|

Stock Market Downturn Of 2002

In 2001, stock prices took a sharp downturn (some say "stock market crash" or " the Internet bubble bursting") in stock markets across the United States, Canada, Asia, and Europe. After recovering from lows reached following the September 11 attacks, indices slid steadily starting in March 2002, with dramatic declines in July and September leading to lows last reached in 1997 and 1998. The U.S. dollar increased in value relative to the euro, reaching a 1-to-1 valuation not seen since the euro's introduction. Background This downturn can be viewed as part of a larger bear market or correction that began in 2000 after a decade-long bull market had led to unusually high stock valuations, according to a report by the Cleveland Federal Reserve. The collapse of Enron is a prime example. Many internet companies ( Webvan, Exodus Communications, and Pets.com) went bankrupt. Others (Amazon.com, eBay, and Yahoo!) went down dramatically in value, but remain in business to this day and hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants. Other aspects such as wars, large corporate hacks, changes in federal laws and regulations, and natural disasters within economically productive areas may also influence a significant decline i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankrupt

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, meaning the term ''bankruptcy'' is not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian , literally meaning . The term is often described as having originated in Renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment. However, the existence of such a ritual is doubted. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into " debt slavery" until the creditor recouped losses through their physical labour. Many city-states in ancient Greece limited debt slavery to a perio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indices. It is Price-weighted index, price-weighted, unlike other common indexes such as the Nasdaq Composite or S&P 500, which use Capitalization-weighted index, market capitalization. The DJIA also contains fewer stocks, which could exhibit higher risk; however, it could be less volatile when the market is rapidly rising or falling due to its components being well-established large-cap companies. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor, which is approximately 0.163 . The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

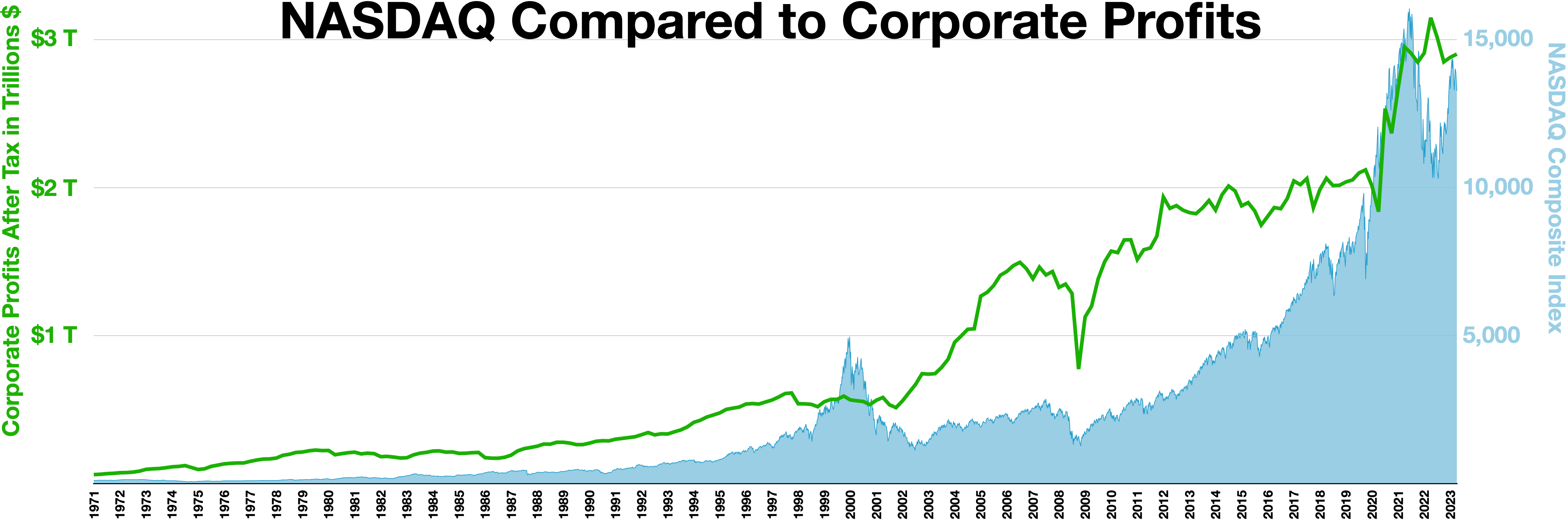

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Stability

Economic stability is the absence of excessive fluctuations in the macroeconomy. An economy with fairly constant output growth and low and stable inflation would be considered economically stable. An economy with frequent large recessions, a pronounced business cycle, very high or variable inflation, or frequent financial crises would be considered economically unstable. Measures Real macroeconomic output can be decomposed into a trend and a cyclical part, where the variance of the cyclical series derived from the filtering technique (e.g., the band-pass filter, or the most commonly used Hodrick–Prescott filter) serves as the primary measure of departure from economic stability. A simple method of decomposition involves regressing real output on the variable "time", or on a polynomial in the time variable, and labeling the predicted levels of output as the trend and the residuals as the cyclical portion. Another approach is to model real output as difference stationary wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate economic stability, stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and poverty reduction, reduce poverty around the world." Established in July 1944 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary systems, international monetary system after World War II. In its early years, the IMF primarily focused on facilitating fixed exchange rates across the developed worl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of The United States

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth highest GDP per capita by PPP. The U.S. accounts for 27% of the global economy in 2025 in nominal terms, and about 16% in PPP terms. The U.S. dollar is the currency of record most used in international transactions and is the world's reserve currency, backed by a large U.S. treasuries market, its role as the reference standard for the petrodollar system, and its linked eurodollar. Several countries use it as their official currency and in others it is the ''de facto'' currency.Benjamin J. Cohen, ''The Future of Money'', Princeton University Press, 2006, ; ''cf.'' "the dollar is the de facto currency in Cambodia", Charles Agar, '' Frommer's Vietnam'', 2006, , p. 17 Since the end of World War II, the economy has achieved relatively ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Terrorism

Terrorism, in its broadest sense, is the use of violence against non-combatants to achieve political or ideological aims. The term is used in this regard primarily to refer to intentional violence during peacetime or in the context of war against non-combatants. There are various different definitions of terrorism, with no universal agreement about it. Different definitions of terrorism emphasize its randomness, its aim to instill fear, and its broader impact beyond its immediate victims. Modern terrorism, evolving from earlier iterations, employs various tactics to pursue political goals, often leveraging fear as a strategic tool to influence decision makers. By targeting densely populated public areas such as transportation hubs, airports, shopping centers, tourist attractions, and nightlife venues, terrorists aim to instill widespread insecurity, prompting Public policy, policy changes through Manipulation (psychology), psychological manipulation and undermining confidence ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WorldCom

MCI, Inc. (formerly WorldCom and MCI WorldCom) was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunications companies, including MCI Communications in 1998, and filed for bankruptcy in 2002 after an accounting scandal, in which several executives, including CEO Bernard Ebbers, were convicted of a scheme to inflate the company's assets. In January 2006, the company, by then renamed MCI, was acquired by Verizon Communications and was later integrated into Verizon Business. WorldCom was originally headquartered in Clinton, Mississippi, before moving to Ashburn, Virginia, when it changed its name to MCI. History Foundation In 1983, in a coffee shop in Hattiesburg, Mississippi, Bernard Ebbers and three other investors formed Long Distance Discount Services, Inc. based in Jackson, Mississippi, and in 1985, Ebbers was named chief executi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adelphia Communications Corporation

Adelphia Communications Corporation was an American cable television company with headquarters in Coudersport, Pennsylvania. It was founded in 1952 by brothers Gus and John Rigas after the pair purchased a cable television franchise for US$300. Combining various cable properties, the company became one of the most successful in the United States and reached over two million subscribers in 1998. In addition to cable television, Adelphia later started providing high-speed internet, phone services and voice messaging for businesses. Despite its success, in 2002 the company filed for bankruptcy amid an internal corruption scandal. An investigation was launched and later revealed that some members of the Rigas family used $2.3 billion to illegitimately purchase personal luxuries. A trial for the case was launched and saw John Rigas being sentenced to 15 years in prison, while his son Timothy Rigas received a sentence of 20 years. John Rigas was released in 2016 as a result of health ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arthur Andersen

Arthur Andersen LLP was an American accounting firm based in Chicago that provided auditing, tax advising, consulting and other professional services to large corporations. By 2001, it had become one of the world's largest multinational corporations and was one of the "Big Five" accounting firms (along with Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers). The firm collapsed by mid-2002, as details of its questionable accounting practices for energy company Enron and telecommunications company WorldCom were revealed amid the two high-profile bankruptcies. The scandals were a factor in the enactment of the Sarbanes–Oxley Act of 2002. History Founding Born on May 30, 1885, in Plano, Illinois, and orphaned at the age of 16, Arthur E. Andersen began working as a mail boy by day and attended school at night, eventually being hired as the assistant to the comptroller of Allis-Chalmers in Chicago. In 1908, after attending courses at night while working f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Scandals

Accounting scandals are business scandals that arise from intentional manipulation of financial statements with the disclosure of financial misdeeds by trusted executives of corporations or governments. Such misdeeds typically involve complex methods for misusing or misdirecting funds, overstating revenues, understating expenses, overstating the value of corporate assets, or underreporting the existence of liabilities; these can be detected either manually, or by means of deep learning. It involves an employee, account, or corporation itself and is misleading to investors and shareholders. This type of "creative accounting" can amount to fraud, and investigations are typically launched by government oversight agencies, such as the Securities and Exchange Commission (SEC) in the United States. Employees who commit accounting fraud at the request of their employers are subject to personal criminal prosecution. Two types of fraud Misappropriation of assets Misappropriat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |