|

Pecking Order Theory

In corporate finance, the pecking order theory (or pecking order model) postulates that "firms prefer to finance their investments internally, using retained earnings, before turning to external sources of financing such as debt or equity" - i.e. there is a " pecking order" when it comes to financing decisions. The theory was first suggested by Gordon Donaldson in 1961 and was modified by Stewart C. Myers and Nicolas Majluf in 1984. Theory The theory assumes asymmetric information, and that the firm's financing decision constitutes a signal to the market. Under the theory, managers know more about their company's prospects, risks and value than outside investors; see efficient market hypothesis. This asymmetry affects the choice between internal and external financing and between the issue of debt or equity: companies prioritize their sources of financing, first preferring internal financing, and then debt, with equity financing seen as a "last resort". Here, the issue of de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hierarchy

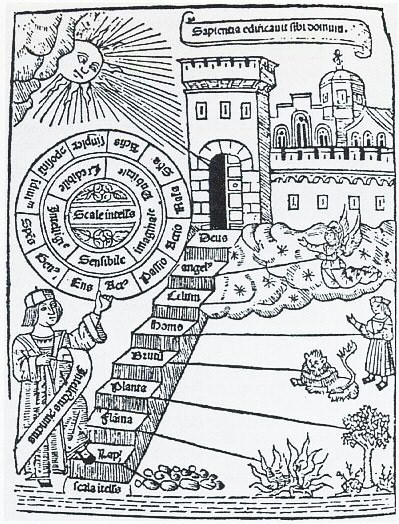

A hierarchy (from Ancient Greek, Greek: , from , 'president of sacred rites') is an arrangement of items (objects, names, values, categories, etc.) that are represented as being "above", "below", or "at the same level as" one another. Hierarchy is an important concept in a wide variety of fields, such as architecture, philosophy, design, mathematics, computer science, organizational theory, systems theory, systematic biology, and the social sciences (especially political science). A hierarchy can link entities either directly or indirectly, and either vertically or diagonally. The only direct links in a hierarchy, insofar as they are hierarchical, are to one's immediate superior or to one of one's subordinates, although a system that is largely hierarchical can also incorporate alternative hierarchies. Hierarchical links can extend "vertically" upwards or downwards via multiple links in the same direction, following a path (graph theory), path. All parts of the hierarchy that are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividends

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asymmetric Information

In contract theory, mechanism design, and economics, an information asymmetry is a situation where one party has more or better information than the other. Information asymmetry creates an imbalance of power in transactions, which can sometimes cause the transactions to be inefficient, causing market failure in the worst case. Examples of this problem are adverse selection, moral hazard,Dembe, Allard E. and Boden, Leslie I. (2000). "Moral Hazard: A Question of Morality?" New Solutions 2000 10(3). 257–79 and monopolies of knowledge. A common way to visualise information asymmetry is with a scale, with one side being the seller and the other the buyer. When the seller has more or better information, the transaction will more likely occur in the seller's favour ("the balance of power has shifted to the seller"). An example of this could be when a used car is sold, the seller is likely to have a much better understanding of the car's condition and hence its market value than the bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade-off Theory Of Capital Structure

The trade-off theory of capital structure is the idea that a company chooses how much debt finance and how much equity finance to use by balancing the costs and benefits. The classical version of the hypothesis goes back to Kraus and Litzenberger who considered a balance between the dead-weight costs of bankruptcy and the tax saving benefits of debt. Often agency costs are also included in the balance. This theory is often set up as a competitor theory to the pecking order theory of capital structure. A review of the trade-off theory and its supporting evidence is provided by Ai, Frank, and Sanati. An important purpose of the theory is to explain the fact that corporations usually are financed partly with debt and partly with equity. It states that there is an advantage to financing with debt, the tax benefits of debt and there is a cost of financing with debt, the costs of financial distress including bankruptcy costs of debt and non-bankruptcy costs (e.g. staff leaving, sup ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Timing Hypothesis

The market timing hypothesis, in corporate finance, is a theory of how firms and corporations decide whether to finance their investment with equity or with debt instruments. Here, equity market timing refers to "the practice of issuing shares at high prices and repurchasing at low prices, herethe intention is to exploit temporary fluctuations in the cost of equity relative to the cost of other forms of capital". Malcolm Baker and Jeffrey Wurgler (2002) "Market Timing and Capital Structure" ''The Journal of Finance''. It is one of many such corporate finance theories; it is often contrasted with the pecking order theory and the trade-off theory. It is differentiated by its emphasis on the level of the market, which is seen as the first order determinant of a corporation's capital structure: the (further) implication being that firms are generally ''indifferent'' as to whether they finance with debt or equity, choosing the form of financing, which, at that point in tim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Structure Substitution Theory

In finance, the capital structure substitution theory (CSS) describes the relationship between earnings, stock price and capital structure of public companies. The CSS theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share (EPS) are maximized. Managements have an incentive to do so because shareholders and analysts value EPS growth. The theory is used to explain trends in capital structure, valuation (finance), stock market valuation, dividend decision, dividend policy, the monetary transmission mechanism, and volatility (finance), stock volatility, and provides an alternative to the Modigliani–Miller theorem that has limited descriptive validity in real markets. The CSS theory is only applicable in markets where share repurchases are allowed. Investors can use the CSS theory to identify undervalued stocks. The formula The CSS theory assumes that company managements can freely change the capital structure of the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Asymmetry

In contract theory, mechanism design, and economics, an information asymmetry is a situation where one party has more or better information than the other. Information asymmetry creates an imbalance of power in transactions, which can sometimes cause the transactions to be inefficient, causing market failure in the worst case. Examples of this problem are adverse selection, moral hazard,Dembe, Allard E. and Boden, Leslie I. (2000). "Moral Hazard: A Question of Morality?" New Solutions 2000 10(3). 257–79 and monopolies of knowledge. A common way to visualise information asymmetry is with a scale, with one side being the seller and the other the buyer. When the seller has more or better information, the transaction will more likely occur in the seller's favour ("the balance of power has shifted to the seller"). An example of this could be when a used car is sold, the seller is likely to have a much better understanding of the car's condition and hence its market value than the buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade-off Theory

The trade-off theory of capital structure is the idea that a company chooses how much debt finance and how much equity finance to use by balancing the costs and benefits. The classical version of the hypothesis goes back to Kraus and Litzenberger who considered a balance between the dead-weight costs of bankruptcy and the tax saving benefits of debt. Often agency costs are also included in the balance. This theory is often set up as a competitor theory to the pecking order theory of capital structure. A review of the trade-off theory and its supporting evidence is provided by Ai, Frank, and Sanati. An important purpose of the theory is to explain the fact that corporations usually are financed partly with debt and partly with equity. It states that there is an advantage to financing with debt, the tax benefits of debt and there is a cost of financing with debt, the costs of financial distress including bankruptcy costs of debt and non-bankruptcy costs (e.g. staff leaving, supp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage (or gearing, in the United Kingdom) the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible. Capital structure is an important issue in setting rates charged to customers by regulated utilities in the United States. The utility company has the right to choose any capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First-order Approximation

In science, engineering, and other quantitative disciplines, order of approximation refers to formal or informal expressions for how accurate an approximation is. Usage in science and engineering In formal expressions, the ordinal number used before the word order refers to the highest power in the series expansion used in the approximation. The expressions: a ''zeroth-order approximation'', a ''first-order approximation'', a ''second-order approximation'', and so forth are used as fixed phrases. The expression a ''zero-order approximation'' is also common. Cardinal numerals are occasionally used in expressions like an ''order-zero approximation'', an ''order-one approximation'', etc. The omission of the word ''order'' leads to phrases that have less formal meaning. Phrases like first approximation or to a first approximation may refer to ''a roughly approximate value of a quantity''. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |