|

Budget Process

A budget process refers to the process by which governments create and approve a budget, which is as follows: * The Financial Service Department prepares worksheets to assist the department head in preparation of department budget estimates * The Administrator calls a meeting of managers and they present and discuss plans for the following year’s projected level of activity. * The managers can work with the Financial Services, or work alone to prepare an estimate for the departments coming year. * The completed budgets are presented by the managers to their Executive Officers for review and approval. * Justification of the budget request may be required in writing. In most cases, the manager talks with their administrative officers about budget requirements. Adjustments to the budget submission may be required as a result of this phase in the process. Budgeting is the setting of expenditure levels for each of an organization’s functions. It is the estimation and allocation of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Budget Process

The United States budget process is the framework used by Congress and the President of the United States to formulate and create the United States federal budget. The process was established by the Budget and Accounting Act of 1921, the Congressional Budget and Impoundment Control Act of 1974, and additional budget legislation. Prior to 1974, Congress had no formal process for establishing a federal budget. When President Richard Nixon began to refuse to spend funds that Congress had allocated, they adopted a more formal means by which to challenge him. The Congressional Budget Act of 1974 created the Congressional Budget Office (CBO), which gained more control of the budget, limiting the power of the President's Office of Management and Budget (OMB). The Act passed easily while the administration was embroiled in the Watergate scandal and was unwilling to provoke Congress. Discretionary spending Discretionary spending requires an annual appropriation bill, which is a piec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget

A budget is a calculation plan, usually but not always financial plan, financial, for a defined accounting period, period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, Liability (financial accounting), liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic planning, strategic plans of activities in measurable terms. Preparing a budget allows Company, companies, Public authority, authorities, private entities or Family, families to establish priorities and evaluate the achievement of their objectives. To achieve these goals it may be necessary to incur a Deficit spending, deficit (expenses exceed income) or, on the contrary, it may be possible to save, in which case the budget will present a Surplus (economics), surplus (income exceed expense ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Surplus

A balanced budget (particularly that of a government) is a budget in which revenues are equal to expenditures. Thus, neither a budget deficit nor a budget surplus exists (the accounts "balance"). More generally, it is a budget that has no budget deficit, but could possibly have a budget surplus. A ''cyclically'' balanced budget is a budget that is not necessarily balanced year-to-year but is balanced over the economic cycle, running a surplus in boom years and running a deficit in lean years, with these offsetting over time. Balanced budgets and the associated topic of budget deficits are a contentious point within academic economics and within politics. Some economists argue that moving from a budget deficit to a balanced budget decreases interest rates, increases investment, shrinks trade deficits and helps the economy grow faster in the longer term. Other economists, especially (but not limited to) those associated with Modern Monetary Theory (MMT), downplay the need for balan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance refers to the monetary resources available to governments and also to the study of finance within government and role of the government in the economy. Within academic settings, public finance is a widely studied subject in many branches of political science, political economy and public economics. Research assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. American public policy advisor and economist Jonathan Gruber put forth a framework to assess the broad field of public finance in 2010:Gruber, J. (2010) Public Finance and Public Policy (Third Edition), Worth Publishers, Pg. 3, Part 1 # When shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Administration

Public administration, or public policy and administration refers to "the management of public programs", or the "translation of politics into the reality that citizens see every day",Kettl, Donald and James Fessler. 2009. ''The Politics of the Administrative Process''. Washington D.C.: CQ Press and also to the academic discipline which studies how public policy is created and implemented. In an academic context, public administration has been described as the study of government decision-making; the analysis of policies and the various inputs that have produced them; and the inputs necessary to produce alternative policies. It is also a subfield of political science where studies of policy processes and the structures, functions, and behavior of public institutions and their relationships with broader society take place. The study and application of public administration is founded on the principle that the proper functioning of an organization or institution relies on effectiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government-owned Corporation

A state-owned enterprise (SOE) is a business entity created or owned by a national or local government, either through an executive order or legislation. SOEs aim to generate profit for the government, prevent private sector monopolies, provide goods at lower prices, implement government policies, or serve remote areas where private businesses are scarce. The government typically holds full or majority ownership and oversees operations. SOEs have a distinct legal structure, with financial and developmental goals, like making services more accessible while earning profit (such as a state railway). They can be considered as government-affiliated entities designed to meet commercial and state capitalist objectives. Terminology The terminology around the term state-owned enterprise is murky. All three words in the term are challenged and subject to interpretation. First, it is debatable what the term "state" implies (e.g., it is unclear whether municipally owned corporations and ente ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Accountability Office Investigations Of The Department Of Defense

Government Accountability Office investigations of the Department of Defense (DoD) are typically audits in which the Government Accountability Office (GAO), the United States Congress' investigative arm, studies how the Department of Defense spends taxpayer dollars. Since the GAO is accountable only to the legislative branch, it is in a unique position to investigate the military; no other agency can audit Federal departments with the same degree of independence from the President. However, the GAO is still subject to influence from powerful members of Congress. As of May 19, 2021, the DoD was the only government agency to have failed every audit since all government agencies were required to pass such audits by the Chief Financial Officers Act of 1990. Two examples of major GAO investigations in the 2000s were the audits of Operation Iraqi Freedom and Defense Department airline reimbursements. Major investigations Operation Iraqi Freedom GAO investigations into Operation Iraqi Fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comprehensive Income

In company financial reporting in the United States, comprehensive income (or comprehensive earnings) "includes all changes in equity during a period except those resulting from investments by owners and distributions to owners". Because that use excludes the effects of changing ownership interest, an economic measure of comprehensive income is necessary for financial analysis from the shareholders' point of view (all changes in equity except those resulting from investment by or distribution to owners). Accounting Comprehensive income is defined by the Financial Accounting Standards Board, or FASB, as “the change in equity et assetsof a business enterprise during a period from transactions and other events and circumstances from non-owner sources. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.” Comprehensive income is the sum of net income and other items that must bypass the income statement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Federal Budget

In Canada, federal budgets are presented annually by the Government of Canada to identify planned government spending and expected government revenue, and to forecast economic conditions for the upcoming year. They are usually released in February or March, before the start of the fiscal year. All the Canadian provinces also present budgets. Since provincial finances depend on funds from the federal government, they are usually released after the federal budget. Budget process The budget is announced in the House of Commons by the Minister of Finance, who traditionally wears new shoes while doing so. The Budget is then voted on by the House of Commons. Budgets are a confidence measure, and if the House votes against it the government can fall, as happened to Prime Minister Joe Clark's government in 1980. The governing party strictly enforces party discipline, usually expelling from the party caucus any government Member of Parliament (MP) who votes against the budget. O ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Crisis

A budget crisis is a situation in which the legislative and the executive in a presidential system deadlock and are unable to pass a budget. In presidential systems, the legislature has the power to pass a budget, but the executive often has a veto in which there are insufficient votes in the legislature to override. If no emergency provisions are made for the government's budget, a budget crisis may develop into a government shutdown in which the government temporarily suspends non-essential services until a budget is passed. Unlike parliamentary systems, where a loss of supply would trigger the immediate fall of the government, a budget crisis can often lead to an extended stand-off. At the federal level in the United States, a crisis can often be averted by a continuing resolution which appropriates funding at the same level as the previous budget. A budget crisis can also occur if the legislative branch has a constitutionally mandated dissolution or suspension date and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom times so that there is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constitutional Economics

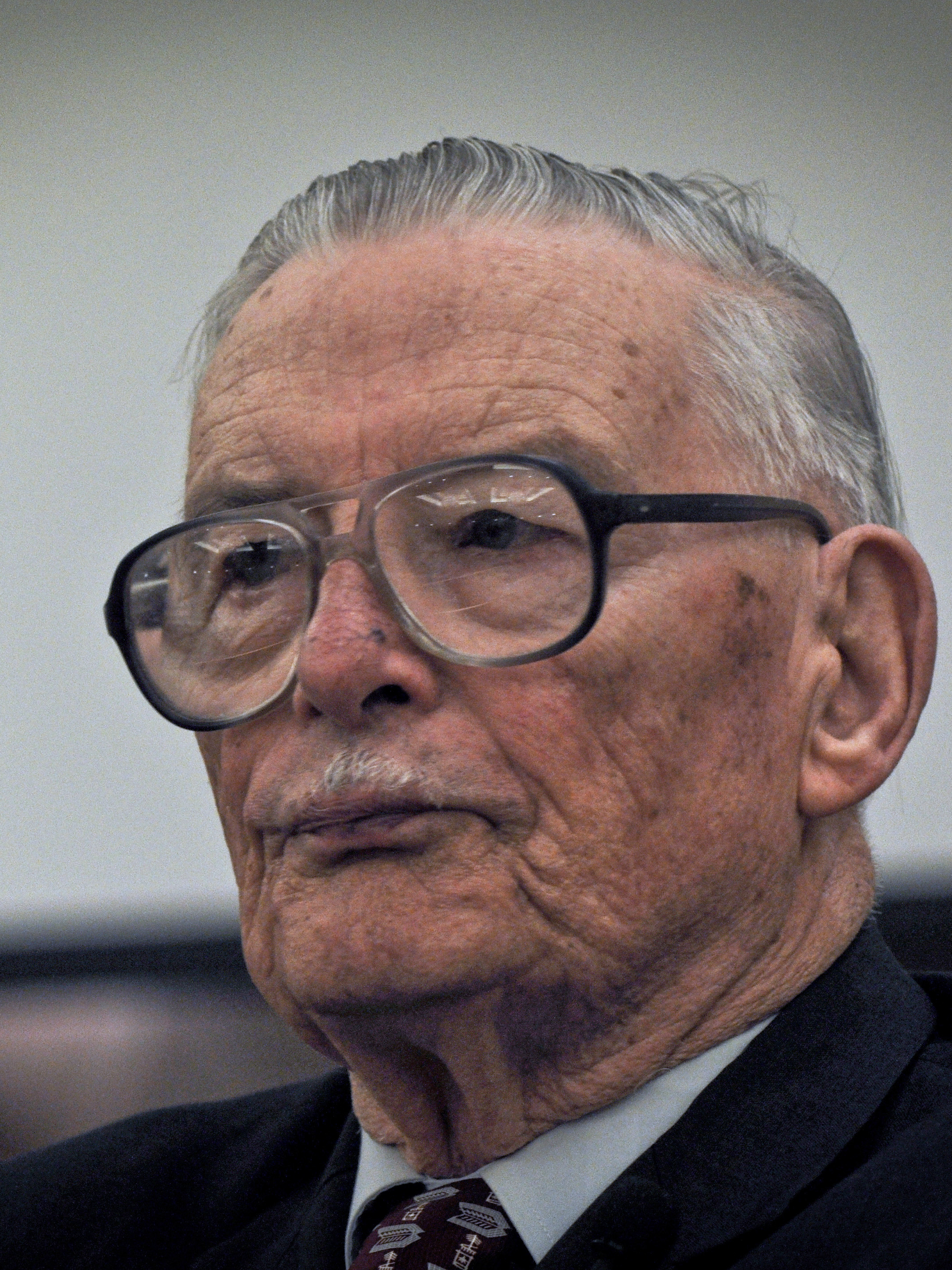

Constitutional economics is a research program in economics and constitutionalism that has been described as explaining the choice "of alternative sets of legal-institutional-constitutional rules that constrain the choices and activities of economic and political agents". This extends beyond the definition of "the economic analysis of constitutional law" and is distinct from explaining the choices of economic and political agents within those rules, a subject of orthodox economics. Instead, constitutional economics takes into account the impacts of political economic decisions as opposed to limiting its analysis to economic relationships as functions of the dynamics of distribution of marketable goods and services. Constitutional economics was pioneered by the work of James M. Buchanan. He argued that "The political economist who seeks to offer normative advice, must, of necessity, concentrate on the process or structure within which political decisions are observed to be made. Ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |