|

Tennessee Department Of Financial Institutions

The Tennessee Department of Financial Institutions (TDFI) is a Cabinet-level agency within Tennessee state government, currently led by Greg Gonzales, Commissioner of Financial Institutions. The department is responsible for regulating Tennessee's banking system, including state-chartered banks and credit unions, and handling consumer complaints involving state regulated financial institutions. The department is divided into the Administrative/Legal Division, Bank Division, Compliance Division, Consumer Resources Division, and the Credit Union Division - each of which is led by an Assistant Commissioner. The Banking Department, created in 1913, was headed by the Superintendent of Banks when it was first established, ten years later credit unions were added to its responsibilities. Over the next eighty-five years, the department made a final name change and increased regulatory responsibilities to cover trust companies, licensed business and industrial development corporations (BI ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

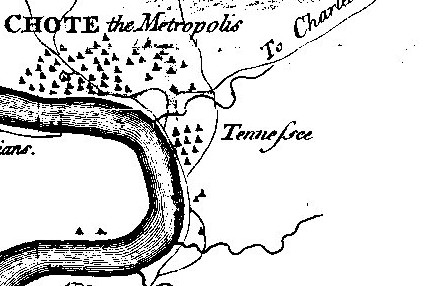

Tennessee

Tennessee ( , ), officially the State of Tennessee, is a landlocked state in the Southeastern region of the United States. Tennessee is the 36th-largest by area and the 15th-most populous of the 50 states. It is bordered by Kentucky to the north, Virginia to the northeast, North Carolina to the east, Georgia, Alabama, and Mississippi to the south, Arkansas to the southwest, and Missouri to the northwest. Tennessee is geographically, culturally, and legally divided into three Grand Divisions of East, Middle, and West Tennessee. Nashville is the state's capital and largest city, and anchors its largest metropolitan area. Other major cities include Memphis, Knoxville, Chattanooga, and Clarksville. Tennessee's population as of the 2020 United States census is approximately 6.9 million. Tennessee is rooted in the Watauga Association, a 1772 frontier pact generally regarded as the first constitutional government west of the Appalachian Mountains. Its name derives fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tennessee Commissioner Of Financial Institutions

The Tennessee Commissioner of Financial Institutions is the head of Tennessee's Department of Financial Institutions, which is responsible for regulating the bank system of that U.S. state. The Commissioner is appointed by the governor of Tennessee and is a member of the governor's Cabinet, which meets at least once per month, or more often to the governor's liking. Originally, a Banking Department had been created in 1913, led by a Superintendent of Banks, and then ten years later credit unions were added to the Department's responsibilities. The first Commissioner of Banking, after the position was renamed in 1973, was Hugh F. Sinclair during the administration of Governor Winfield Dunn. The second Commissioner of Banking, under Ray Blanton, was Joe Hemphill. The last person to hold the title of Commissioner of Banking was Thomas C. Mottern, under Lamar Alexander. The first person to hold the title of Commissioner of Financial Institutions, also under Lamar Alexander, was W. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative to credit unions and were two and a half ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institutions: # Depository institutions – deposit-taking institutions that accept and manage deposits and make loans, including banks, building societies, credit unions, trust companies, and mortgage loan companies; # Contractual institutions – insurance companies and pension funds # Investment institutions – investment banks, underwriters, and other different types of financial entities managing investments. Financial institutions can be distinguished broadly into two categories according to ownership structure: * Commercial banks * Cooperative banks Some experts see a trend toward homogenisation of financial institutions, meaning a tendency to invest in similar areas and have similar business strategies. A consequence of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Companies

A trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being a trustee of various kinds of trusts. The "trust" name refers to the ability to act as a trustee – someone who administers financial assets on behalf of another. The assets are typically held in the form of a trust, a legal instrument that spells out who the beneficiaries are and what the money can be spent for. A trustee will manage investments, keep records, manage assets, prepare court accounting, pay bills (depending on the nature of the trust), medical expenses, charitable gifts, inheritances or other distributions of income and principal. Estate administration A trust company can be named as an executor or personal representative in a last will and testament. The responsibilities of an executor in settling the estate of a deceased pers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property (" foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the '' drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Transmitter

In the legal code of the United States, a money transmitter or money transfer service is a business entity that provides money transfer services or payment instruments. Money transmitters in the US are part of a larger group of entities called money service businesses or MSBs. Under federal law, 18 USC § 1960, businesses are required to register for a money transmitter license where their activity falls within the state definition of a money transmitter. Regulation Forty-nine US states (sans Montana) regulate (i.e., require licensure for) money transmitters although the laws vary from one state to the other. Most of the states require a money transmitter surety bond with widely ranging amounts from as little as $25,000 to over $1 million and maintaining a minimum capital requirement. There is an association of state regulators, the Money Transfer Regulators Association (MTRA) that seeks to create uniformity and common practices and efficient and effective regulation of money tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tennessee Department Of Revenue

The Tennessee Department of Revenue (TDOR) is an agency within the Tennessee state government that is responsible for administering the state’s tax laws and motor vehicle title and registration laws. More than 800 people work for the Department of Revenue. The Department collects about 87 percent of total state revenue. During the 2018 fiscal year, it collected $14.5 billion in state taxes and fees and more than $2.8 billion in taxes and fees for local governments. The Department is led by Commissioner David Gerregano. See also *Tennessee Department of Financial Institutions *Tennessee General Assembly The Tennessee General Assembly (TNGA) is the state legislature of the U.S. state of Tennessee. It is a part-time bicameral legislature consisting of a Senate and a House of Representatives. The Speaker of the Senate carries the additional title ... References External linksDepartment of Revenue website [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Agencies Of Tennessee

State may refer to: Arts, entertainment, and media Literature * '' State Magazine'', a monthly magazine published by the U.S. Department of State * ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States * '' Our State'', a monthly magazine published in North Carolina and formerly called ''The State'' * The State (Larry Niven), a fictional future government in three novels by Larry Niven Music Groups and labels * States Records, an American record label * The State (band), Australian band previously known as the Cutters Albums * ''State'' (album), a 2013 album by Todd Rundgren * ''States'' (album), a 2013 album by the Paper Kites * ''States'', a 1991 album by Klinik * ''The State'' (album), a 1999 album by Nickelback Television * ''The State'' (American TV series), 1993 * ''The State'' (British TV series), 2017 Other * The State (comedy troupe), an American comedy troupe Law and politics * State (polity), a centralized political organ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)