|

Target Two Point Zero

Target Two Point Zero was an interest rate challenge for students in the UK set by the Bank of England and The Times. Students aged 16 to 18 were asked to analyse the economic outlook and recommend what interest rate should be set. The students made a 15-minute presentation and were judged by Bank of England staff, through three rounds with an ultimate winner being selected in a national final. The Bank of England announced that 2017 was the last year of the competition. The challenge Target Two Point Zero invited students aged 16 to 18 to take on the role of the Monetary Policy Committee to analyse current economic conditions in the UK and the outlook for inflation. Teams of four students created a formal presentation that was delivered to a panel of judges from the Bank of England. The presentations were concluded with a recommendation on exactly what interest rate the team would set in order to achieve the UK government's inflation target of 2.0% CPI. Following the initial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income". The borrower wants, or needs, to have money sooner, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * the term to m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Times

''The Times'' is a British Newspaper#Daily, daily Newspaper#National, national newspaper based in London. It began in 1785 under the title ''The Daily Universal Register'', adopting its modern name on 1 January 1788. ''The Times'' and its sister paper ''The Sunday Times'' (founded in 1821), are published by Times Media, since 1981 a subsidiary of News UK, in turn wholly owned by News Corp. ''The Times'' and ''The Sunday Times'' were founded independently and have had common ownership only since 1966. It is considered a newspaper of record in the UK. ''The Times'' was the first newspaper to bear that name, inspiring numerous other papers around the world. In countries where these other titles are popular, the newspaper is often referred to as or , although the newspaper is of national scope and distribution. ''The Times'' had an average daily circulation of 365,880 in March 2020; in the same period, ''The Sunday Times'' had an average weekly circulation of 647,622. The two ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student

A student is a person enrolled in a school or other educational institution, or more generally, a person who takes a special interest in a subject. In the United Kingdom and most The Commonwealth, commonwealth countries, a "student" attends a secondary school or higher (e.g., college or university); those in primary or elementary schools are "pupils". Africa Nigeria In Nigeria, Education in Nigeria, education is classified into four systems known as a 6-3-3-4 system of education. It implies six years in primary school, three years in junior secondary, three years in senior secondary and four years in the university. However, the number of years to be spent in university is mostly determined by the course of study. Some courses have longer study lengths than others. Those in primary school are often referred to as pupils. Those in university, as well as those in secondary school, are referred to as students. The Nigerian system of education also has other recognized categorie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy Committee (United Kingdom)

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom (the Bank of England Base Rate). It is also responsible for directing other aspects of the government's monetary policy framework, such as quantitative easing and forward guidance. The Committee comprises nine members, including the Governor of the Bank of England, and is responsible primarily for keeping the Consumer Price Index (CPI) measure of inflation close to a target set by the government, currently 2% per year (as of 2019). Its secondary aim – to support growth and employment – was reinforced in March 2013. Announced on 6 May 1997, only five days after that year's General Election, and officially given operational responsibility for setting interest rates in the Bank of England Act 1998, the committee was designed to be independent of political interference and thus to add ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption purposes by households. It is calculated as the weighted average price of a market basket of Goods, consumer goods and Service (economics), services. Changes in CPI track changes in prices over time. The items in the basket are updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected (often monthly) from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. While the CPI is not a perfect measure of inflation or the cost of living, it is a useful tool for tracking these economic indicators. It is one of several Price index, price indices calculated by many national statistical agencies. Overview A CPI is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

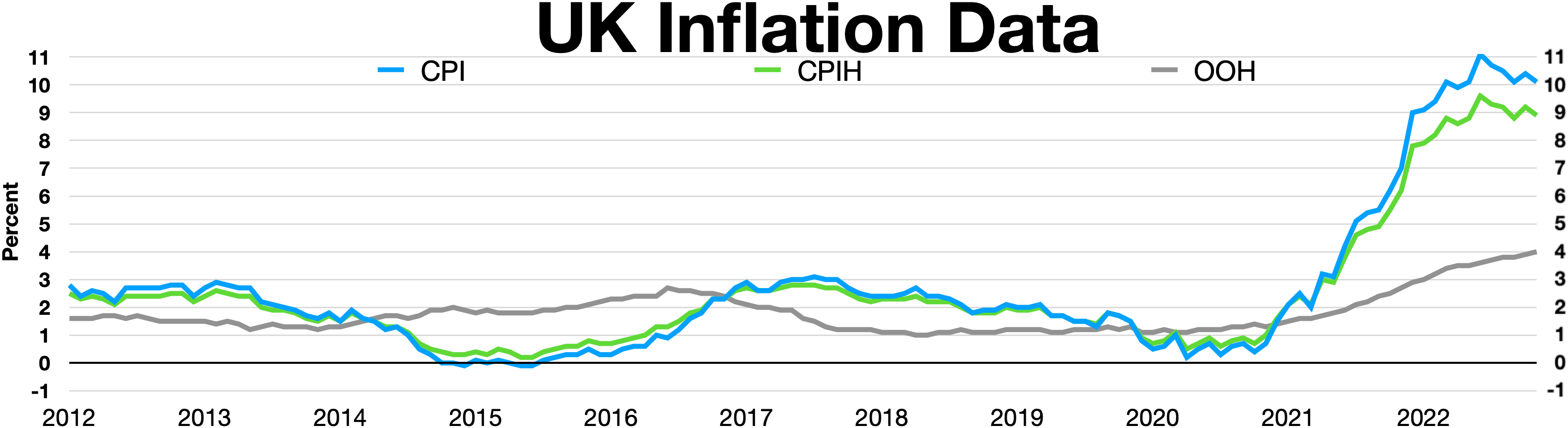

Inflation In The United Kingdom

The Consumer Price Index (CPI) is the official measure of inflation in consumer prices in the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962, this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |