|

Systematica Investments

Systematica Investments (Systematica) is a quantitative investment management firm. It is focused on a quantitative and systematic approach to investing. The firm is headquartered in Jersey with additional offices in Geneva, London, New York, Pasadena, Singapore and Shanghai. Background The origins of Systematica can be traced to BlueTrend, a computer-driven fund using a managed futures strategy that was part of BlueCrest Capital Management (BlueCrest). It was founded in 2004 by Brazilian-born Leda Braga. From 2004 to 2014, the fund averaged a return of over 11% a year and was one of BlueCrest's largest funds. In late 2014, there were plans to spin off BlueTrend into a separate new firm by the end of the year. It would be named Systematica Investments and would be led by Braga to manage the BlueTrend branded funds. This came at the time BlueCrest was having performance issues and investors were withdrawing money from it. The spinoff would allow BlueTrend to control risk and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Managed Futures Account

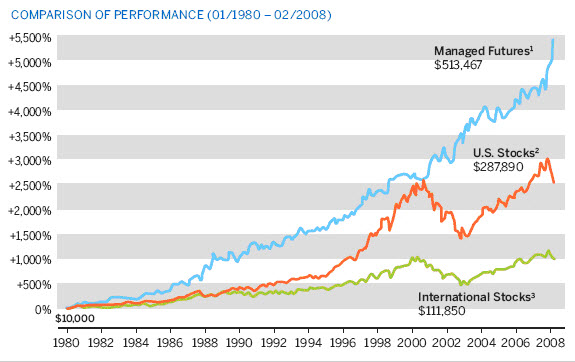

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the Futures exchange, futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or Commodity Pool Operator, commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. , the assets under management held by managed futures accounts totaled $340 billion. Characteristics Managed futures accounts are operated on behalf of an individual by professional money managers such as Commodity trading advisor, CTAs or Commodity Pool Operator, CPOs, trading in Futures contract, futures or other derivative securities. The funds can take both Long (finance), long and Short (finance), short positions in future ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Geneva

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is to generate sales, revenue, and profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duties according to the publicly declared incorporatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

China–United States Trade War

An economic conflict between China and the United States has been ongoing since January 2018, when U.S. president Donald Trump began Tariffs in the first Trump administration, imposing tariffs and other trade barriers on China with the aim of forcing it to make changes to what the U.S. has said are longstanding unfair trade practices and Allegations of intellectual property theft by China, intellectual property theft. The First presidency of Donald Trump, first Trump administration stated that these practices may contribute to the U.S.–China Balance of trade, trade deficit, and that the Government of China, Chinese government requires the transfer of American technology to China. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Data

In economic policy, alternative data refers to the inclusion of non-financial payment reporting data in credit files, such as telecom and energy utility payments. Types Alternative data in the broadest sense refers to any non-financial information that can be used to estimate the lending risk of an individual. Information includes: * Utility bills (such as electricity, gas, and heating oil) * Telecommunications bills (such as landlines and mobile telephones) * Rental payments * Electronic payments ( remittances, withdrawals, transfers, etc.) * Social media activity * Psychometric data * Telco data * Smartphone device metadata In North America United States In the United States, credit files include negative information, such as delinquencies as well as positive information, such as repayment of debts. Still, an estimated 35 to 54 million Americans have insufficient credit information to qualify for mainstream credit. If immigrants in the United States are included, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UCITS

The Undertakings for Collective Investment in Transferable Securities Directive (Directive 2009/65/EC, "UCITS") is a directive of the European Union (EU) that allows collective investment schemes to operate freely throughout the EU on the basis of a single authorisation from one member state. EU member states are entitled to have additional regulatory requirements for the benefit of investors. Evolution The objective of Directive 85/611/EEC, adopted in 1985, was to allow for open-ended funds investing in transferable securities to be subject to the same regulation in every member state. It was hoped that once such legislative uniformity was established throughout Europe, funds authorised in one member state could be sold to the public in each member state without further authorisation, thereby furthering the EU's goal of a single market for financial services in Europe. The reality differed somewhat from the expectation due primarily to individual marketing rules in each membe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Mutual

Old Mutual (officially Old Mutual Limited) is a South African investment, savings, insurance, and banking group, operating across Africa. It is listed on the Johannesburg Stock Exchange, the Zimbabwe Stock Exchange, the Namibian Stock Exchange and the Botswana Stock Exchange. Old Mutual was founded in South Africa by John Fairbairn in 1845 and was demutualised and listed on the London Stock Exchange and other stock exchanges in 1999. It introduced a new strategy, called 'managed separation', that entailed the separation of its four businesses – Old Mutual Emerging Markets, Nedbank, UK-based Old Mutual Wealth and Boston-based Old Mutual Asset Management (OMAM) – into standalone entities in 2018. This led to the demerger of Quilter plc (formerly 'Old Mutual Wealth') and the unbundling of its shareholding in Nedbank. The business, which is now largely based in South Africa, provides sponsorship and supports bursaries at South African universities. History The compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assured Investment Management

Assured Investment Management (AIM) was an institutional asset management firm with a heritage in credit strategies, managing approximately $15.2 billion as of its defunct status in July 2023. ''Secondaries Investors'' referred to AIM as "one of the world's most prominent hedge funds". Previously known as BlueMountain Capital Management (BlueMountain), the firm was acquired by Assured Guaranty (AG) — a publicly traded financial services holding company headquartered in Bermuda — starting in 2019. In 2023, the firm was acquired by Sound Point Capital Management (Sound Point), a privately held asset management company headquartered in United States. History The company was formed in 2003 by two Harvard Law School classmates, Andrew Feldstein and Stephen Siderow. That same year, the firm launched its flagship relative value credit hedge fund with $300 million in assets under management. The company burnished its reputation in part by making "substantial profits" in 2012 in co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

5 Hertford Street

5 Hertford Street (5HS) is a private members' club in Mayfair, London, which was described in a 2017 Observer article as London's most secretive club. It has annual membership costs of £3,500 and is owned by the English businessman Robin Birley. Its interior design is by the Turkish-born fashion designer Rifat Ozbek. The club is known to have been frequented by figures including Harry Styles, Margot Robbie, Mick Jagger, Lupita Nyong'o, George and Amal Clooney, Leonardo DiCaprio, the Prince of Wales and Princess Eugenie. It is where Meghan Markle had drinks the night before she met Prince Harry. Celia Walden wrote that 5 Hertford Street was the location of the first date of Markle and Prince Harry. Later it was said in ''Finding Freedom'', a biography that includes contributions from Markle, that the first date of the couple was at Soho House on Dean Street. Birley, who has been described as "a committed Leaver", "ushered into membership" a number of politicians; political fig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Platt (financier)

Michael Edward Platt (born 18 March 1968) is a British billionaire hedge fund manager. He is the co-founder and managing director of BlueCrest Capital Management, Europe's third-largest hedge-fund firm which he co-founded in 2000. He is Britain's wealthiest hedge fund manager according to ''Forbes'', with an estimated wealth of US$18 billion as of December 2024. Early life Platt was born in Preston, Lancashire, England in 1968. His father taught civil engineering at the University of Manchester. His mother was a university administrator. His grandmother, whom he has described as "a serious equity trader," introduced him to investment. She "helped him buy stock in trust savings banks that were selling shares to the public." At 14, he invested £500 in a shipping line, Common Brothers, that soon tripled in price. Some of his first investments were in Britain's newly privatised utilities. He studied civil engineering at Imperial College London, but after a year, switched to mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sean Healey

Sean Michael Healey (May 9, 1961 – May 26, 2020) was an American businessman who was chairman and chief executive officer of Affiliated Managers Group, Inc. (NYSE: AMG), a global asset management firm whose affiliates in aggregate managed approximately $736 billion as of December 31, 2018. Early life and education Healey was born in San Rafael, California. Healey attended high school in Oceanside, California, followed by Harvard College, where he was a member of the varsity wrestling squad. In 1983, he received an A.B. in history and literature, magna cum laude, and was elected to Phi Beta Kappa. After graduating from Harvard, Healey was awarded a Rotary Scholarship to study philosophy at University College in Dublin, Ireland, and was awarded a master's degree in philosophy with first-class honors in 1984. In 1987, he earned a J.D. from Harvard Law School, and he was an editor of the Harvard Law Review. Early career Upon graduation from law school, Healey joined Goldman ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets Under Management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institution—or a decentralized network protocol manages and invests, typically on behalf of its clients. Funds may be managed for clients, platform users, or solely for themselves, such as in the case of a financial institution which has mutual funds or holds its own venture capital. The definition and formula for calculating AUM may differ from one entity to another. Overview Assets under management is a popular metric used within the traditional investment industry as well as for , such as cryptocurrency, to measure the size and success of an investment management entity. AUM represents the market value of all of the securities that a financial entity owns and manages, or simply manages. The AUM of an entity is often compared with historical d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |