|

Market-based Environmental Policy Instruments

In environmental law and Environmental policy, policy, market-based instruments (MBIs) are policy instruments that use Market (economics), markets, price, and other Economy, economic variables to provide Economic incentive, incentives for polluters to reduce or eliminate negative environmental Externality, externalities. MBIs seek to address the market failure of externalities (such as pollution) by incorporating the external cost of production or consumption activities through taxes or charges on processes or products, or by creating property rights and facilitating the establishment of a proxy market for the use of environmental services. Market-based instruments are also referred to as economic instruments, price-based instruments, new environmental policy instruments (NEPIs) or new instruments of environmental policy. Examples include environmentally related taxes, charges and Subsidy, subsidies, emissions trading and other tradeable permit systems, deposit-refund systems, envi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Law

Environmental laws are laws that protect the environment. The term "environmental law" encompasses treaties, statutes, regulations, conventions, and policies designed to protect the natural environment and manage the impact of human activities on ecosystems and natural resources, such as forests, minerals, or fisheries. It addresses issues such as pollution control, resource conservation, biodiversity protection, climate change mitigation, and sustainable development. As part of both national and international legal frameworks, environmental law seeks to balance environmental preservation with economic and social needs, often through regulatory mechanisms, enforcement measures, and incentives for compliance. The field emerged prominently in the mid-20th century as industrialization and environmental degradation spurred global awareness, culminating in landmark agreements like the 1972 Stockholm Conference and the 1992 Rio Declaration. Key principles include the precaut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental Pricing Reform

Environmental pricing reform (EPR) or Ecological fiscal reform (EFR) is a fiscal policy of adjusting market prices to account for environmental costs and benefits; this is accomplished by the utilization of any forms of taxation or subsidy to incentivize or disincentivize practices with environmental impacts. An externality (a type of market failure) exists where a market price omits environmental costs and/or benefits. In such a situation, rational (self-interested) economic decisions can lead to environmental harm, as well as to economic distortions and inefficiencies. Environmental pricing reform can be economy-wide, or more focused (e.g. specific to a sector (such as electric power generation or mining) or a particular environmental issue (such as climate change). A " market-based instrument" or "economic instrument for environmental protection" is an individual instance of Environmental Pricing Reform. Examples include green tax-shifting ( ecotaxation), tradeable pollution pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thin Market

Thin may refer to: * ''Thin'' (film), a 2006 documentary about eating disorders * Thin, a web server based on Mongrel * Thin (name), including a list of people with the name * Mal language, also known as Thin See also * * * Body shape * Emaciation * Underweight * Paper Thin (other) * Thin capitalisation * Thin client, a computer in a client-server architecture network. * Thin film, a material layer of about 1 μm thickness. * Thin-layer chromatography (TLC), a chromatography technique used in chemistry to separate chemical compounds * Thin layers (oceanography), congregations of phytoplankton and zooplankton in the water column * Thin lens, lens with a thickness that is negligible compared to the focal length of the lens in optics * Thin Lizzy, Irish rock band formed in Dublin in 1969 * Thin Man (other) * The Thin Blue Line (other) The thin blue line is a colloquial term for police forces. __NOTOC__ The Thin Blue Line or Thin Blue Line may als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Induced Innovation

Induced innovation is a microeconomic hypothesis first proposed in 1932 by John Hicks in his work '' The Theory of Wages''. He proposed that "a change in the relative prices of the factors of production is itself a spur to invention, and to invention of a particular kind—directed to economizing the use of a factor which has become relatively expensive." Considerable literature has been produced on this hypothesis, which is often presented in terms of the effects of wage increases as an encouragement to labor-saving innovation. The hypothesis has also been applied to viewing increases in energy costs as a motivation for a more rapid improvement in energy efficiency of goods than would normally occur. Induced innovation in climate change A significant application of Hicks's theory can be found in the field of climate change. The exponential population growth occurred in the last century has drastically increased pressure on natural resources. In order to have a sustainable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Command And Control Regulation

Command and Control (CAC) regulation finds common usage in academic literature and beyond. The relationship between CAC and environmental policy is considered in this article, an area that demonstrates the application of this type of regulation. However, CAC is not limited to the environmental sector and encompasses a variety of different fields. Definition Command and Control (CAC) Regulation can be defined as “the direct regulation of an industry or activity by legislation that states what is permitted and what is illegal”.McManus, P. (2009) Environmental Regulation. Australia: Elsevier Ltd. This approach differs from other regulatory techniques, e.g. the use of economic incentives, which frequently includes the use of taxes and subsidies as incentives for compliance.Baldwin, R., Cave, M., Lodge, M. (2011) Understanding Regulation: Theory, Strategy and Practice. 2nd ed. Oxford: Oxford University Press The ‘command’ is the presentation of quality standards/targets by a gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Recycling

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of a business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, revenue is a subsection of the equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of income by the sale ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Compliance Costs

