|

Steering Tax

{{Taxation A steering tax or ecological incentive tax is a tax which aims to change the behaviour of the tax payer, as defined by lawmakers, and not particularly to increase tax revenue. The term is not sharply definable because many tax related laws influence buyer behaviour which is not always a wanted effect (Price elasticity of demand, compensation reaction). The Pigovian tax is a special case of a steering tax to avoid Negative externalities, negative Externality. An ecological tax reform is often understood to refer to the introduction of a steering tax on energy use, according to the Polluter pays principle.René L. Frey, (2007)"Grundzüge eines ressourcenoptimalen Steuersystems für die Schweiz - Lenkungsabgaben"Umwelt-Wissen Nr. 0710. Federal Department of Environment, Transport, Energy and Communications – Bundesamt für Umwelt (Nummer UW-0710-D), Bern. (35 pages, German text, abstracts in English, French and Italien). In other languages incentive taxes (or fees) are kn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

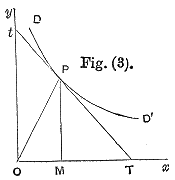

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatile Organic Compound

Volatile organic compounds (VOCs) are organic compounds that have a high vapor pressure at room temperature. They are common and exist in a variety of settings and products, not limited to Indoor mold, house mold, Upholstery, upholstered furniture, Handicraft, arts and crafts supplies, Dry cleaning, dry cleaned clothing, and Cleaning agent, cleaning supplies. VOCs are responsible for the odor of scents and perfumes as well as pollutants. They play an important role in communication between animals and plants, such as attractants for pollinators, protection from predation, and even inter-plant interactions. Some VOCs are dangerous to human health or cause harm to the natural environment, environment, often despite the odor being perceived as pleasant, such as "new car smell". Human impact on the environment, Anthropogenic VOCs are regulated by law, especially indoors, where concentrations are the highest. Most VOCs are not acutely toxic, but may have long-term chronic health effect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Tax

A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden Social cost of carbon, social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels. This both decreases demand for goods and services that produce high emissions and incentivizes making them less emission intensity, carbon-intensive. When a fossil fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to . Greenhouse gas emissions cause climate change. This negative externality can be reduced by taxing carbon content at any point in the product cycle. A carbon tax as well as carbon emission trading is used within the carbon price concept. Two common economic alternatives to carbon taxes are tradable permits with Carbon offsets and credits, carbon credits and Subsidy, subsidies. In its simplest form, a carbon tax covers only ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Fee And Dividend

A carbon fee and dividend or climate income is a system to reduce carbon emissions, greenhouse gas emissions and address climate change. The system imposes a carbon tax on the sale of fossil fuels, and then distributes the revenue of this tax over the entire population (equally, on a per-person basis) as a monthly income or regular payment. Since the adoption of the system in Canada and Switzerland, it has gained increased interest worldwide as a cross-sector and socially just approach to reducing emissions and tackling climate change. Designed to maintain or improve economic vitality while speeding the transition to a sustainable energy economy, carbon fee and dividend has been proposed as an alternative to emission reduction mechanisms such as command and control regulation, complex regulatory approaches, Emissions trading, cap and trade or a straightforward carbon tax. While there is general agreement among scientists and economists on the need for a carbon tax, economists ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market-based Environmental Policy Instruments

In environmental law and Environmental policy, policy, market-based instruments (MBIs) are policy instruments that use Market (economics), markets, price, and other Economy, economic variables to provide Economic incentive, incentives for polluters to reduce or eliminate negative environmental Externality, externalities. MBIs seek to address the market failure of externalities (such as pollution) by incorporating the external cost of production or consumption activities through taxes or charges on processes or products, or by creating property rights and facilitating the establishment of a proxy market for the use of environmental services. Market-based instruments are also referred to as economic instruments, price-based instruments, new environmental policy instruments (NEPIs) or new instruments of environmental policy. Examples include environmentally related taxes, charges and Subsidy, subsidies, emissions trading and other tradeable permit systems, deposit-refund systems, envi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Neutrality

In economics, the excess burden of taxation is one of the economic losses that society suffers as the result of taxes or subsidies. Economic theory posits that distortions change the amount and type of economic behavior from that which would occur in a free market without the tax. Excess burdens can be measured using the average cost of funds or the marginal cost of funds (MCF). Excess burdens were first discussed by Adam Smith Adam Smith (baptised 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics"——— or .... An equivalent kind of inefficiency can also be caused by subsidies (which technically can be viewed as taxes with negative rates). Economic losses due to taxes have been evaluated to be as low as 2.5 cents per dollar of revenue, and as high as 30 cents per dollar of revenue (on average), and even much h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Environment Agency

The European Environment Agency (EEA) is the agency of the European Union (EU) which provides independent information on the environment. Definition The European Environment Agency (EEA) is the agency of the European Union (EU) which provides independent information on the environment. Its goal is to help those involved in developing, implementing and evaluating environmental policy, and to inform the general public. Organization The EEA was established by the European Economic Community (EEC) Regulation 1210/1990 (amended by EEC Regulation 933/1999 and EC Regulation 401/2009) and became operational in 1994, headquartered in Copenhagen, Denmark. The agency is governed by a management board composed of representatives of the governments of its 32 member states, a European Commission representative and two scientists appointed by the European Parliament, assisted by its Scientific Committee. The current Executive Director of the agency is Leena Ylä-Mononen, who has been appo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ecological Footprint

The ecological footprint measures human demand on natural capital, i.e. the quantity of nature it takes to support people and their economies. It tracks human demand on nature through an ecological accounting system. The accounts contrast the biologically productive area people use to satisfy their consumption to the biologically productive area available within a region, nation, or the world (biocapacity). Biocapacity is the productive area that can regenerate what people demand from nature. Therefore, the metric is a measure of human impact on the environment. As Ecological Footprint accounts measure to what extent human activities operate within the means of our planet, they are a central metric for sustainability. The metric is promoted by the Global Footprint Network which has developed standards to make results comparable. FoDaFo, supported by Global Footprint Network and York University are now providing the national assessments of Footprints and biocapacity. Footprint and b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rio+20

Rio or Río is the Portuguese and Spanish word for "river". The word also exists in Italian, but is largely obsolete and used in a poetical or literary context to mean "stream". Rio, RIO or Río may also refer to: Places United States * Rio, Florida, a census-designated place * Rio, Georgia, an unincorporated community * Rio, Illinois, a village * Rio, a location in Deerpark, New York * Rio, Virginia, a community * Rio, West Virginia, a village * Rio, Wisconsin, a village * El Río, Las Piedras, Puerto Rico, a barrio Elsewhere * Rio de Janeiro, Brazil, often referred to as simply Rio * Rio, Italy, a municipality on the island of Elba in Tuscany * Rio, Greece, a community in suburban Patras People * Rio (given name) * Rio (surname) * Tina Yuzuki (born 1986), also known as Rio, Japanese AV idol Arts and entertainment Films * ''Rio'' (1939 film), starring Basil Rathbone * ''Rio'' (franchise), a film series and related media * ''Rio'' (2011 film), an animated film from 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pigovian Tax

A Pigouvian tax (also spelled Pigovian tax) is a tax on any market activity that generates negative externalities (i.e., external costs incurred by third parties that are not included in the market price). It is a method that tries to internalize negative externalities to achieve the Nash equilibrium and optimal Pareto efficiency. The tax is normally set by the government to correct an undesirable or inefficient market outcome (a market failure) and does so by being set equal to the external marginal cost of the negative externalities. In the presence of negative externalities, social cost includes private cost and external cost caused by negative externalities. This means the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs assoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |