|

Single Tax

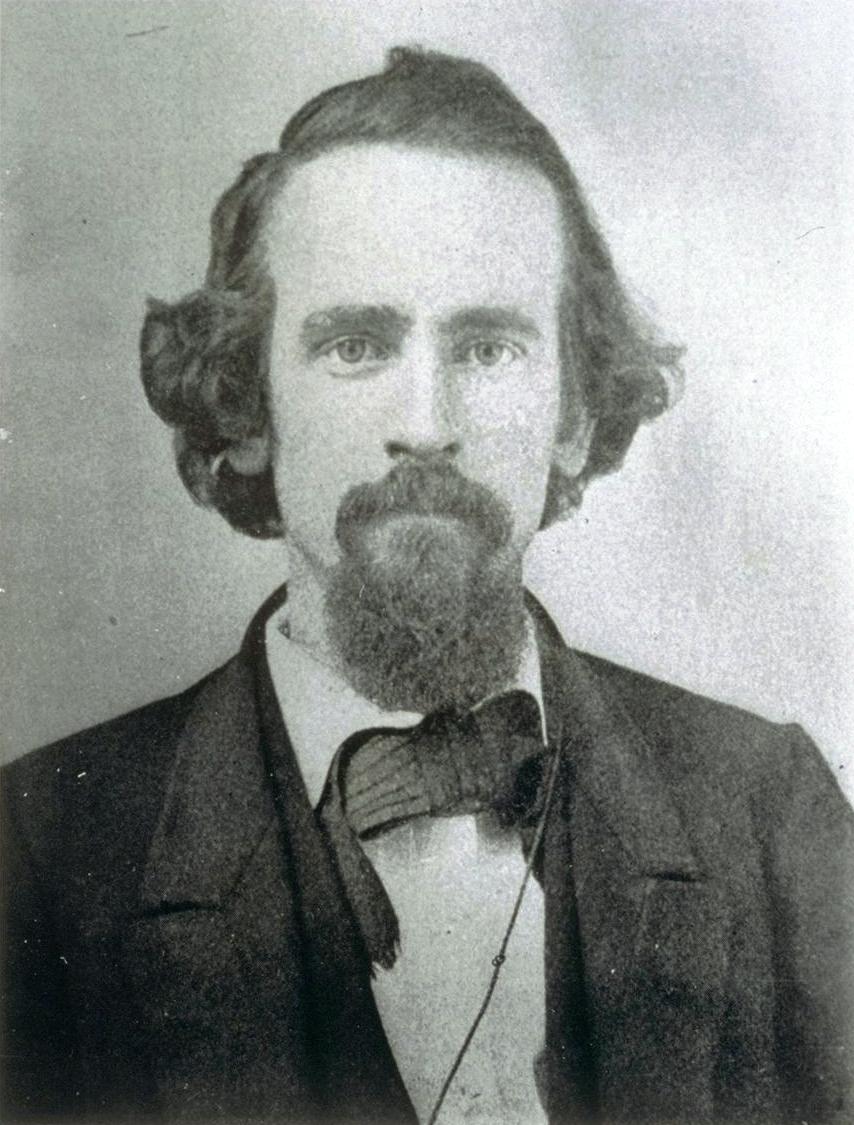

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value. Pierre Le Pesant, sieur de Boisguilbert and Sébastien Le Prestre de Vauban were early advocates for a single tax, but, rejecting the claim that land has certain economic properties which make it uniquely suitable for taxation, they instead proposed a flat tax on all incomes. In the late 19th and early 20th century, a populist single tax movement emerged which also sought to levy a single tax on the rental value of land and natural resources, but for somewhat different reasons. This "Single Tax" movement later became known as Georgism, after its most famous proponent, Henry George. It proposed a simplified and equitable tax system that upholds natural rights and whose revenue is based exclusively on ground and natural resource rents, with no additional taxation of improvements such as buildings. Some libertarians adv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements upon it. Some economists favor LVT, arguing it does not cause economic efficiency, economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (human activity), work. In contrast, a ''guaranteed minimum income'' is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is considered a ''full basic income''; if it is less than that amount, it is called a ''partial basic income''. As of 2025, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been Universal basic income pilots, numerous pilot projects, and the idea Universal basic income around the world, is discussed in many countries. Some have labelled UBI as utopian du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Taxes

This page, a companion page to tax, lists different taxes by economic design. For different taxes by country, see Tax rates around the world. Taxes generally fall into the following broad categories: * Income tax * Payroll tax * Property tax * Consumption tax * Tariff (taxes on international trade) * Capitation, a fixed tax charged per person * Fee, Fees and Fee, tolls * Effective taxes, government policies that are not explicitly taxes, but result in income to the government through losses to the public Income tax * Capital gains tax is a tax on the sale of an investment, usually stocks, bonds, precious metals and property. * Corporate tax is levied on the earnings or profits of a corporation. * Dividend tax is a tax on dividends paid to shareholders of a company. * Excess profits tax is a tax on unusually high profits levied on a corporation. This was largely levied in the United States in times of war to prevent war profiteering, but has been proposed at other times. * Flat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements upon it. Some economists favor LVT, arguing it does not cause economic efficiency, economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geolibertarianism

Geolibertarianism is a political and economic ideology that integrates libertarianism with Georgism. It favors a taxation system based (as in Georgism) on income derived from land and natural resources instead of on labor, coupled with a minimalist model of government, as in libertarianism. The term was coined by the late economist Fred Foldvary in 1981. Geolibertarians recognize the right to private ownership of land, but only if fair recompense is paid to the community for the loss of access to that land. Some geolibertarians broaden out the tax base to include resource depletion, environmental damage, and other ancillaries to land use. A succinct summary of this philosophy can be found in Thomas Paine's 1797 pamphlet '' Agrarian Justice'': "Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds". Overview Geolibertarians mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flat Tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation. A flat tax system is usually discussed in the context of an income tax, where progressivity is common, but it may also apply to taxes on consumption, property or transfers. Major categories Flat tax proposals differ in how the subject of the tax is defined. True flat-rate income tax A true flat-rate tax is a system of taxation where one tax rate is applied to all personal income with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Burden Of Taxation

In economics, the excess burden of taxation is one of the economic losses that society suffers as the result of taxes or subsidies. Economic theory posits that distortions change the amount and type of economic behavior from that which would occur in a free market without the tax. Excess burdens can be measured using the average cost of funds or the marginal cost of funds (MCF). Excess burdens were first discussed by Adam Smith. An equivalent kind of inefficiency can also be caused by subsidies (which technically can be viewed as taxes with negative rates). Economic losses due to taxes have been evaluated to be as low as 2.5 cents per dollar of revenue, and as high as 30 cents per dollar of revenue (on average), and even much higher at the margins. Measures of the excess burden The cost of a distortion is usually measured as the amount that would have to be paid to the people affected by its supply, the greater the excess burden. The second is the tax rate: as a general ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax. Types Value-added tax A value-added tax applies to the market value added to a product or material at each stage of its manufacture or distribution. For example, if a retailer buys a shirt for twenty dollars and sells it for thirty dollars, this tax would apply to the ten dollar difference between the two amounts. A simple value-added tax is proportional tax, proportional to consumption but is regressive tax, regressive on income at higher income levels, as consumption tends to fall as a percentage of income as income rises. Savings and investment are tax-deferred until they become consumption. A value-added t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FairTax

FairTax is a flat tax, fixed rate sales tax proposal introduced as bill H.R. 25 in the United States Congress every year since 2005. The ''Fair Tax Act'' calls for elimination of the Internal Revenue Service and repeal the Sixteenth Amendment to the United States Constitution. H.R. 25 would eliminate all Income tax in the United States, federal income taxes (including the alternative minimum tax, corporate tax in the United States, corporate income taxes, and Capital gains tax in the United States, capital gains taxes), payroll tax#United States, payroll taxes (including Federal Insurance Contributions Act tax, Social Security and Medicare taxes), gift taxes, and Estate tax in the United States, estate taxes, replacing federal taxes with a single consumption tax levied on retail sales. The ''Fair Tax Act'' (/) would apply a fixed rate sales tax at the point of sale on all new, final Goods (economics), goods and Services (economics), services purchased for household consumption. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overfishing

Overfishing is the removal of a species of fish (i.e. fishing) from a body of water at a rate greater than that the species can replenish its population naturally (i.e. the overexploitation of the fishery's existing Fish stocks, fish stock), resulting in the species becoming increasingly underpopulated in that area. Overfishing can occur in water bodies of any sizes, such as ponds, wetlands, rivers, lakes or oceans, and can result in resource depletion, reduced biological growth rates and low biomass (ecology), biomass levels. Sustained overfishing can lead to critical depensation, where the fish population is no longer able to sustain itself. Some forms of overfishing, such as the Threatened sharks, overfishing of sharks, has led to the upset of entire marine ecosystems. Types of overfishing include growth overfishing, recruitment overfishing, and ecosystem overfishing. Overfishing not only causes negative impacts on biodiversity and ecosystem functioning, but also reduces fish pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Severance Tax

Severance taxes are taxes imposed on the removal of natural resources within a taxing jurisdiction. Severance taxes are most commonly imposed in oil producing states within the United States. Resources that typically incur severance taxes when extracted include oil, natural gas, coal, uranium, and timber. Some jurisdictions use other terms like gross production tax. Note that severance taxes are used in jurisdictions where most resource extraction occurs on privately owned land and/or where sub-surface minerals are privately owned (for example, the United States). Where the resources are publicly owned to begin with (for example, in most Commonwealth and European Union countries), it is not a tax but rather a resource royalty that is paid. In the case of the forestry industry, this royalty is called " stumpage". Oil and natural gas Severance taxes are set and collected at the state level. States usually calculate the tax based on the value and/or volume produced; sometime ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Externality

In economics, an externality is an indirect cost (external cost) or indirect benefit (external benefit) to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced components that are involved in either consumer or producer consumption. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport. Water pollution from mills and factories are another example. All (water) consumers are made worse off by pollution but are not compensated by the market for this damage. The concept of externality was first developed by Alfred Marshall in the 1890s and achieved broader attention in the works of economist Arthur Pigou in the 1920s. The prototypical example of a negative externality is environmental pollution. Pigou argued that a tax, equal to the marginal damage or marginal external cost, (later called a "Pigou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |