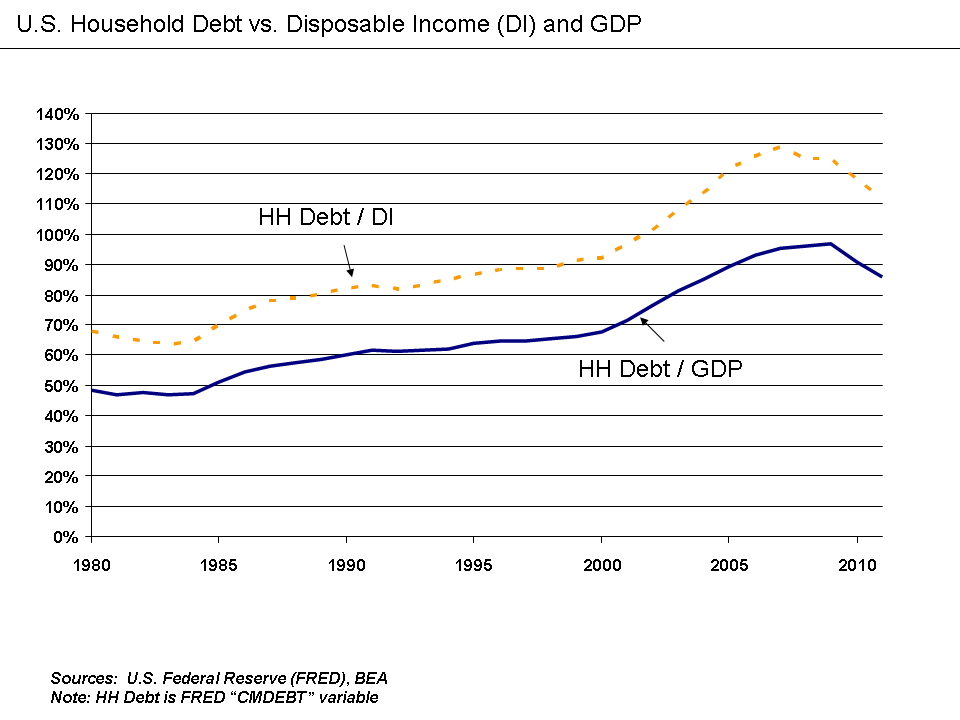

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

A credit crunch (a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investors in debt when th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |