|

Patrick Honohan

Patrick Honohan (born 9 October 1949) is an Irish economist and public servant who served as the Governor of the Central Bank of Ireland from 2009 to 2015 (and as such was a member of the Governing Council of the European Central Bank). He has been a nonresident senior fellow at the Peterson Institute for International Economics since 2016. His period in office as Governor was mainly focused on resolving the Post-2008 Irish banking crisis. Education Honohan graduated with a B.A. in Economics and Mathematics from University College Dublin in 1971 and an M.A. in Economics from the same institution in 1973. His postgraduate study continued at the London School of Economics where he received an M.Sc. in Econometrics and Mathematical Economics (1974) and a PhD in Economics (1978). Professional career Before pursuing postgraduate research, Honohan took a position with the International Monetary Fund in 1971. While completing his PhD, he joined the economics staff of the Central Ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governor Of The Central Bank Of Ireland

The Central Bank of Ireland ( ga, Banc Ceannais na hÉireann) is Ireland's central bank, and as such part of the European System of Central Banks (ESCB). It is the country's financial services regulator for most categories of financial firms. It was the issuer of Irish pound banknotes and coinage until the introduction of the Euro currency, and now provides this service for the European Central Bank. The Central Bank of Ireland was founded on 1 February 1943, and since 1 January 1972 has been the banker of the Government of Ireland in accordance with the Central Bank Act 1971, which can be seen in legislative terms as completing the long transition from a currency board to a fully functional central bank. Its head office, the Central Bank of Ireland building, was located on Dame Street, Dublin from 1979 until 2017. Its offices at Iveagh Court and College Green also closed down at the same time. Since March 2017, its headquarters are located on North Wall Quay, where the pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Garret FitzGerald

Garret Desmond FitzGerald (9 February 192619 May 2011) was an Irish Fine Gael politician, economist and barrister who served twice as Taoiseach, serving from 1981 to 1982 and 1982 to 1987. He served as Leader of Fine Gael from 1977 to 1987, and was twice Leader of the Opposition between 1977 and 1982; he was previously Minister for Foreign Affairs from 1973 to 1977. FitzGerald served as a Teachta Dála (TD) from 1969 to 1992 and was a Senator for the Industrial and Commercial Panel from 1965 to 1969. He was the son of Desmond FitzGerald, the first foreign minister of the Irish Free State. At the time of his death, FitzGerald was president of the Institute of International and European Affairs and a columnist for ''The Irish Times'', and had made occasional appearances on television programmes. Early life Garret FitzGerald was born in Ballsbridge, Dublin, in 1926, son of Desmond FitzGerald and Mabel McConnell Fitzgerald. His mother was involved in politics, and it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document was legally effective. More modern versions of the tax no longer require an actual stamp. The duty is thought to have originated in Venice in 1604, being introduced (or re-invented) in Spain in the 1610s, the Spanish Netherlands in the 1620s, France in 1651, Denmark in 1657, Prussia in 1682 and England in 1694. Usage by country Australia The Australian Federal Government does not levy stamp duty. However, stamp duties are levied by the Australian states on various instruments (written documents) and transactions. Stamp duty laws can differ significantly between all eight jurisdictions. The rates of stamp duty also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return, however its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisitio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leprechaun Economics

Leprechaun economics was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 Irish national accounts. At that point, the distortion of Irish economic data by tax-driven accounting flows reached a climax. In 2020, Krugman said the term was a feature of all tax havens. While the event that caused the artificial Irish GDP growth occurred in Q1 2015, the Irish CSO had to delay its GDP revision and redact the release of its regular economic data in 2016–2017 to protect the source's identity, as required by Irish law. Only in Q1 2018 could economists confirm Apple as the source, and that this was the largest ever base erosion and profit shifting (BEPS) action, and the largest hybrid– tax inversion of a U.S. corporation. The event marked the replacement of Ireland's prohibited BEPS tool, the Double Irish, with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

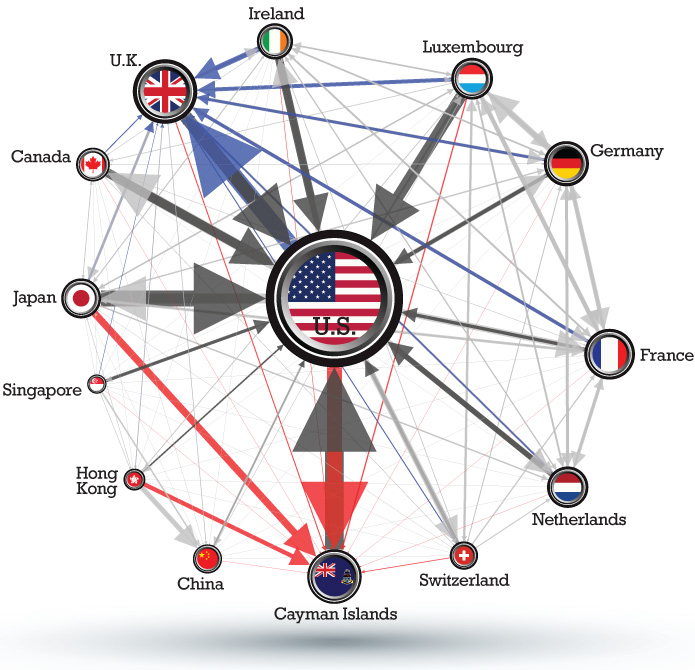

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Green Jersey Agenda

'Put on the green jersey' is a phrase to represent putting the Irish national interest first. The phrase can be used in a positive sense, for example evoking feelings of national unity during times of crisis. The phrase can also be used in a negative sense - e.g. the Irish national interest as an excuse for immoral conduct or corruption. The phrase reflects the wearing of green sports jerseys by most of Ireland's sporting teams. Main use Political intrigue While the term is used in a range of contexts, it is most common to see it used in a pejorative sense, and to describe taking face saving actions, over unveiling the facts. In this context, it is often used in relation to political situations and the choice between protecting Ireland's international reputation versus the need for public disclosure. The term is invoked frequently in such a manner during debates in the Irish Dáil Éireann (a search of Dáil Éireann debates lists over 400 instances), where opposition members s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trinity College, Dublin

, name_Latin = Collegium Sanctae et Individuae Trinitatis Reginae Elizabethae juxta Dublin , motto = ''Perpetuis futuris temporibus duraturam'' (Latin) , motto_lang = la , motto_English = It will last into endless future times , founder = Queen Elizabeth I , established = , named_for = The Holy Trinity.The Trinity was the patron of The Dublin Guild Merchant, primary instigators of the foundation of the University, the arms of which guild are also similar to those of the College. , previous_names = , status = , architect = , architectural_style =Neoclassical architecture , colours = , gender = , sister_colleges = St. John's College, CambridgeOriel College, Oxford , freshman_dorm = , head_label = , head = , master = , vice_head_label = , vice_head = , warden ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian National University

The Australian National University (ANU) is a public research university located in Canberra, the capital of Australia. Its main campus in Acton encompasses seven teaching and research colleges, in addition to several national academies and institutes. ANU is regarded as one of the world's leading universities, and is ranked as the number one university in Australia and the Southern Hemisphere by the 2022 QS World University Rankings and second in Australia in the '' Times Higher Education'' rankings. Compared to other universities in the world, it is ranked 27th by the 2022 QS World University Rankings, and equal 54th by the 2022 '' Times Higher Education''. In 2021, ANU is ranked 20th (1st in Australia) by the Global Employability University Ranking and Survey (GEURS). Established in 1946, ANU is the only university to have been created by the Parliament of Australia. It traces its origins to Canberra University College, which was established in 1929 and was integrated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |