|

Payment Processing

A payment processor is a system that enables financial transactions, commonly employed by a merchant, to handle transactions with customers from various channels such as credit cards and debit cards or bank accounts. They are usually broken down into two types: front-end and back-end. Front-end processors have connections to various card associations and supply authorization and settlement services to the merchant banks' merchants. Back-end processors accept settlements from front-end processors and, via the Federal Reserve Bank for example, move the money from the issuing bank to the merchant bank. In an operation that will usually take a few seconds, the payment processor will both check the details received by forwarding them to the respective card's issuing bank or card association for verification, and also carry out a series of anti-fraud measures against the transaction. Additional parameters, including the card's country of issue and its previous payment history, ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant

A merchant is a person who trades in goods produced by other people, especially one who trades with foreign countries. Merchants have been known for as long as humans have engaged in trade and commerce. Merchants and merchant networks operated in ancient Babylonia, Assyria, China, Egypt, Greece, India, Persia, Phoenicia and Rome. During the European medieval period, a rapid expansion in trade and commerce led to the rise of a wealthy and powerful merchant class. The European Age of Discovery opened up new trading routes and gave European consumers access to a much broader range of goods. By the 18th century, a new type of manufacturer-merchant had started to emerge and modern business practices were becoming evident. The status of the merchant has varied during different periods of history and among different societies. In modern times, the term ''merchant'' has occasionally been used to refer to a businessperson or someone undertaking activities (commercial or industrial) for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December 2019. Soon after, it spread to other areas of Asia, and COVID-19 pandemic by country and territory, then worldwide in early 2020. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern (PHEIC) on 30 January 2020, and assessed the outbreak as having become a pandemic on 11 March. COVID-19 symptoms range from asymptomatic to deadly, but most commonly include fever, sore throat, nocturnal cough, and fatigue. Transmission of COVID-19, Transmission of the virus is often airborne transmission, through airborne particles. Mutations have variants of SARS-CoV-2, produced many strains (variants) with varying degrees of infectivity and virulence. COVID-19 vaccines were developed rapidly and deplo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Online Payment Service Providers

The following is a list of notable online payment service providers and payment gateway providing companies, their platform base and the countries they offer services in: (POS -- Point of Sale) See also * Payment gateway A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payment processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The ... * Payments as a service * Ripple (payment protocol) References {{Digital payment providers * Online companies Online payment service providers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Online Shopping

Online shopping is a form of electronic commerce which allows consumers to directly buy goods or services from a seller over the Internet using a web browser or a mobile app. Consumers find a product of interest by visiting the website of the retailer directly or by searching among alternative vendors using a shopping search engine, which displays the same product's availability and pricing at different e-retailers. customers can shop online using a range of different computers and devices, including desktop computers, laptops, tablet computers and smartphones. Online stores that evoke the physical analogy of buying products or services at a regular "brick-and-mortar" retailer or shopping center follow a process called business-to-consumer (B2C) online shopping. When an online store is set up to enable businesses to buy from another business, the process is instead called business-to-business (B2B) online shopping. A typical online store enables the customer to browse t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Service Provider

A payment service provider (PSP) is a third-party company that allows businesses to accept electronic payments, such as credit card and debit card payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. They will often provide merchant services and act as a payment gateway or payment processor for e-commerce and brick and mortar businesses. They may also offer risk management services for card and bank based payments, transaction payment matching, digital wallets, reporting, fund remittance, currency exchange and fraud protection. The PSP will typically provide software to integrate with e-commerce websites or point of sale systems. Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Currency

Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card. Digital currencies exhibit properties similar to traditional currencies, but generally do not have a classical physical form of fiat currency historically that can be held in the hand, like currencies with printed banknotes or minted coins. However, they do have a physical form in an unclassical sense coming from the computer to computer and computer to human interactions and the information and processing power of the servers that store and keep track o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Economy

The digital economy is a portmanteau of digital computing and economy, and is an umbrella term that describes how traditional Brick and mortar, brick-and-mortar economic activities (production, distribution, trade) are being transformed by the Internet and World Wide Web technologies. It has also been defined more broadly as the way "digital technologies are transforming work, organizations, and the economy." The digital economy is backed by the spread of information and communication technologies (ICT) across all business sectors to enhance productivity. A phenomenon referred to as the Internet of Things (IoT) is increasingly prevalent, as consumer products are embedded with digital services and devices. According to the World Economic Forum, WEF, 70% of the global economy will be made up of digital technology over the next 10 years (from 2020 onwards). This is a trend accelerated by the COVID-19 pandemic and the tendency to go online. The future of work, especially since the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-commerce

E-commerce (electronic commerce) refers to commercial activities including the electronic buying or selling products and services which are conducted on online platforms or over the Internet. E-commerce draws on technologies such as mobile commerce, electronic funds transfer, supply chain management, Internet marketing, online transaction processing, electronic data interchange (EDI), inventory management systems, and automated data collection systems. E-commerce is the largest sector of the electronics industry and is in turn driven by the technological advances of the semiconductor industry. Defining e-commerce The term was coined and first employed by Robert Jacobson, Principal Consultant to the California State Assembly's Utilities & Commerce Committee, in the title and text of California's Electronic Commerce Act, carried by the late Committee Chairwoman Gwen Moore (D-L.A.) and enacted in 1984. E-commerce typically uses the web for at least a part of a transacti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point To Point Encryption

Point-to-point encryption (P2PE) is a standard established by the PCI Security Standards Council. The objective of P2PE is to provide a payment security solution that instantaneously converts confidential payment card (credit and debit card) data and information into indecipherable code at the time the card is swiped, in order to prevent hacking and fraud. It is designed to maximize the security of payment card transactions in an increasingly complex regulatory environment. There also exist payment solutions based on end-to-end encryption, implying the highest level of confidentiality for the transferred data. The standard The P2PE Standard defines the requirements that a "solution" must meet in order to be accepted as a PCI-validated P2PE solution. A "solution" is a complete set of hardware, software, gateway, decryption, device handling, etc. Only "solutions" can be validated; individual pieces of hardware such as card readers cannot be validated. It is also a common mis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Card Industry Data Security Standard

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard used to handle credit cards from major card brands. The standard is administered by the Payment Card Industry Security Standards Council, and its use is mandated by the card brands. It was created to better control cardholder data and reduce credit card fraud. Validation of compliance is performed annually or quarterly with a method suited to the volume of transactions: * Self-assessment questionnaire (SAQ) * Firm-specific Internal Security Assessor (ISA) * External Qualified Security Assessor (QSA) History The major card brands had five different security programs: * Visa's Cardholder Information Security Program * Mastercard's Site Data Protection *American Express's Data Security Operating Policy * Discover's Information Security and Compliance * JCB's Data Security Program The intentions of each were roughly similar: to create an additional level of protection for card issuers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

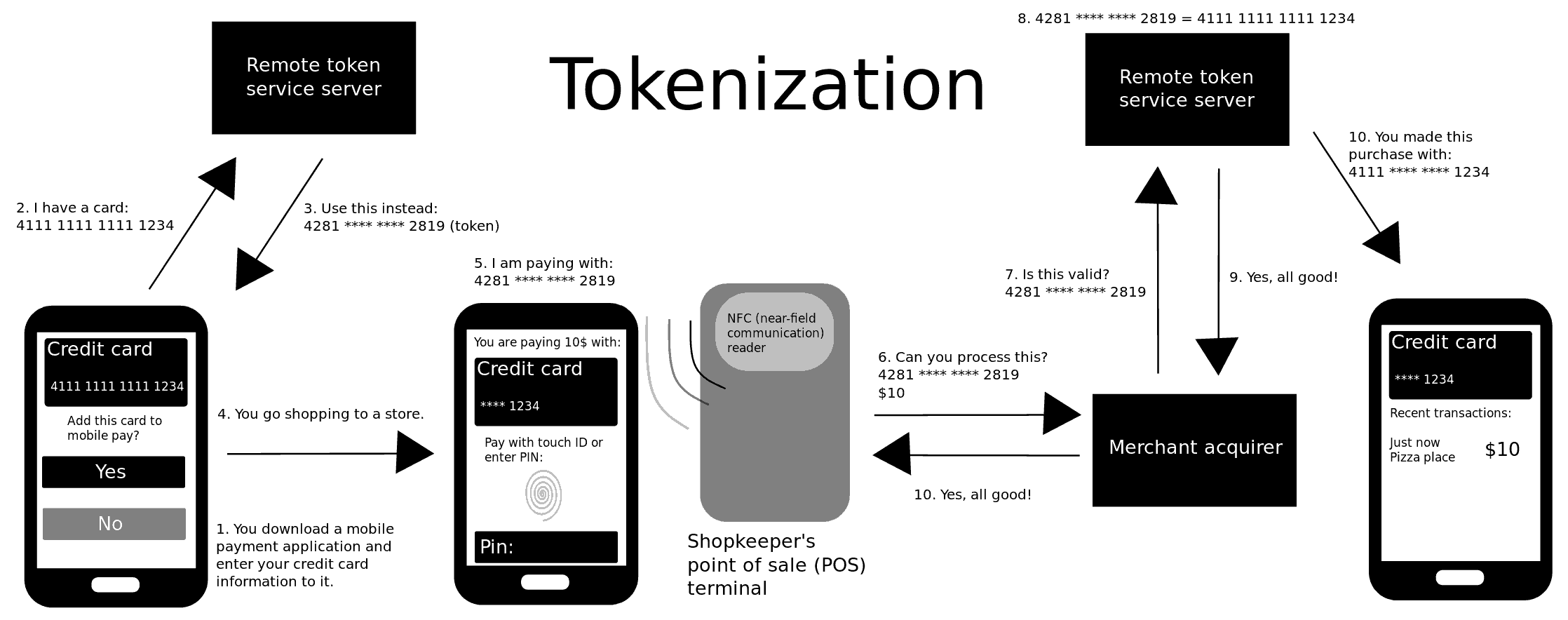

Tokenization (data Security)

Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a Security token, token, that has no intrinsic or exploitable meaning or value. The token is a reference (i.e. identifier) that maps back to the sensitive data through a tokenization system. The mapping from original data to a token uses methods that render tokens infeasible to reverse in the absence of the tokenization system, for example using tokens created from Random number generation, random numbers. A one-way cryptographic function is used to convert the original data into tokens, making it difficult to recreate the original data without obtaining entry to the tokenization system's resources. To deliver such services, the system maintains a vault database of tokens that are connected to the corresponding sensitive data. Protecting the system vault is vital to the system, and improved processes must be put in place to offer dat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Fraud

Credit card fraud is an inclusive term for fraud committed using a payment card, such as a credit card or debit card. The purpose may be to obtain goods or services or to make payment to another account, which is controlled by a criminal. The Payment Card Industry Data Security Standard (PCI DSS) is the data security standard created to help financial institutions process card payments securely and reduce card fraud. Credit card fraud can be authorised, where the genuine customer themselves processes payment to another account which is controlled by a criminal, or unauthorised, where the account holder does not provide authorisation for the payment to proceed and the transaction is carried out by a third party. In 2018, unauthorised financial fraud losses across payment cards and remote banking totalled £844.8 million in the United Kingdom. Whereas banks and card companies prevented £1.66 billion in unauthorised fraud in 2018. That is the equivalent to £2 in every £3 of atte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |