|

Option Adjusted Spread

Option-adjusted spread (OAS) is the yield spread which has to be added to a benchmark yield curve to discount a security's payments to match its market price, using a dynamic pricing model that accounts for embedded options. OAS is hence model-dependent. This concept can be applied to a mortgage-backed security (MBS), or another bond with embedded options, or any other interest rate derivative or option. More loosely, the OAS of a security can be interpreted as its "expected outperformance" versus the benchmarks, if the cash flows and the yield curve behave consistently with the valuation model. In the context of an MBS or callable bond, the embedded option relates primarily to the borrower's right to early repayment, a right commonly exercised via the borrower refinancing the debt. These securities must therefore pay higher yields than noncallable debt, and their values are more fairly compared by OAS than by yield. OAS is usually measured in basis points (bp, or 0.01%). Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OAS Valuation Tree (es)

OAS or Oas may refer to: Chemistry * O-Acetylserine, amino-acid involved in cysteine synthesis Computers * Open-Architecture-System, the main user interface of Wersi musical keyboards * OpenAPI Specification (originally Swagger Specification), specification for machine-readable interface files for RESTful Web services * Oracle Application Server, software platform Medicine * Open aortic surgery, surgical technique * Oral allergy syndrome, food-related allergic reaction in the mouth * 2'-5'-oligoadenylate synthase, an enzyme ** OAS1, OAS2, OAS3, anti-viral enzymes in humans Organizations * Office of Aviation Services, agency of the United States Department of the Interior * Ontario Archaeological Society, organization promoting archaeology within the Province of Ontario, Canada * Organisation Armée Secrète, French dissident terrorist organisation, active during the Algerian War (1954–1962), fighting against Algerian independence * Organization of American States, continenta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Z-spread

The Z-spread, ZSPRD, zero- volatility spread, or yield curve spread of a bond is the parallel shift or spread over the zero-coupon Treasury yield curve required for discounting a predetermined cash flow schedule to arrive at its present market price. The Z-spread is also widely used in the credit default swap (CDS) market as a measure of credit spread that is relatively insensitive to the particulars of specific corporate or government bonds. Since the Z-spread uses the entire yield curve to value the individual cash flows of a bond, it provides a more realistic valuation than an interpolated yield spread based on a single point of the curve, such as the bond's final maturity date or weighted-average life. However, the Z-spread does not incorporate variability in cash flows, so a fuller valuation of an interest-rate-dependent security often requires the more realistic (and more complicated) option-adjusted spread (OAS). Definition The Z-spread of a bond is the number o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interpolation

In the mathematics, mathematical field of numerical analysis, interpolation is a type of estimation, a method of constructing (finding) new data points based on the range of a discrete set of known data points. In engineering and science, one often has a number of data points, obtained by sampling (statistics), sampling or experimentation, which represent the values of a function for a limited number of values of the Dependent and independent variables, independent variable. It is often required to interpolate; that is, estimate the value of that function for an intermediate value of the independent variable. A closely related problem is the function approximation, approximation of a complicated function by a simple function. Suppose the formula for some given function is known, but too complicated to evaluate efficiently. A few data points from the original function can be interpolated to produce a simpler function which is still fairly close to the original. The resulting gai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

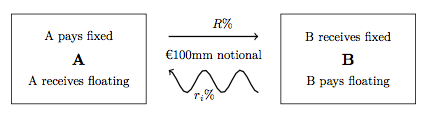

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money (which includes the annual effective discount rate). It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, expectation operator, mathematical expectation, mean, expectation value, or first Moment (mathematics), moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean, mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would expect to get in reality. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by Integral, integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monte Carlo Methods For Option Pricing

In mathematical finance, a Monte Carlo option model uses Monte Carlo methodsAlthough the term 'Monte Carlo method' was coined by Stanislaw Ulam in the 1940s, some trace such methods to the 18th century French naturalist Buffon, and a question he asked about the results of dropping a needle randomly on a striped floor or table. See Buffon's needle. to calculate the value of an option with multiple sources of uncertainty or with complicated features. The first application to option pricing was by Phelim Boyle in 1977 (for European options). In 1996, M. Broadie and P. Glasserman showed how to price Asian options by Monte Carlo. An important development was the introduction in 1996 by Carriere of Monte Carlo methods for options with early exercise features. Methodology As is standard, Monte Carlo valuation relies on risk neutral valuation.Marco DiasReal Options with Monte Carlo Simulation/ref> Here the price of the option is its discounted expected value; see risk neutrality ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic

Stochastic (; ) is the property of being well-described by a random probability distribution. ''Stochasticity'' and ''randomness'' are technically distinct concepts: the former refers to a modeling approach, while the latter describes phenomena; in everyday conversation, however, these terms are often used interchangeably. In probability theory, the formal concept of a '' stochastic process'' is also referred to as a ''random process''. Stochasticity is used in many different fields, including image processing, signal processing, computer science, information theory, telecommunications, chemistry, ecology, neuroscience, physics, and cryptography. It is also used in finance (e.g., stochastic oscillator), due to seemingly random changes in the different markets within the financial sector and in medicine, linguistics, music, media, colour theory, botany, manufacturing and geomorphology. Etymology The word ''stochastic'' in English was originally used as an adjective with the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioral Economics

Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economic theory. Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. Behavioral economics began as a distinct field of study in the 1970s and 1980s, but can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires. The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century. Behavioral economics is still growing as a field, being used increasingly in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Path-dependent

Path dependence is a concept in the social sciences, referring to processes where past events or decisions constrain later events or decisions. It can be used to refer to outcomes at a single point in time or to long-run equilibria of a process. Path dependence has been used to describe institutions, technical standards, patterns of economic or social development, organizational behavior, and more. In common usage, the phrase can imply two types of claims. The first is the broad concept that "history matters", often articulated to challenge explanations that pay insufficient attention to historical factors. This claim can be formulated simply as "the future development of an economic system is affected by the path it has traced out in the past" or "particular events in the past can have crucial effects in the future." The second is a more specific claim about how past events or decisions affect future events or decisions in significant or disproportionate ways, through mechanisms s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prepayment Of Loan

Prepayment is the early repayment of a loan by a borrower, in part (commonly known as a curtailment) or in full, often as a result of optional refinancing to take advantage of lower interest rates.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 4 (Thomson West, 2013 ed.). In the case of a mortgage-backed security (MBS), prepayment is perceived as a financial risk—sometimes known as "call risk"—because mortgage loans are often paid off early in order to incur lower interest payments through cheaper refinancing. The new financing may be cheaper because the borrower's credit has improved or because market interest rates have fallen; but in either of these cases, the payments that ''would have been made'' to the MBS investor would be above current market rates. Redeeming such loans early through prepayment reduces the investor's upside from credit and interest rate variability in an MBS, and in essence forces the MBS investor to reinvest the proceeds at lower ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |