|

Unrelated Business Taxable Income

Unrelated Business Income Tax (UBIT) in the U.S. Internal Revenue Code is the tax on unrelated business income, which comes from an activity engaged in by a tax-exempt 26 U.S.C. 501 organization that is not related to the tax-exempt purpose of that organization. Requirements For most organizations, a business activity generates unrelated business income subject to taxation if: #It is a trade or business, #It is regularly carried on, and #It is not substantially related to furthering the exempt purpose of the organization. A trade or business includes the selling of goods or services with the intention of having a profit. An activity is regularly carried on if it occurs with a frequency and continuity, similar to what a commercial entity would do if it performed the same activity. An activity is substantially related to furthering the exempt purpose of the organization if the activity contributes importantly to accomplishing the organization's purpose, other than for the sake of p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

501(c)

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code (26 U.S.C. § 501(c)). Such organizations are exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions. For example, a nonprofit organization may be tax-exempt under section 501(c)(3) if its primary activities are charitable, religious, educational, scientific, literary, testing for public safety, fostering amateur sports competition, or preventing cruelty to children or animals. Types According to the IRS Publication 557, in the ''Organization Reference Chart'' section, the following is an exact list of 501(c) organization types (29 in total) and their corresponding descriptions. G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. A tax exemption is distinct and different from a tax exclusion and a tax deduction, all of which are different types of tax expenditures. A tax exemption is an income stream on which no tax is levied, such as interest income from state and local bonds, which is often exempt from federal income tax. Additionally, certain qualifying non-profit organizations are exempt from federal income tax. A tax exclusion refers to a dollar amount (or proportion of taxable income) that can be legally excluded from the taxable base income prior to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S Corporation

An S corporation (or S Corp), for United States federal income tax, is a closely held corporation (or, in some cases, a limited liability company (LLC) or a partnership) that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. Overview S corporations are ordinary business corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The term "S corporation" means a "small business corporation" which has made an election under § 1362(a) to be taxed as an S corporation. The S corporation rules are contained in Subchapter S of Chapter 1 of the Internal Revenue Code (sections 1361 through 1379). The United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file Tax return (United States), tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return. Some corporate transactions are not taxable. These include most formations and some ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1928

The Revenue Act of 1928 (May 29, 1928, ch. 852, 45 Stat. 791), formerly codified in part at 26 U.S.C. sec. 22(a), is a statute introduced as H.R. 1 and enacted by the 70th United States Congress in 1928 regarding tax policy. Section 605 of the Act provides that "In case a regulation or Treasury decision relating to the internal revenue laws is amended by a subsequent regulation or Treasury decision, made by the Secretary or by the Commissioner with the approval of the Secretary, such subsequent regulation or Treasury decision may, with the approval of the Secretary, be applied without retroactive effect." (as cited in Helvering v. R.J. Reynolds Tobacco Co., ) Tax on Corporations A rate of 12 percent was levied on the net income of corporations. Tax on Individuals A normal tax and a surtax A surtax is a tax levied upon another tax, also known as tax surcharge. Canada The provincial portion of the value-added tax on goods and services in two Canadian jurisdictions, Quebe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cherry Bekaert LLP

Cherry Bekaert (formerly Cherry, Bekaert & Holland L.L.P.) is a professional services firm based in Raleigh, North Carolina. It provides assurance, consulting, financial advisory, and tax A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ... services. Employing over 1,350 people, Cherry Bekaert has offices in California, Maryland, Virginia, Washington, D.C., Florida, Georgia, North Carolina, Rhode Island, Texas, Tennessee, and South Carolina. History Cherry Bekaert began in 1947 as a small practice in Wilmington, North Carolina, led by Harry Cherry. Charles Bekaert and William Holland joined the Firm in 1952 and 1953 respectively. The firm moved into the Richmond, Virginia, area in 1988, eventually relocating the corporate headquarters to Richmond from Charlotte in 1991. In Febr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York University Law School

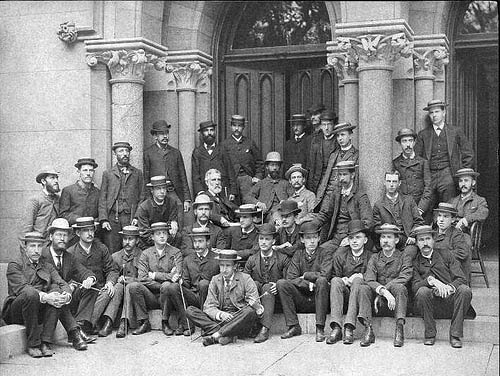

The New York University School of Law (NYU Law) is the law school of New York University, a private research university in New York City. Established in 1835, it was the first law school established in New York City and is the oldest surviving law school in New York State and one of the oldest law schools in the United States. Located in Greenwich Village in Lower Manhattan, NYU Law grants J.D., LL.M., and J.S.D. degrees. In , NYU Law's bar passage rate was 94.9%, the sixth-highest in the United States. History New York University School of Law was founded in 1835, making it the oldest law school in New York City. It is also the oldest surviving law school in New York State and one of the oldest in the United States. The only law school in the state to precede it was a small institution conducted by Peter van Schaack in Kinderhook, New York, from 1785 to his death in 1832. Founded just four years after the establishment of New York University, NYU Law is also the unive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yale Law School

Yale Law School (YLS) is the law school of Yale University, a Private university, private research university in New Haven, Connecticut. It was established in 1824. The 2020–21 acceptance rate was 4%, the lowest of any law school in the United States. Its Yield (college admissions), yield rate is often the highest of any law school in the United States. Each class in Yale Law's three-year J.D. program enrolls approximately 200 students. Yale's flagship law review is the ''Yale Law Journal'', one of the most highly cited legal publications in the United States. According to Yale Law School's American Bar Association, ABA-required disclosures, 83% of the Class of 2019 obtained full-time, long-term, JD-required or JD-advantage employment nine months after graduation, excluding solo practitioners. Yale Law alumni include many List of Yale Law School alumni, prominent figures in law and politics, including U.S. presidents Gerald Ford and Bill Clinton, U.S. vice president JD Vance, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1950

The United States Revenue Act of 1950 eliminated a portion of the individual income tax An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ... rate reductions from the 1945 and 1948 tax acts, and increased the top corporate rate from 38 percent to 45 percent. This act changed the law regarding tax exempt organizations. It introduced the concept of Unrelated Business Income Tax, denied exemption to certain foundations and trusts, and denied deductions to donors of some organization which failed to meet certain standards. References External links Full text of the Act United States federal taxation legislation 1950 in American law {{US-fed-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |