|

Opendoor

Opendoor Technologies Inc. is an online company that buys and sells residential real estate. Headquartered in San Francisco, it makes instant cash offers on homes through an online process, makes repairs on the properties it purchases and relists them for sale. It also provides mobile application-based home buying services along with financing. As of November 2021, the company operates in 44 markets in the US. History The company was founded in March 2014 by serial entrepreneurs Keith Rabois, Eric Wu, who previously founded Movity, a real-estate startup acquired by Trulia, and JD Ross, now a general partner at Atomic. After raising a $9.95m venture capital round led by Khosla Ventures in May 2014, the company began operations. In 2018, Opendoor raised $400m in funding from the SoftBank Group Vision Fund. In 2019, it raised $300m in a funding round led by General Atlantic. At the time, the enterprise valuation was $3.8b. In August 2019, Opendoor launched mortgage services throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eric Wu (businessperson)

Eric Wu is an American investor and entrepreneur. Since 2008, Wu has founded several companies having to do with real estate, such as RentAdvisor and Movity; in 2014, he co-founded Opendoor, an iBuyer company, and served as its CEO until 2024. He has also invested in dozens of companies such as Airtable and Roofstock. At the age of 37, Wu was named to ''Fortune'''s 40 under 40. In 2022, he was the third youngest CEO on the ''Fortune'' 500 at the age of 39. ''Business Insider'' named him a top 60 angel investor and a top 100 early-stage seed investor. In 2024, Wu was listed in the Angels' Share 100, "an exclusive list of the most active angel investors in the most promising startups in enterprise tech." Early life and education Wu grew up in Glendale, Arizona as the son of Taiwanese immigrants. His father passed away when he was four. At the time, his mother worked as a social worker. While studying economics at the University of Arizona, at the age of 19, Wu bought his f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zillow

Zillow Group, Inc., or simply Zillow, is an American tech real-estate marketplace company that was founded in 2006 by co-executive chairmen Rich Barton and Lloyd Frink, former Microsoft executives and founders of Microsoft spin-off Expedia; Spencer Rascoff, a co-founder of Hotwire.com; David Beitel, Zillow's current chief technology officer; and Kristin Acker, Zillow's current technology leadership advisor. History Early history Rich Barton got the inspiration for Zillow while at Microsoft, where he had founded Expedia.com from within the company. Barton believed that a consumer-facing site could transform the real estate industry in the same way that Expedia had the travel industry. Barton told the Seattle Post-Intelligencer, "the web [had] been around for now 9 years or 10 years, but still I couldn't get pictures of homes and complete listings and prices and addresses." "We were trying to answer a simple question. What is that house worth? What should we offer if we wanted ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Softbank Portfolio Companies

is a Japanese multinational Investment company, investment holding company headquartered in Minato, Tokyo, that focuses on investment management. The group primarily invests in companies operating in technology that offer goods and services to customers in a multitude of markets and industries ranging from the internet to automation. With over $100 billion in capital at its onset, SoftBank's SoftBank Vision Fund, Vision Fund is the world's largest technology-focused venture capital fund. Fund investors included sovereign wealth funds from countries in the Middle East. The company is known for the leadership of its controversial founder and largest shareholder Masayoshi Son. Its investee companies, subsidiaries and divisions, including several unprofitable Unicorn (finance), unicorns, operate in robotics, artificial intelligence, software, logistics, transportation, biotechnology, robotic process automation, Property technology, proptech, real estate, hospitality, broadband, f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SoftBank Group

is a Japanese multinational investment holding company headquartered in Minato, Tokyo, that focuses on investment management. The group primarily invests in companies operating in technology that offer goods and services to customers in a multitude of markets and industries ranging from the internet to automation. With over $100 billion in capital at its onset, SoftBank's Vision Fund is the world's largest technology-focused venture capital fund. Fund investors included sovereign wealth funds from countries in the Middle East. The company is known for the leadership of its controversial founder and largest shareholder Masayoshi Son. Its investee companies, subsidiaries and divisions, including several unprofitable unicorns, operate in robotics, artificial intelligence, software, logistics, transportation, biotechnology, robotic process automation, proptech, real estate, hospitality, broadband, fixed-line telecommunications, e-commerce, information technology, finance, me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keith Rabois

Keith Rabois (born March 17, 1969) is an American technology executive and investor. He is a managing director at Khosla Ventures. He was an early-stage startup investor, and executive, at PayPal, LinkedIn, Slide, and Square. Rabois invested in Yelp and the Xoom Corporation prior to each company's initial public offering (IPO). For both investments he insisted on being a board of directors member. Rabois is considered a member of the ''PayPal Mafia''. Rabois has been involved in investments in YouTube, Palantir Technologies, Lyft, Airbnb, Eventbrite, wish.com, Relcy and theorg.com. Early life and education Rabois was born on March 17, 1969, and raised in Edison, New Jersey. He studied political science as an undergraduate at Stanford University, receiving his B.A. in 1991 and a J.D. from Harvard Law School in 1994. While at Stanford, he became acquainted with Peter Thiel, then-editor and co-founder of '' The Stanford Review''. Rabois later contributed to the libertarian ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Khosla Ventures

Khosla Ventures is a private American venture capital firm based in Menlo Park, California. It was founded by entrepreneur Vinod Khosla in 2004. The firm works with early-stage companies in the Internet, computing, mobile technology, artificial intelligence, financial services, agriculture, healthcare and clean technology sectors. It is known for making early capital investments in startups such as Impossible Foods, Instacart, Affirm, DoorDash, Square and OpenAI. History The firm was founded in 2004 by Vinod Khosla, a former general partner of Kleiner Perkins. Khosla Ventures's first two investment vehicles were funded with his own personal capital and were not open to institutional investors. Khosla Ventures Fund III secured $1 billion to invest in traditional early stage and growth stage companies. Khosla also raised $300 million for Khosla Seed, which would invest in higher-risk opportunities and science experiments. By 2013, the company was considered one of the top ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IBuyer

Instant buyer (or iBuyer) is a real estate transaction model wherein companies purchase residential properties directly from private sellers, to eventually re-sell them. Background The term ‘instant’ refers to the fact that this type of business aims to provide a faster cash offer on a property than traditional real estate brokers. Valuation of the property takes place online and is an instantaneous or near-instantaneous process which makes use of machine learning and AI technologies. Examples of companies using the iBuyer model include Opendoor and ibuyhomes.com. The term iBuyer was coined by Stephen Kim, an equity research analyst at Evercore ISI on May 29, 2017 in a report to clients titled "The Rise of the iBuyer". The iBuyer process iBuyer companies use computer-generated analysis of market data, information supplied by sellers, and in some cases input from local real estate agents, to make instant cash offers on residential properties. Individuals wishing to sel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chamath Palihapitiya

Chamath Palihapitiya (born 3 September 1976) is a Sri Lankan-born Canadian-American venture capitalist and entrepreneur. He is the founder and chief executive officer (CEO) of Social Capital, and previously served as an early senior executive at Facebook from 2007 to 2011. Palihapitiya is known for his venture capital investments, work with Special-purpose acquisition companies (SPACs), his minority ownership in the Golden State Warriors, and as a co-host of the business and technology podcast '' All-In''. Early life and education Born in Sri Lanka to a family from Galle, Palihapitiya moved to Canada at age five when his father was posted to the High Commission of Sri Lanka in Ottawa. In 1986, when his father's diplomatic posting came to an end, the family sought asylum in Canada due to his father's criticism of violence against Tamils during the Sri Lankan Civil War. Growing up in difficult economic circumstances, Palihapitiya's father struggled with alcoholism and unemployme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

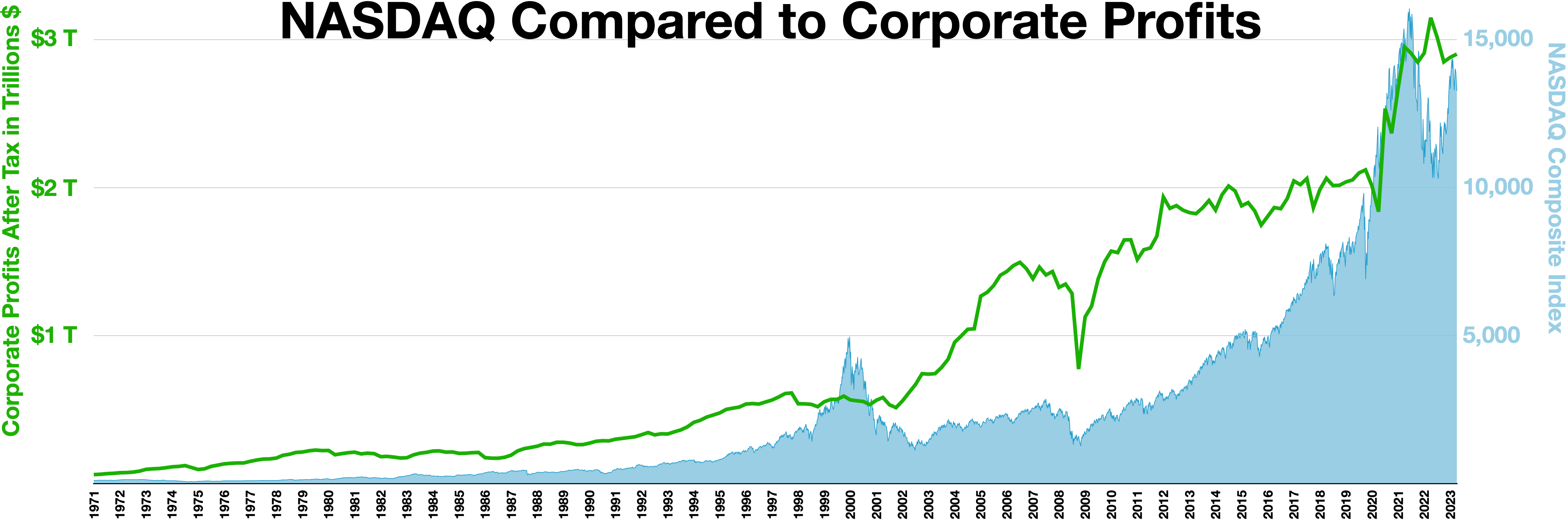

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Trade Commission

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) United States antitrust law, antitrust law and the promotion of consumer protection. It shares jurisdiction over federal civil antitrust law enforcement with the United States Department of Justice Antitrust Division, Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC. The FTC was established in 1914 by the Federal Trade Commission Act of 1914, Federal Trade Commission Act, which was passed in response to the 19th-century monopolistic trust crisis. Since its inception, the FTC has enforced the provisions of the Clayton Antitrust Act of 1914, Clayton Act, a key U.S. antitrust statute, as well as the provisions of the FTC Act, et seq. Over time, the FTC has been delegated with the enforcement of additional business regulation statutes and has promul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |