|

Resona Holdings

() is the holding company of , the fifth-largest banking group in Japan as of 2012. It is headquartered in the Kiba area of Koto, Tokyo. The main operating entities of the group are Resona Bank, a nationwide corporate and retail bank headquartered in Osaka, and Saitama Resona Bank, a smaller bank headquartered in Saitama City which primarily serves Saitama Prefecture, and are thus considered to be " city banks" of Japan. Most of these banks' operations are descended from Daiwa Bank and Asahi Bank, which merged in 2003. History Daiwa Bank Resona was formed as the Osaka Nomura Bank in 1918. This entity served as the financing arm of the Nomura ''zaibatsu'' founded by Tokushichi Nomura. Its securities brokerage operation separated in 1925 to form Nomura Securities, now Japan's largest securities company. The bank was renamed Nomura Bank in 1927 and became the main bank for the Osaka Prefecture government in 1929, immediately following the 1929 stock market crash. The Nomur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nomura Group

is a financial holding company and a principal member of the Nomura Group, which is Japan's largest investment bank and brokerage group. It, along with its broker-dealer, banking and other financial services subsidiaries, provides investment, financing and related services to individual, institutional, and government customers on a global basis with an emphasis on securities businesses. History Origins The history of Nomura began on December 25, 1925, when Nomura Securities Co., Ltd. (NSC) was established in Osaka, as a spin-off from Securities Dept. of Osaka Nomura Bank Co., Ltd (the present day Resona Bank). NSC initially focused on the bond market. It was named after its founder Tokushichi Nomura II, a wealthy Japanese businessman and investor. He had earlier established Osaka Nomura bank in 1918, based on the Mitsui zaibatsu model with a capital of ¥10 million. Like the majority of Japanese conglomerates, or zaibatsu, its origins were in Osaka, but today operate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voting Rights

Suffrage, political franchise, or simply franchise is the right to vote in representative democracy, public, political elections and referendums (although the term is sometimes used for any right to vote). In some languages, and occasionally in English, the right to vote is called active suffrage, as distinct from passive suffrage, which is the right to stand for election. The combination of active and passive suffrage is sometimes called ''full suffrage''. In most democracies, eligible voters can vote in elections for representatives. Voting on issues by referendum (direct democracy) may also be available. For example, in Switzerland, this is permitted at all levels of government. In the United States, Initiatives and referendums in the United States#Types of initiatives and referendums, some states allow citizens the opportunity to write, propose, and vote on referendums (popular initiatives); other states and the United States federal government, federal government do not. Re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nationalization

Nationalization (nationalisation in British English) is the process of transforming privately owned assets into public assets by bringing them under the public ownership of a national government or state. Nationalization contrasts with privatization and with demutualization. When previously nationalized assets are privatized and subsequently returned to public ownership at a later stage, they are said to have undergone renationalization (or deprivatization). Industries often subject to nationalization include telecommunications, electric power, fossil fuels, railways, airlines, iron ore, media, postal services, banks, and water (sometimes called the commanding heights of the economy), and in many jurisdictions such entities have no history of private ownership. Nationalization may occur with or without financial compensation to the former owners. Nationalization is distinguished from property redistribution in that the government retains control of nationalized pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscription model, requiring readers to pay for access to most of its articles and content. The ''Journal'' is published six days a week by Dow Jones & Company, a division of News Corp. As of 2023, ''The'' ''Wall Street Journal'' is the List of newspapers in the United States, largest newspaper in the United States by print circulation, with 609,650 print subscribers. It has 3.17 million digital subscribers, the second-most in the nation after ''The New York Times''. The newspaper is one of the United States' Newspaper of record, newspapers of record. The first issue of the newspaper was published on July 8, 1889. The Editorial board at The Wall Street Journal, editorial page of the ''Journal'' is typically center-right in its positio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Holding Company

A bank holding company is a company that controls one or more banks, but does not necessarily engage in banking itself. The compound bancorp (''banc''/''bank'' + '' corp ration') or bancorporation is often used to refer to such companies as well, particularly in the United States. United States In the United States, a bank holding company, as provided by the Bank Holding Company Act of 1956 ( '' et seq.''), is broadly defined as "any company that has control over a bank". All bank holding companies in the US are required to register with the Board of Governors of the Federal Reserve System. Regulation The Federal Reserve Board of Governors, under Regulation Y () has responsibility for regulating and supervising bank holding company activities, such as establishing capital standards, approving mergers and acquisitions and inspecting the operations of such companies. This authority applies even though a bank owned by a holding company may be under the primary supervision ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UFJ Bank

UFJ, which stands for the United Financial of Japan, is used in the former companies of UFJ Bank, UFJ Group, and UFJ Holdings. These related institutions disappeared after the merger of The Bank of Tokyo-Mitsubishi and UFJ Bank in 2005. UFJ Bank itself was established by the merger in 2002 of the Sanwa Bank, Tokai Bank, and Toyo Trust and Banking. See also * Mitsubishi UFJ Financial Group is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan. MUFG was created in 2005 by merger between and UFJ Holdings (株式会社UFJホールディングス; ''kabushikigaisha yūefujei hōrudingusu'' ... * MUFG Bank Banks of Japan Mitsubishi UFJ Financial Group {{Japan-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mizuho Financial Group

The , known from 2000 to 2003 as Mizuho Holdings and abbreviated as MHFG or simply Mizuho, is a Japanese banking holding company headquartered in the Ōtemachi district of Chiyoda, Tokyo, Japan. The group was formed in 2000-2002 by merger of Dai-Ichi Kangyo Bank, Fuji Bank, and Industrial Bank of Japan. The name literally means "abundant rice" in Japanese and "harvest" in the figurative sense. Mizuho Financial Group is the parent holding of Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Capital, and the majority owner of Asset Management One. The group offers a range of financial services, including banking, securities, trust and asset management services, employing more than 59,000 people throughout 880 offices. It is listed on the Tokyo Stock Exchange—where it is a constituent of the Nikkei 225 and TOPIX Core30 indices—and in the New York Stock Exchange in the form of American depositary receipts. Upon its founding, Mizuho was the largest bank in the w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

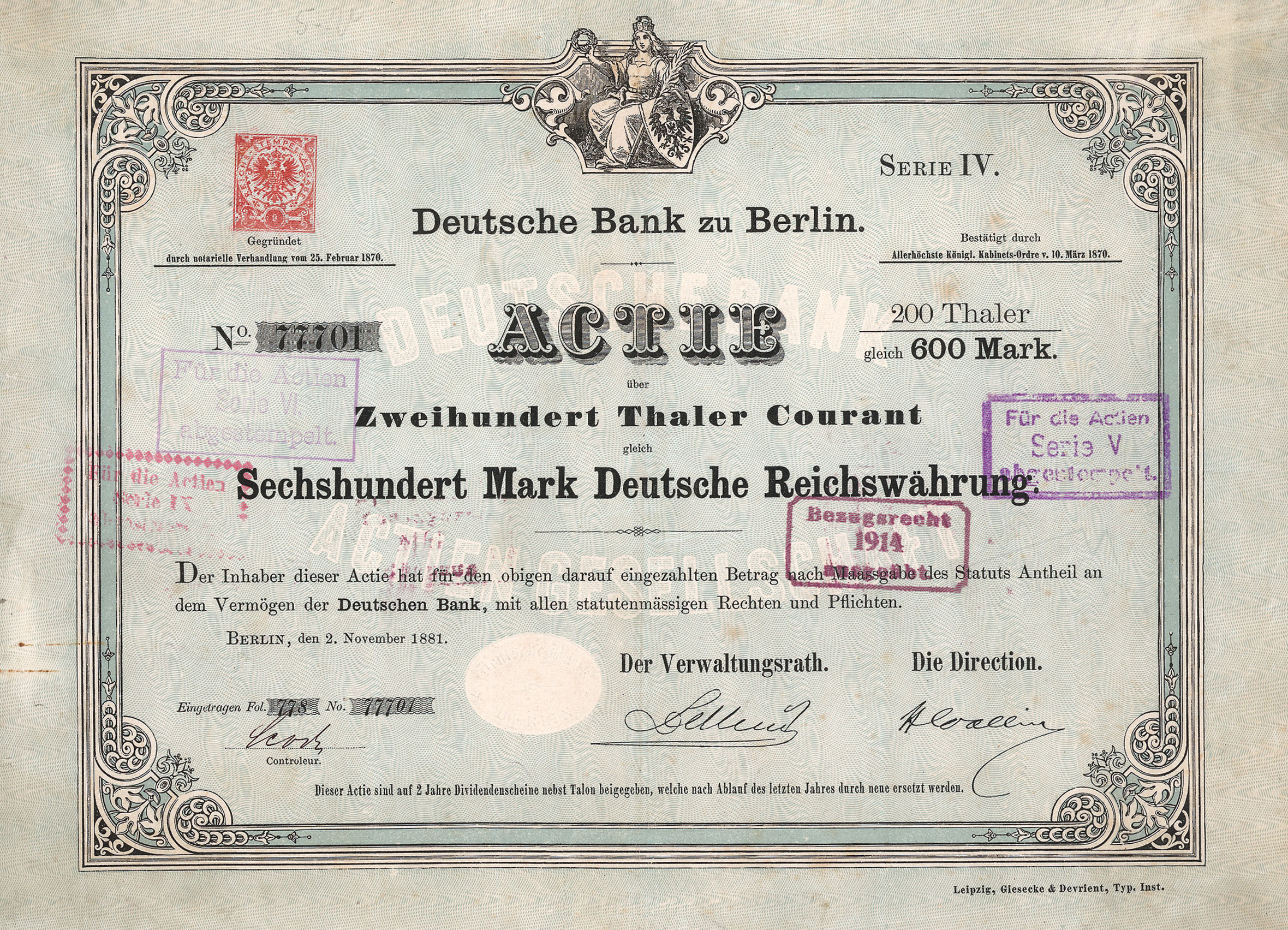

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tokai Bank

The Tokai Bank was a leading commercial bank in Japan, based in Nagoya. In the second half of the 20th century, it was the dominant bank in the Chūkyō metropolitan area of central Japan, the home of Toyota and other manufacturing firms. Tokai Bank was formed by merger during World War II, and eventually merged in 2000-2002 with Sanwa Bank and Toyo Trust and Banking to form UFJ Bank, a predecessor of Mitsubishi UFJ Financial Group. Overview The Tokai (, namely the Sea of Japan) Bank was established in 1941, before Japan's entry into World War II though well into the Second Sino-Japanese War. It resulted from the merger of three smaller banks of roughly equal size, namely the Ito Bank (est. 1881), Nagoya Bank (est. 1882), and Aichi Bank (est. 1896), all three based in Nagoya. The latter was itself the continuation of the Eleventh National Bank, originally established in 1877 under the system of National Banks in Meiji Japan (not to be confused with a later bank also named A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sanwa Bank

The was a major Japanese bank headquartered in Osaka, which operated from 1933 to 2002. It resulted from the merger of three local banks, (est. 1877 as 13th National Bank), (est. 1878), and (est. 1879 as 148th National Bank). In 2002, Sanwa Bank merged with Tokai Bank and Toyo Trust and Banking to form UFJ Bank, itself a predecessor entity of Mitsubishi UFJ Financial Group. Overview Sanwa was formed by the 1933 merger of three Osaka-based banks. The oldest of these banks, Kōnoike Bank, dated its operations back to 1656, when the Kōnoike family of Osaka established a money exchange business. The exchange was chartered to provide services for the Tokugawa shogunate in 1670. In 1877, it was awarded a national bank charter. By the 1930s, Kōnoike was unable to compete with larger banks tied to ''zaibatsu'' conglomerates, so it merged with the Sanjushi Bank and Yamaguchi Bank. It became the largest bank in Japan in terms of assets during the years prior to World War II. Dur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sumitomo Bank

was a major Japanese bank, founded 1895 in Osaka and a central component of the Sumitomo Group. For much of the 20th century it was one of the largest Japanese banks, together with Dai-Ichi Bank, Mitsubishi Bank, Mitsui Bank, and Yasuda / Fuji Bank. In 1948, it was renamed Osaka Bank, but reverted to Sumitomo Bank in 1952. On , Sumitomo Bank merged with Sakura Bank to form Sumitomo Mitsui Banking Corporation. History Sumitomo Bank was established as a private enterprise in November 1895 and reorganized as a limited company with 15 million yen of capital in March 1912. It opened overseas branches during the World War I era as the Sumitomo zaibatsu business became more international. By 1929, Sumitomo Bank had 8 offices outside of Japan and its colonies, more than any of its commercial banking peers though less than the Yokohama Specie Bank, Bank of Chōsen and Bank of Taiwan for which foreign trade was part of a public-interest mandate under special legislation. After World ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |