|

Securitisation Act

The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (also known as the SARFAESI Act) is an Indian law. It allows banks and other financial institutions to auction residential or commercial properties of defaulters to recover loans. The first asset reconstruction company (ARC) of India, ARCIL, was set up under this act. By virtue of the SARFAESI Act 2002, the Reserve Bank of India has the authority to register and regulate Asset Reconstruction Companies (ARCs). Under this act secured creditors (banks or financial institutions) have many rights for enforcement of security interest under section 13 of SARFAESI Act, 2002. If borrower of financial assistance defaults on repayment of a loan and their account is classified as Non performing Asset by secured creditor, then secured creditor may repossess the security asset before expiry of period of limitation by written notice. Summary The law does not apply to unsecured loans, l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of India

The Parliament of India (ISO 15919, ISO: ) is the supreme legislative body of the Government of India, Government of the Republic of India. It is a bicameralism, bicameral legislature composed of the Rajya Sabha (Council of States) and the Lok Sabha (House of the People). The president of India, President of the Republic of India, in their role as head of the legislature, has full powers to summon and prorogue either house of Parliament or to dissolve the Lok Sabha, but they can exercise these powers only upon the advice of the prime minister of India, Prime Minister of the Republic of India and the Union Council of Ministers. Those elected or nominated (by the president) to either house of the Parliament are referred to as member of Parliament (India), members of Parliament (MPs). The member of Parliament, Lok Sabha, members of parliament in the Lok Sabha are direct election, directly elected by the voting of Indian citizens in single-member districts and the member of Parliame ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lok Sabha

The Lok Sabha, also known as the House of the People, is the lower house of Parliament of India which is Bicameralism, bicameral, where the upper house is Rajya Sabha. Member of Parliament, Lok Sabha, Members of the Lok Sabha are elected by an adult universal suffrage and a first-past-the-post system to represent their respective List of constituencies of the Lok Sabha, constituencies, and they hold their seats for five years or until the body is dissolved by the president of India on the advice of the Union Council of Ministers. The house meets in the Lok Sabha Chambers of the New Parliament House, New Delhi. The maximum membership of the House allotted by the Constitution of India is 552. (Initially, in 1950, it was 500.) Currently, the house has 543 seats which are filled by the election of up to 543 elected members. Between 1952 and 2020, Anglo-Indian reserved seats in the Lok Sabha, two additional members of the Anglo-Indian community were also nominated by the President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. The largest and the oldest bank which is still in existence is the State Bank of India (SBI). It originated and started working as the Bank of Calcutta in mid-June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks founded by a presidency government, the other two were the Bank of Bombay in 1840 and the Bank of Madras in 1843. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years, the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. In 1960, the State Banks of India ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India

Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Ministry of Finance, Government of India, Government of the Republic of India, it is responsible for the control, issue, and maintenance of the supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. The RBI, along with the Indian Banks' Association, established the National Payments Corporation of India to promote and regulate the payment and settlement systems in India. Bharatiya Reserve Bank Note Mudran, Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Mysore (Karnataka; Southern India) and Salboni (West Bengal; Eastern India). Depos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Registry Of Securitisation Asset Reconstruction And Security Interest

Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) is a central online security interest registry of India. It was primarily created to check frauds in lending against equitable mortgages, in which people would take multiple loans on the same asset from different banks. It is a registered company under section 8 of the Companies Act, 2013 having its registered office at New Delhi. CERSAI is a Registration System under the provisions of Chapter IV of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. ( SARFAESI Act). History It was formed under the Chapter IV Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act). It was registered as a company under the Section 25 of the Companies Act, 1956. CERSAI become operational on 31 March 2011. 51% of the equity is owned by the government, and the rest is owned equally by Nat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crore

Crore (; abbreviated cr) denotes the quantity ten million (107) and is equal to 100 lakh in the Indian numbering system. In many international contexts, the decimal quantity is formatted as 10,000,000, but when used in the context of the Indian numbering system, the quantity is usually formatted 1,00,00,000. Crore is widely used both in official and other contexts in Bangladesh, Bhutan, India, Myanmar, Nepal, and Pakistan. Etymology The word ''crore'' derives from the Prakrit word , which in turn comes from the Sanskrit (), denoting ten million in the Indian number system, which has separate terms for most powers of ten from 100 up to 1019. The ''crore'' is known by various regional names. Money Large amounts of money in India, Bangladesh, Nepal, and Pakistan are often written in terms of ''crore''. For example 150,000,000 (one hundred and fifty million) rupees is written as "fifteen ''crore'' rupee Rupee (, ) is the common name for the currency, currencies of India ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gujarat

Gujarat () is a States of India, state along the Western India, western coast of India. Its coastline of about is the longest in the country, most of which lies on the Kathiawar peninsula. Gujarat is the List of states and union territories of India by area, fifth-largest Indian state by area, covering some ; and the List of states and union territories of India by population, ninth-most populous state, with a population of 60.4 million in 2011. It is bordered by Rajasthan to the northeast, Dadra and Nagar Haveli and Daman and Diu to the south, Maharashtra to the southeast, Madhya Pradesh to the east, and the Arabian Sea and the Pakistani province of Sindh to the west. Gujarat's capital city is Gandhinagar, while its largest city is Ahmedabad. The Gujarati people, Gujaratis are indigenous to the state and their language, Gujarati language, Gujarati, is the state's official language. The state List of Indus Valley civilisation sites#List of Indus Valley sites discovered, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

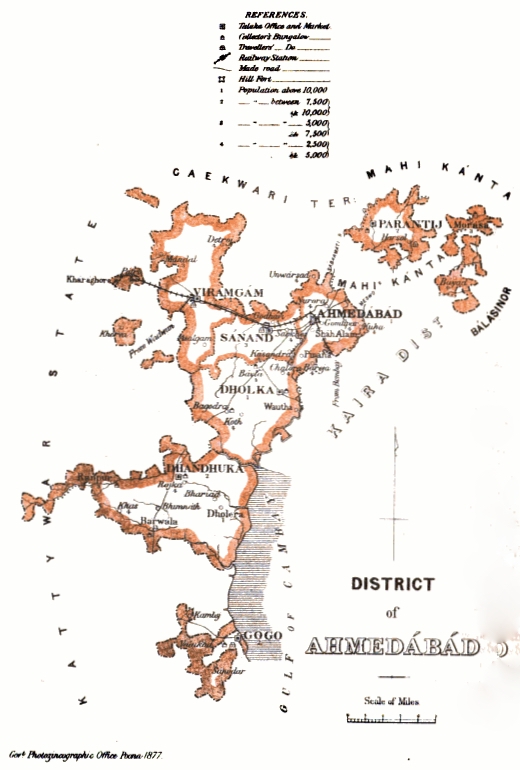

Ahmedabad District

Ahmedabad (Amdavad) district is a district comprises the city of Ahmedabad, in the central part of the state of Gujarat in western India. It is the seventh most populous district in India (out of 739). Ahmedabad District Surrounded By Kheda district in the east, Mehsana district in the north, Anand district in the south and Surendranagar district in the west. Etymology The area around Ahmedabad has been inhabited since the 11th century, when it was known as '' Ashaval''. At that time, Karna, the Chaulukya (Solanki) ruler of Anhilwara (modern Patan), waged a successful war against the Bhil king of Ashaval, and established a city called ''Karnavati'' on the banks of the Sabarmati. In 1411, this area came under the control of Muzaffar Shah I's grandson, Sultan Ahmed Shah, who selected the forested area along the banks of the Sabarmati river for a new capital city. He laid the foundation of a new walled city near Karnavati and named it Ahmedabad after himself. According to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ICICI Bank

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with a registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through various delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management. ICICI Bank has a network of 6,613 branches and 16,120 ATMs across India. It also has a presence in 11 countries. The bank has subsidiaries in the United Kingdom and Canada; branches in United States, Singapore, Bahrain, Hong Kong, Qatar, Oman, Dubai International Finance Centre, China and South Africa; as well as representative offices in United Arab Emirates, Bangladesh, Malaysia and Indonesia. The company's UK subsidiary has also established branches in Belgium and Germany. The Reserve Bank of India (RBI) has identified the State Bank of India, HDFC Bank, and ICICI Bank as Domesti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supreme Court Of India

The Supreme Court of India is the supreme judiciary of India, judicial authority and the supreme court, highest court of the Republic of India. It is the final Appellate court, court of appeal for all civil and criminal cases in India. It also has the power of Judicial review in India, judicial review. The Supreme Court, which consists of the Chief Justice of India and a maximum of fellow 33 judges, has extensive powers in the form of original jurisdiction, original, appellate jurisdiction, appellate and Advisory opinion, advisory jurisdictions. As the apex constitutional court, it takes up appeals primarily against verdicts of the List of High Courts of India, High Courts of various states and tribunals. As an advisory court, it hears matters which are referred by the President of India#Judicial powers, president of India. Under judicial review, the court invalidates both ordinary laws as well as Amendment of the Constitution of India, constitutional amendments as per the basi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Economic Times

''The Economic Times'' is an Indian English-language business-focused daily newspaper. Owned by The Times Group, ''The Economic Times'' began publication in 1961 and it is sold in all major cities in India. As of 2012, it is the world's second-most widely read English-language business newspaper, after ''The Wall Street Journal'', with a daily readership of over 800,000. According to the Audit Bureau of Circulations (India), Audit Bureau of Circulations, the newspaper's Print circulation, circulation averaged 269,882 copies during the latter half of 2022. It is published simultaneously from 14 cities: Mumbai, Bangalore, Delhi, Chennai, Kolkata, Lucknow, Hyderabad, Jaipur, Ahmedabad, Nagpur, Chandigarh, Pune, Indore, and Bhopal. Its main content is based on the Economy of India, Indian economy, international finance, share prices, prices of commodities as well as other matters related to finance. This newspaper is Publishing, published by Bennett Coleman & Co. Ltd, Bennett, Cole ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-performing Asset

A non-performing loan (NPL) is a bank loan that is subject to late repayment or is unlikely to be repaid by the borrower in full. Non-performing loans represent a major challenge for the banking sector, as they reduce profitability. They are often claimed to prevent banks from lending more to businesses and consumers, which in turn slows economic growth, although this theory is disputed. In the European Union, the management of the NPLs resulting from the 2008 financial crisis has become a politically sensitive topic, culminating in 2017 with the decision by the European Council to task the European Commission to launch an action plan to tackle NPLs. The action plan supports the fostering of a secondary market for NPLs and the creation of Asset Management Companies (aka bad banks). In December 2020, this action plan was revised in the wake of the COVID-19 pandemic crisis. Definition Non-performing loans are generally recognised as per the following criteria: * Payments of inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |