|

Scheduled Commercial Bank

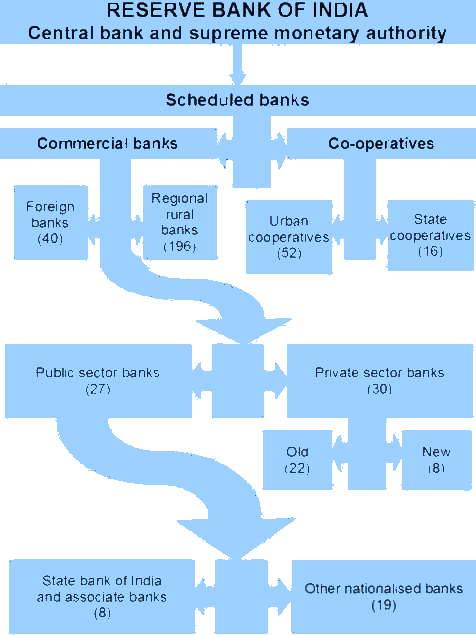

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934. Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy all the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks Facilities Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of clearing house. Types of banks There are two main categories of scheduled banks in India, namely: * Scheduled Commercial banks * Scheduled Co-operative banks Scheduled commercial Banks are further divided into six types, as below: # Scheduled Public Sector Banks # Scheduled Private Sector Banks # Scheduled Small Finance Banks # Regional Rural Banks # Foreign Banks # Payment banks (currently five banks Airtel Payments Bank, Fino Payments Bank, I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scheduled Banking Structure In India

A schedule (, ) or a timetable, as a basic time-management tool, consists of a list of times at which possible tasks, events, or actions are intended to take place, or of a sequence of events in the chronological order in which such things are intended to take place. The process of creating a schedule — deciding how to order these tasks and how to commit resources between the variety of possible tasks — is called scheduling,Ofer Zwikael, John Smyrk, ''Project Management for the Creation of Organisational Value'' (2011), p. 196: "The process is called scheduling, the output from which is a timetable of some form". and a person responsible for making a particular schedule may be called a scheduler. Making and following schedules is an ancient human activity. Some scenarios associate this kind of planning with learning life skills. Schedules are necessary, or at least useful, in situations where individuals need to know what time they must be at a specific location to rece ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Airtel Payments Bank

Airtel Payments Bank is an Indian payments bank with its headquarters in New Delhi. The company is a subsidiary of Bharti Airtel. On 5 January 2022, it was granted the scheduled bank status by the Reserve Bank of India under the second schedule of RBI Act, 1934. History In 2015, eleven companies received In-principle approval from the Reserve Bank of India to set up Payments Bank under the guidelines for Licensing of Payments Bank. On 11 April 2016, Airtel Payments Bank became the first company to receive the Payments Bank license from the Reserve Bank of India under Section 22 (1) of the Banking Regulation Act, 1949. Airtel Payments Bank started with an 80:20 partnership between Bharti Airtel and Kotak Mahindra Bank. Bharti Airtel launched Airtel Payments Bank in September 2016 and went live with its pilot project in Rajasthan in November 2016. It was launched nationally in January 2017 to support the cashless revolution promised by the Government of India. In August 202 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. The largest and the oldest bank which is still in existence is the State Bank of India (SBI). It originated and started working as the Bank of Calcutta in mid-June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks founded by a presidency government, the other two were the Bank of Bombay in 1840 and the Bank of Madras in 1843. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years, the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. In 1960, the State Banks of India ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paytm Payments Bank(Paytm Payment Bank Restricted To Deposit Money In 2024)

Paytm Payments Bank (PPBL) was an Indian payments bank, founded in 2017 and headquartered in Noida. In the same year, it received the license to run a payments bank from the Reserve Bank of India and was launched in November 2017. In 2021, the bank received a scheduled bank status from the RBI. Vijay Shekhar Sharma holds 51 percent in the entity with One97 Communications holding 49 percent. Vijay Shekhar Sharma is the promoter of Paytm Payments Bank, and One97 Communications Limited is not categorized as one of its promoters. He resigned as part-time non-executive chairman and board member of Paytm Payments Bank, citing regulatory challenges with the Reserve Bank of India. On , Paytm Payments Bank was stopped from onboarding new customers onto their platform, due to persistent non-compliance and continued material supervisory concerns within the bank. It was also told to not accept deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jio Payments Bank

Jio Payments Bank Limited is an Indian payments bank, it started operating in 2018 and is currently a subsidiary of Jio Financial Services, which was initially owned by Reliance Industries but was listed separately on stock exchanges in 2023. History On 19-August-2015 Reliance Industries received a license to run a payments bank from the Reserve Bank of India under Section 22 (1) of the Banking Regulation Act, 1949. It then partnered with the State Bank of India and incorporated Jio Payments Bank Limited in November 2016. Jio Payments Bank Limited is an 82.17:17.83 partnership between Reliance Industries and the State Bank of India. On 10-November-2016, it registered as a public limited company to set up a payments bank. On 03-April-2018, Jio Payments Bank became the sixth payments bank to commence operations in India. In March 2024, it was reported that they were working on releasing a soundbox product for merchants, which would allow them to be notified whenever a customer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NSDL Payments Bank , the largest securities depository in India

{{Disambig ...

NSDL may refer to: *National Science Digital Library, a free online library * National Securities Depository Limited National Securities Depository Limited (NSDL) is an Indian central securities depository, based in Mumbai. It was established in August 1996 as the first electronic securities depository in India with national coverage. It was established based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India Post Payments Bank

India Post Payments Bank, abbreviated as IPPB, is a division of India Post that is under the ownership of the Department of Post, a department under the Ministry of Communications of the Government of India. Opened in 2018, as of March 2024, the bank has more than 90 million customers. History On 19 August 2015, India Post received a license to run a payments bank from the Reserve Bank of India Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Min .... On 17 August 2016, it was registered as a public limited government company for setting up a payments bank. IPPB is operating with the Department of Posts under the Ministry of Communications (India), Ministry of Communications. The pilot project of IPPB was inaugurated on 30 January 2017 at Raipur and Ranchi. In August 2018, the Unio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fino Payments Bank

In computer science, FINO is a humorous scheduling algorithm. It is an acronym for ''first in, never out'' as opposed to traditional FIFO (computing and electronics), ''first in, first out'' (FIFO) and LIFO (computing), ''last in, first out'' (LIFO) algorithms. A similar acronym is "FISH", for ''first in, still here''. FINO works by withholding all scheduled tasks permanently. No matter how many tasks are scheduled at any time, no task ever actually takes place. A state (computer science), stateful FINO queue can be used to implement a memory leak. The first mention of FINO appears in the Signetics 25120 Write-only memory (joke), write-only memory joke datasheet. (alternate copy) See also * Bit bucket * Black hole (networking) * * Write-only memory (joke), Write-only memory References Scheduling algorithms Computer humour {{comp-sci-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payments Bank

Payments banks are a new model of banks, conceptualised by the Reserve Bank of India (RBI), which cannot issue credit. These banks can accept a restricted deposit, which is currently limited to Indian rupee, ₹200,000 per customer and may be increased further. These banks cannot issue loans and credit cards. Both current account and savings accounts can be operated by such banks. Payments banks can issue ATM cards or debit cards and provide online or mobile banking. Bharti Airtel set up India's first payments bank, Airtel Payments Bank. History On 23 September 2013, Committee on Comprehensive Financial Services for Small Businesses and Low Income Households, headed by Nachiket Mor, was formed by the RBI. On 7 January 2014, the Nachiket Mor committee submitted its final report. Among its various recommendations, it recommended the formation of a new category of bank called payments bank. On 17 July 2014, the RBI released the draft guidelines for payment banks, seeking comments fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India Act, 1934

Reserve Bank of India Act, 1934 is the legislative act under which the Reserve Bank of India (RBI) was formed. This act along with the Companies Act, which was amended in 1936, were meant to provide a framework for the supervision of banking firms in India. Summary The Act contains the definition of the so-called scheduled banks, as they are mentioned in the 2nd Schedule of the Act. These are banks which were to have paid up capital and reserves above 5 lakh. Sections There are various section in the RBI Act but the most controversial and confusing is Section 7. Although this section has been used only once by the central govt, it puts a restriction on the autonomy of the RBI. Section 7 states that the central government can legislate the functioning of the RBI through the RBI board, and the RBI is not an autonomous body. Section 17 of the Act defines the manner in which the RBI can conduct business as the central bank of India. The RBI can accept deposits from the central and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cooperative Banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, Building society, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. Institutions Cooperative banks Cooperative banks are owned by their customers and follow the Rochdale Principles, cooperative principle of one person, one vote. Co-operative banks are often regulated under both banking and cooperative legislation. They provide services such as savings and loans to non-members as well as to members, and some participate in the wholesale markets for bonds, money and even equities. Many cooperative banks are traded on public stock markets, with the result that they are p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit. It can also refer to a bank or a division of a larger bank that deals with wholesale banking to corporations or large or middle-sized businesses, to differentiate from retail banks and investment banks. Commercial banks include private sector banks and public sector banks. However, central banks function differently from commercial banks, despite a common misconception known as the "bank analogy". Unlike commercial banks, central banks are not primarily focused on generating profits and cannot become insolvent in the same way as commercial banks in a fiat currency system. History The name ''bank'' derives from the Italian word ''banco'' 'desk/bench', used during the Italian Renaissance era by Florentine bankers, who used to carry out their transactions on a desk covered by a green tablecloth. However, traces of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |