|

Shutdown (economics)

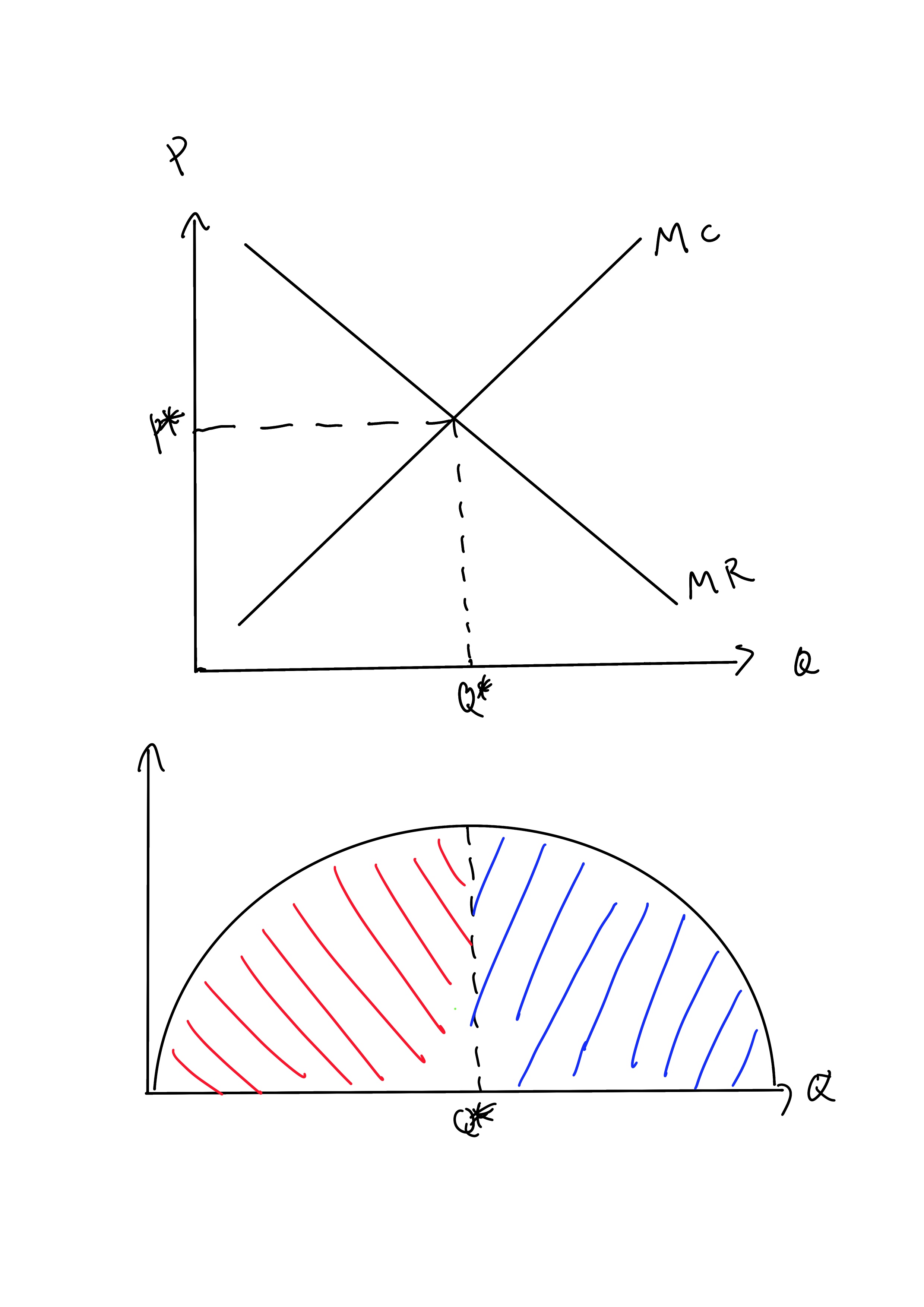

A firm will choose to implement a shutdown of production when the revenue received from the sale of the goods or services produced cannot even cover the variable costs of production. In that situation, the firm will experience a higher loss when it produces, compared to not producing at all. Technically, shutdown occurs if average revenue is below average variable cost at the profit-maximizing positive level of output. Producing anything would not generate enough revenue to offset the associated variable costs; producing some output would add further costs in excess of revenues to the costs inevitably being incurred (the fixed costs). By not producing, the firm loses only the fixed costs. Explanation The goal of a firm is to maximize profits or minimize losses. The firm can achieve this goal by following two rules. First, the firm should operate, if at all, at the level of output where marginal revenue equals marginal cost. Second, the firm should shut down rather than operat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Production (economics)

Production is the process of combining various inputs, both material (such as metal, wood, glass, or plastics) and immaterial (such as plans, or knowledge) in order to create output. Ideally this output will be a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is called production theory, and it is closely related to the consumption (or consumer) theory of economics. The production process and output directly result from productively utilising the original inputs (or factors of production). Known as primary producer goods or services, land, labour, and capital are deemed the three fundamental production factors. These primary inputs are not significantly altered in the output process, nor do they become a whole component in the product. Under classical economics, materials and energy are categorised as secondary factors as they are byproducts of land, labour and capital. Delving further, primary fac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of incom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goods And Services

Goods are items that are usually (but not always) tangible, such as pens, physical books, salt, apples, and hats. Services are activities provided by other people, who include architects, suppliers, contractors, technologists, teachers, doctors, lawn care workers, dentists, barbers, waiters, online servers, a digital book, a digital video game or a digital movie. Taken together, it is the production, distribution, and consumption of goods and services which underpins all economic activity and trade. According to economic theory, consumption of goods and services is assumed to provide utility (satisfaction) to the consumer or end-user, although businesses also consume goods and services in the course of producing other goods and services (see: Distribution: Channels and intermediaries). History Physiocratic economists categorized production into productive labour and unproductive labour. Adam Smith expanded this thought by arguing that any economic activitie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable Cost

Variable costs are costs that change as the quantity of the good or service that a business produces changes.Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 48 Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct costs are costs that can easily be associated with a particular cost object.Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 51 However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs that are indirect costs, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced. Direct labor and overhead are often called conversion cost,Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 39 while direct material and direct labor are oft ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Total Revenue

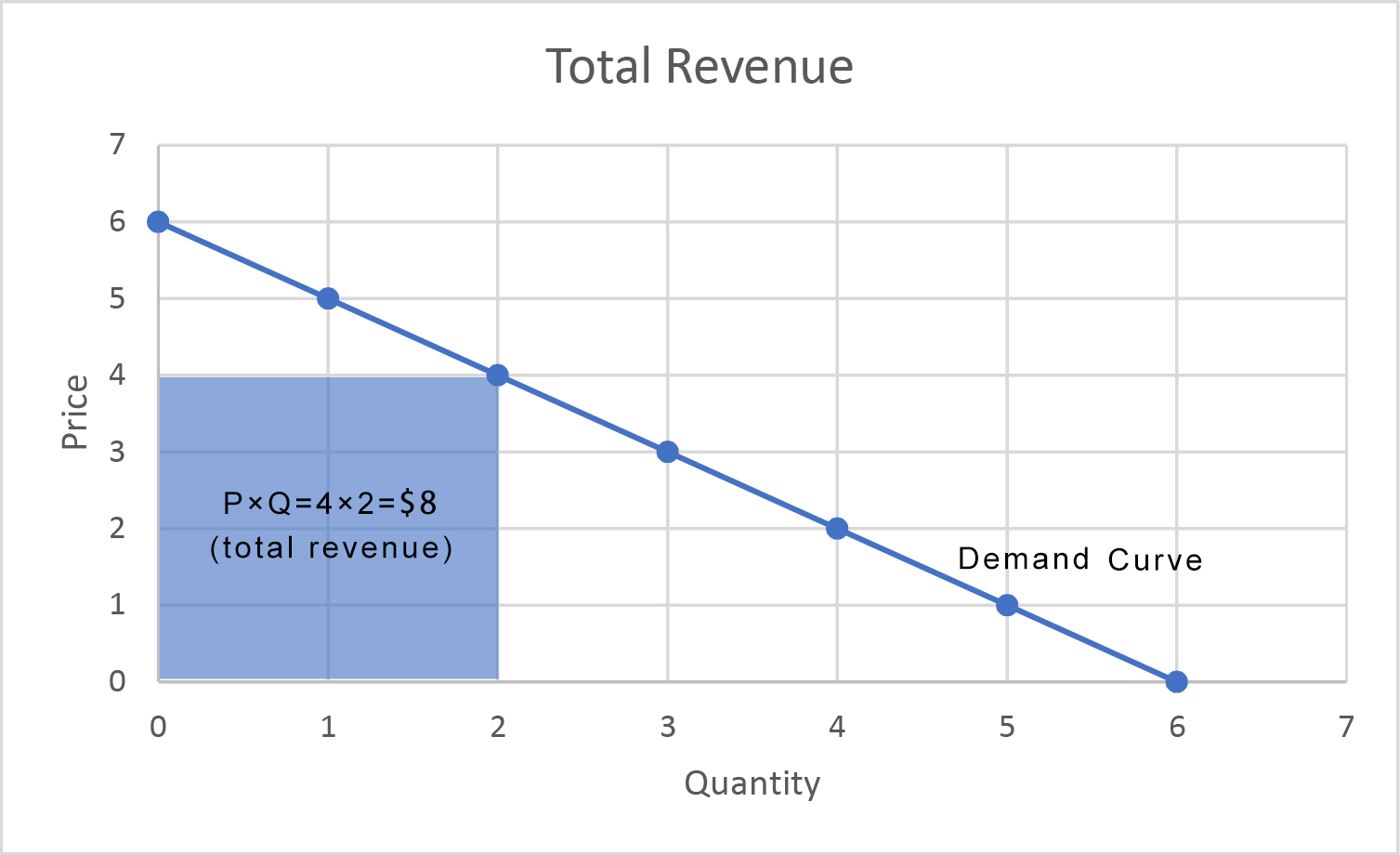

Total revenue is the total receipts a seller can obtain from selling goods or services to buyers. It can be written as ''P × Q'', which is the price of the goods multiplied by the quantity of the sold goods. Perfect competitor A perfectly competitive firm faces a demand curve that is infinitely elastic. That is, there is exactly one price that it can sell at – the market price. At any lower price it could get more revenue by selling the same amount at the market price, while at any higher price no one would buy any quantity. Total revenue equals the market price times the quantity the firm chooses to produce and sell. Monopoly As with a perfect competitor, a monopolist’s total revenue is the total receipts it can obtain from selling goods or services to buyers. It can be written as P\times Q, which is the price of the goods multiplied by the quantity of the sold goods. A monopolist's total revenue can be graphed as in Figure 1, in which Price (P) is the height of the box ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Variable Cost

In economics, average variable cost (AVC) is a firm's variable costs (labour, electricity, etc.) divided by the quantity of output produced. Variable costs are those costs which vary with the output level: :\text = \frac where \text = variable cost, \text = average variable cost, and \text = quantity of output produced. Average variable cost plus average fixed cost equals average total cost: :\text + \text = \text. A firm would choose to shut down if the price of its output is below average variable cost at the profit-maximizing level of output (or, more generally if it sells at multiple prices, its average revenue is less than AVC). Producing anything would not generate revenue significant enough to offset the associated variable costs; producing some output would add losses (additional costs in excess of revenues) to the costs inevitably being incurred (the fixed costs). By not producing, the firm loses only the fixed costs. As a result, the firm's short-run supply curve ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Cost

In accounting and economics, 'fixed costs', also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month. These costs also tend to be capital costs. This is in contrast to variable costs, which are volume-related (and are paid per quantity produced) and unknown at the beginning of the accounting year. Fixed costs have an effect on the nature of certain variable costs. For example, a retailer must pay rent and utility bills irrespective of sales. As another example, for a bakery the monthly rent and phone line are fixed costs, irrespective of how much bread is produced and sold; on the other hand, the wages are variable costs, as more workers would need to be hired for the production to increase. For any factory, the fix cost should be all the money paid on capitals and land. Such fixed costs as buying machines an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition In The Short Run (simple)

Perfect commonly refers to: * Perfection, completeness, excellence * Perfect (grammar), a grammatical category in some languages Perfect may also refer to: Film * ''Perfect'' (1985 film), a romantic drama * ''Perfect'' (2018 film), a science fiction thriller Literature * ''Perfect'' (Friend novel), a 2004 novel by Natasha Friend * ''Perfect'' (Hopkins novel), a young adult novel by Ellen Hopkins * ''Perfect'' (Joyce novel), a 2013 novel by Rachel Joyce * ''Perfect'' (Shepard novel), a Pretty Little Liars novel by Sara Shepard * ''Perfect'', a young adult science fiction novel by Dyan Sheldon Music * Perfect interval, in music theory * Perfect Records, a record label Artists * Perfect (musician) (born 1980), reggae singer * Perfect (Polish band) * Perfect (American band), an American alternative rock group Albums * ''Perfect'' (Intwine album) (2004) * ''Perfect'' (Half Japanese album) (2016) * ''perfecT'', an album by Sam Shaber * ''Perfect'', an album by True ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunk Cost

In economics and business decision-making, a sunk cost (also known as retrospective cost) is a cost that has already been incurred and cannot be recovered. Sunk costs are contrasted with ''prospective costs'', which are future costs that may be avoided if action is taken. In other words, a sunk cost is a sum paid in the past that is no longer relevant to decisions about the future. Even though economists argue that sunk costs are no longer relevant to future rational decision-making, people in everyday life often take previous expenditures in situations, such as repairing a car or house, into their future decisions regarding those properties. Bygones principle According to classical economics and standard microeconomic theory, only prospective (future) costs are relevant to a rational decision. At any moment in time, the best thing to do depends only on ''current'' alternatives. The only things that matter are the ''future'' consequences. Past mistakes are irrelevant. Any cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exit (economics)

In economics, barriers to exit are obstacles in the path of a firm that wants to leave a given market or industrial sector. These obstacles often have associated costs, prohibiting the firm from leaving the market. If the barriers of exit are significant, a firm may be forced to continue competing in a market. This forced stay in the market occurs when the costs of leaving a market are higher than costs incurred by continuing in the market. Sometimes, when firms operate at low profit or at loss, they still choose to compete with others. Major factors of this decision making is high barriers to exit. Definitions There are various definitions of "barrier to exit", this means the absence of one common approach to define barriers to exit. In 1976, Porter defines "exit barriers" as "adverse structural, strategic and managerial factors that keep firms in business even when they earn low or negative returns.” In 1989, Gilbert used the definition “costs or forgone profits that a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take a more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_last_flight.jpg)