Compliance costs are all expenses that a company uses up to adhere to government regulations. Compliance costs incorporate salaries of employees in compliance, time and funds spend on announcing, new system necessitated to meet retention, and so on. Compliance costs happen to be as results of local, national or even international regulation (for instance MiFID II or GDPR applying to countries in European Union). Global firms operating all over the world with varying new regulations in each country tend to face significantly larger compliance costs than those functionating solely in one region. Example – people registered for value added tax (shortly VAT) have to keep records of all tax (input and output) to simplify the completion of returns. They need to employ someone skilled in this domain, which is regarded as compliance cost. Compliance cost mostly includes following: *The cost to assemble and issue reports *Cost of creating and maintenance of the system needed to collect fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be influenced by many factors such as income level, type of income, and so on. There are several methods used to present a tax rate: statutory, average, marginal, flat, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. Averag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

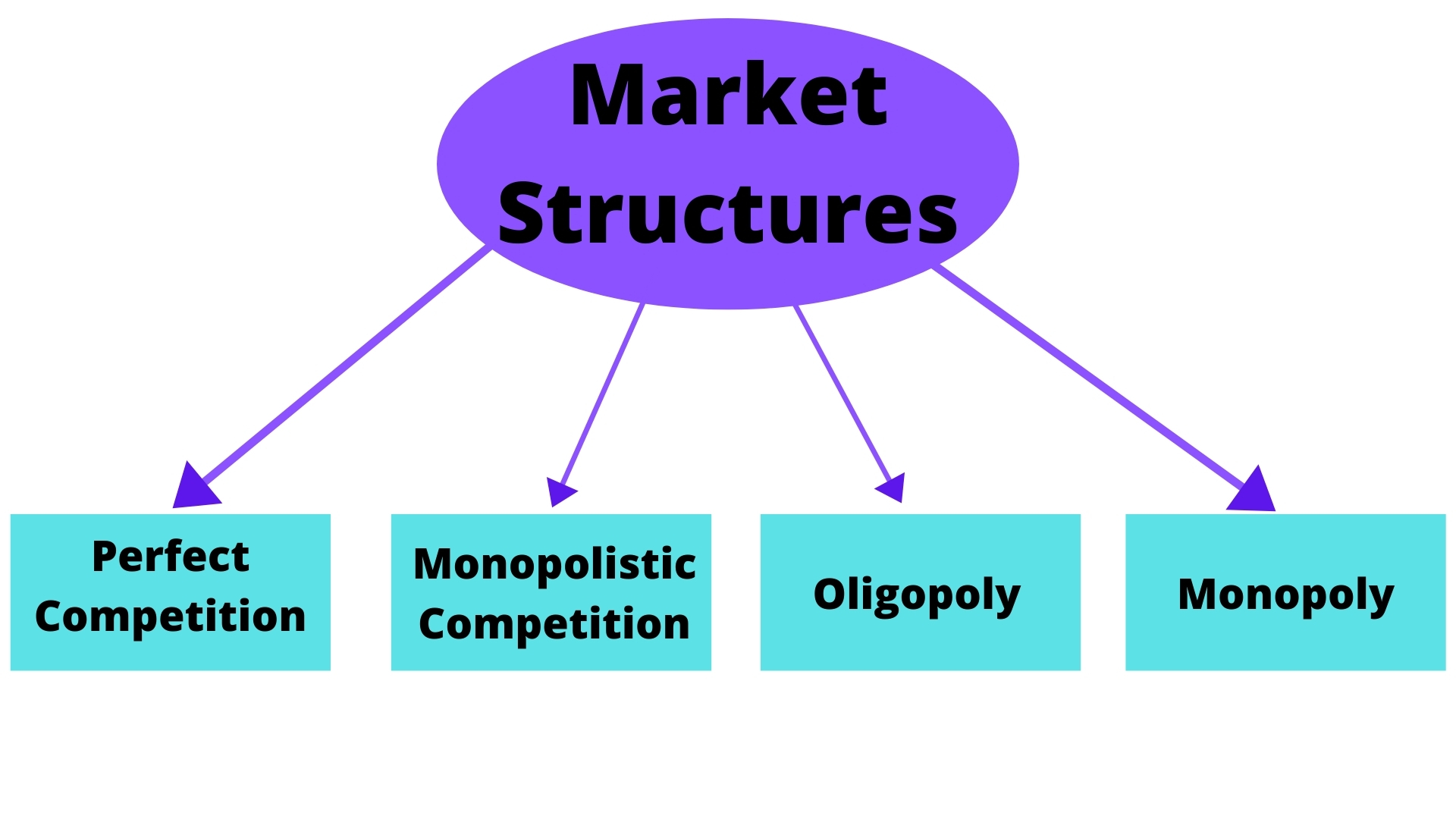

Market Power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue. This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. The size of the gap, which encapsulates the firm's level of market dominance, is determined by the residual demand curve's form. A steeper reverse demand indicates higher earnings and more dominance in the market. Such propensities contradict Perfect competition, perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the ..., the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Funding liquidity, the availability of credit to finance the purchase of financial asset * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also * Liquid (other) * Liquidation (other) {{SIA ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |