|

Eco-tariff

An eco-tariff, also known as an environmental tariff, is a trade barrier for the purpose of reducing pollution and improving the environment. These trade barriers may take the form of import or export taxes on products that have a large carbon footprint or are imported from countries with lax environmental regulations.Kraus, Christiane (2000), ''Import Tariffs as Environmental Policy Instruments'', Springer, , A carbon tariff is a type of eco-tariff. International trade vs. environmental degradation There is debate on the role that increased international trade has played in increasing pollution. While some maintain that increases in pollution which result in both local environmental degradation and a global tragedy of the commons are intimately linked to increases in international trade, others have argued that as citizens become more affluent they'll also advocate for cleaner environments. According to a World Bank paper:Since freer trade raises income, it directly contr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Tariff

A carbon tariff or carbon border adjustment mechanism (CBAM) is an eco-tariff on embedded carbon. In 2024 the United States said it is not a carbon tax, but the World Trade Organization has not come to a conclusion. One aim to prevent carbon leakage from nations without a carbon price. Examples of imports which are high-carbon and so may be subject to a carbon tariff are electricity generated by Coal-fired power station, coal-fired power stations, iron and steel from Blast furnace, blast furnaces, and fertilizer from the Haber process. Several countries levy carbon tariffs or are considering them. Existing and forthcoming European Union United Kingdom California California has a carbon border adjustment mechanism for imported electricity. References {{Reflist Climate change mitigation Environmental tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.) In most countries, such trade represents a significant share of gross domestic product (GDP). While international trade has existed throughout history (for example Uttarapatha, Silk Road, Amber Road, salt roads), its economic, social, and political importance has been on the rise in recent centuries. Carrying out trade at an international level is a complex process when compared to domestic trade. When trade takes place between two or more states, factors like currency, government policies, economy, judicial system, laws, and markets influence trade. To ease and justify the process of trade between countries of different economic standing in the modern era, some international economic organizations were formed, such as the World Trade Organization. These organizations work towards the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Barrier

Trade barriers are government-induced restrictions on international trade. According to the comparative advantage, theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency. Most trade barriers work on the same principle: the imposition of some sort of cost (money, time, bureaucracy, quota) on trade that raises the price or availability of the traded product (business), products. If two or more nations repeatedly use trade barriers against each other, then a trade war results. Barriers take the form of tariffs (which impose a financial burden on imports) and non-tariff barriers to trade (which uses other overt and covert means to restrict imports and occasionally exports). In theory, free trade involves the removal of all such barriers, except perhaps those considered necessary for health or national security. In practice, however, even those countries promoting free trade heavily subsidize certain industries, such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Clean Energy And Security Act

The American Clean Energy and Security Act of 2009 (ACES) was an energy bill in the 111th United States Congress () that would have established a variant of an emissions trading plan similar to the European Union Emission Trading Scheme. The bill was approved by the House of Representatives on June 26, 2009, by a vote of 219–212. With no prospect of overcoming a threatened Republican filibuster, the bill was never brought to the floor of the Senate for discussion or a vote. The House passage of the bill was the "first time either house of Congress had approved a bill meant to curb the heat-trapping gases scientists have linked to climate change." The bill was also known as the Waxman-Markey Bill, after its authors, Representatives Henry A. Waxman of California and Edward J. Markey of Massachusetts, both Democrats. Waxman was at the time the chairman of the Energy and Commerce Committee, and Markey was the chairman of that committee's Energy and Power Subcommittee. Summary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Law

Environmental laws are laws that protect the environment. The term "environmental law" encompasses treaties, statutes, regulations, conventions, and policies designed to protect the natural environment and manage the impact of human activities on ecosystems and natural resources, such as forests, minerals, or fisheries. It addresses issues such as pollution control, resource conservation, biodiversity protection, climate change mitigation, and sustainable development. As part of both national and international legal frameworks, environmental law seeks to balance environmental preservation with economic and social needs, often through regulatory mechanisms, enforcement measures, and incentives for compliance. The field emerged prominently in the mid-20th century as industrialization and environmental degradation spurred global awareness, culminating in landmark agreements like the 1972 Stockholm Conference and the 1992 Rio Declaration. Key principles include the precaut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Tax

An environmental tax, ecotax (short for ecological taxation), or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly alternatives via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory ( command and control) approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes (e.g. taxes on wages and income or property taxes); such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts. Ecotaxes are examples of Pigouvian taxes, which are taxes on goods whose production or consumption creates external costs or externalities. An example might be philosopher Thomas Pogge's proposed Global Resources Dividend. Categories of Environmental Taxes The term, environmenta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PROVE IT Act

The Providing Reliable, Objective, Verifiable Emissions Intensity and Transparency (PROVE IT) Act, S.1863, is a bill in the United States Senate to study the greenhouse gas intensity of certain industrial products of the United States and other countries. Chris Coons (), its lead Senate sponsor, intends it to "provide reliable data that’s needed to quantify the climate benefits of the United States’ investments in cleaner, more efficient manufacturing practices and to hold nations like China accountable for their emissions-heavy production of goods like steel." John Curtis (), the bill's lead House sponsor, describes it as "leveling the playing field in international competition" given US regulations and technology for cleaner energy. He also envisions it helping to "strengthen our trade relationships, and provide our allies with a reliable energy partner." The measure has been described by the Washington Post as a "rare example of bipartisan climate policy". History Sena ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Green Politics

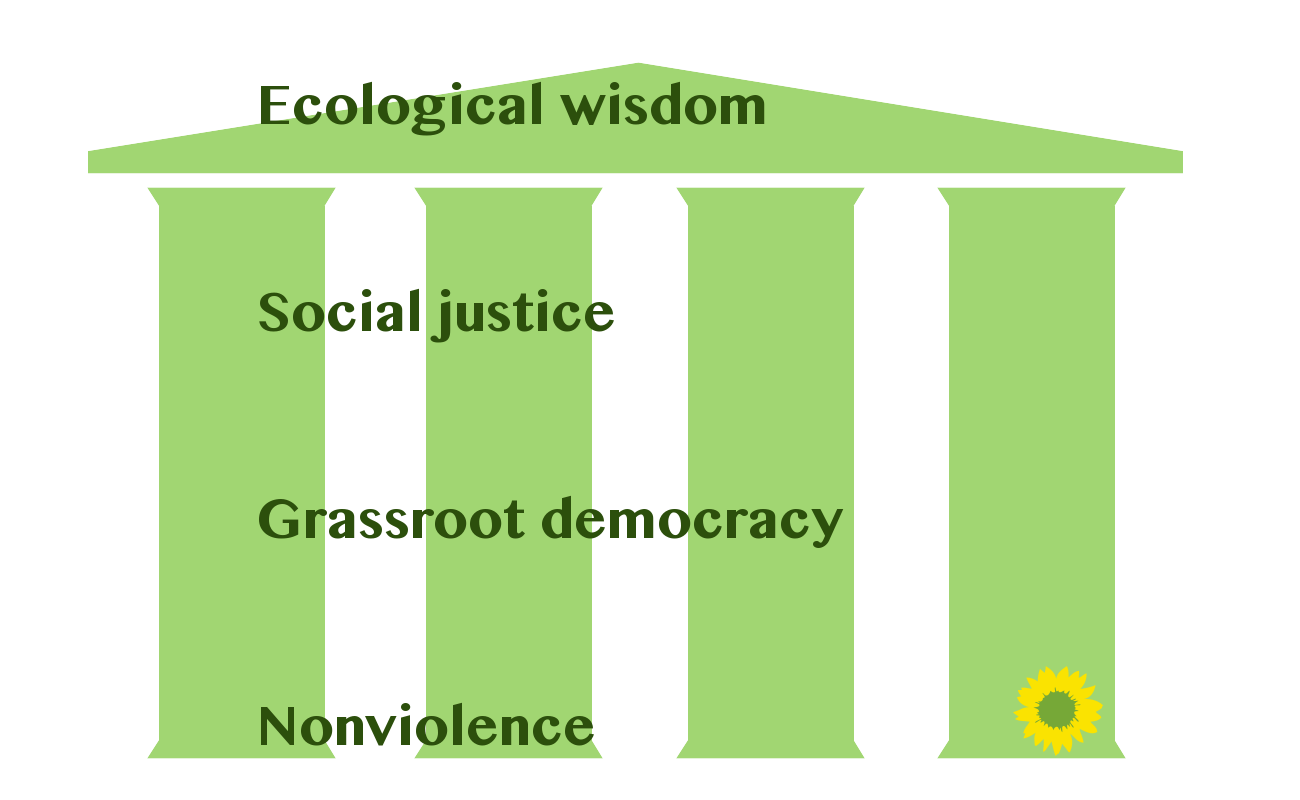

Green politics, or ecopolitics, is a political ideology that aims to foster an ecologically sustainable society often, but not always, rooted in environmentalism, nonviolence, social justice and grassroots democracy.#Wal10, Wall 2010. p. 12-13. It began taking shape in the Western world in the 1970s; since then, green parties have developed and established themselves in many countries around the globe and have achieved some electoral success. The political term ''green'' was used initially in relation to ''Alliance 90/The Greens, die Grünen'' (German for "the Greens"), a green party formed in the late 1970s. The term ''political ecology'' is sometimes used in academic circles, but it has come to represent an interdisciplinary field of study as the academic discipline offers wide-ranging studies integrating ecological social sciences with political economy in topics such as degradation and marginalization, environmental conflict, conservation and control and environmental identi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Economics

Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or empirical studies of the economic effects of national or local environmental policies around the world. Particular issues include the costs and benefits of alternative environmental policies to deal with air pollution, water quality, toxic substances, solid waste, and global warming." Environmental Versus Ecological Economics Environmental economics is distinguished from ecological economics in that ecological economics emphasizes the economy as a subsystem of the ecosystem with its focus upon preserving natural capital. While environmental economics focuses on human preferences, by trying to balance protecting natural resources with people's needs for products and services. Due to these differences it can be seen that ecologi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ecotax

An environmental tax, ecotax (short for ecological taxation), or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly alternatives via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory ( command and control) approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes (e.g. taxes on wages and income or property taxes); such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts. Ecotaxes are examples of Pigouvian taxes, which are taxes on goods whose production or consumption creates external costs or externalities. An example might be philosopher Thomas Pogge's proposed Global Resources Dividend. Categories of Environmental Taxes The term, environmenta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Fee And Dividend

A carbon fee and dividend or climate income is a system to reduce carbon emissions, greenhouse gas emissions and address climate change. The system imposes a carbon tax on the sale of fossil fuels, and then distributes the revenue of this tax over the entire population (equally, on a per-person basis) as a monthly income or regular payment. Since the adoption of the system in Canada and Switzerland, it has gained increased interest worldwide as a cross-sector and socially just approach to reducing emissions and tackling climate change. Designed to maintain or improve economic vitality while speeding the transition to a sustainable energy economy, carbon fee and dividend has been proposed as an alternative to emission reduction mechanisms such as command and control regulation, complex regulatory approaches, Emissions trading, cap and trade or a straightforward carbon tax. While there is general agreement among scientists and economists on the need for a carbon tax, economists ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |