|

Speculative Attack

In economics, a speculative attack is a precipitous selling of untrustworthy assets by previously inactive speculators and the corresponding acquisition of some valuable assets ( currencies, gold). The first model of a speculative attack was contained in a 1975 discussion paper on the gold market by Stephen Salant and Dale Henderson at the Federal Reserve Board. Paul Krugman, who visited the Board as a graduate student intern, soon adapted their mechanism to explain speculative attacks in the foreign exchange market.Paul Krugman (1979), 'A model of balance-of-payments crises'. ''Journal of Money, Credit, and Banking'' 11, pp. 311-25. There are now many hundreds of journal articles on financial speculative attacks, which are typically grouped into three categories: first, second, and third generation models. Salant has continued to explore real speculative attacks in a series of six articles. How it works A speculative attack in the foreign exchange market is the massive and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller. There are a number of ways of achieving a short position. The most basic is physical selling short or short-selling, by which the short seller Securities lending, borrows an asset (often a security (finance), security such as a share (finance), share of stock or a bond (finance), bond) and sells it. The short seller must later buy the same amount of the asset to return it to the lender. If the market price of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference in price. Conversely, if the price has risen then the short seller will bear a loss. The short seller ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spahn Tax

A Spahn tax is a type of currency transaction tax that is meant to be used for the purpose of controlling exchange-rate volatility. This idea was proposed by Paul Bernd Spahn in 1995. Early history The initial idea for a currency transaction tax is attributed to James Tobin in 1972, a concept now known as a Tobin tax. On 16 June 1995 Spahn, in his analysis of the original idea, concluded that the concept was not viable and suggested an alternative solution to the problem of managing exchange-rate volatility. Concept According to Spahn, "Analysis has shown that the Tobin tax as originally proposed is not viable and should be laid aside for good." Furthermore, he believes that "it is virtually impossible to distinguish between normal liquidity trading and speculative 'noise' trading. If the tax is generally applied at high rates, it will severely impair financial operations and create international liquidity problems, especially if derivatives are taxed as well. A lower tax r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Transaction Tax

A financial transaction tax (FTT) is a levy on a specific type of financial transaction for a particular purpose. The tax has been most commonly associated with the financial sector for transactions involving intangible property rather than real property. It is not usually considered to include consumption taxes paid by consumers. A transaction tax is levied on specific transactions designated as taxable rather than on any other attributes of financial institutions. If an institution is never a party to a taxable transaction, then no transaction tax will be levied from it. If an institution carries out one such transaction, then it will be levied the tax for the one transaction. This tax is narrower in scope than a financial activities tax (FAT), and is not directly an industry or sector tax like a Financial stability contribution (FSC), or "bank tax", for example. These distinctions are important in discussions about the utility of financial transaction tax as a tool to select ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Crisis

A currency crisis is a type of financial crisis, and is often associated with a real economic crisis. A currency crisis raises the probability of a banking crisis or a default crisis. During a currency crisis the value of foreign denominated debt will rise drastically relative to the declining value of the home currency. Generally doubt exists as to whether a country's central bank has sufficient foreign exchange reserves to maintain the country's fixed exchange rate, if it has any. The crisis is often accompanied by a speculative attack in the foreign exchange market. A currency crisis results from chronic balance of payments deficits, and thus is also called a balance of payments crisis. Often such a crisis culminates in a devaluation of the currency. Financial institutions and the government will struggle to meet debt obligations and economic crisis may ensue. Causation also runs the other way. The probability of a currency crisis rises when a country is experiencing a banki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Transaction Tax

A currency transaction tax is a tax placed on the use of currency for various types of transactions. The tax is associated with the financial sector and is a type of financial transaction tax, as opposed to a consumption tax paid by consumers, though the tax may be passed on by the financial institution to the customer. Types of currency transaction taxes Currency transaction taxes have been proposed as taxes on domestic currency usage as part of the automated payment transaction (APT) tax and on international currency transactions, the Tobin tax and the Spahn tax. APT tax The automated payment transaction (APT) tax was first proposed in Buenos Aires at the International Institute of Public Finance Conference by Edgar L. Feige in 1989 and an extended version of the proposal appeared in Economic Policy in 2000. The APT tax proposal is a generalization of the Keynes tax and the Tobin tax. The APT tax consists of a small flat tax levied on all transactions. The tax is automat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The union has a total area of and an estimated population of over 449million as of 2024. The EU is often described as a ''sui generis'' political entity combining characteristics of both a federation and a confederation. Containing 5.5% of the world population in 2023, EU member states generated a nominal gross domestic product (GDP) of around €17.935 trillion in 2024, accounting for approximately one sixth of global economic output. Its cornerstone, the European Union Customs Union, Customs Union, paved the way to establishing European Single Market, an internal single market based on standardised European Union law, legal framework and legislation that applies in all member states in those matters, and only those matters, where the states ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe. After the adoption of the euro, policy changed to linking currencies of EU countries outside the eurozone to the euro (having the common currency as a central point). The goal was to improve the stability of those currencies, as well as to gain an evaluation mechanism for potential eurozone members. As of January 2025, two currencies participate in ERM II: the Danish krone and the Bulgarian lev. Intent and operation The ERM is based on the concept of fixed currency exchange rate margins, but with exchange rates variable within those margins. This is also known as a semi-pegged system. Before the introduction of the eur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (symbol: £; currency code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word '' pound'' is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency in continuous use since its inception. In 2022, it was the fourth-most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and the renminbi, it forms the basket of currencies that calculate the value of IMF special drawing rights. As of late 2022, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cornering The Market

In finance, cornering the market consists of obtaining sufficient control of a particular stock, commodity, or other asset in an attempt to manipulate the market price. Companies that have cornered their markets have usually done so in an attempt to gain greater leeway in their decisions; for example, they may desire to charge higher prices for their products without fears of losing too much business. The cornerer hopes to gain control of enough of the supply of the commodity to be able to set the price for it. Strategy and risks Cornering a market can be attempted through several mechanisms. The most direct strategy is to buy a large percentage of the available commodity offered for sale in some spot market and hoard it. With the advent of futures trading, a cornerer may buy a large number of futures contracts on a commodity and then sell them at a profit after inflating the price. Although there have been many attempts to corner markets by massive purchases in everything from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

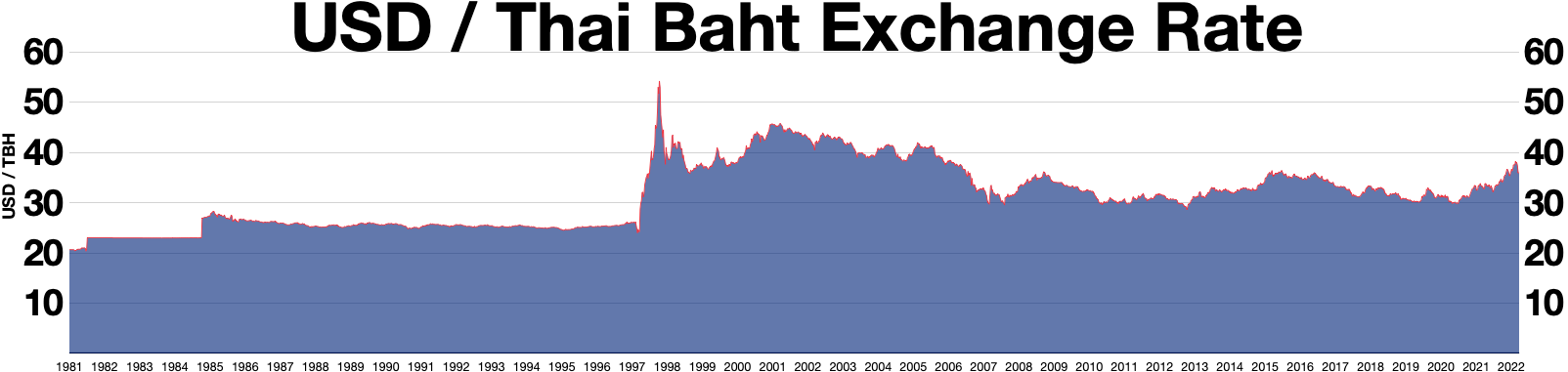

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Soros

George Soros (born György Schwartz; August 12, 1930) is an American investor and philanthropist. , he has a net worth of US$7.2 billion, Note that this site is updated daily. having donated more than $32 billion to the Open Society Foundations, of which $15 billion has already been distributed, representing 64% of his original fortune. In 2020, ''Forbes'' called Soros the "most generous giver" in terms of percentage of net worth. Born in Budapest to a non-observant Jewish family, Soros survived the Nazi occupation of Hungary and moved to the United Kingdom in 1947. He studied at the London School of Economics and was awarded a BSc in philosophy in 1951, and then a Master of Science degree, also in philosophy, in 1954. Soros started his career working in British and American merchant banks, before setting up his first hedge fund, Double Eagle, in 1969. Profits from this fund provided the seed money for Soros Fund Management, his second hedge fund, in 1970. Double Eagle w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |