|

VOEC

The European e-commerce VAT directive (2002/38/EC from 7 May 2002) is a directive in the European Union which regulates value added tax of sales to consumers in EU and EEA countries. A consequence of the directive is the Norwegian VAT On E-Commerce (VOEC) scheme, which was implemented in Norway starting in 2020. To avoid a customs clearance fee, foreign webshops selling goods to consumers in Norway need to register in the VOEC registry of the Norwegian Tax Administration. See also * Import One-Stop Shop Import One-Stop Shop (IOSS or Import OSS) is an electronic one-stop shop (OSS) portal in the European Union (EU) which serves as a point of contact for the import of goods from third countries into the European Union. The scheme aims to simplify ... (IOSS), an EU-wide scheme with similarities to the VOEC{{Cite web , url=https://www.toll.no/no/verktoy/regelverk/nytt-fra-tolletaten/eu-innforte-ioss-ordningen-fra-1.-juli/ , title=EU innførte IOSS-ordningen fra 1. juli - Tolleta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Import One-Stop Shop

Import One-Stop Shop (IOSS or Import OSS) is an electronic one-stop shop (OSS) portal in the European Union (EU) which serves as a point of contact for the import of goods from third countries into the European Union. The scheme aims to simplify the declaration and payment of value-added tax when importing goods into the European Union. IOSS became available from 1 July 2021, and applies to distance sales of items imported from third territories or third countries with a value from 0 to 150 euros. Participation in the IOSS portal is voluntary. History A system change in the VAT procedure was proposed by the European Commission in two stages. The first stage came into effect on 1 January 2015 under the name Mini One-Stop Shop (MOSS), and related to telecommunications, radio and television services as well as electronically provided services to end customers. The second package of measures was adopted by the European Council in 2017 December, and extended the VAT system change ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Directive (European Union)

A directive is a legal act of the European Union that requires Member state of the European Union, member states to achieve particular goals without dictating how the member states achieve those goals. A directive's goals have to be made the goals of one or more new or changed national laws by the member states before this legislation applies to individuals residing in the member states. Directives normally leave member states with a certain amount of leeway as to the exact rules to be adopted. Directives can be adopted by means of a variety of European Union legislative procedure, legislative procedures depending on their subject matter. The text of a draft directive (if subject to the co-decision process, as contentious matters usually are) is prepared by the European Commission, Commission after consultation with its own and national experts. The draft is presented to the European Parliament, Parliament and the Council of the European Union, Council—composed of relevant min ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The union has a total area of and an estimated population of over 449million as of 2024. The EU is often described as a ''sui generis'' political entity combining characteristics of both a federation and a confederation. Containing 5.5% of the world population in 2023, EU member states generated a nominal gross domestic product (GDP) of around €17.935 trillion in 2024, accounting for approximately one sixth of global economic output. Its cornerstone, the European Union Customs Union, Customs Union, paved the way to establishing European Single Market, an internal single market based on standardised European Union law, legal framework and legislation that applies in all member states in those matters, and only those matters, where the states ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the 193 countries with UN membership employ a VAT, including all OECD members except the United States. History German indust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Economic Area

The European Economic Area (EEA) was established via the ''Agreement on the European Economic Area'', an international agreement which enables the extension of the European Union's single market to member states of the European Free Trade Association (EFTA). The EEA links the EU member states and three of the four EFTA states (Iceland, Liechtenstein, and Norway) into an internal market governed by the same EU laws. These rules aim to enable free movement of persons, goods, services, and capital within the European single market, including the freedom to choose residence in any country within this area. The EEA was established on 1 January 1994 upon entry into force of the EEA Agreement. The contracting parties are the EU, its member states, and Iceland, Liechtenstein, and Norway. New members of EFTA would not automatically become party to the EEA Agreement, as each EFTA State decides on its own whether it applies to be party to the EEA Agreement or not. According to Article 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Norwegian Tax Administration

The Norwegian Tax Administration () is a government agency responsible for resident registration (''National Population Register'') and tax collection in Norway. The agency is subordinate to the Ministry of Finance and is based at Helsfyr in Oslo. It is organized in six regional organizations, based in Oslo, Skien, Bergen, Trondheim, Mo i Rana and Tromsø Tromsø is a List of towns and cities in Norway, city in Tromsø Municipality in Troms county, Norway. The city is the administrative centre of the municipality as well as the administrative centre of Troms county. The city is located on the is ..., in addition to local tax offices. References External links Official English site Government agencies of Norway Taxation in Norway Revenue services Civil registries Organisations based in Oslo {{Norway-gov-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Socioeconomics

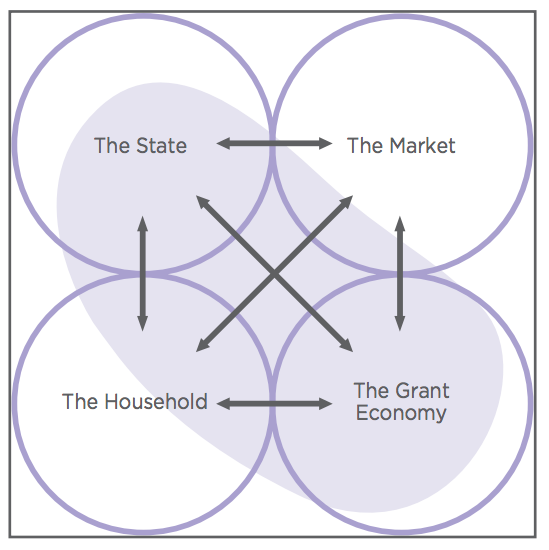

Economic sociology is the study of the social cause and effect of various economic phenomena. The field can be broadly divided into a classical period and a contemporary one, known as "new economic sociology". The classical period was concerned particularly with modernity and its constituent aspects, including rationalisation, secularisation, urbanisation, and social stratification. As sociology arose primarily as a reaction to capitalist modernity, economics played a role in much classic sociological inquiry. The specific term "economic sociology" was first coined by William Stanley Jevons in 1879, later to be used in the works of Émile Durkheim, Max Weber and Georg Simmel between 1890 and 1920. Weber's work regarding the relationship between economics and religion and the cultural " disenchantment" of the modern West is perhaps most representative of the approach set forth in the classic period of economic sociology. Contemporary economic sociology may include studies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |