|

Order Book (trading)

An order book is the list of orders (manual or electronic) that a trading venue (in particular stock exchanges) uses to record the interest of buyers and sellers in a particular financial instrument. A matching engine uses the book to determine which orders can be fully or partially executed. In securities trading In securities trading, an order book contains the list of buy orders and the list of sell orders. For each entry it must keep among others, some means of identifying the party (even if this identification is obscured, as in a dark pool), the number of securities and the price that the buyer or seller are bidding/asking for the particular security. Price levels When several orders contain the same price, they are referred as a price level, meaning that if, say, a bid comes at that price level, all the sell orders on that price level could potentially fulfill that. Crossed book When the order book is part of a matching engine, orders are matched as the interest of buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

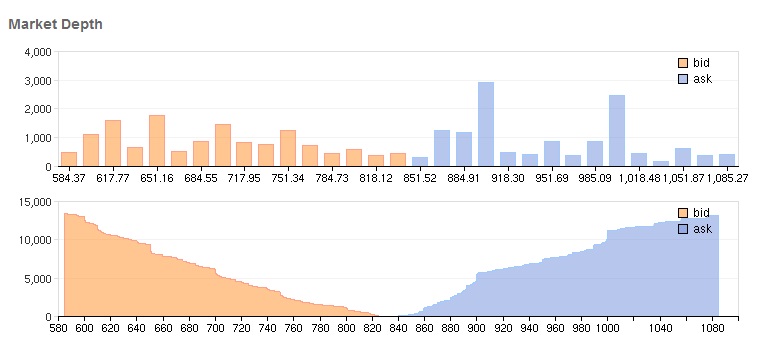

Order Book Depth Chart

Order, ORDER or Orders may refer to: * A socio-political or established or existing order, e.g. World order, Ancien Regime, Pax Britannica * Categorization, the process in which ideas and objects are recognized, differentiated, and understood * Heterarchy, a system of organization wherein the elements have the potential to be ranked a number of different ways * Hierarchy, an arrangement of items that are represented as being "above", "below", or "at the same level as" one another * an action or inaction that must be obeyed, mandated by someone in authority People * Orders (surname) Arts, entertainment, and media * Order (film), ''Order'' (film), a 2005 Russian film * Order (album), ''Order'' (album), a 2009 album by Maroon * "Order", a 2016 song from ''Brand New Maid'' by Band-Maid * Orders (1974 film), ''Orders'' (1974 film), a film by Michel Brault * Orders (Star Wars: The Clone Wars), "Orders" (''Star Wars: The Clone Wars'') Business * Blanket order, a purchase order to allow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply And Demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris_paribus#Applications, holding all else equal, the unit price for a particular Good (economics), good or other traded item in a perfect competition, perfectly competitive market, will vary until it settles at the market clearing, market-clearing price, where the quantity demanded equals the quantity supplied such that an economic equilibrium is achieved for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In situations where a firm has market power, its decision on how much output to bring to market influences the market price, in violation of perfect competition. There, a more complicated model should be used; for example, an oligopoly or product differentiation, differentiated-product model. Likewise, where a buyer has market power, models such as monopsony will be more a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Depth

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the Financial markets, market price by a given amount. If the market is ''deep'', a large order is needed to change the price. Factors influencing market depth *Tick size. This refers to the minimum price increment at which trades may be made on the market. The major stock markets in the United States went through a process of decimalisation in April 2001. This switched the minimum increment from a sixteenth to a one hundredth of a dollar. This decision improved market depth.Market Depth Investopedia *Price movement restrictions. Most major financial markets do not allow completely free exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-commerce

E-commerce (electronic commerce) refers to commercial activities including the electronic buying or selling products and services which are conducted on online platforms or over the Internet. E-commerce draws on technologies such as mobile commerce, electronic funds transfer, supply chain management, Internet marketing, online transaction processing, electronic data interchange (EDI), inventory management systems, and automated data collection systems. E-commerce is the largest sector of the electronics industry and is in turn driven by the technological advances of the semiconductor industry. Defining e-commerce The term was coined and first employed by Robert Jacobson, Principal Consultant to the California State Assembly's Utilities & Commerce Committee, in the title and text of California's Electronic Commerce Act, carried by the late Committee Chairwoman Gwen Moore (D-L.A.) and enacted in 1984. E-commerce typically uses the web for at least a part of a transacti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (accounting)

Profit, in accounting, is an income distributed to the ownership , owner in a Profit (economics) , profitable market production process (business). Profit is a measure of profitability which is the owner's major interest in the income-formation process of market production. There are several profit measures in common use. Income formation in market production is always a balance between income generation and income distribution. The income generated is always distributed to the Stakeholder (corporate), stakeholders of production as economic value within the review period. The profit is the share of income formation the owner is able to keep to themselves in the income distribution process. Profit is one of the major sources of economics , economic well-being because it means incomes and opportunities to develop production. The words "income", "profit" and "earnings" are synonyms in this context. Other terms See also * Gross income * Net profit * Profitability index * Rate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Margin

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every dollar of revenue generated. Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry. All margin changes provide useful indicators for assessing growth potential, investment viability and the financial stability of a company relative to its competitors. Maintaining a healthy profit margin will help to ensure the financial success of a business, which will improve its ability to obtain loans. It is calculated by finding the profit as a percentage of the revenue. \text = = For example, if a company reports that it achieved a 35% profit margin during the last quarter, it means that it netted $0.35 from each dollar of sales generated. Profit margins are generally distinct from rate of return. Pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order (business)

In business or commerce, an order is a stated intention, either spoken or written, to engage in a commercial transaction for specific products or services. From a buyer's point of view it expresses the intention to buy and is called a purchase order. From a seller's point of view it expresses the intention to sell and is referred to as a sales order. When the purchase order of the buyer and the sales order of the seller agree, the orders become a contract between the buyer and seller. Within an organization, it may be a work order for manufacturing, a preventive maintenance order, or an order to make repairs to a facility. In many businesses, orders are used to collect and report costs and revenues according to well-defined purposes. Then it is possible to show for what purposes costs have been incurred. Spoken orders Businesses such as retail stores, restaurants and filling stations conduct business with their customers by accepting orders that are spoken or implied by the bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MtGox

Mt. Gox was a bitcoin exchange based in Shibuya, Tokyo, Japan. Launched in 2010, it was handling over 70% of all bitcoin transactions worldwide by early 2014, when it abruptly ceased operations amid revelations of its involvement in the loss/theft of hundreds of thousands of bitcoin, then worth hundreds of millions in US dollars. In February 2014, Mt. Gox suspended trading, closed its website and exchange service, and filed for bankruptcy protection from creditors. In April 2014, the company began liquidation proceedings. Although 200,000 bitcoins have since been "found", the reasons for the disappearance—theft, fraud, mismanagement, or a combination of these—were initially unclear. New evidence presented in April 2015 by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot cryptocurrency wallet over time, beginning in late 2011." The collapse of Mt. Gox and the subsequent arrest and convicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order Matching System

An order matching system or simply matching system is an electronic system that matches order (exchange), buy and sell orders for a stock market, commodity market or other financial exchanges. The order matching system is the core of all electronic Exchange (organized market), exchanges and are used to execute orders from participants in the exchange. Orders are usually entered by members of an exchange and executed by a central system that belongs to the exchange. The algorithm that is used to match orders varies from system to system and often involves rules around best execution. The order matching system and implied order system or Implication engine is often part of a larger electronic trading system which will usually include a settlement system and a central securities depository that are accessed by electronic trading platforms. These services may or may not be provided by the organisation that provides the order matching system. The matching algorithms decide the effic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order (exchange)

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders. Market order A market order is a buy or sell order to be executed immediately at the ''current'' ''market'' prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are used when certainty of execution is a priority over the price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. A market order may b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jean-François Mertens

Jean-François Mertens (11 March 1946 – 17 July 2012) was a Belgian game theorist and mathematical economist. Mertens contributed to economic theory in regards to order-book of market games, cooperative games, noncooperative games, repeated games, epistemic models of strategic behavior, and refinements of Nash equilibrium (see solution concept). In cooperative game theory he contributed to the solution concepts called the core and the Shapley value. Regarding repeated games and stochastic games, Mertens 1982 and 1986 survey articles, and his 1994 survey co-authored with Sylvain Sorin and Shmuel Zamir, are compendiums of results on this topic, including his own contributions. Mertens also made contributions to probability theory and published articles on elementary topology. Epistemic models Mertens and Zamir implemented John Harsanyi's proposal to model games with incomplete information by supposing that each player is characterized by a privately known type that describes h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid–ask Spread

The bid–ask spread (also bid–offer or bid/ask and buy/sell in the case of a market maker) is the difference between the prices quoted (either by a single market maker or in a Order book (trading), limit order book) for an immediate sale (Ask price, ask) and an immediate purchase (Bid price, bid) for Shares, stocks, futures contracts, Option (finance), options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless market, frictionless asset. Liquidity The trader initiating the transaction is said to demand market liquidity, liquidity, and the other party (counterparty) to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders. For a round trip (a purchase and sale together) the liquidity demander pays the spread and the liquidity supplier earns the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |