|

Wirecard Scandal

The Wirecard scandal (German: ''Wirecard-Skandal'') was a series of corrupt business practices and fraudulent financial reporting that led to the insolvency of Wirecard, a payment processor and financial services provider, headquartered in Munich, Germany. The company was part of the DAX index. They offered customers electronic payment transaction and risk management services, as well as the issuance and processing of physical cards. The subsidiary, Wirecard Bank AG, held a banking licence and had contracts with multiple international financial services companies. Allegations of accounting malpractices have trailed the company since the early days of its incorporation, reaching a peak in 2019 after the ''Financial Times'' published a series of investigations along with whistleblower complaints and internal documents. On 25 June 2020, Wirecard filed for insolvency after revealing that €1.9 billion was "missing", and the termination and arrest of its CEO Markus Braun. Questio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wirecard Headquarters, Aschheim (49556187461)

Wirecard AG is an insolvent German payment processor and financial services provider whose former CEO, COO, two board members, and other executives have been arrested or otherwise implicated in criminal proceedings. In June 2020, the company announced that €1.9 billion in cash was missing. It owed €3.2 billion in debt. In November 2020, the company was dismantled after it sold the assets of its main business unit to Santander Group for €100 million. Other assets, including its North American, UK and Brazilian units had been previously sold at nondisclosed prices. The company offered electronic payment transaction services and risk management, and issued and processed physical and virtual cards. As of 2017, the company was listed on the Frankfurt Stock Exchange, and was a part of the DAX stock index from September 2018 to August 2020. The company is at the center of an international financial scandal. Allegations of accounting malpractices had trailed the company sinc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malpractice

In the law of torts, malpractice, also known as professional negligence, is an "instance of negligence or incompetence on the part of a professional".Malpractice definition, Professionals who may become the subject of malpractice actions include: * medical professionals: a medical malpractice claim may be brought against a doctor or other healthcare provider who fails to exercise the degree of care and skill that a similarly situated professional of the same medical specialty would provide under the circumstances. * lawyers: a legal malpractice claim may be brought against a lawyer who fails to render services with the level of skill, care, and diligence that a reasonable lawyer would apply under similar circumstances. * financial professionals: professionals such as accountants, financial planners, and stockbrokers may be subject to claims for professional negligence based upon their failure to meet professional standards when providing services to their clients. * archit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Visa Inc

Visa Inc. () is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa does not issue cards, extend credit, or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash access programs to their customers. In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. This article is authored by a ''Forbes'' staff member. Visa was founded in 1958 by Bank of America (BofA) as the BankAmericard credit card program. Available through SpringerLink. In response to competitor Master Charge (now Mastercard ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Handelsblatt

The ''Handelsblatt'' (literally "commerce paper" in English) is a German-language business newspaper published in Düsseldorf by Handelsblatt Media Group, formerly known as Verlagsgruppe Handelsblatt. History and profile ''Handelsblatt'' was established in 1946 by journalist Herbert Gross, but after some months Friedrich Vogel (1902–1976) became publisher. In 1969, Georg von Holtzbrinck became partner of Friedrich Vogel. Since 2021, its editor-in-chief is Sebastian Matthes. Its publisher, Handelsblatt Media Group, also publishes the weekly business magazine ''Wirtschaftswoche'' of which the editor-in-chief is Beat Balzli. ''Handelsblatt'' headquarters are in Düsseldorf. Since September 2005 ''Handelsblatt'' has been offering an online lexicon called ''WirtschaftsWiki'' which features definitions of terms used in economics and politics. The database can be modified by any registered user. In September 2006 ''Handelsblatt'' ranked all economists working in Germany, Austria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, the bank holding company for Citibank, and The Travelers Companies, Travelers; Travelers was spun off from the company in 2002. Citigroup is the List of largest banks in the United States, third-largest banking institution in the United States by assets; alongside JPMorgan Chase, Bank of America, and Wells Fargo, it is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. It is considered a Systemically important financial institution, systemically important bank by the Financial Stability Board, and is commonly cited as being "too big to fail". It is one of the eight global investment banks in the Bulge Bracket. Citigroup is ranked 36th on the Fortune 500, ''Fortune'' 500, and was ranked #24 in Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TecDAX

The TecDAX stock index tracks the performance of the 30 largest German companies from the technology sector. In terms of order book turnover and market capitalization the companies rank below those included in the DAX. The TecDax was introduced on 24 March 2003. It succeeded the NEMAX50 (''Neuer Markt'' — new market) stock index of German new economy companies that existed from 1997 to 2003 and was discontinued after extreme value loss due to the burst of the dot-com bubble. TecDAX is based on prices generated in Xetra. The index is calculated on every trading day, between 9am and 5.30pm CET . In 2018, the TecDAX had an average performance of 23,3 % in five years, outpacing even the NASDAQ. Companies The following 30 companies make up the index as of the quarterly review effective February 2024. * 1&1 Drillisch * Adtran *Aixtron * Atoss Software AG * Bechtle * Cancom AG *Carl Zeiss Meditec * CompuGroup Medical SE *Deutsche Telekom * Energiekontor * Evotec *Freenet *Hens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Takeover

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company. Process In a reverse takeover, shareholders of a private company purchase control of a public shell company/ SPAC, and then merge it with the private company. The publicly traded corporation is called a "shell," since all that exists of the original company is its organizational structure. The private company shareholders receive a substantial majority of the shares of the public company and control of its board of directors. The transaction can be accomplished within weeks. The transaction involves the private and shell company exchanging information on each other, negot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prime Standard

The Prime Standard is a market segment of the Frankfurt Stock Exchange that includes companies which comply with transparency standards higher than those of the General Standard, which is regulated by law. The Prime Standard includes quarterly reporting as well as ''ad hoc'' disclosure in German and English, application of international accounting standards ( IFRS/ IAS or US-GAAP), publication of a financial calendar and staging of at least one analyst conference per year. Companies must satisfy the requirements of the Prime Standard to be listed in the DAX, MDAX, TecDAX and SDAX. References {{Reflist Stock market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seasoned Equity Offering

A seasoned equity offering (SEO) or capital increase is a new equity issued by an already publicly traded company. Seasoned offerings may involve shares sold by existing shareholders (non-dilutive), new shares (dilutive), or both. If the seasoned equity offering is made by an issuer that meets certain regulatory criteria, it may be a shelf offering. See also * * * * * References External linksUNDERWRITER CHOICE AND ANNOUNCEMENT EFFECTS FOR SEASONED EQUITY OFFERINGS by Fredrick P. Schadler* and Timothy L. ManuelInvestopedia: Secondary Offering Corporate finance Stock market Equity securities {{econ-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded stocks worldwide rose from US$2.5 trillion in 1980 to US$111 trillion by the end of 2023. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

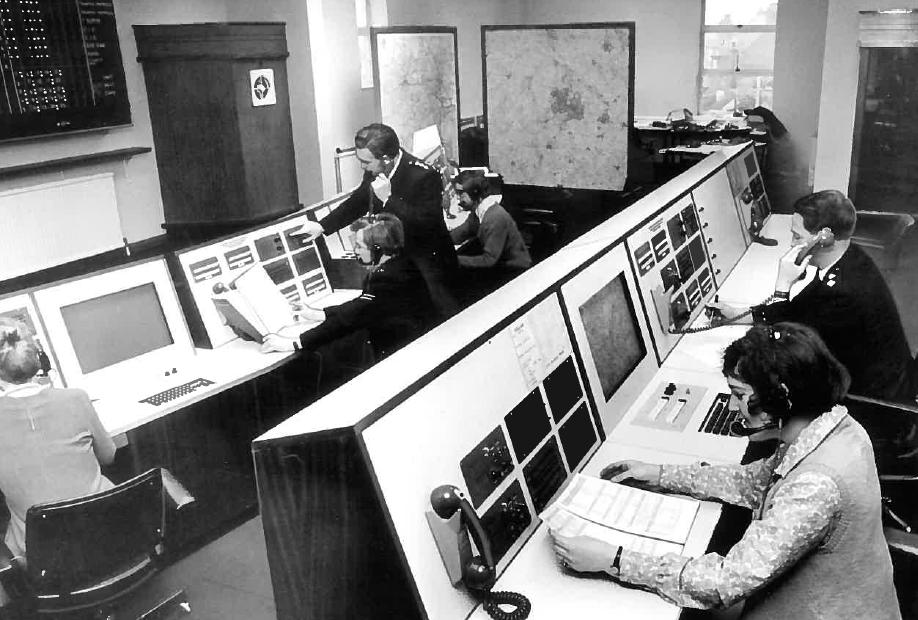

Call Centre

A call centre ( Commonwealth spelling) or call center ( American spelling; see spelling differences) is a managed capability that can be centralised or remote that is used for receiving or transmitting a large volume of enquiries by telephone. An inbound call centre is operated by a company to administer incoming product or service support or information inquiries from consumers. Outbound call centres are usually operated for sales purposes such as telemarketing, for solicitation of charitable or political donations, debt collection, market research, emergency notifications, and urgent/critical needs blood banks. A contact centre is a further extension of call centres telephony based capabilities, administers centralised handling of individual communications, including letters, faxes, live support software, social media, instant message, and email. A call center was previously seen as an open workspace for call center agents, with workstations that included a compute ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |