|

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is referred to as the "ceding company" or "cedent". The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain Solvency, solvent after major claims events, such as major disasters like hurricanes or wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies that accept reinsur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catastrophe Bond

Catastrophe bonds (also known as cat bonds) are a subset of insurance-linked securities (ILS) that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake. Catastrophe bonds emerged from a need by (re)insurance companies to alleviate some of the risks they would face if a major catastrophe occurred, which would incur damage that they could not cover with the invested premiums. An insurance company issues bonds through an investment bank, which are then sold to investors. Catastrophe bonds are non-investment grade corporate bonds (roughly equivalent to B or BB) with floating interest rates, and have an average maturity of 3 years with some up to 5 years but are uncommon. If no catastrophe occurred, the insurance company would pay a coupon to the investors. But if a catastrophe did occur, then the principal would be forgiven and the insurance company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Reinsurance

Financial reinsurance (or fin re) is a form of reinsurance which is focused more on capital management than on risk transfer. In the non-life insurance segment of the insurance industry this class of transactions is often referred to as finite reinsurance. One of the particular difficulties of running an insurance company is that its financial results - and hence its profitability - tend to be uneven from one year to the next. Since insurance companies generally want to produce consistent results, they may be attracted to ways of hoarding this year's profit to pay for next year's possible losses (within the constraints of the applicable standards for financial reporting). Financial reinsurance is one means by which insurance companies can "smooth" their results. A pure 'fin re' contract for a non-life insurer tends to cover a multi-year period, during which the premium is held and invested by the reinsurer. It is returned to the ceding company - minus a pre-determined profit marg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industry Loss Warranties

Industry loss warranties (ILWs), are a type of reinsurance contract used in the insurance industry through which one party will purchase protection based on the total loss arising from an event to the entire insurance industry above a certain trigger level rather than their own losses. For example, the buyer of a "$100million limit US Wind ILW attaching at $20bn" will pay a premium to a protection writer (generally a reinsurer but sometimes a hedge fund) and in return will receive $100million if total losses to the insurance industry from a single US hurricane exceed $20bn. The industry loss ($20bn in this case) is often referred to as the "trigger". The amount of protection offered by the contract ($100million in this case) is referred to as the "limit". ILWs could also be constructed based on an index not linked to insurance industry losses. For example, Professor Lawrence A. Cunningham of George Washington University suggests adapting similar mechanisms to the risks that l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catastrophe Modeling

Catastrophe modeling (also known as cat modeling) is the process of using computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic event such as a hurricane or earthquake. Cat modeling is especially applicable to analyzing risks in the insurance industry and is at the confluence of actuarial science, engineering, meteorology, and seismology. Catastrophes/ Perils Natural catastrophes (sometimes referred to as "nat cat") that are modeled include: * Hurricane (main peril is wind damage; some models can also include storm surge and rainfall) * Earthquake (main peril is ground shaking; some models can also include tsunami, fire following earthquakes, liquefaction, landslide, and sprinkler leakage damage) * severe thunderstorm or severe convective storms (main sub-perils are tornado, straight-line winds and hail) * Flood * Extratropical cyclone (commonly referred to as European windstorm) * Wildfire * Winter storm Human catastrophes inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans, or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governance

Governance is the overall complex system or framework of Process, processes, functions, structures, Social norm, rules, Law, laws and Norms (sociology), norms born out of the Interpersonal relationship, relationships, Social interaction, interactions, Power (social and political) , power dynamics and communication within an organized group of individuals. It sets the boundaries of acceptable conduct and practices of different actors of the group and controls their decision-making processes through the creation and enforcement of rules and guidelines. Furthermore, it also manages, allocates and mobilizes relevant resources and capacities of different members and sets the overall direction of the group in order to effectively address its specific collective needs, problems and challenges. The concept of governance can be applied to social, political or economic entities (groups of individuals engaged in some purposeful activity) such as a Country, state and its government (pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AM Best

A.M. Best Company, Inc. is an American credit rating agency headquartered in Oldwick, New Jersey, that focuses on the insurance industry. Both the U.S. Securities and Exchange Commission and the National Association of Insurance Commissioners have designated the company as a Nationally Recognized Statistical Rating Organization (NRSRO) in the United States. Business AM Best issues financial-strength ratings measuring insurance companies' ability to pay claims. It also rates financial instruments issued by insurance companies, such as bonds, notes, and securitization products. AM Best publishes a series of printed and online resources of insurance professionals and publications. The oldest and best known is ''Best's Recommended Insurance Attorneys & Adjusters''. Insurance publications include ''BestWeek'', a weekly newsletter, ''Best's Review'', a monthly digital & print magazine, and an online wire service called ''BestWire''. History Founded in 1899 by Alfred M. Best ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P Global Ratings

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is considered the largest of the Big Three credit-rating agencies, which also include Moody's Ratings and Fitch Ratings. Its head office is located on 55 Water Street in Lower Manhattan, New York City. Corporate history The company traces its history back to 1860, with the publication by Henry Varnum Poor of ''History of Railroads and Canals in the United States''. This book compiled comprehensive information about the financial and operational state of U.S. railroad companies. In 1868, Henry Varnum Poor established H.V. and H.W. Poor Co. with his son, Henry William Poor, and published two annually updated hardback guidebooks, '' Poor's Manual of the Railroads of the United States'' and ''Poor's Directory of Railway Officials''. In 1906, Lut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrics

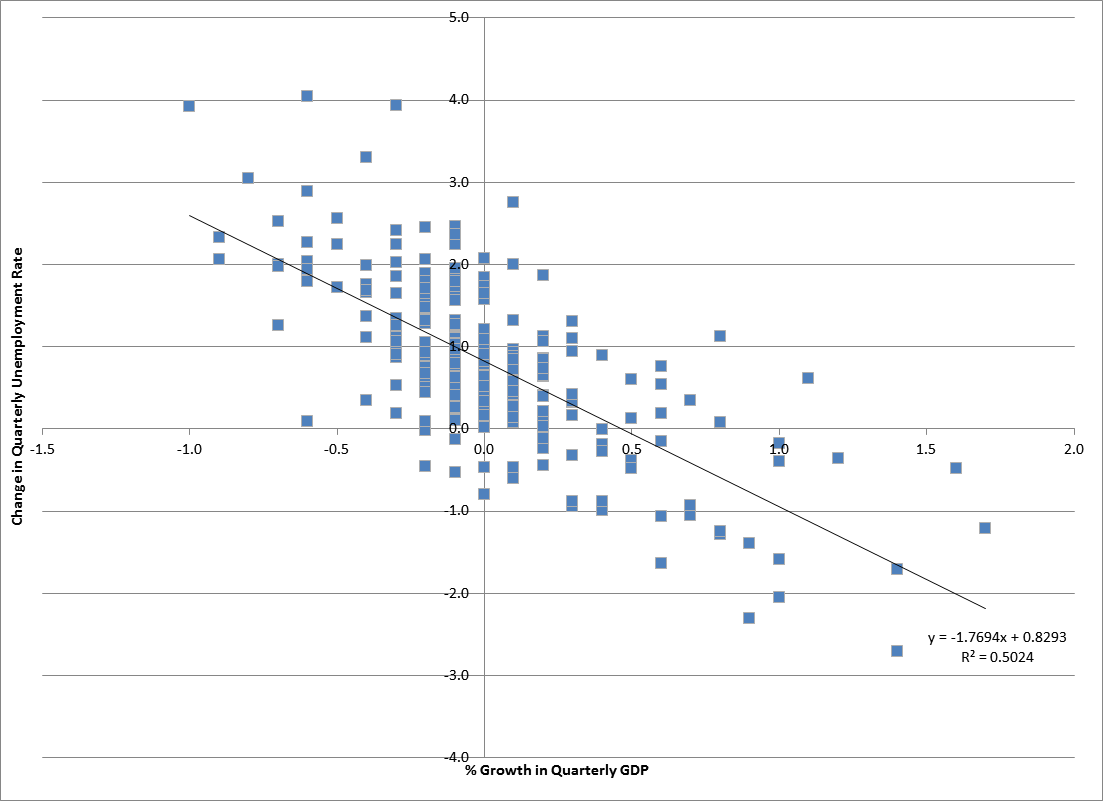

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1 p. 1–34Abstract ( 2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Econome ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |