|

Service Tax (India)

Service tax was a tax levied by the Government of India on services provided or agreed to be provided excluding services covered under the negative list and considering the ''Place of Provision of Service Rules 2012'' and collected as per ''Point of Taxation Rules 2011'' from the person liable to pay service tax. According to the Service Tax Rules 1994, a person responsible for paying service tax may be either the service provider or the service receiver, or any other individual person made so liable. It was an indirect tax, where the service provider collected the tax on services from the service receiver and then paid it to the Government of India. Few services were exempt in public interest via Mega Exemption Notification 25/2012-ST as amended up to date and few services are charged service tax at an abated rate as per Notification No. 26/2012-ST as amended up to date. It was set, more recently, at 15% for transactions that occurred on or after 1 June 2016. Service tax was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

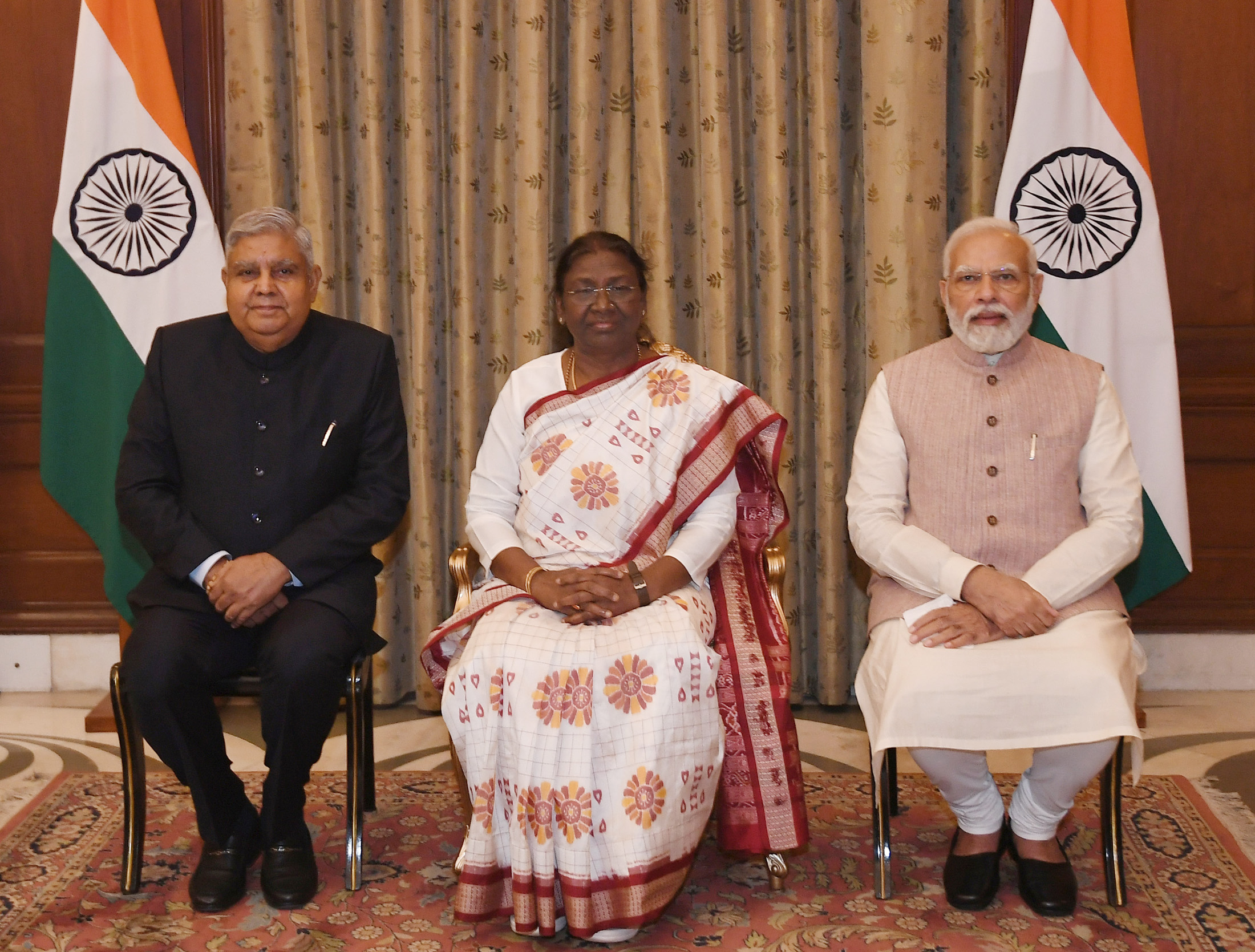

Government Of India

The Government of India (ISO 15919, ISO: Bhārata Sarakāra, legally the Union Government or Union of India or the Central Government) is the national authority of the Republic of India, located in South Asia, consisting of States and union territories of India, 36 states and union territories. The government is led by the president of India (currently ) who largely exercises the executive powers, and selects the Prime Minister of India, prime minister of India and other ministers for aid and advice. Government has been formed by the The prime minister and their senior ministers belong to the Union Council of Ministers, its executive decision-making committee being the Cabinet (government), cabinet. The government, seated in New Delhi, has three primary branches: the legislature, the executive and the judiciary, whose powers are vested in bicameral Parliament of India, Union Council of Ministers (headed by prime minister), and the Supreme Court of India respectively, with a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Service (economics)

A service is an act or use for which a consumer, company, or government is willing to payment, pay. Examples include work done by barbers, doctors, lawyers, mechanics, banks, insurance companies, and so on. Public services are those that society (nation state, fiscal union or region) as a whole pays for. Using resources, skill, ingenuity, and experience, service providers benefit service consumers. Services may be defined as intangible acts or performances whereby the service provider provides value to the customer. Key characteristics Services have three key characteristics: Intangibility Services are by definition intangible. They are not manufactured, transported or stocked. One cannot store services for future use. They are produced and consumed simultaneously. Perishability Services are perishable in two regards: * Service-relevant resources, processes, and systems are assigned for service delivery during a specific period in time. If the service consumer does not request ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Service Provider

A service provider (SP) is an organization that provides services, such as consulting, legal, real estate, communications, storage, and processing services, to other organizations. Although a service provider can be a sub-unit of the organization that it serves, it is usually a third-party or outsourced supplier. Examples include telecommunications service providers (TSPs), application service providers (ASPs), storage service providers (SSPs), and internet service providers (ISPs). A more traditional term is service bureau. IT professionals sometimes differentiate between service providers by categorizing them as type I, II, or III. The three service types are recognized by the IT industry although specifically defined by ITIL and the U.S. Telecommunications Act of 1996. *Type I: internal service provider *Type II: shared service provider *Type III: external service provider Type III SPs provide IT services to external customers and subsequently can be referred to as external ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Interest

In social science and economics, public interest is "the welfare or well-being of the general public" and society. While it has earlier philosophical roots and is considered to be at the core of democratic theories of government, often paired with two other concepts, convenience and necessity, it first became explicitly integrated into governance instruments in the early part of the 20th century. The public interest was rapidly adopted and popularised by human rights lawyers in the 1960s and has since been incorporated into other fields such as journalism and technology. Overview Economist Lok Sang Ho, in his ''Public Policy and the Public Interest'', argues that the public interest must be assessed impartially and, therefore, defines the public interest as the "'' ex ante'' welfare of the representative individual". Under a thought experiment, by assuming that there is an equal chance for one to be anyone in society and, thus, could benefit or suffer from a change, the pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goods And Services Tax (India)

The Goods and Services Tax (GST) is a successor to VAT used in India on the supply of goods and service. Both VAT and GST have the same taxation slabs. It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes. Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic beverages, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system. There is a special rate of 0.25% on rough precious and semi-precious ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raja Chelliah

Raja Jesudoss Chelliah (12 December 1922 – 7 April 2009) was an economist and founding chairman of the Madras School of Economics. He completed an MA in economics from the University of Madras and PhD in the United States. He worked as the chief of the Fiscal Analysis Division, Fiscal Affairs Department, International Monetary Fund between 1969 and 1975. He served as a consultant to the government of Papua New Guinea on Centre Provincial Financial Relations. He also worked in several state and central government financial institutions in India. He was considered a public finance expert in India, instrumental in bringing about the early reforms to the direct taxation structure. He was awarded Padma Vibushan in 2007. He is often referred to as "The Father of Tax Reforms". Personal life and education He was born on 12 December 1922. His father Chelliah Pillai was his greatest inspiration. He graduated with a master's degree in economics from University of Madras and worked as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year. Overview In the UK, the Chancellor of the Exchequer delivers a Budget speech on Budget Day, outlining changes in spending, as well as tax and duty. The changes to tax and duty are passed as law, and each year form the respective Finance Act. Additional Finance Acts are also common and are the result of a change in governing party due to a general election, a pressing loophole or defect in the law of taxation, or a backtrack with regard to government spending or taxation. The rules governing the various taxation methods are contained within the relevant taxation acts. Capital Gains Tax legislation, for example, is contained within Taxation of Chargeable Gains Act 1992. The Finance Act details amendments to be made t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue

In accounting, revenue is the total amount of income generated by the sale of product (business), goods and services related to the primary operations of a business. Commercial revenue may also be referred to as sales or as turnover. Some company, companies receive revenue from interest, royalties, or other fees. This definition is based on International Accounting Standard, IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, company X had revenue of $42 million". Profit (accounting), Profits or net income generally imply total revenue minus total expenses in a given period. In accountancy, accounting, revenue is a subsection of the equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income (gross reve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation System

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swachh Bharat Mission

Swachh Bharat Mission (SBM), Swachh Bharat Abhiyan, or Clean India Mission is a country-wide campaign initiated by the Government of India on 2 October 2014 to eliminate open defecation and improve solid waste management and to create Open Defecation Free (ODF) villages. The program also aims to increase awareness of menstrual health management. It is a restructured version of the Nirmal Bharat Abhiyan which was launched by the Government of India in 2009. A formal sanitation programme was first launched in 1954, followed by Central Rural Sanitation Programme in 1986, Total Sanitation Campaign (TSC) in 1999 and Nirmal Bharat Abhiyan in 2012. Phase 1 of the Swachh Bharat Mission (SBM) lasted until 2 October 2019, and Phase 2 is being implemented between 2020–21 and 2024–25 to reinforce the achievements of Phase 1. Initiated by the Government of India, the mission aimed to achieve an " open-defecation free" (ODF) India by 2 October 2019, the 150th anniversary of the birth of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cess

Cess (pronounced ) is a tax - generally one levied for promoting services like health and education. Governments often charge a cess for the purpose of development in social sectors. The word is a shortened form of "assess". The spelling is due to a mistaken connection with ''census''. "Cess" (, possibly from Latin ) was an official term used in Ireland from at least the 16th century and when that country formed part of the United Kingdom of Great Britain and Ireland, but has been superseded by "rate". The term was formerly particularly applied to local taxation. In the British Raj the term was applied, with a qualifying prefix, to any taxation, such as irrigation-cess and educational-cess. Government censuses referred to them collectively as "cesses", as in "land revenue and cesses". In modern India, the word refers to a tax earmarked for a particular purpose, such as education; such cesses are levied as an additional tax on the basic tax-liability. In Scotland, "cess" ref ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |