|

Split-adjusted

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much. A stock split causes a decrease of market price of individual shares, but does not change the total market capitalization of the company: stock dilution does not occur. A company may split its stock when the market price per share is so high that it becomes unwieldy when traded. One of the reasons is that a very high share price may deter small investors from buying the shares. Stock splits are usually initiated after a large run up in share price. Effects The main effect of stock splits is an increase in the liquidity of a stock: there are more buyers and sellers for 10 shares at $10 than 1 share at $100. Some companies avoid a stock split to obtain the opposite strategy: by refusing to split the stock and keeping the price high, they reduce trading volume. Berkshire Hathaw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

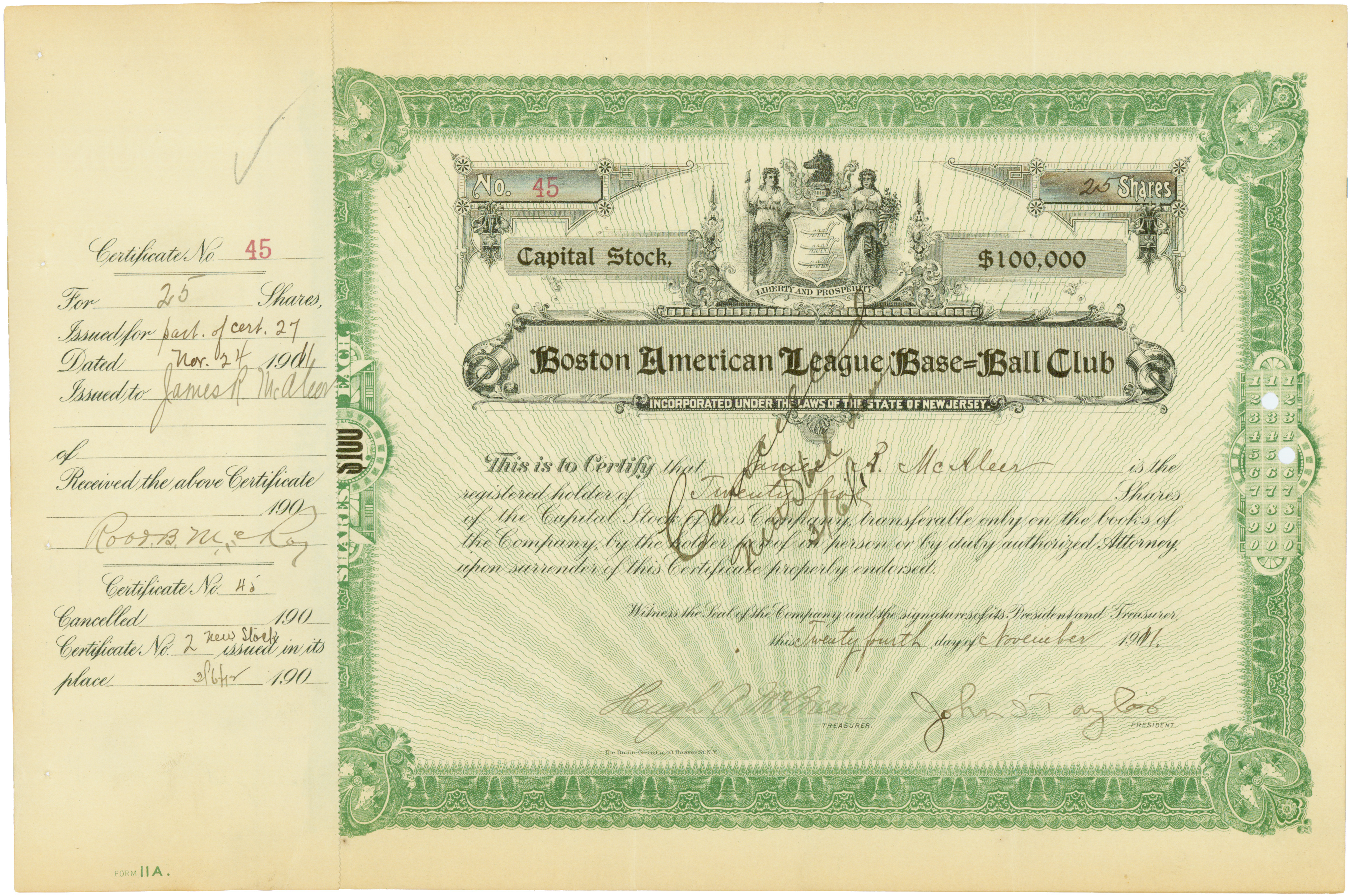

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Redenomination

In monetary economics, redenomination is the process of changing the face value of banknotes and coins in circulation. It may be done because inflation has made the currency unit so small that only large denominations of the currency are in circulation. In such cases the name of the currency may change or the original name may be used with a temporary qualifier such as "new". Redenomination may be done for other reasons such as changing over to a new currency such as the Euro or during decimalisation. Redenomination itself is considered symbolic as it does not have any impact on a country's exchange rate in relation to other currencies. It may, however, have a psychological impact on the population by suggesting that a period of hyperinflation is over, and is not a reminder of how much inflation has impacted them. The reduction in the number of zeros also improves the image of the country abroad. Inflation over time is the main cause for the purchasing power of the monetary un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded stocks worldwide rose from US$2.5 trillion in 1980 to US$111 trillion by the end of 2023. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

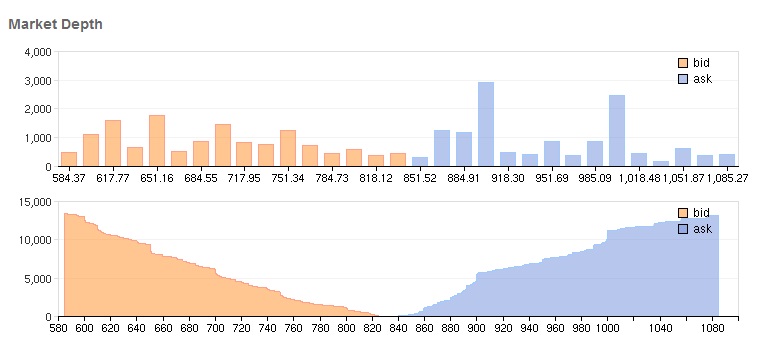

Market Depth

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the Financial markets, market price by a given amount. If the market is ''deep'', a large order is needed to change the price. Factors influencing market depth *Tick size. This refers to the minimum price increment at which trades may be made on the market. The major stock markets in the United States went through a process of decimalisation in April 2001. This switched the minimum increment from a sixteenth to a one hundredth of a dollar. This decision improved market depth.Market Depth Investopedia *Price movement restrictions. Most major financial markets do not allow completely free exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share Repurchase

Share repurchase, also known as share buyback or stock buyback, is the reacquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders. Repurchases allow stockholders to legally delay taxes which they would have been required to pay on dividends in the year the dividends are paid, to instead pay taxes on the capital gains they receive when they sell the stock, whose price is now proportionally higher because of the smaller number of shares outstanding. In most countries, a corporation can repurchase its own stock by distributing cash to existing shareholders in exchange for a fraction of the company's outstanding equity; that is, cash is exchanged for a reduction in the number of shares outstanding. The company either retires the repurchased shares or keeps them as treasury stock, available for reissuance. Under U.S. corporate law, there are six primary methods of stock repurchase: o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Stock Split

In finance, a reverse stock split or reverse split is a process by which shares of corporate stock are effectively merged to form a smaller number of proportionally more valuable shares. The "reverse stock split" appellation is a reference to the more common stock split in which shares are effectively divided to form a larger number of proportionally less valuable shares. New shares are typically issued in a simple ratio, e.g. 1 new share for 2 old shares, 3 for 4, etc. A reverse split is the opposite of a stock split. Typically, the exchange temporarily adds a "D" to the end of a ticker symbol during a reverse stock split. Sometimes a company may concurrently change its name. This is known as a name change and consolidation (i.e. using a different ticker symbol for the new shares). There is a stigma attached to doing a reverse stock split, as it underscores the fact that shares have declined in value, so it is not common and may take a shareholder or board meeting for consen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Dollar

The Australian dollar (currency sign, sign: $; ISO 4217, code: AUD; also abbreviated A$ or sometimes AU$ to distinguish it from other dollar, dollar-denominated currencies; and also referred to as the dollar or Aussie dollar) is the official currency and Legal tender#Australia, legal tender of Australia, including States and territories of Australia, all of its external territories, and three independent sovereign Pacific Islands, Pacific Island states: Kiribati, Nauru, and Tuvalu. * ThMoney Trackersite allows users to track Australian banknotes as they circulate around Australia. Images of historic and modern Australian bank notes* [https://www.rba.gov.au/statistics/historical-data.html?v=2022-09-25-02-11-35#exchange-rates Reserve Bank of Australia – historical data of AUD since 1969 (various .xls files)] The banknotes of Australia {{Authority control 1966 establishments in Australia Articles containing video clips Circulating currencies Currencies int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Company

A company, abbreviated as co., is a Legal personality, legal entity representing an association of legal people, whether Natural person, natural, Juridical person, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the State (polity), state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * List of legal entity types by country, business entities, whose aim is to generate sales, revenue, and For-profit, profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Odd Lot

An odd lotter is an investor who purchases shares or other securities in small or unusual quantities. Stocks are typically traded in increments of 100 shares, a quantity known as a '' round lot'' or ''board lot''. The cost of 100 shares of a security may be beyond the means of an individual investor, or may represent a larger investment than the investor wishes to make. Thus, the investor purchases an odd lot. Odd lot theory Odd lotters were central to a historical theory of technical analysis known as odd lot theory. Odd lot theory was predicated on the belief that one could outperform the stock market by identifying the least-informed investors and making investments opposite to them. (If the least-informed investors were selling, it was generally a good time to buy, and vice versa.) Assuming that odd lotters were generally smaller investors with little market knowledge, practitioners of odd lot theory identified the actions of odd lotters and did the opposite. The actions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Signalling (economics)

Signalling (or signaling; see American and British English spelling differences#Doubled consonants, spelling differences) in contract theory is the idea that one party (the law of agency, agent) credibly conveys some information about itself to another party (the principal (commercial law), principal). Signalling was already discussed and mentioned in the seminal Theory of Games and Economic Behavior, which is considered to be the text that created the research field of game theory. Although signalling theory was initially developed by Michael Spence based on observed knowledge gaps between organisations and prospective employees, its intuitive nature led it to be adapted to many other domains, such as Human Resource Management, business, and financial markets. In Spence's job-market signaling model, (potential) employees send a signal about their ability level to the employer by acquiring education credentials. The informational value of the credential comes from the fact that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |