|

Rally (stock Market)

A rally is a period of sustained increases in the prices of stocks, bonds or indices. This type of price movement can happen during either a bull or a bear market, when it is known as either a bull market rally or a bear market rally, respectively. However, a rally will generally follow a period of flat or declining prices.Investopedia Definition oMarket Rally/ref> An increase in prices during a primary trend bear market is called a ''bear market rally''. A bear market rally is sometimes defined as an increase of 10% to 20%. Bear market rallies typically begin suddenly and are often short-lived. Notable bear market rallies occurred in the Dow Jones index after the 1929 stock market crash leading down to the market bottom in 1932, and throughout the late 1960s and early 1970s. The Japan Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

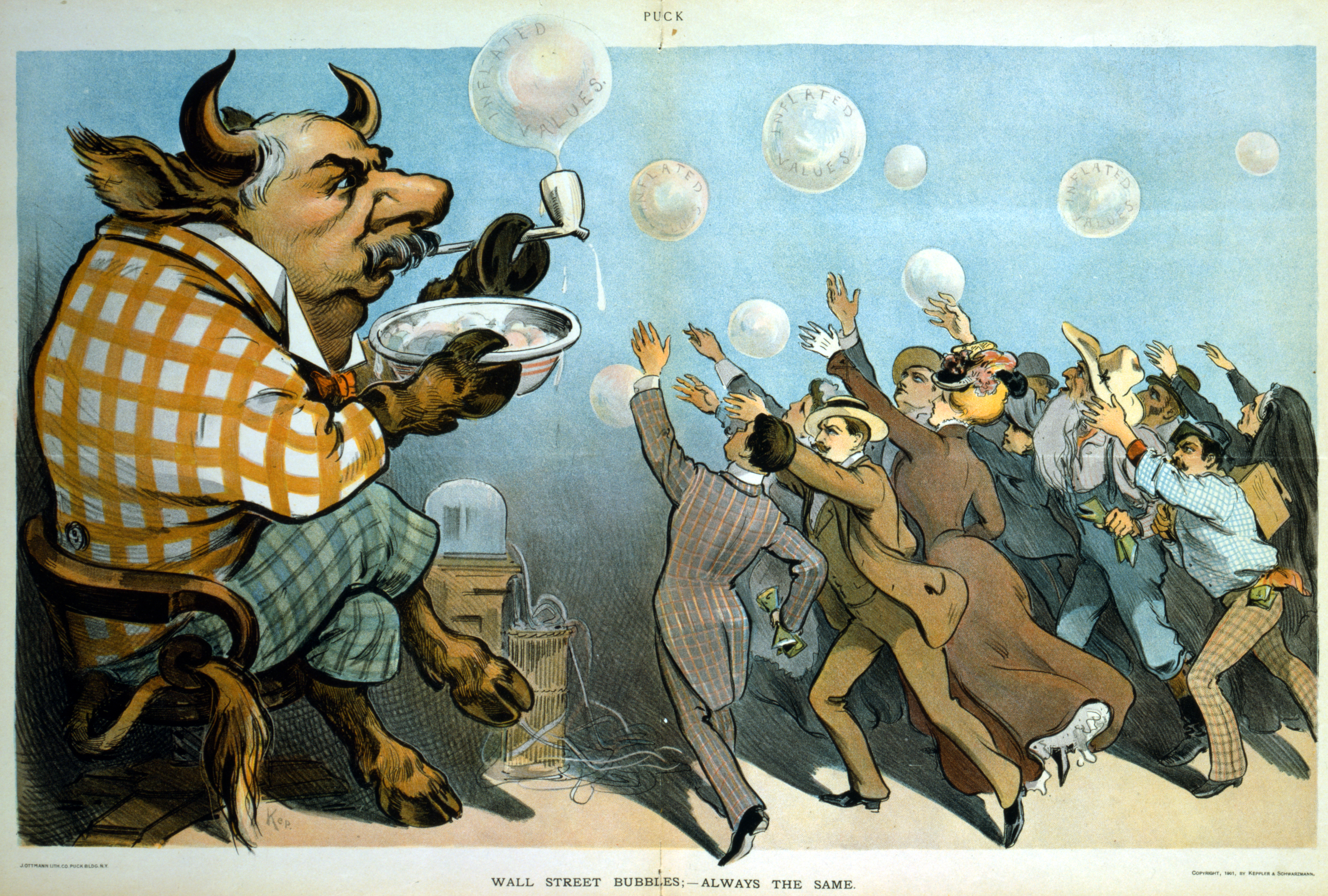

Bull Market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A future market trend can only be determined in hindsight, since at any time prices in the future are not known. This fact makes market timing inherently a game of educated guessing rather than a certainty. Past trends are identified by drawing lines, known as trendlines, that connect price action making higher highs and higher lows for an uptrend, or lower lows and lower highs for a downtrend. Market terminology The terms "bull market" and "bear market" describe upward and downward market tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indices. It is Price-weighted index, price-weighted, unlike other common indexes such as the Nasdaq Composite or S&P 500, which use Capitalization-weighted index, market capitalization. The DJIA also contains fewer stocks, which could exhibit higher risk; however, it could be less volatile when the market is rapidly rising or falling due to its components being well-established large-cap companies. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor, which is approximately 0.163 . The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea in the south. The Japanese archipelago consists of four major islands—Hokkaido, Honshu, Shikoku, and Kyushu—and List of islands of Japan, thousands of smaller islands, covering . Japan has a population of over 123 million as of 2025, making it the List of countries and dependencies by population, eleventh-most populous country. The capital of Japan and List of cities in Japan, its largest city is Tokyo; the Greater Tokyo Area is the List of largest cities, largest metropolitan area in the world, with more than 37 million inhabitants as of 2024. Japan is divided into 47 Prefectures of Japan, administrative prefectures and List of regions of Japan, eight traditional regions. About three-quarters of Geography of Japan, the countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nikkei 225

The Nikkei 225, or , more commonly called the ''Nikkei'' or the ''Nikkei index'' (), is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index, operating in the Japanese yen, Japanese Yen (JP¥), and its components are reviewed twice a year. The Nikkei 225 measures the performance of 225 highly capitalised and liquid publicly owned companies in Japan from a wide array of industry sectors. Since 2017, the index is calculated every five seconds. It was originally launched by the Tokyo Stock Exchange in 1950, and was taken over by the ''The Nikkei, Nihon Keizai Shimbun'' (''The Nikkei'') newspaper in 1950 in Japan, 1970, when the Tokyo Exchange switched to the TOPIX, Tokyo Stock Price Index (TOPIX), which is weighed by market capitalisation rather than stock prices. History The Nikkei 225 began to be calculated on 7 September 1950, retroactively calculated back to 16 May 1949, when the average price of its component stocks was 176.21 yen. Since July ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Trend

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A future market trend can only be determined in hindsight, since at any time prices in the future are not known. This fact makes market timing inherently a game of educated guessing rather than a certainty. Past trends are identified by drawing lines, known as trendlines, that connect price action making higher highs and higher lows for an uptrend, or lower lows and lower highs for a downtrend. Market terminology The terms "bull market" and "bear market" describe upward and downward market tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms. There are many definitions of a business cycle. The simplest defines recessions as two consecutive quarters of negative GDP growth. More satisfactory classifications are provided by, first including more economic indicators and second by looking for more data patterns than the two quarter definition. In the United States, the National Bureau of Economic Research oversees a Business Cycle Dating Committee that defines a recession as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." Business cycles are usually thought of as medium-term ev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trend Following

Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal, including the current market price calculation, moving averages and channel breakouts. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Due to the different techniques and time frames employed by trend followers to identify trends, trend followers as a group are not always strongly correlated to one another. Trend following is used by commodity trading advisors (CTAs) as the predominant strategy of technical traders. Research done by Galen Burghardt has shown that between 2000-2009 there was a very high correlation (.97) between tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |